Creating an organized audit working paper is crucial for a smooth auditing process, ensuring all information is easily accessible and understandable. An efficient structure not only enhances clarity but also paves the way for accurate analysis and effective review. By following a clear template, auditors can maintain consistency and quality throughout their documentation. Curious to discover how to craft the perfect audit working paper organization? Read on!

Introduction and Purpose

An effective audit working paper organization enhances clarity and ensures comprehensive documentation of financial transactions. The introduction outlines the scope of the audit, highlighting key areas reviewed, such as revenue recognition and expenditure validation. Purpose identifies objectives, including adherence to Generally Accepted Accounting Principles (GAAP) and compliance with regulatory standards established by the Financial Accounting Standards Board (FASB). Practitioners at firms such as Deloitte and PwC utilize structured templates to streamline the process. Maintaining consistency across jurisdictions, whether in the United States or internationally, ensures relevant information is easily accessible for stakeholders and regulators alike. Detailed annotations contribute to understanding the methodology and support conclusions drawn from the audit findings.

Scope of Audit

The scope of the audit encompasses a comprehensive evaluation of financial statements (including balance sheets and income statements) for the fiscal year ending December 31, 2023, focusing on compliance with Generally Accepted Accounting Principles (GAAP), internal controls (policies and procedures established by the company), and adherence to applicable local regulations (such as the Sarbanes-Oxley Act in the United States). The audit will cover a variety of areas including cash transactions, revenue recognition practices, accounts receivable, and inventory management processes across all operational divisions (such as manufacturing, sales, and distribution) of the organization, XYZ Corporation, based in New York City. The examination will also involve analytical procedures (methods of assessing financial information through analysis of plausible relationships among data) and risk assessments to identify potential areas of financial misstatement or fraud (intentional misrepresentation of financial information) that could affect the overall integrity of the financial reporting framework. This thorough assessment aims to provide stakeholders (including investors, management, and regulatory authorities) with reasonable assurance regarding the accuracy and fairness of the financial statements presented.

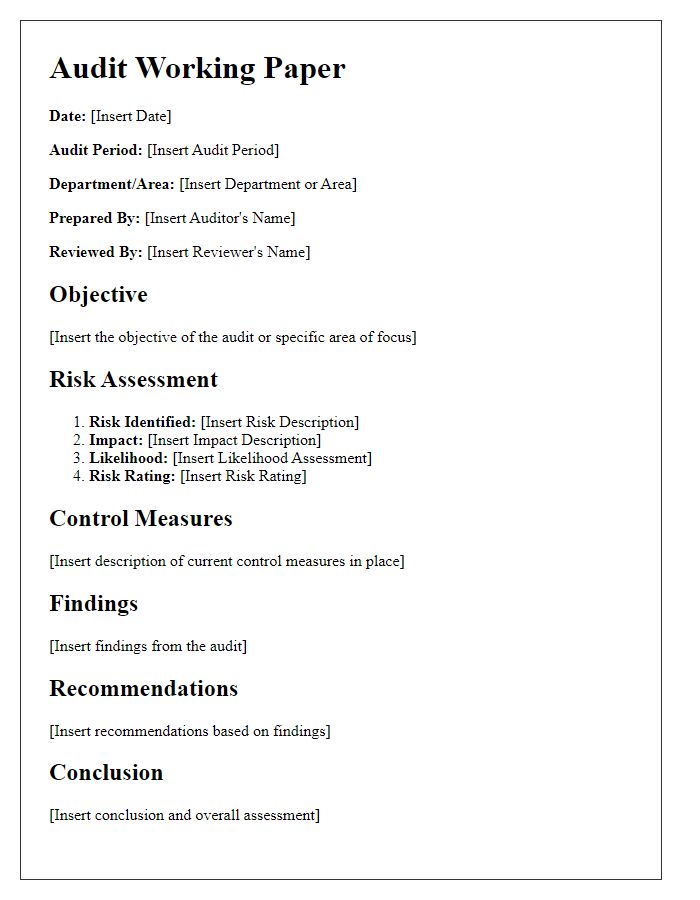

Methodology and Approach

In auditing, a rigorous methodology and structured approach enhance the reliability of working papers. The audit methodology encompasses steps such as engagement planning, risk assessment, and evidence gathering, which ensures compliance with standards set by the International Auditing and Assurance Standards Board (IAASB). During the planning phase, relevant client data, including financial statements and internal controls, are analyzed to identify significant risk areas, often involving percentages that highlight variances from industry benchmarks. The approach further entails detailed documentation of audit procedures, specifying tests performed, findings reported, and any anomalies observed. Each working paper serves as a breadcrumb trail, guiding future audits and facilitating easier reviews by stakeholders, including regulatory authorities, ensuring a clear audit trail and fostering transparency throughout the audit process.

Key Findings and Observations

Key findings and observations during the audit process provide critical insights into the financial operations of the organization. A thorough examination of financial records, such as income statements and balance sheets, reveals discrepancies in reported revenue figures, specifically a 15% variance when compared to actual receipts for the year ended December 31, 2022. Additionally, internal control assessments highlight weaknesses in the inventory management system, leading to potential overstatements of asset values by approximately $200,000. The review of compliance with regulatory standards indicates several areas of concern, including late filings with the Securities and Exchange Commission (SEC), which could result in penalties. Furthermore, employee interviews underscore a lack of training regarding company policies, which may contribute to inconsistencies in financial reporting practices. These findings will guide management in addressing gaps and improving operational efficiency moving forward.

Conclusion and Recommendations

An effective audit working paper conclusion summarizes key findings and insights obtained from analyzing financial records, compliance documents, and operational processes. The conclusions should clearly state any material misstatements identified during the audit, highlight areas of excessive risk exposure, and assess overall compliance with applicable regulations, such as the Sarbanes-Oxley Act of 2002 in the United States. Recommendations may include implementing stronger internal controls to mitigate identified risks, scheduling regular training sessions for staff on compliance requirements, and enhancing data management systems to ensure accurate reporting, specifically regarding financial metrics like revenue recognition and expense classification. Proper documentation of these conclusions and recommendations aids in fostering transparency and accountability in organizational practices.

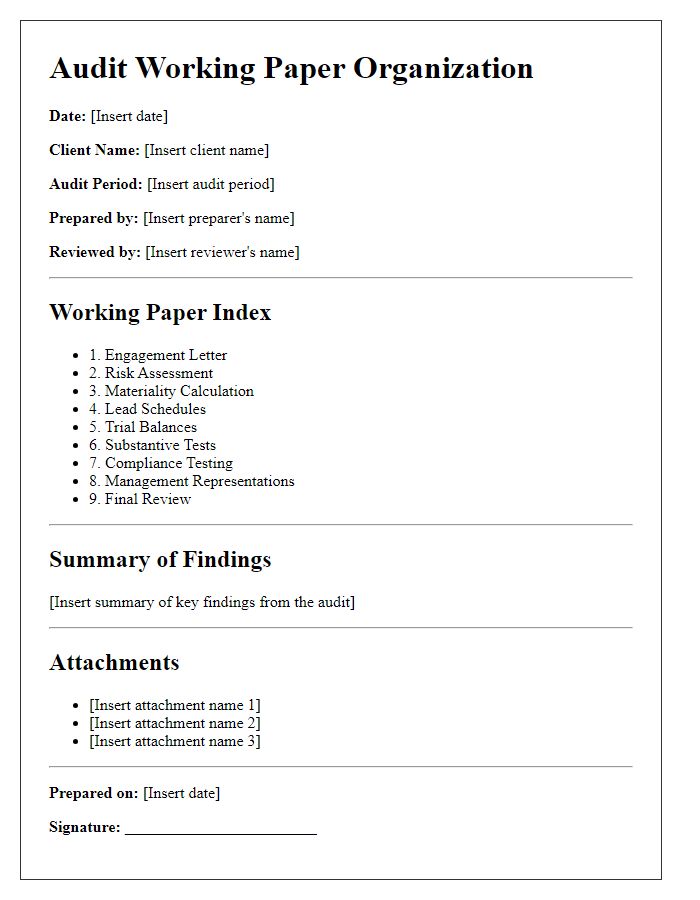

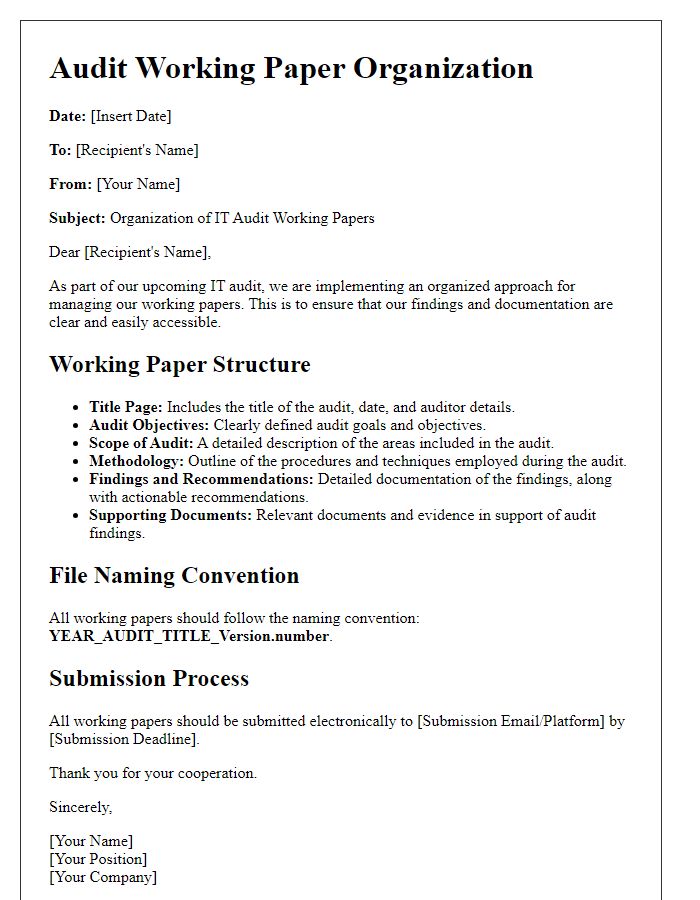

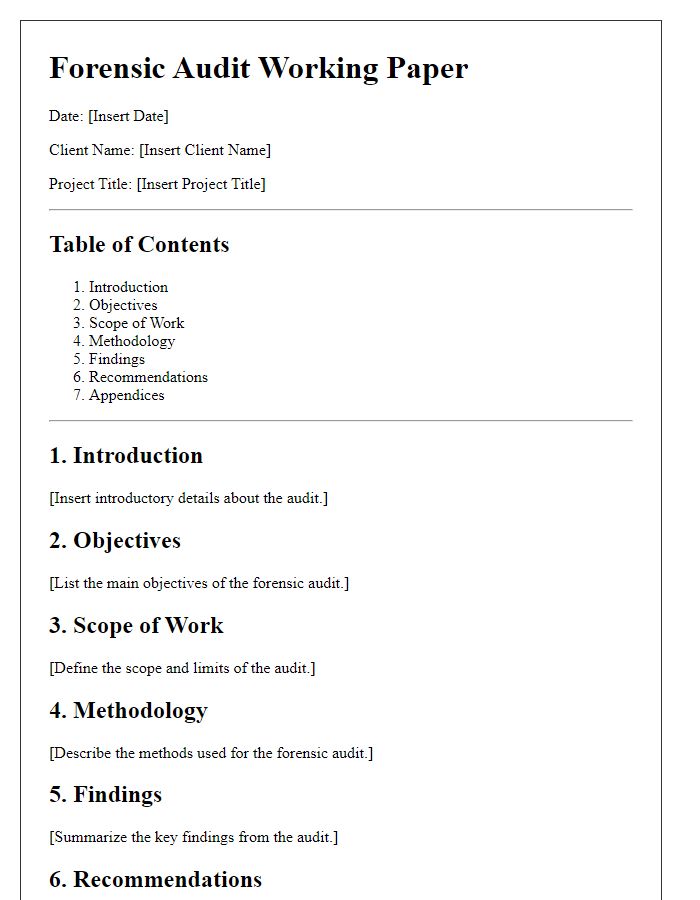

Letter Template For Audit Working Paper Organization Samples

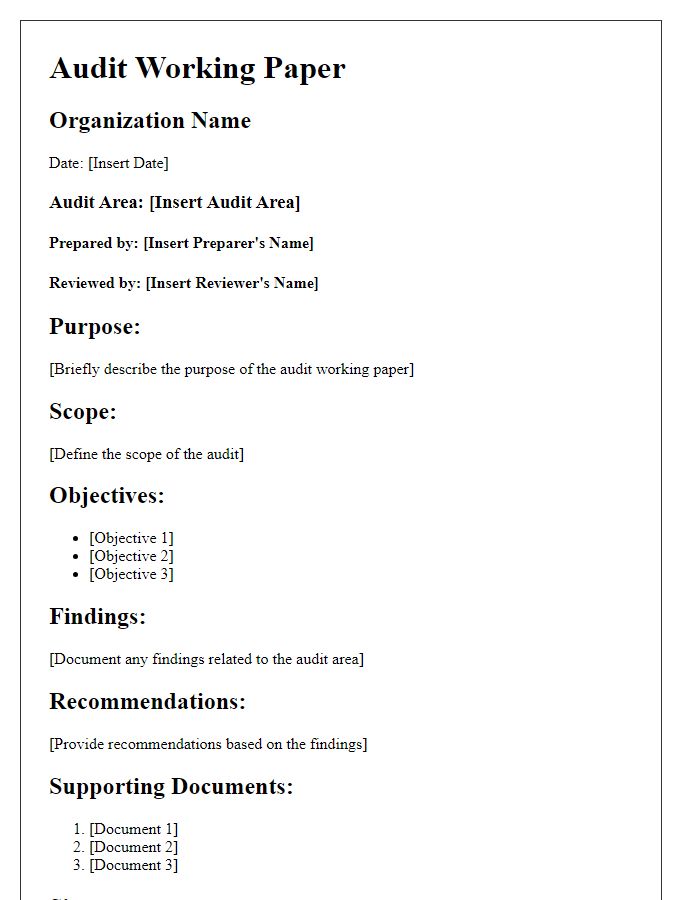

Letter template of audit working paper organization for financial audits

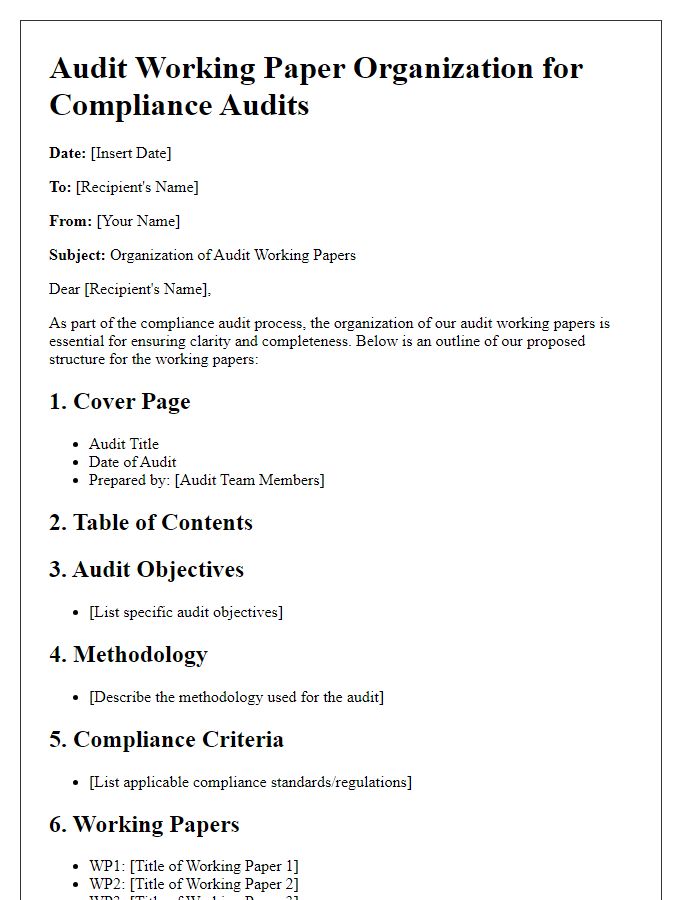

Letter template of audit working paper organization for compliance audits

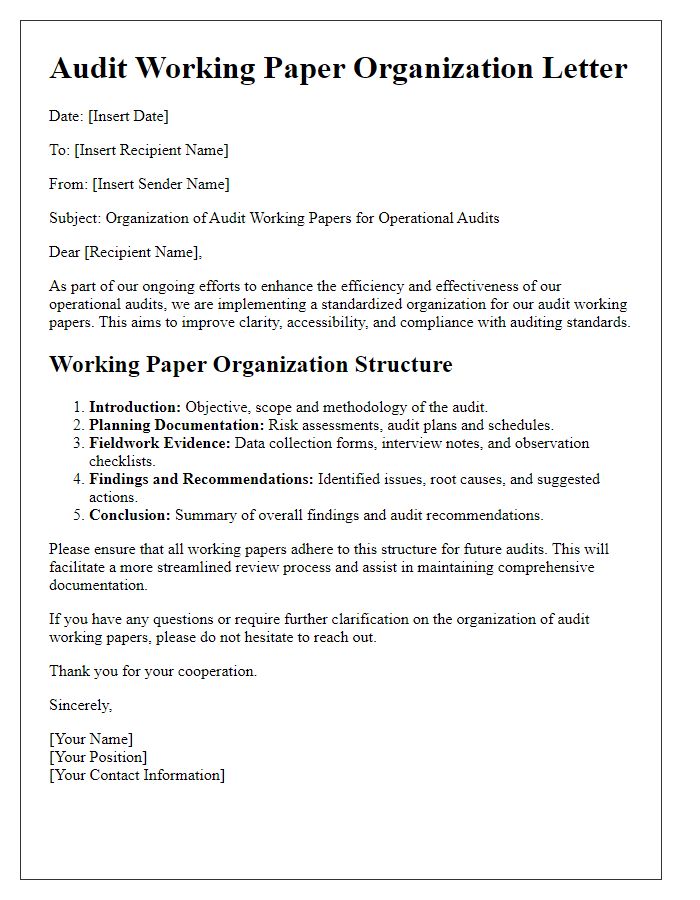

Letter template of audit working paper organization for operational audits

Letter template of audit working paper organization for government audits

Letter template of audit working paper organization for performance audits

Comments