Transferring business ownership can feel like navigating a complex maze, but with the right guidance, it becomes a manageable task. Whether you're a seasoned entrepreneur or a newcomer, understanding the nuances of ownership structuring is essential for a smooth transition. It's not just about changing names on paper; it encompasses legal implications, financial arrangements, and strategic planning to ensure a seamless transfer. Ready to explore how to effectively manage this process? Keep reading to uncover valuable insights!

Clear Business Overview

The business ownership transfer process, particularly in structured environments like Limited Liability Companies (LLCs) or Corporations, requires clear communication of operational frameworks. Essential elements include defining the business structure, such as the type of corporation (e.g., C-Corp, S-Corp) with established tax implications, and detailing key operational protocols. A business overview should encapsulate the mission statement, market analysis reflecting economic factors, customer demographics, competitive landscape, and financial performance metrics, including revenue and profit margins from the past three fiscal years. Furthermore, it is critical to identify ongoing contracts and obligations which may impact the transition, including lease agreements for physical locations, intellectual property ownership, and employee contracts. Comprehensive documentation not only facilitates a smooth transition but also assures potential buyers of the enterprise's viability and growth opportunities in the marketplace.

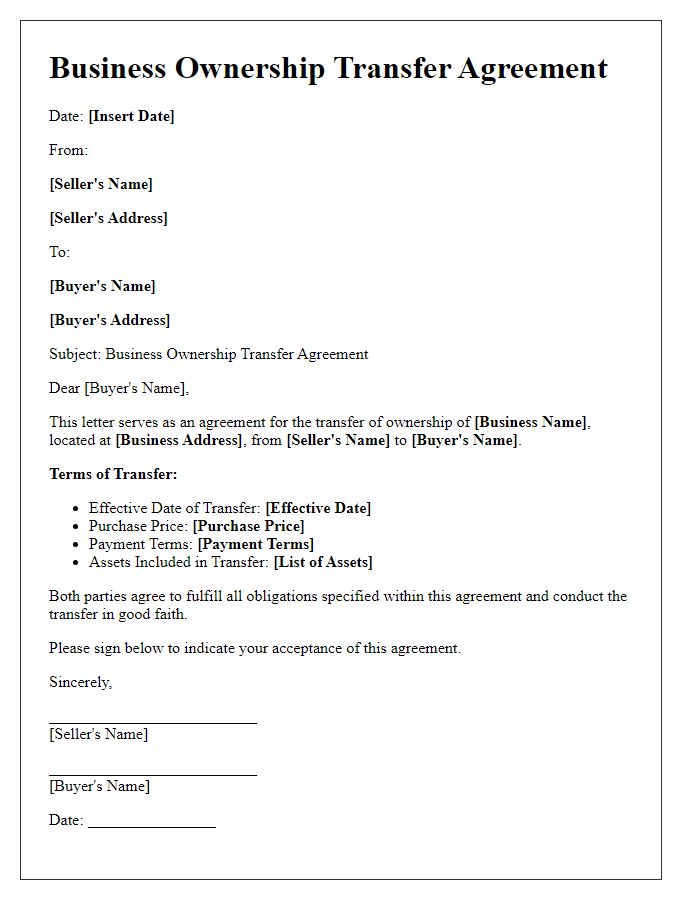

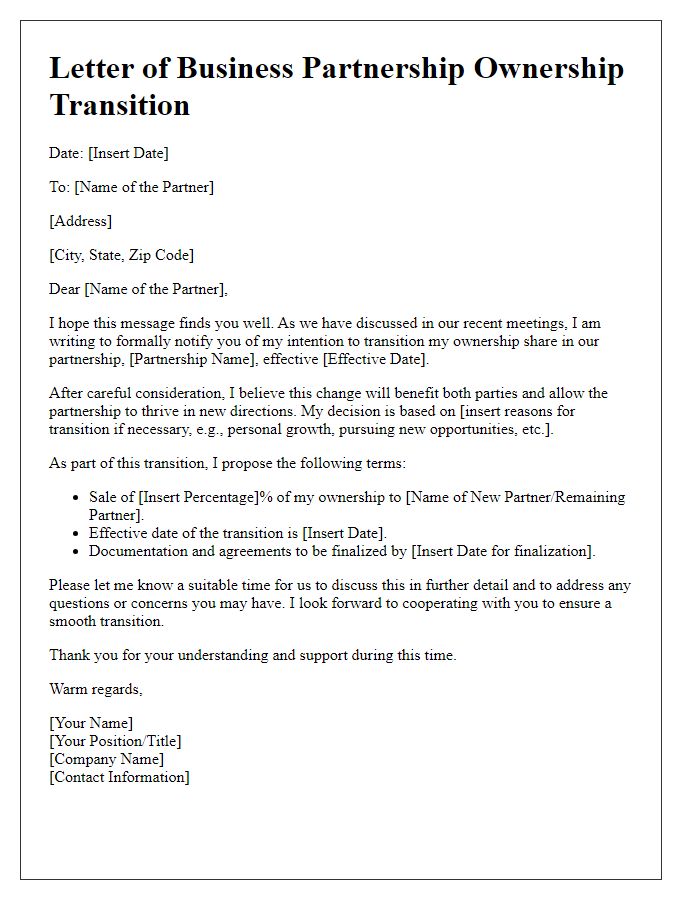

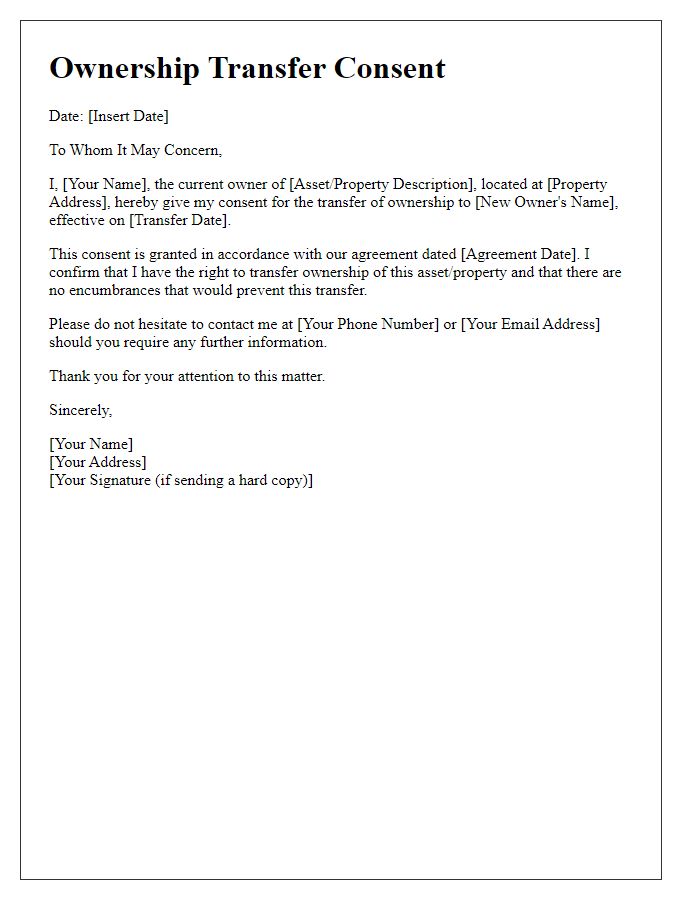

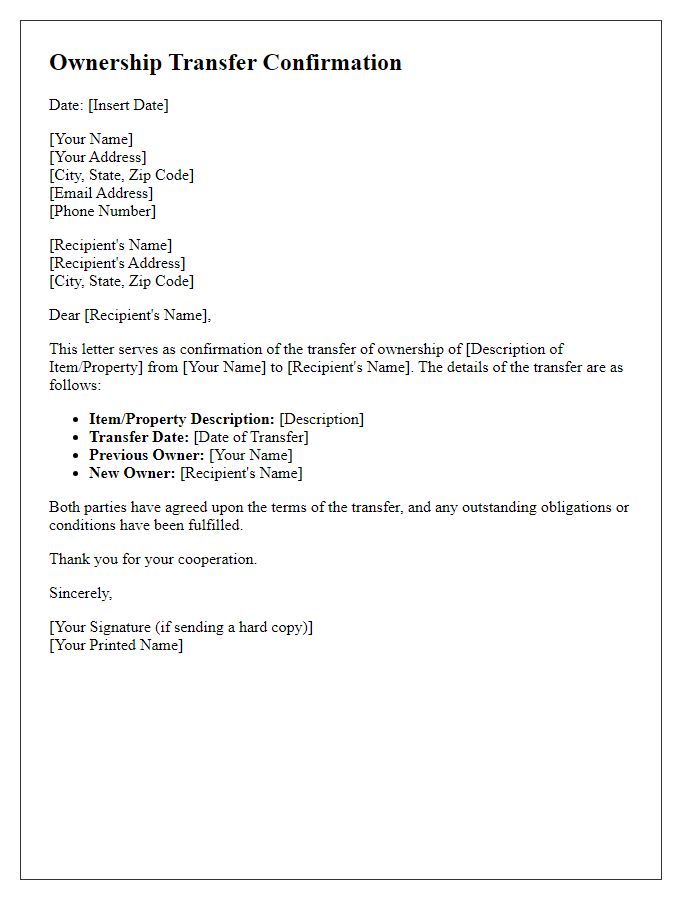

Detailed Ownership Transfer Agreement

A detailed Ownership Transfer Agreement outlines the specific terms and conditions governing the transfer of business ownership from one party to another. This legal document includes critical elements such as the names of the current owner (often referred to as the "Transferor") and the new owner (the "Transferee"), the precise description of the business entity involved (including the business name, registration number, and location), and the valuation of the business being transferred. Clear provisions regarding the purchase price, payment terms, and method of payment (cash, assets, or financing) are essential. Additionally, the document specifies any liabilities or debts that the Transferee will assume as part of the agreement, ensuring both parties understand their responsibilities. Important clauses regarding non-compete agreements, confidentiality, and the transfer of assets (including real estate, equipment, and intellectual property) may also be included to protect the interests of both parties. The agreement typically requires the signature of all involved parties and may also require notarization or witnesses to lend it legal legitimacy.

Legal and Compliance Requirements

Transferring business ownership involves navigating legal and compliance requirements specific to jurisdictions such as local, state, and federal laws. Key considerations include drafting a formal sales agreement, detailing the terms of transfer, ensuring all parties understand their rights and obligations. Business licenses must be updated to reflect the new owner, and tax implications, including capital gains tax, require careful examination to avoid unexpected liabilities. Compliance with regulations, such as the U.S. Securities and Exchange Commission (SEC) rules for publicly traded companies or local business association guidelines, is essential to avoid legal disputes. Additionally, due diligence must be performed to assess liabilities, intellectual property rights, and contractual obligations to ensure a smooth transition and protect all parties involved.

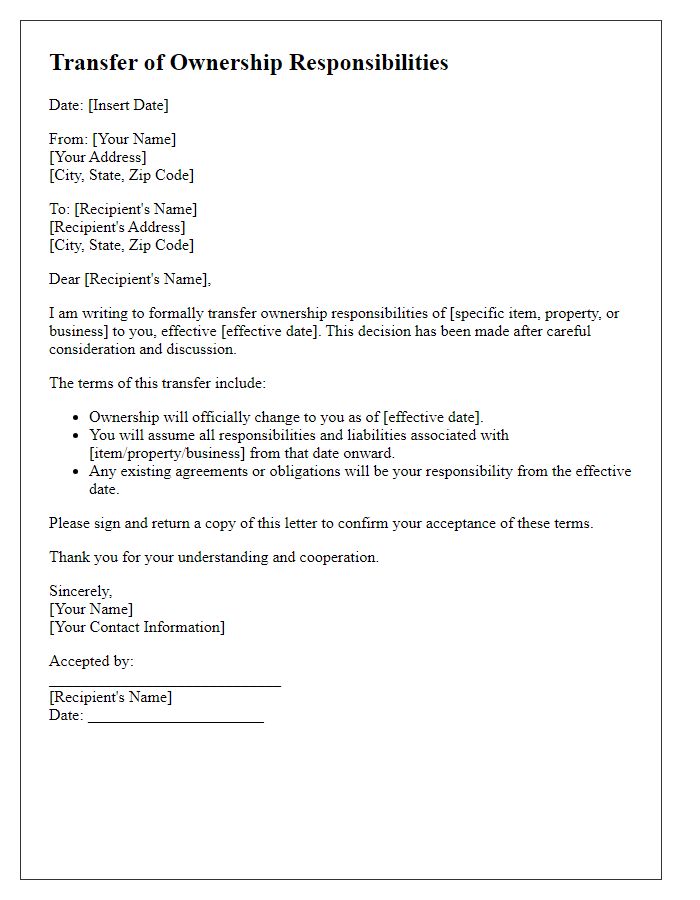

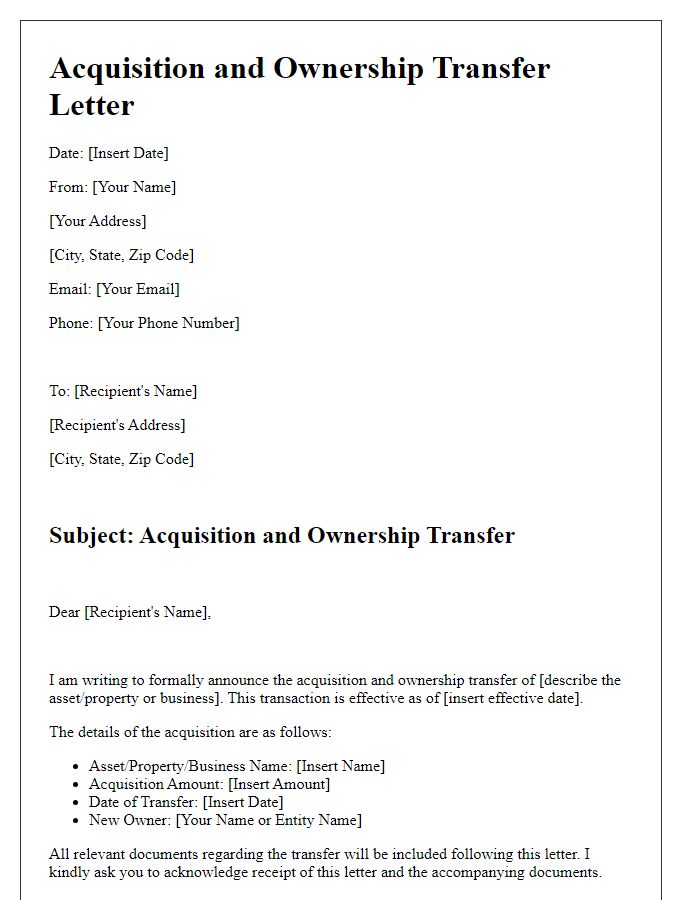

Financial and Asset Considerations

Transfer of business ownership involves critical financial and asset considerations such as valuation, tax implications, and the structure of the transaction. Business valuation, determined by methods like the income approach or asset-based approach, establishes the fair market price, which may vary based on revenue, assets, or industry standards. Tax implications (capital gains tax, corporate tax) significantly affect both parties; potential deductions and liabilities must be analyzed to optimize benefits. Asset considerations include the transferof tangible assets (equipment, property) and intangible assets (trademarks, customer lists), requiring due diligence to assess liabilities and ownership rights. Structuring the deal (asset purchase vs. stock purchase) influences both financial outcomes and operational continuity, which requires a strategic approach to ensure a smooth transition and minimize risk.

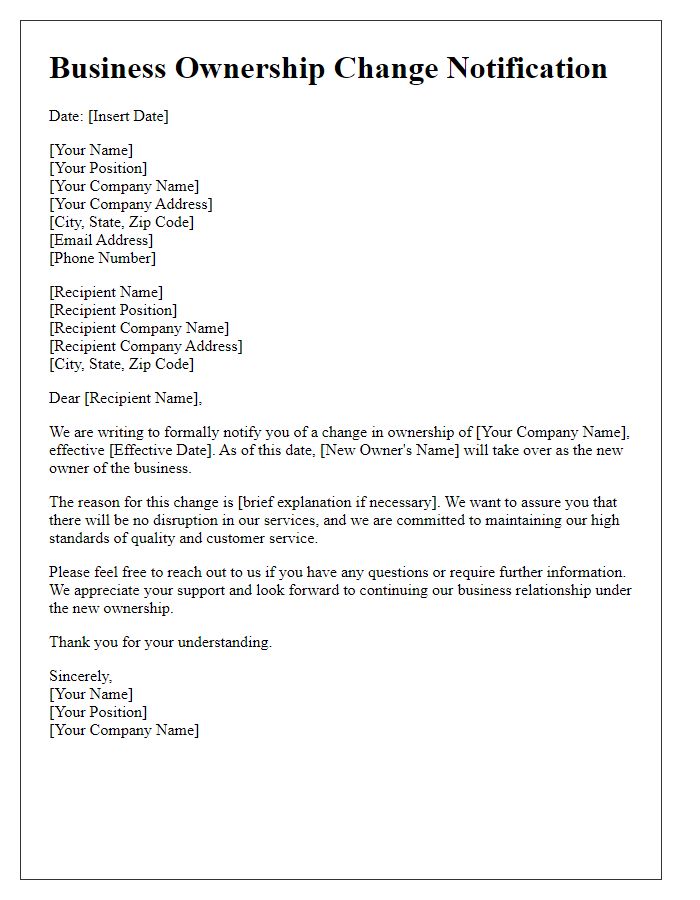

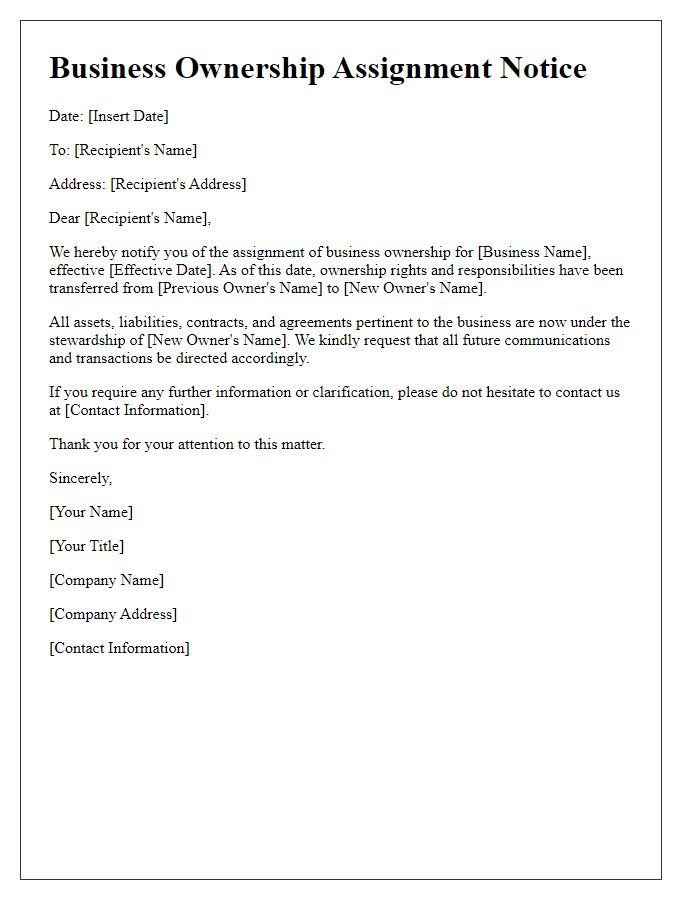

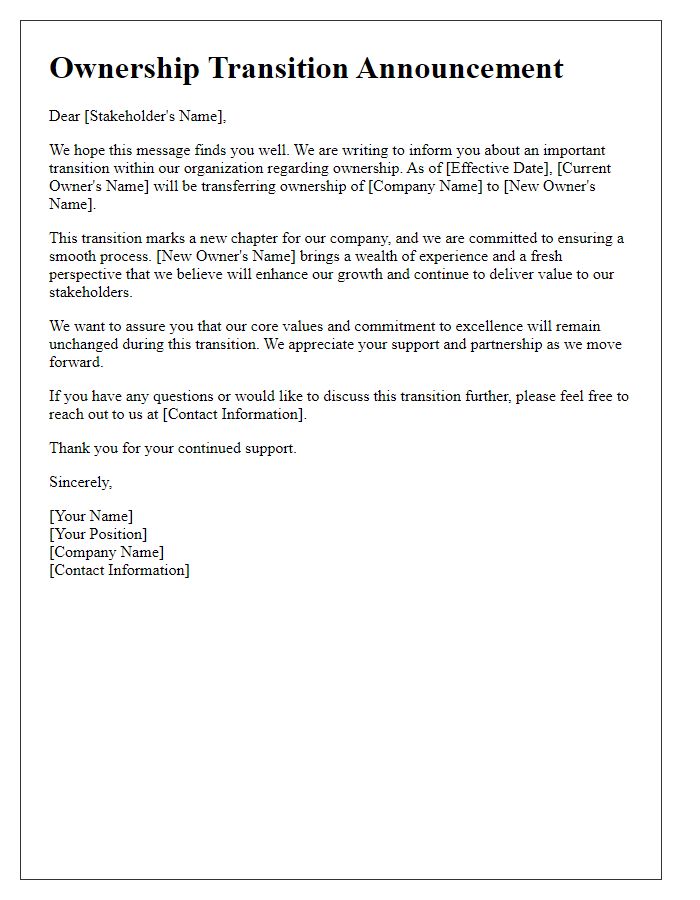

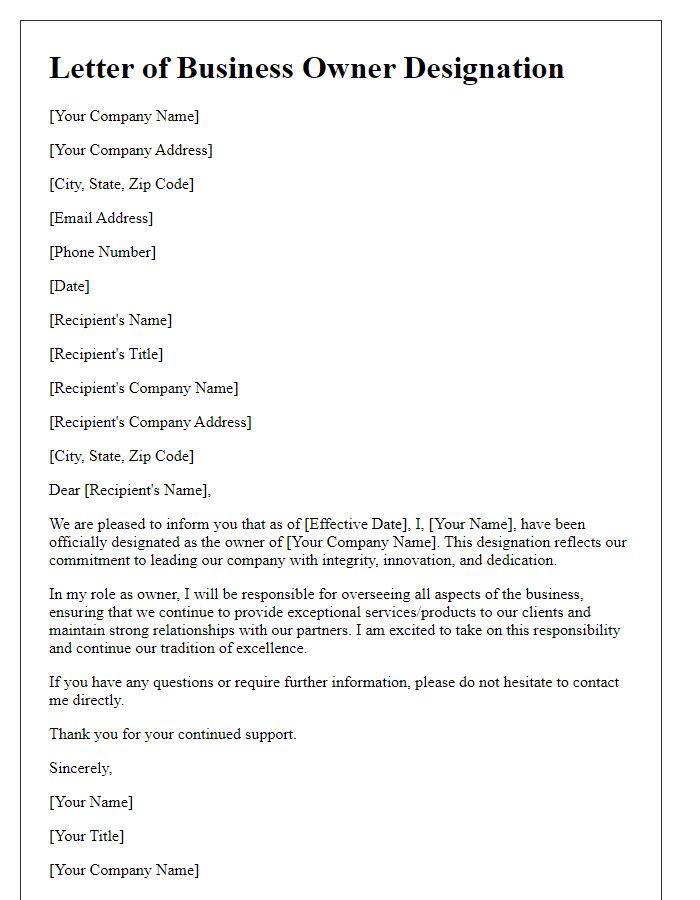

Communication and Stakeholder Notification

The transfer of business ownership involves crucial communication strategies to inform stakeholders effectively. Stakeholders, including employees, clients, suppliers, and investors, must be promptly notified about the ownership transition to maintain transparency and trust. The initial communication should be a formal announcement detailing the reason for the transfer, which could stem from events like retirement, acquisition, or restructuring. It is essential to express appreciation for stakeholders' support and reassure them about the continuity of operations in places such as company headquarters located in New York City. Additionally, a timeline for the transition process, including key milestones and contact information for inquiries, helps facilitate a smooth transition. Regular updates throughout the process can further strengthen relationships and mitigate uncertainties associated with the change in leadership.

Comments