Navigating financial disputes can often feel overwhelming, but with the right approach, it doesn't have to be. Whether you're addressing discrepancies in accounts or seeking clarity on transactions, having a solid letter template can simplify the reconciliation process. This guide aims to equip you with a reliable framework to effectively articulate your concerns and reach an amicable resolution. So, let's dive in and explore how you can tackle financial disputes with confidence!

Contact Information

In financial reconciliation disputes, the accuracy of contact information plays a crucial role in effective resolution. Essential details such as the name of the disputed account holder, account number (typically a unique identifier), company name, and relevant contact number must be clearly documented. It is vital to reference the date of the original statement (indicating the period under dispute), along with the name of the financial institution involved, whether a bank, credit card issuer, or investment firm. Additionally, including email addresses can expedite communication, streamlining the process of reaching a satisfactory outcome while minimizing misunderstandings during the dispute resolution.

Account Details

Financial reconciliation disputes often arise from discrepancies in account statements between organizations or individuals. Accurate account details, such as account number, transaction dates, and amounts, play a crucial role in resolving these issues. For instance, discrepancies in transaction amounts, where one party records a payment of $1,000 while the other records $1,200, can lead to misunderstandings. Additionally, identifying the specific date of a transaction, say March 15, 2023, is essential to trace back records and validate entries. Providing clear documentation of account statements, ledger entries, and supporting invoices is vital in facilitating a fast resolution process.

Issue Description

In financial reconciliation processes, discrepancies between accounting records can arise, often leading to disputes that require resolution. Common issues include mismatched transaction amounts, missing documentation, or timing differences in cash flow, with significant financial implications in businesses or organizations. For instance, an unnoticed $5,000 invoice from a supplier can result in cash flow problems and impact budget planning. Events such as audits or quarterly financial reviews may uncover these discrepancies, prompting urgent attention to resolve conflicts efficiently. Maintaining clear communication with stakeholders, including accounting teams and external auditors, is vital in addressing these issues and ensuring accurate financial reporting compliance with regulations like GAAP or IFRS.

Supporting Documentation

Supporting documentation plays a crucial role in the financial reconciliation dispute resolution process. Essential documents include bank statements, transaction records, invoices, and correspondence related to the disputed items. Accurate bank statements revealing account activity for specific periods provide a foundation for identifying discrepancies in financial records. Invoices detailing purchased goods and services establish timelines and amounts owed or paid, serving as vital evidence in disputes. Additionally, transaction records sourced from accounting systems illuminate the flow of funds, illustrating potential errors or issues. Properly formatted correspondence, such as emails or letters exchanged between parties, can clarify communication and intentions, contributing to an amicable resolution. Comprehensive documentation strengthens each party's stance and facilitates a thorough examination of the discrepancies at hand.

Desired Resolution

To resolve financial reconciliation disputes, companies often seek clear communication and a structured approach. The resolution process includes identifying discrepancies, such as unmatched invoices or payment amounts affecting cash flow and profitability. Effective documentation, including financial statements from specific periods (e.g., Q1 2023), transaction records, and correspondence, plays a critical role in supporting claims. In addition, setting a timeline for resolution helps facilitate timely discussions. Resolution meetings may involve key stakeholders, such as finance department heads and external auditors. Ultimately, a successful resolution could involve agreeing on corrective measures, such as credit adjustments or enhanced internal controls, bolstering future reconciliation efforts.

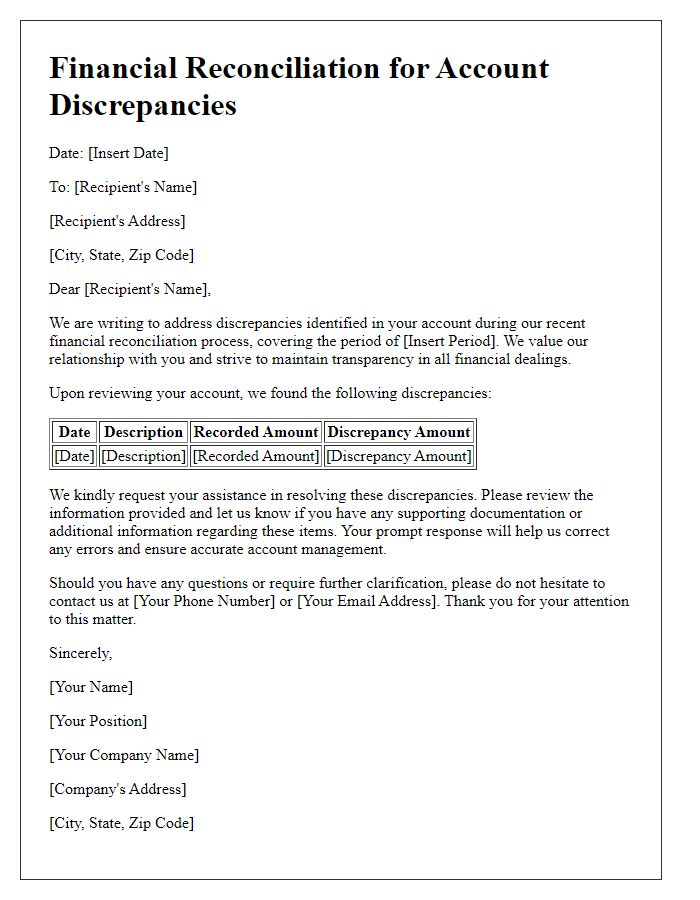

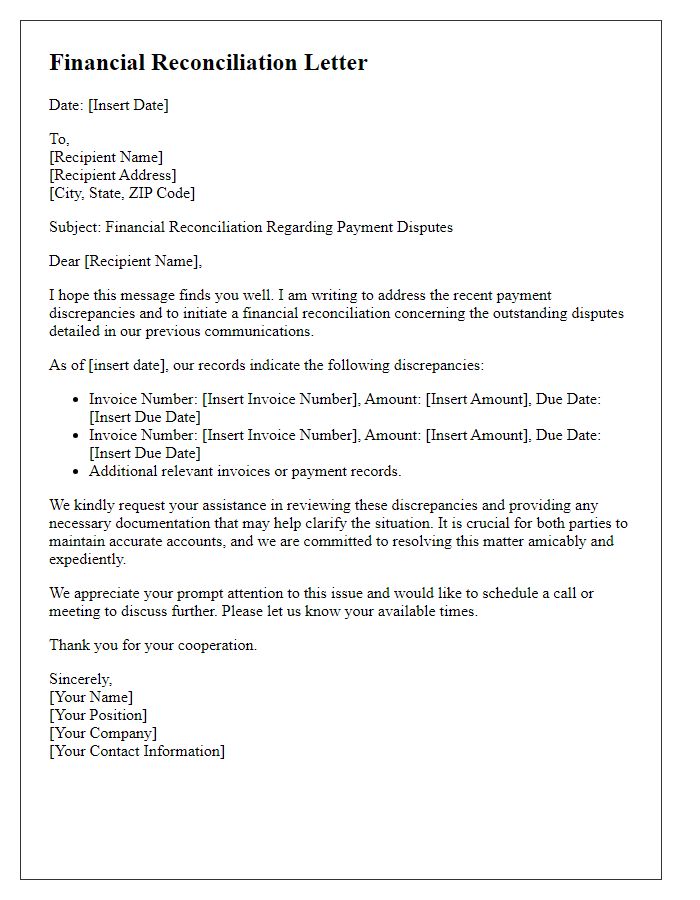

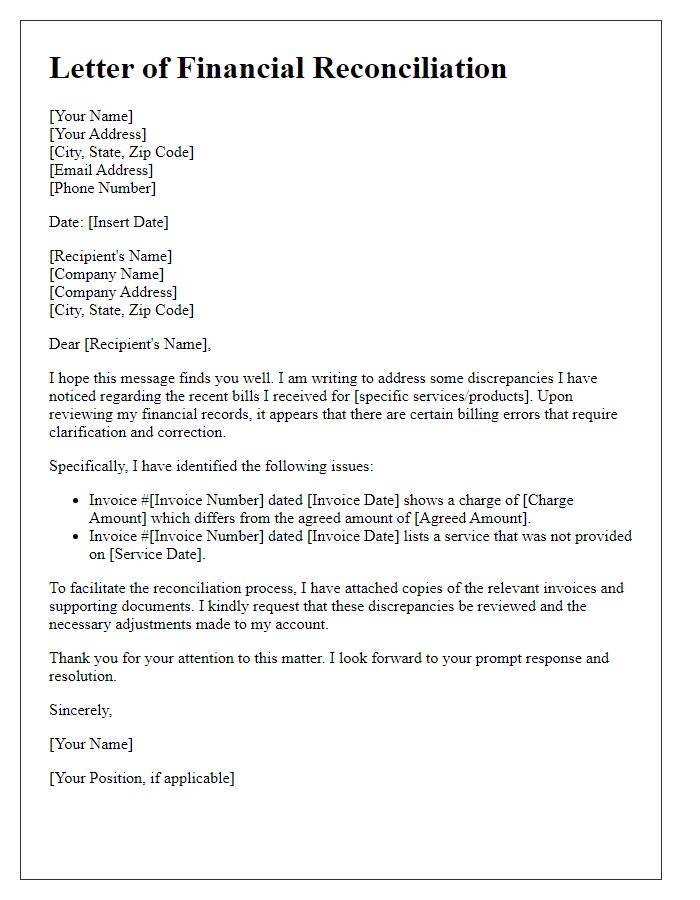

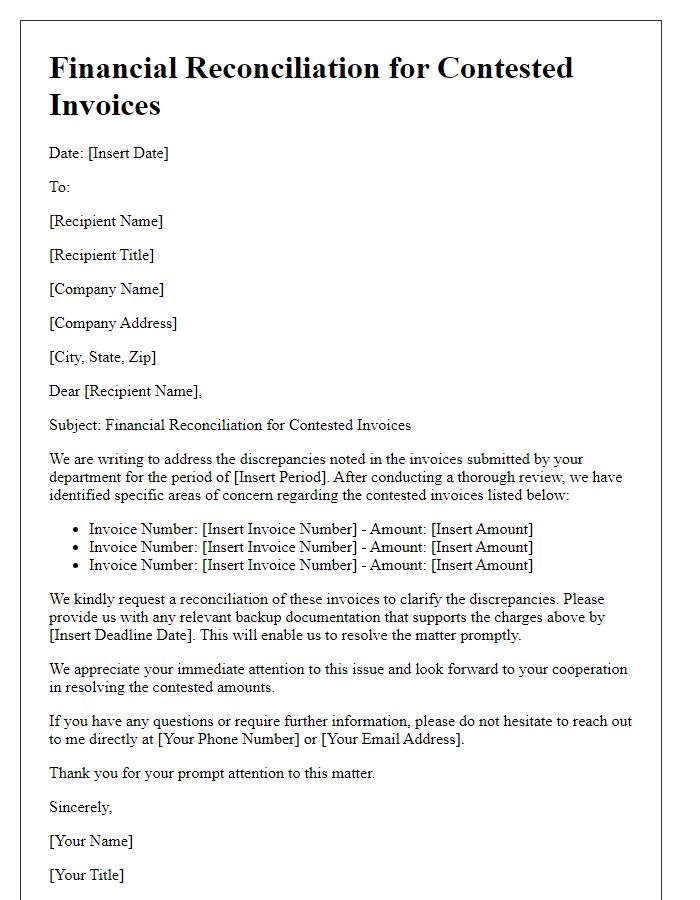

Letter Template For Financial Reconciliation Dispute Resolution Samples

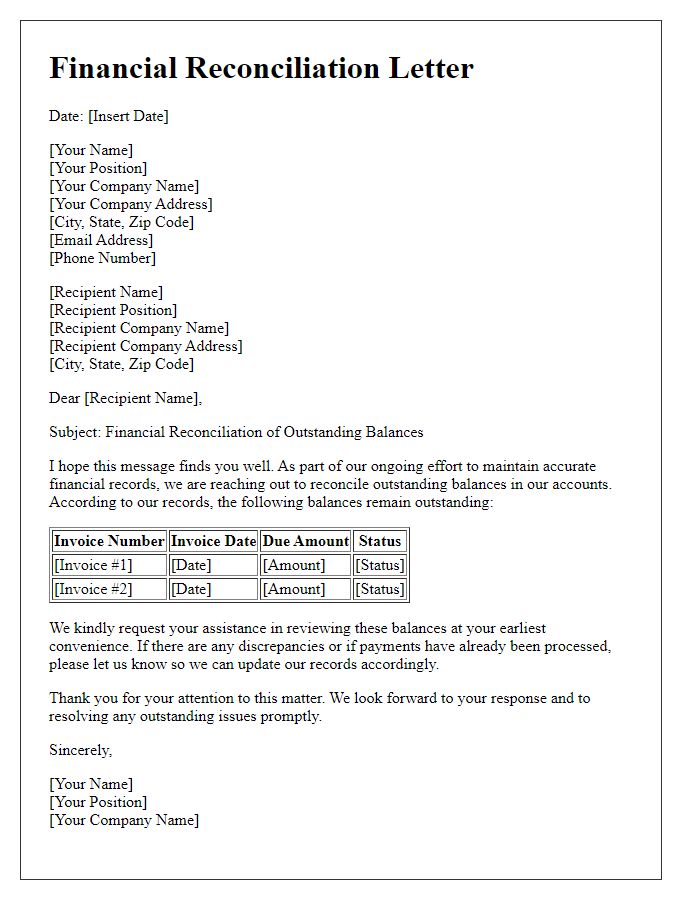

Letter template of financial reconciliation concerning outstanding balances.

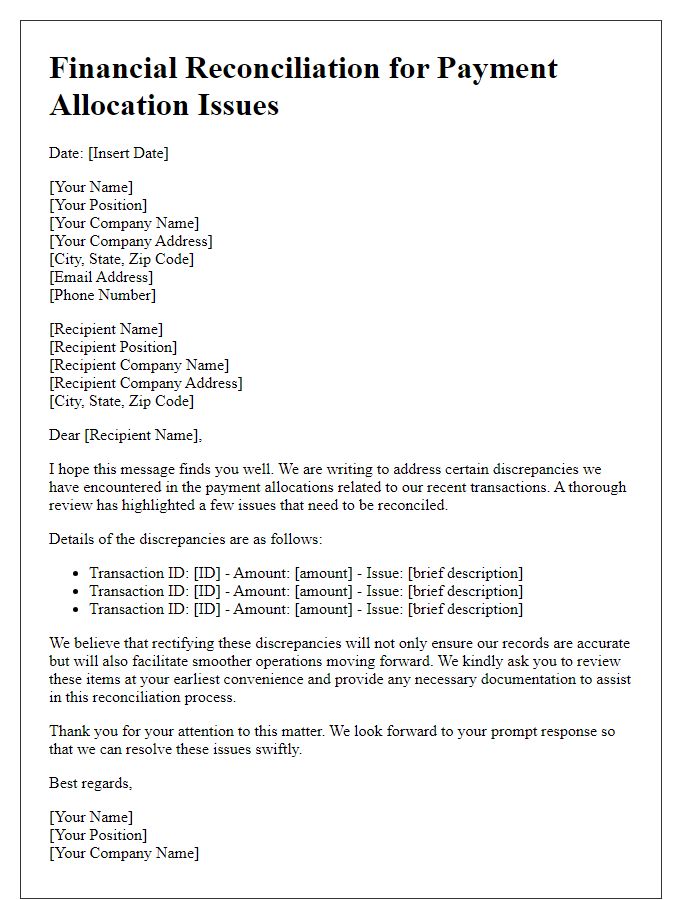

Letter template of financial reconciliation for payment allocation issues.

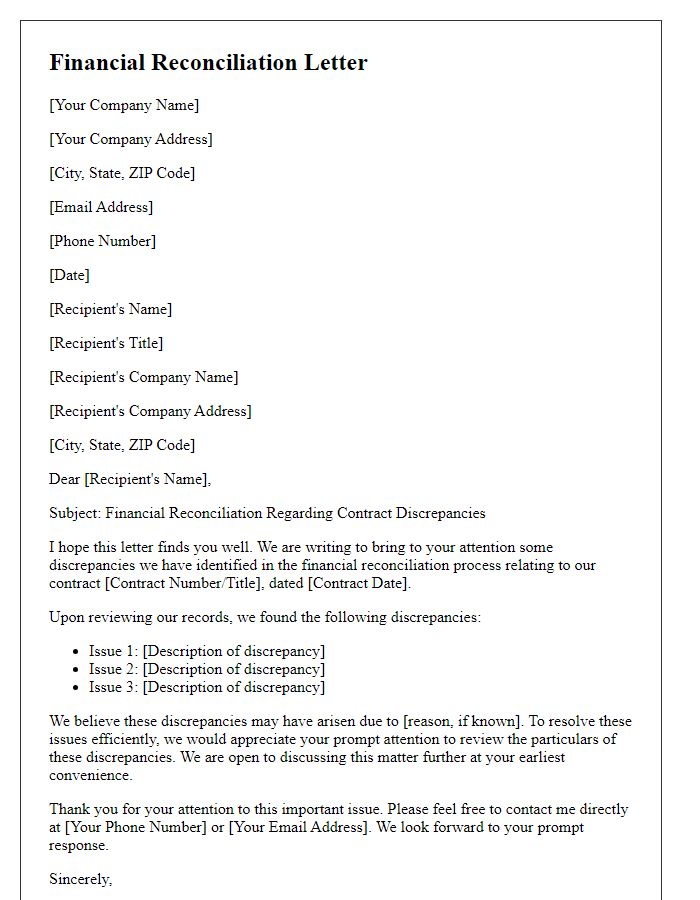

Letter template of financial reconciliation about contract discrepancies.

Comments