Are you considering a joint venture and feeling a bit overwhelmed about where to start? Crafting a letter outlining your agreement is essential to ensure all parties are on the same page. In this article, we'll break down a simple template to guide you through the crucial components of a joint venture letter, from basic information to specific terms and conditions. So, let's dive in and simplify the process for youâread more to discover the essential elements you need to include!

Introduction and Objective

A joint venture agreement serves as a formal contract between two or more parties aiming to collaborate on a specific business project or objective. The introduction section outlines the purpose of the partnership, clarifying mutual interests and anticipated synergistic benefits, such as shared resources, expertise, and risk management. Objectives typically focus on distinct goals, such as revenue targets, market expansion, product development timelines, or innovative strategies tailored to specific industry challenges within designated geographies. Key elements include definition of contributions from each party, governance structure, and anticipated outcomes that foster accountability and alignment across the venture.

Parties Involved and Responsibilities

A joint venture agreement between Company A, a manufacturing leader based in New York, and Company B, an innovative tech startup located in San Francisco, outlines the mutual responsibilities of both parties. Company A will contribute its extensive resources, production capabilities, and established distribution network, ensuring efficient manufacturing processes. Company B will provide cutting-edge technology, including proprietary software and design expertise, driving product innovation. Both entities will collaborate on marketing strategies targeting the North American market, employing data analytics to optimize outreach. Regular meetings will occur quarterly at Company A's headquarters to review progress and adjust strategies accordingly. Each party will also be accountable for maintaining compliance with federal regulations regarding business operations and product standards. Financial contributions will be predetermined, with profits distributed based on pre-agreed ratios, reflecting each party's investment and effort in the upcoming product launch scheduled for Q3 2024.

Term and Termination Clauses

A joint venture agreement outlines the partnership between two or more entities aiming to collaborate for mutual benefit. The "Term" clause typically defines the duration of the joint venture, specifying start and end dates, which may be set for a fixed period, such as five years, or until the completion of a specific project, like constructing a commercial building. The "Termination" clause details conditions under which the joint venture may be dissolved, including mutual consent, breach of agreement, inability to meet objectives, or significant changes in market conditions impacting the partnership viability. Specific notice periods, often ranging from 30 to 90 days, must be included to inform other parties effectively. Additional stipulations regarding the distribution of assets and liabilities upon termination, particularly pertinent if one party invested more, should be clearly outlined.

Financial Contributions and Profit Sharing

In a joint venture agreement, financial contributions serve as the foundation for establishing the partnership's operational framework. Each party, identified as Venture Partner A and Venture Partner B, outlines their respective financial investments, specifying amounts in US dollars, such as $500,000 and $300,000. These investments will underpin the capital required for essential activities, including product development, marketing initiatives, and operational costs. The profit-sharing structure is critical, delineating how revenue generated from the joint venture's activities will be distributed. This typically includes provisions for income allocation, specifying percentages--such as a 60/40 split favoring the dominant investor--ensuring clarity on how profits will flow back to each party based on their contributions and involvement in key decision-making processes. This section of the agreement should detail timelines for profit distribution, responsibilities in financial reporting, and conditions under which the profit-sharing dynamics may be adjusted, safeguarding the interests of all partners involved.

Confidentiality and Dispute Resolution

A joint venture agreement outlines essential components such as confidentiality provisions and dispute resolution mechanisms to protect the interests of all parties involved. Confidentiality clauses ensure sensitive information shared between partners, like trade secrets, proprietary technologies, or financial data, remains protected from unauthorized disclosure. Specific timeframes, often ranging from three to five years post-termination, may dictate the lasting nature of this obligation. Dispute resolution sections typically include methods such as mediation and arbitration, often governed by established guidelines like the American Arbitration Association (AAA) regulations, to foster a collaborative atmosphere for resolving conflicts. Key locations, such as the headquarters of either party or neutral venues, may also be specified to establish where disputes will be addressed, enhancing accountability and clarity in the joint venture relationship.

Letter Template For Joint Venture Agreement Outline Samples

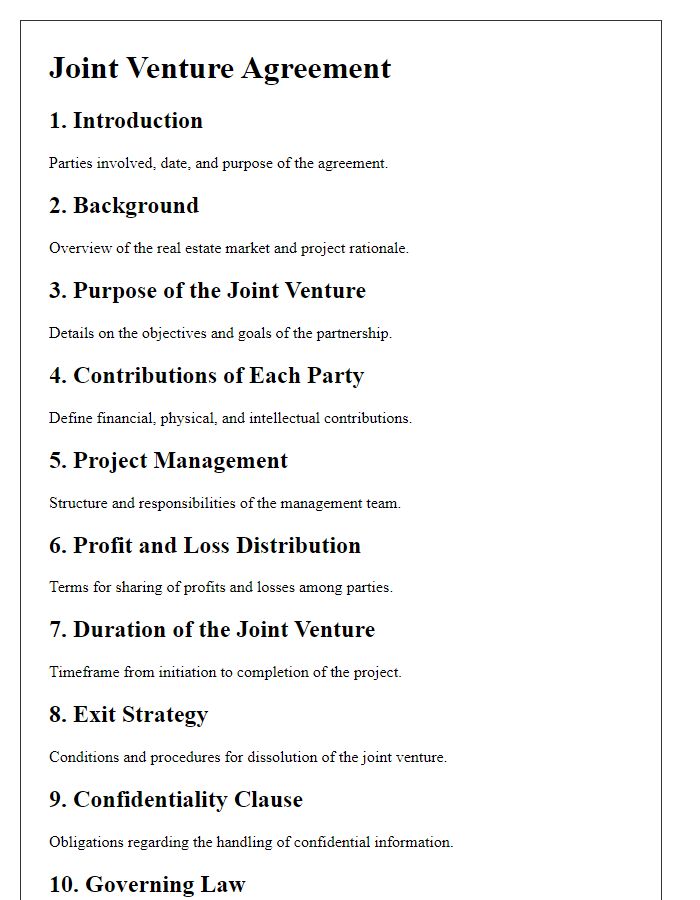

Letter template of Joint Venture Agreement Outline for Real Estate Projects

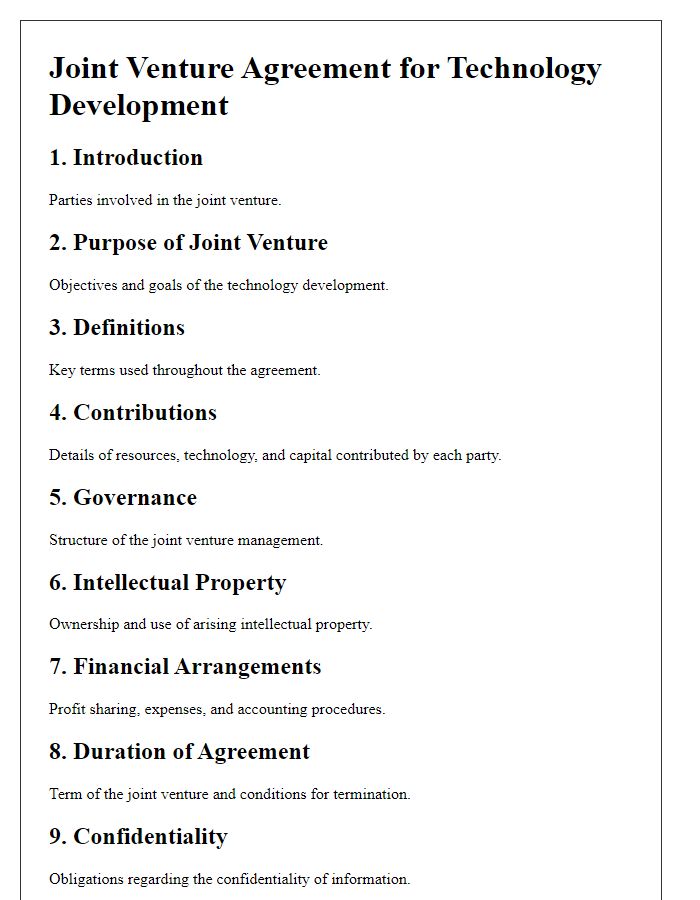

Letter template of Joint Venture Agreement Outline for Technology Development

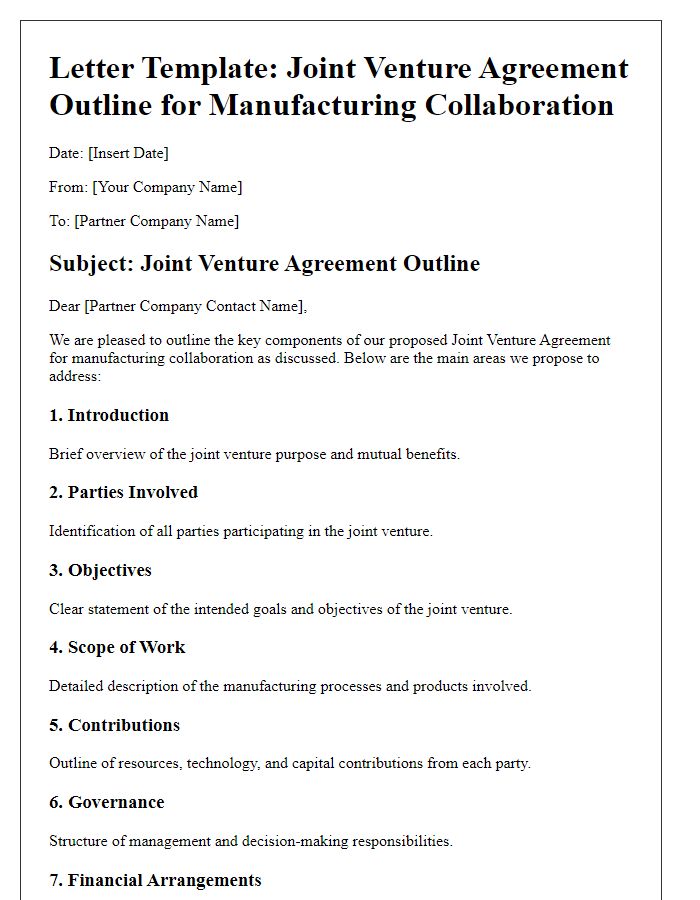

Letter template of Joint Venture Agreement Outline for Manufacturing Collaboration

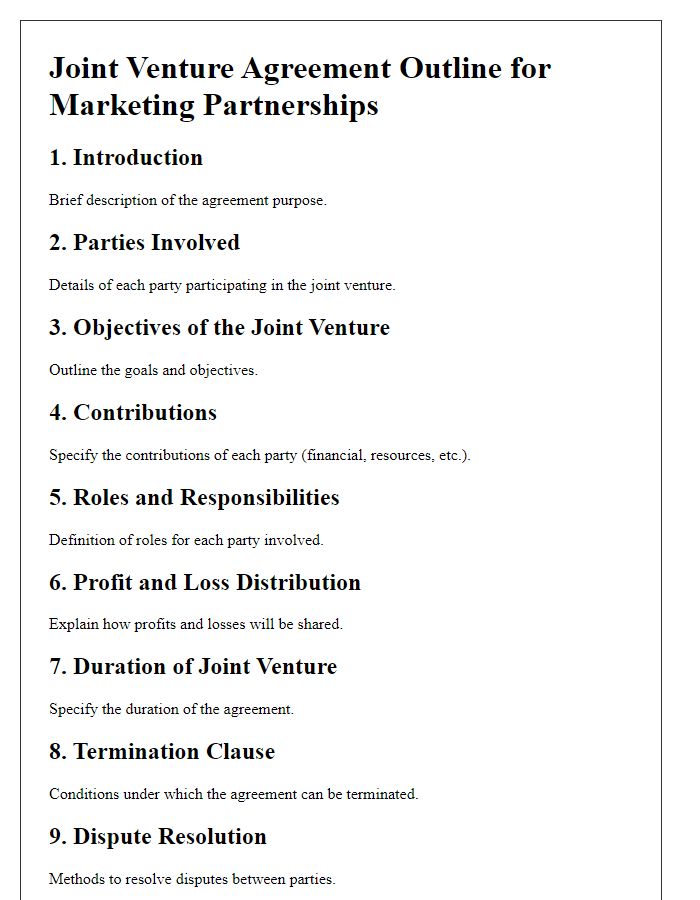

Letter template of Joint Venture Agreement Outline for Marketing Partnerships

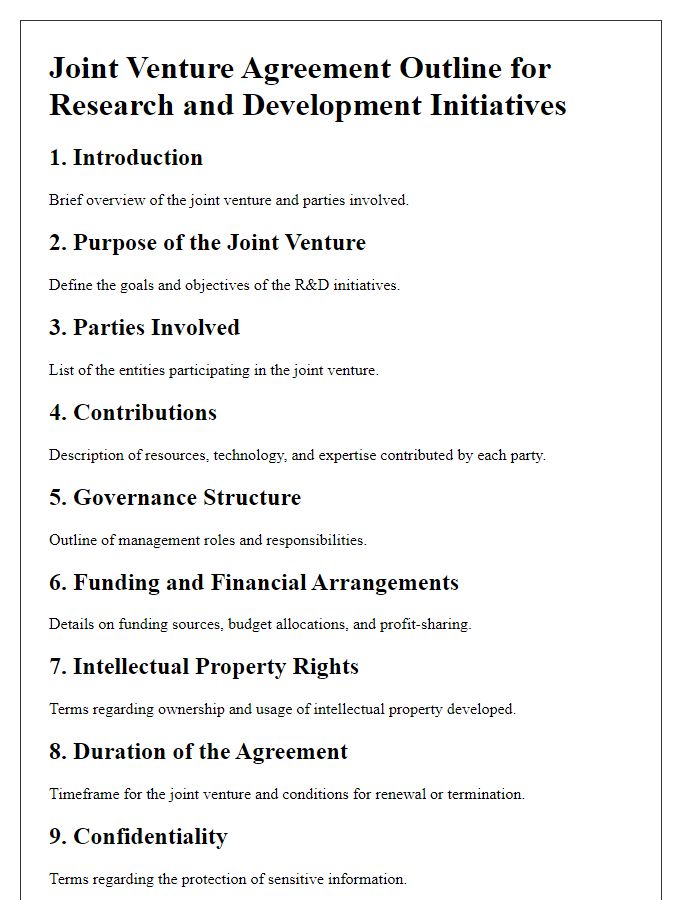

Letter template of Joint Venture Agreement Outline for Research and Development Initiatives

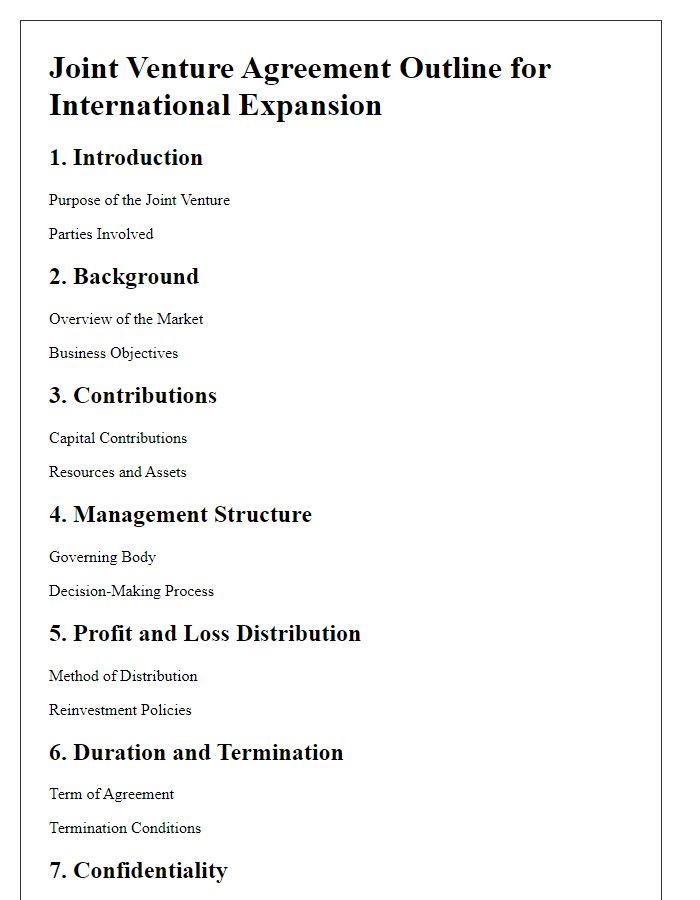

Letter template of Joint Venture Agreement Outline for International Expansion

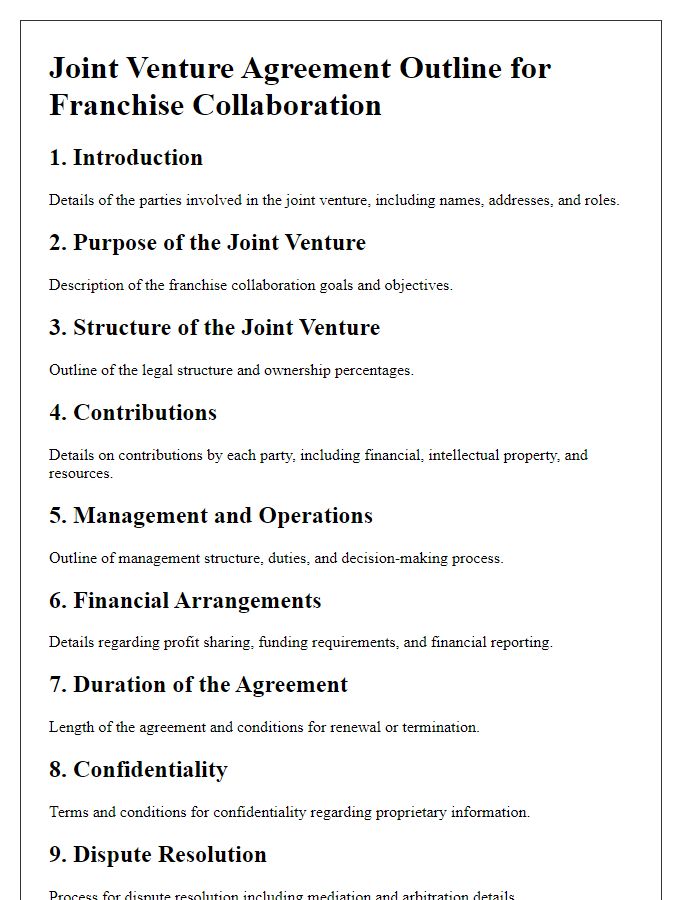

Letter template of Joint Venture Agreement Outline for Franchise Collaboration

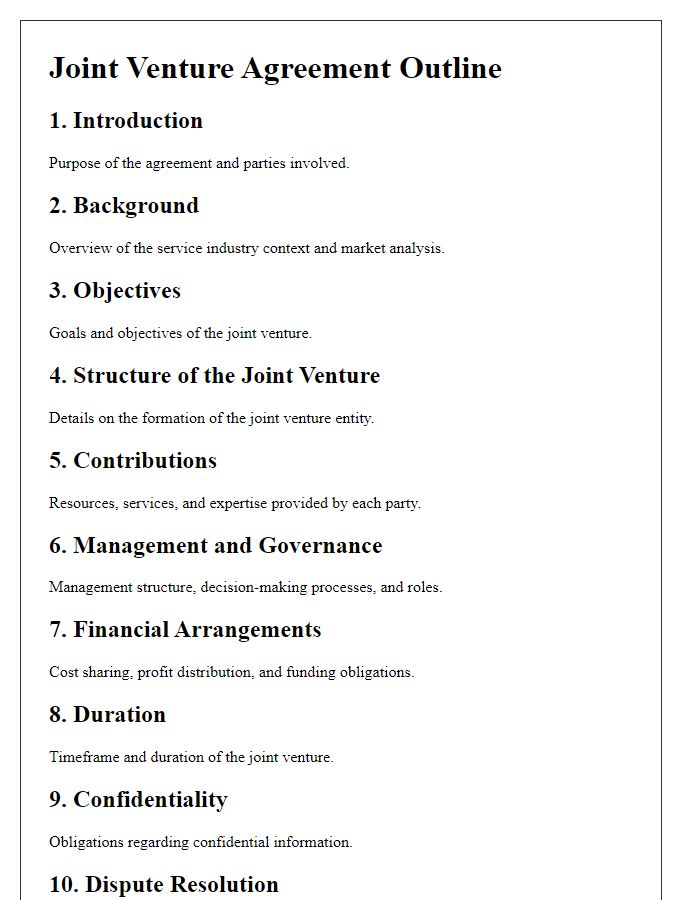

Letter template of Joint Venture Agreement Outline for Service Industry Partnerships

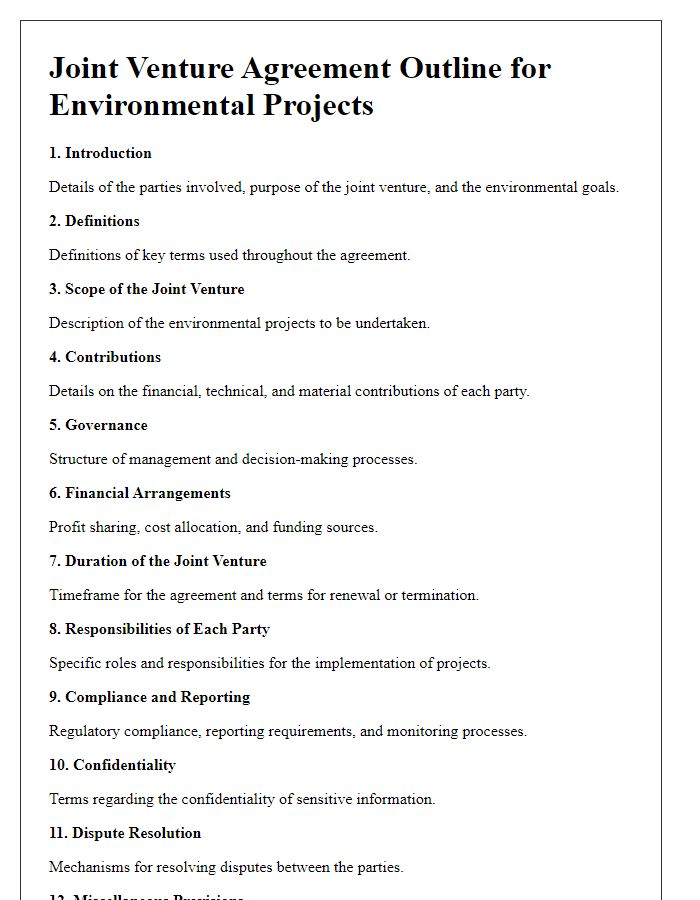

Letter template of Joint Venture Agreement Outline for Environmental Projects

Comments