Are you looking to navigate the intricate world of contingent liability disclosures? Understanding these financial nuances can be challenging, but with the right guidance, it becomes much simpler. In this article, we'll break down the essentials of contingent liabilities, including what they are, when they need to be disclosed, and how to approach them in your financial statements. So, let's dive in and get you equipped with the knowledge you needâread more to uncover the full story!

Purpose of Disclosure

Contingent liability disclosure serves a critical function in financial reporting, particularly within the realm of corporate accounting. Organizations, like publicly traded companies, must adhere to accounting standards, such as the International Financial Reporting Standards (IFRS) or the Generally Accepted Accounting Principles (GAAP). These standards mandate the disclosure of potential obligations that may arise from past events, such as lawsuits or product warranties. This transparency aids stakeholders, including investors and regulators, in comprehending the financial risks that could potentially impact the entity's future financial position and performance. Disclosed contingent liabilities, which must be carefully evaluated for probability and estimability, ensure that comprehensive financial statements reflect not only current assets and liabilities but also potential future obligations, promoting informed decision-making.

Description of Contingent Liability

Contingent liabilities represent potential obligations that may arise from past events, such as lawsuits or warranty claims, depending on the occurrence of future events (e.g., legal judgments or settlements). These financial obligations are not recorded on the balance sheet until a specific condition is met, although they must be disclosed in footnotes in financial statements. For instance, a company facing litigation, such as XYZ Corporation involved in a lawsuit valued at $500,000 filed in September 2023, must evaluate the likelihood of losing the case to determine the necessity of disclosure. If the outcome is probable, a liability should be recognized. If it is merely possible, only a footnote outlining the circumstances, potential financial impact, and any related estimates should be provided. Accurate disclosure is vital for ensuring transparency and maintaining investor trust.

Potential Financial Impact

Contingent liabilities represent potential financial obligations that may arise depending on the outcome of uncertain future events, affecting corporate financial statements. Examples include pending legal disputes or regulatory investigations, which could lead to financial settlements or penalties ranging in the millions of dollars, impacting the balance sheet and cash flow statements significantly. Companies must evaluate the likelihood of these events--categorized as probable, reasonably possible, or remote--according to accounting standards such as IFRS and GAAP. Accurate disclosure in financial reports ensures transparency for stakeholders, measuring the risk exposure that could influence investment decisions and overall company valuation. Additionally, maintaining robust internal controls and regular assessment procedures can help mitigate risks associated with contingent liabilities.

Disclosure Compliance and Regulations

Contingent liabilities represent potential obligations that may arise depending on the outcome of future events, often reflected in financial statements as per International Financial Reporting Standards (IFRS), specifically IFRS 37. Accurate disclosure of these liabilities is essential for transparency and compliance, particularly for publicly traded companies subject to regulations set by the Securities and Exchange Commission (SEC) in the United States. Events that trigger contingent liabilities include lawsuits, product defects, or regulatory inquiries, each carrying significant financial implications if they materialize. Companies must evaluate and disclose the nature, timing, and potential impact of these liabilities, ensuring that stakeholders fully understand associated risks while adhering to legal standards in their annual reports and quarterly filings. Failure to comply with disclosure requirements can lead to severe penalties, including fines and reputational damage.

Risk Management and Mitigation Strategies

Contingent liabilities, such as potential legal claims or environmental remediation costs, require careful monitoring and disclosure. Organizations need to assess the probability of these liabilities materializing, often classified as probable, reasonably possible, or remote. For instance, businesses in high-risk industries, like pharmaceuticals or energy, should consider the implications of litigation or regulatory changes. Risk management strategies can include regular legal assessments, insurance coverage to mitigate financial impacts, and proactive communication with stakeholders. It is crucial to maintain accurate records of potential liabilities, alongside their estimated financial impact, to ensure transparency in financial reporting and compliance with guidelines like IFRS and GAAP. Effective mitigation strategies, like establishing contingency reserves, can provide a financial buffer against unexpected liabilities, ensuring organizational stability and continued operational capacity.

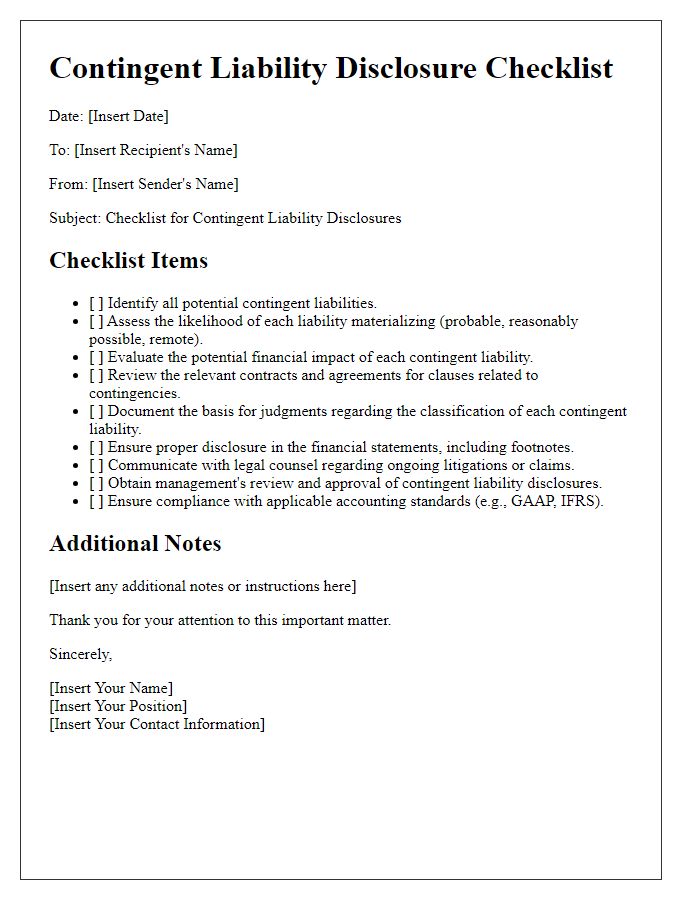

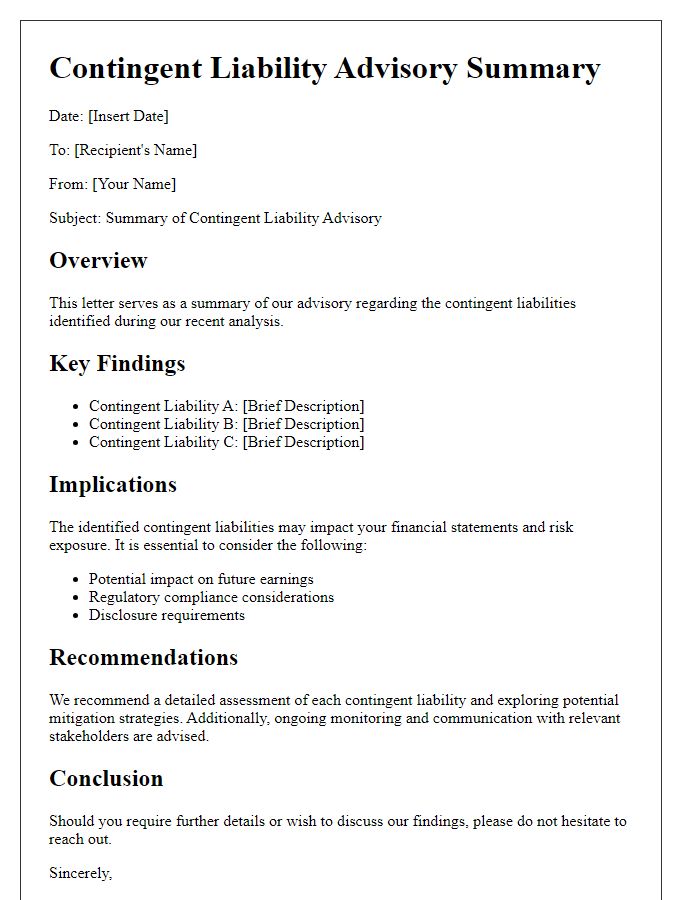

Letter Template For Contingent Liability Disclosure Advice Samples

Letter template of recommendations for contingent liability disclosures.

Comments