Are you curious about how your organization measures up against industry standards? Benchmarking analysis can provide invaluable insights into best practices and areas for improvement, helping you stay competitive in today's fast-paced market. In this article, we'll explore the essential components of an effective benchmarking letter template, designed to facilitate clear communication and data sharing. Join us as we dive deeper into the nuances of crafting the perfect letter for your next industry analysis!

Introduction and Purpose

Industry benchmarking analysis serves as a critical tool for organizations seeking to evaluate their performance relative to peers within their specific sector. This process involves the systematic comparison of key performance indicators (KPIs), operational practices, and strategic initiatives against those of industry leaders in areas such as revenue growth, market share, and customer satisfaction. The primary purpose of conducting this analysis is to identify gaps in performance, uncover best practices, and ultimately enhance organizational efficiency and competitiveness. By leveraging insights gained from industry benchmarks, companies can make informed decisions that drive innovation and improve overall business outcomes, ensuring alignment with market trends and customer expectations.

Methodology and Data Sources

Industry benchmarking analysis involves a systematic approach to comparing key performance indicators (KPIs) and operational metrics against industry standards. Methodology includes identifying relevant competitors and selecting benchmark metrics such as revenue growth rates, operating margins, and customer satisfaction scores. Data sources may encompass industry reports from organizations like IBISWorld, financial statements from publicly traded companies, and surveys from professional associations like the National Association of Manufacturers. Secondary data analysis contributes insights into market trends and emerging practices. Tools like SWOT Analysis and Balanced Scorecards aid in interpreting results, providing a comprehensive understanding of competitive positioning within the industry landscape.

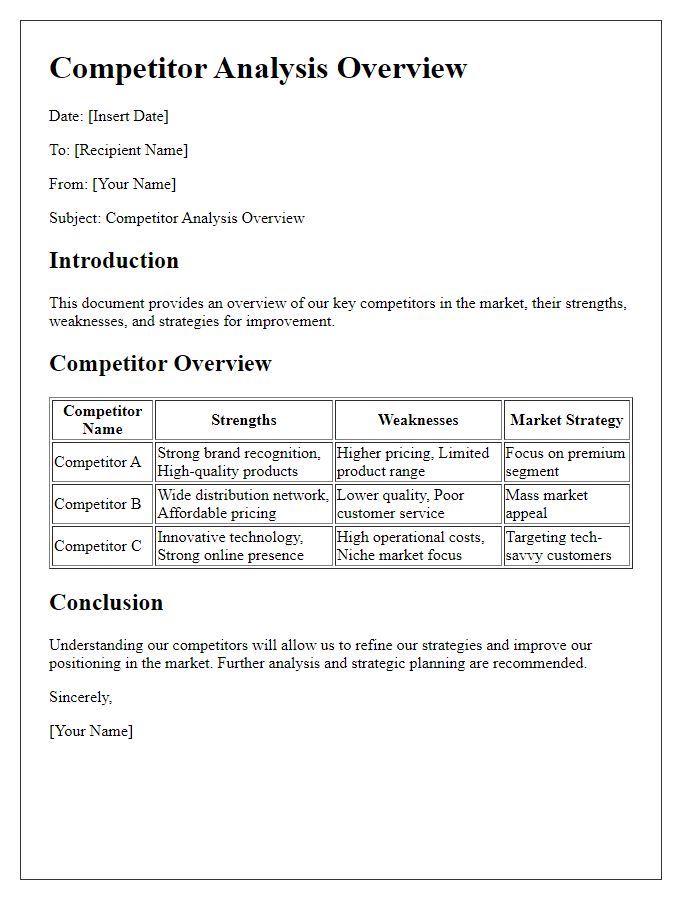

Key Findings and Insights

Industry benchmarking analysis reveals critical insights regarding performance metrics within specific sectors. Companies, such as Tesla (automotive industry), often exhibit remarkable innovation rates, with a reported annual growth of 38% in EV sales over the last three years. Concurrently, firms like Procter & Gamble (consumer goods) maintain a gross profit margin of approximately 50%, showcasing efficiency in production processes. Additionally, companies in the healthcare sector, exemplified by UnitedHealth Group, achieve patient satisfaction scores averaging 4.2 out of 5, indicating high service quality. Competitive analysis emphasizes the importance of adopting best practices, with leaders in technology, like Microsoft, investing over $20 billion annually in research and development, significantly impacting their market share and product offerings. Understanding these key figures and trends facilitates strategic planning and operational improvements across various industries.

Recommendations and Strategic Actions

The comprehensive industry benchmarking analysis reveals critical insights into best practices and performance metrics within the competitive landscape. The data shows that top-performing companies, such as Tech Giants and Manufacturing Leaders, exhibit an average operational efficiency of 85% while maintaining customer satisfaction scores exceeding 90%. Strategic actions recommended include adopting advanced analytics tools to enhance decision-making processes, implementing lean management techniques to streamline operations, and investing in employee training programs that target skill gaps. Additionally, companies should prioritize sustainability initiatives which have demonstrated a 20% reduction in costs while enhancing brand reputation. Engaging in regular performance reviews will ensure alignment with industry standards and foster a culture of continuous improvement. These recommendations aim to position organizations competitively within their respective markets, ultimately driving growth and innovation.

Conclusion and Next Steps

Conducting industry benchmarking analysis reveals critical insights about competitive positioning and operational efficiency. Key performance indicators (KPIs) such as revenue growth rates, cost management ratios, and customer satisfaction metrics are vital for comparing against industry leaders. The analysis indicates that organizations achieving above-average performance, such as Company X with a 25% revenue growth compared to the industry average of 10%, implement innovative strategies and robust customer engagement approaches. Next steps involve developing targeted action plans based on identified gaps and opportunities. Engaging cross-functional teams will facilitate the implementation of best practices, improve internal processes, and enhance overall performance metrics to align with industry standards. Regular follow-up reviews should be scheduled every quarter to track progress and adjust strategies as necessary, ensuring continuous improvement and competitive advantage.

Comments