Are you looking for a clear and effective way to draft an audit data collection request letter? Understanding the specifics of your data needs can streamline the auditing process and foster better communication with stakeholders. In this article, we'll cover essential elements to include in your letter, ensuring you convey your requests professionally and concisely. Join us as we explore practical tips and a sample template to help you craft the perfect audit data collection request!

Clear Purpose and Scope

The purpose of the audit data collection request focuses on evaluating financial records, operational processes, and compliance with regulatory standards. The scope encompasses a comprehensive review of transaction documentation from January 2022 to December 2022, including invoices, receipts, and bank statements. Additionally, it includes an examination of internal controls, risk management procedures, and adherence to policies within the organization's headquarters located in Springfield. This structured approach aims to identify discrepancies, enhance accuracy, and ensure alignment with industry standards set forth by the Financial Accounting Standards Board (FASB).

Specific Data Requirements

Audit data collection requires precise information to ensure compliance and accuracy. Financial records, such as profit and loss statements, revenue details, and expense reports, need to be gathered for the fiscal year ending December 31, 2023. Specific documentation must include transaction invoices, bank statements, and purchase orders from major suppliers like XYZ Corp. Additionally, employee payroll data, including hours worked and tax deductions, should be compiled for the last six months. Internal control assessments and risk management reports for the current auditing period must also be included to provide a comprehensive overview of company operations. Compliance documents related to local regulations in the jurisdiction of the headquarters must be verified to ensure adherence to legal standards.

Submission Deadline

Audit data collection requests require precise details for effective compliance. Entities such as departments must provide specific financial documents, transaction records, and operational reports. Submission deadlines typically fall within 30 days of request issuance to ensure timely review. Each document must adhere to standards set by regulatory bodies such as the Financial Accounting Standards Board (FASB) or the International Financial Reporting Standards (IFRS). Appropriate access protocols, including secure file sharing methods like encrypted emails or designated cloud storage, must be utilized to protect sensitive information. Clear communication regarding the consequences of late submissions, including potential penalties or additional scrutiny, is essential for maintaining accountability within organizations.

Contact Information

Contact information plays a crucial role in effective communication during the audit data collection process. Collecting accurate details such as email addresses, phone numbers, and mailing addresses facilitates seamless correspondence between auditors and relevant personnel within organizations. For example, including the primary contact's title, such as Chief Financial Officer (CFO) or Compliance Officer, ensures direct communication with decision-makers. Additionally, providing the organization's official name, like Tech Innovations Inc., along with physical locations and specific department contacts enhances delivery efficiency. This precision aids in minimizing delays and misunderstandings during the audit process, ensuring all necessary data is gathered promptly for thorough analysis.

Confidentiality Assurance

Confidentiality assurance in audit data collection is crucial to maintain the integrity of sensitive information. Organizations must ensure that data handling procedures align with guidelines detailed in documents like the Sarbanes-Oxley Act (2002) and HIPAA (1996), specifically when dealing with financial and health-related records. During the data collection process, auditors may request access to comprehensive datasets, including financial statements, transaction logs, and employee records. Implementing strict confidentiality agreements protects personal and proprietary information, reassuring stakeholders that adequate measures are in place. Failure to uphold these standards might lead to data breaches, impacting organizational reputation and resulting in legal ramifications. Compliance with these audit processes not only promotes transparency but also fosters trust among partners, clients, and regulatory authorities.

Letter Template For Audit Data Collection Request Samples

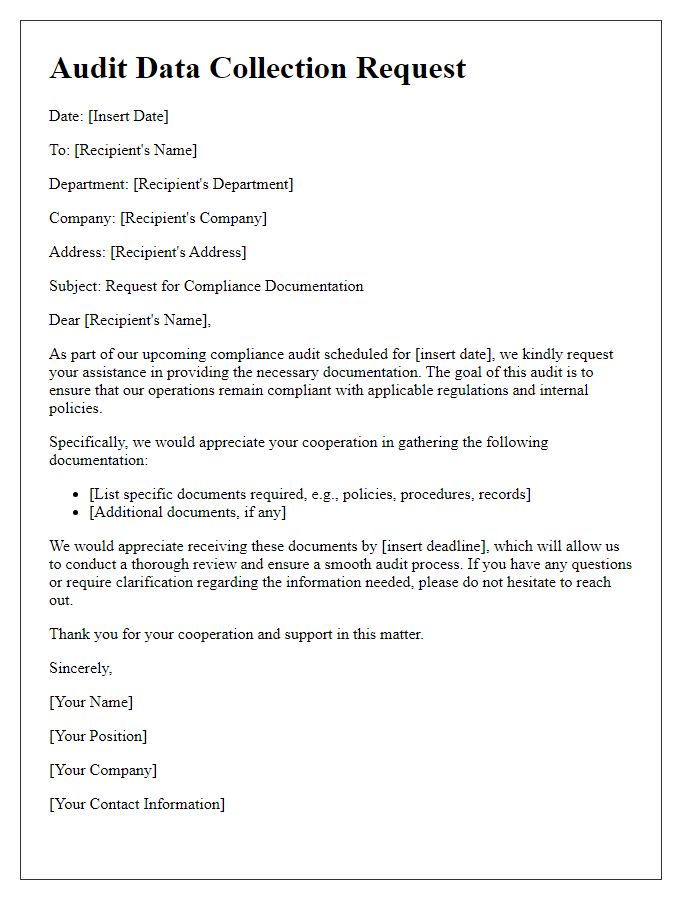

Letter template of audit data collection request for compliance documentation

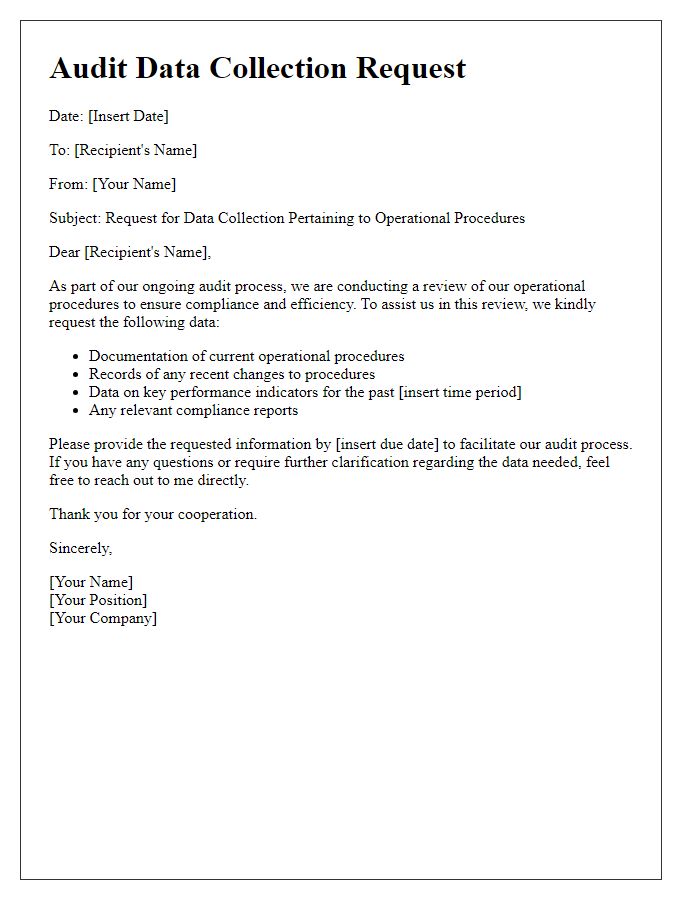

Letter template of audit data collection request for operational procedures

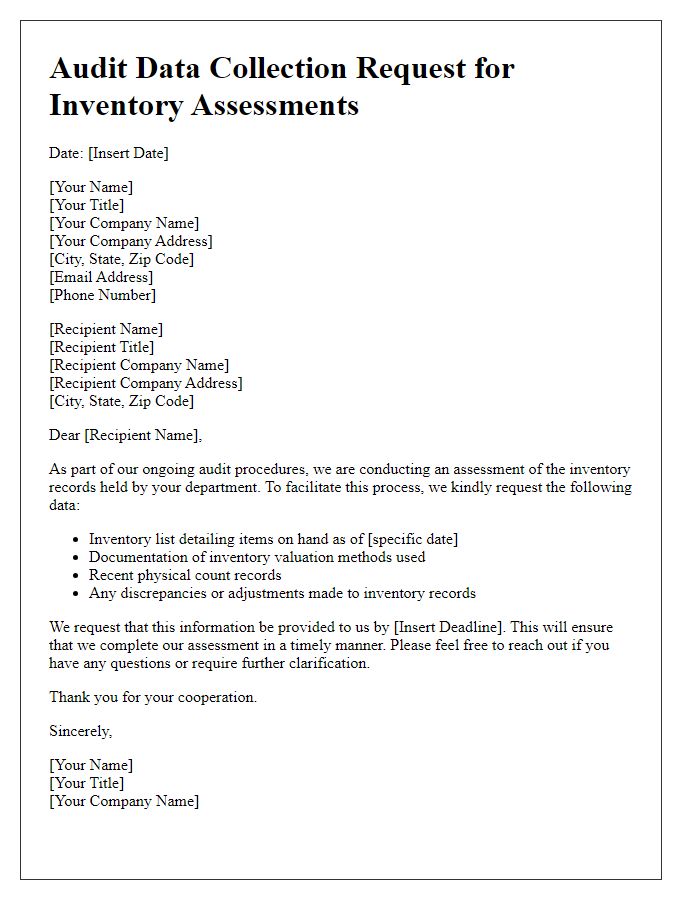

Letter template of audit data collection request for inventory assessments

Letter template of audit data collection request for client account information

Letter template of audit data collection request for human resources records

Letter template of audit data collection request for IT system access logs

Letter template of audit data collection request for marketing materials

Comments