When it comes to audit engagements, clarity and communication are key, and a well-crafted letter can set the right tone for the relationship between auditors and clients. This letter serves not only as a formal confirmation of the audit arrangement but also as an opportunity to address any questions or concerns that may arise throughout the process. By ensuring all parties are on the same page, we pave the way for a smoother, more efficient audit experience. If you're interested in learning how to create an effective audit engagement confirmation letter, keep reading!

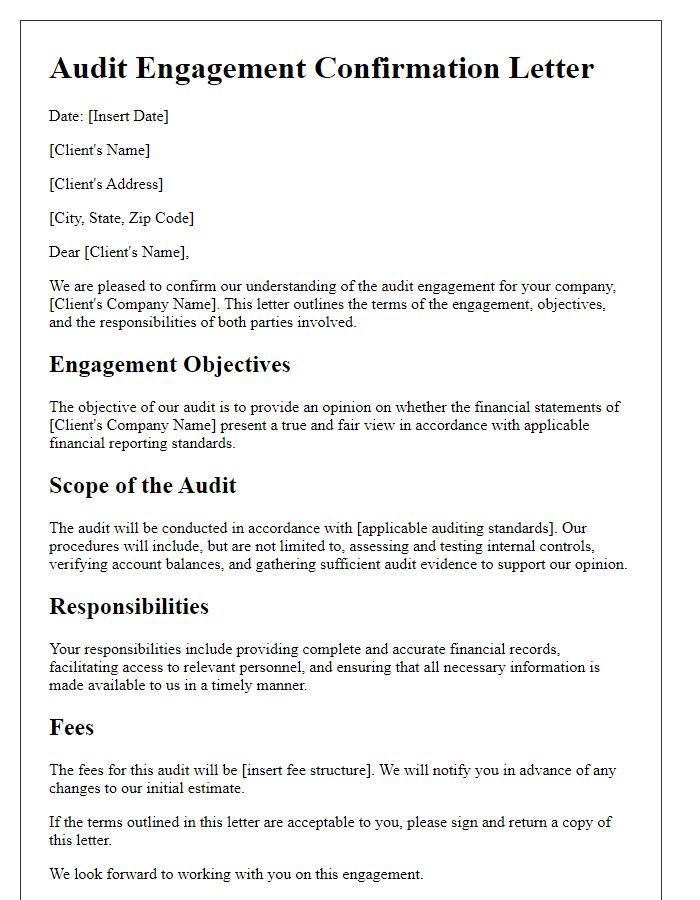

Client's Name and Address

The audit engagement confirmation process involves obtaining written verification from clients regarding the accuracy of financial statements and other key audit details. This is often conducted by sending confirmation letters to clients, located at their official address, which might include essential information such as city, state, and ZIP code. The confirmation letters serve as a formal request for evidence that supports the financial information presented, facilitating the auditing process and ensuring compliance with Generally Accepted Auditing Standards (GAAS). These confirmations can pertain to account balances, transactions, or significant agreements, contributing to the overall integrity of the audit.

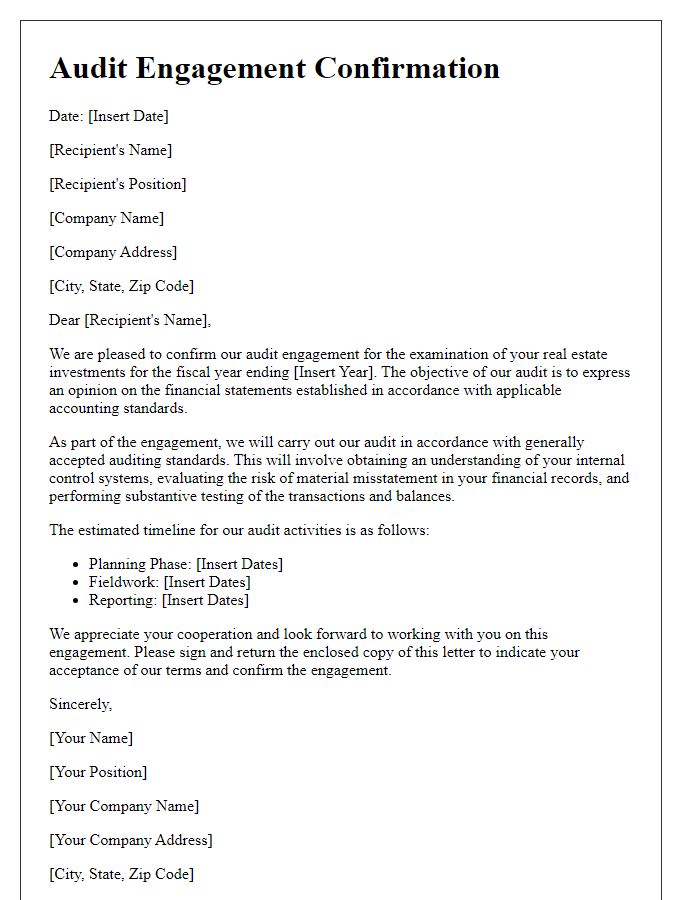

Scope of Audit Engagement

The audit engagement confirmation outlines essential aspects regarding the scope of the audit engagement, particularly focusing on the examination of financial statements. This includes definitions of the audit objectives, which aim to provide a reasonable assurance that the financial statements present a true and fair view of the entity's financial position. Key components include the assessment of internal controls, the evaluation of accounting practices, and compliance with relevant financial reporting frameworks such as International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP). Additionally, the timeframe for the audit, typically spanning several weeks, should be highlighted, along with the participation of the audit team, which may include Certified Public Accountants (CPAs) and specialists in certain areas. Notably, the scope may also encompass supplementary services such as fraud investigations or risk assessments if deemed necessary by the audit committee or the organization's management.

Auditor's Responsibilities

During an audit engagement, auditors hold significant responsibilities concerning the assessment and verification of financial statements. Auditors evaluate the fairness of representations made by management in accordance with applicable financial reporting frameworks, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). They undertake procedures to obtain sufficient evidence regarding the amounts and disclosures in the financial statements, ensuring compliance with regulatory requirements. Additionally, auditors are tasked with assessing risks of material misstatement, whether due to fraud or error, within the financial reporting process. Their objective is to form an opinion on the financial statements, providing reasonable assurance that they are free from material misstatements, hence enhancing the credibility of the information presented to stakeholders, including investors and regulatory bodies.

Client's Responsibilities

In an audit engagement, clients must ensure accurate financial records. These records include balance sheets, income statements, and cash flow statements that reflect true financial position. Clients must provide all necessary documentation, such as contracts, invoices, and payroll records, for thorough examination by accountants. Timely response to auditors' inquiries is crucial, facilitating effective planning and execution of the audit process. Clients must communicate any significant changes in operations or accounting policies that could impact the audit. Lastly, adherence to compliance regulations, including the Sarbanes-Oxley Act for publicly traded companies, is essential for maintaining transparency and accountability.

Signature and Date

Audit engagement confirmation involves verifying financial information with external parties. This process typically includes obtaining signatures from authorized representatives to validate the receipt and acknowledgment of specific audit-related requests. The date included signifies when the confirmation was executed, reflecting the timeliness of the information. Key components include the name of the auditing firm (e.g., Deloitte, EY), the client company, and any relevant accounting periods or financial statements under review, ensuring clarity in communication and record-keeping practices.

Letter Template For Audit Engagement Confirmation Samples

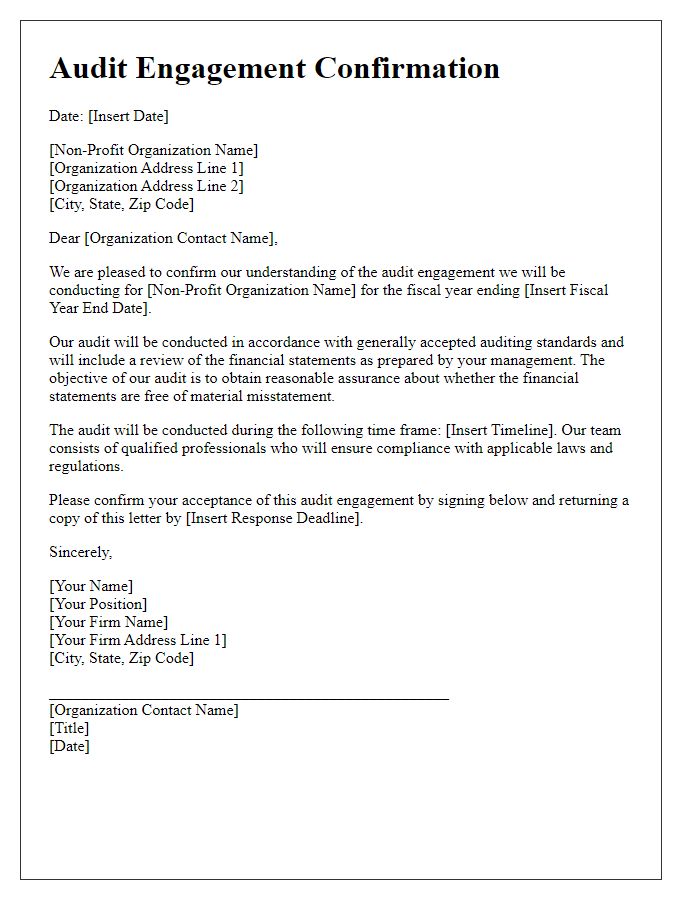

Letter template of audit engagement confirmation for non-profit organizations.

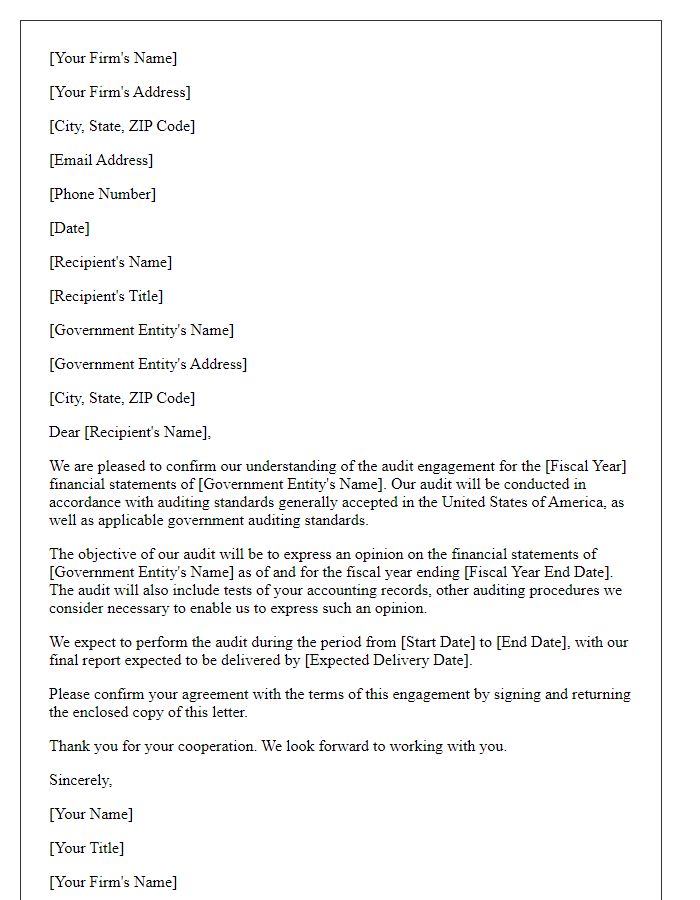

Letter template of audit engagement confirmation for government entities.

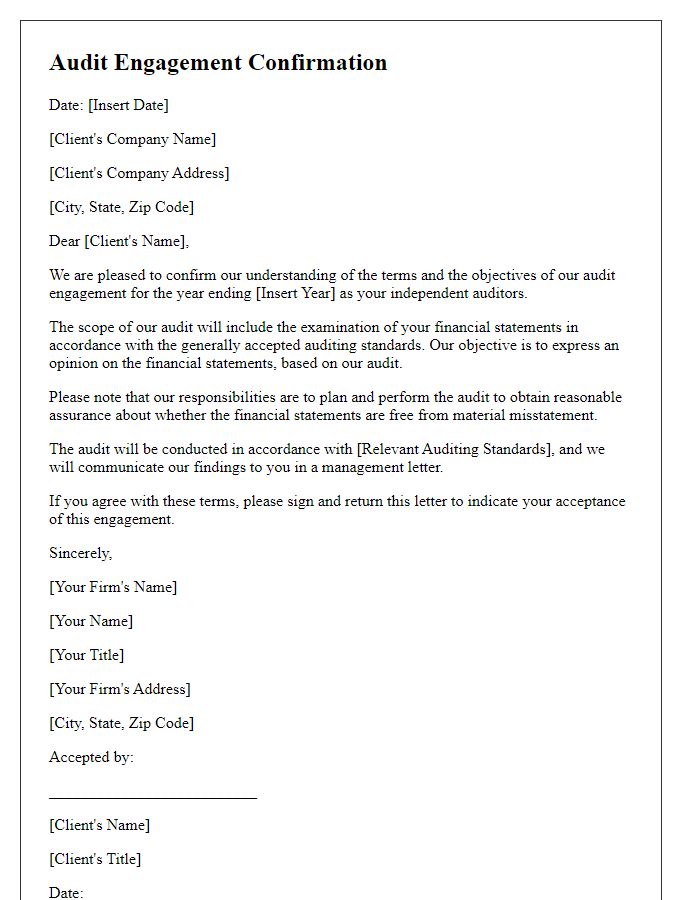

Letter template of audit engagement confirmation for multinational corporations.

Letter template of audit engagement confirmation for publicly traded companies.

Letter template of audit engagement confirmation for private equity firms.

Comments