As the year draws to a close, it's the perfect time to start thinking about your tax planning strategies. From maximizing deductions to evaluating your investment accounts, there are plenty of ways to ensure you're making the most of your financial situation. Whether you're a seasoned taxpayer or new to the process, understanding the ins and outs of year-end tax planning can significantly impact your overall tax obligation. Ready to dive deeper into effective tips and strategies? Let's explore!

Tax liability assessment

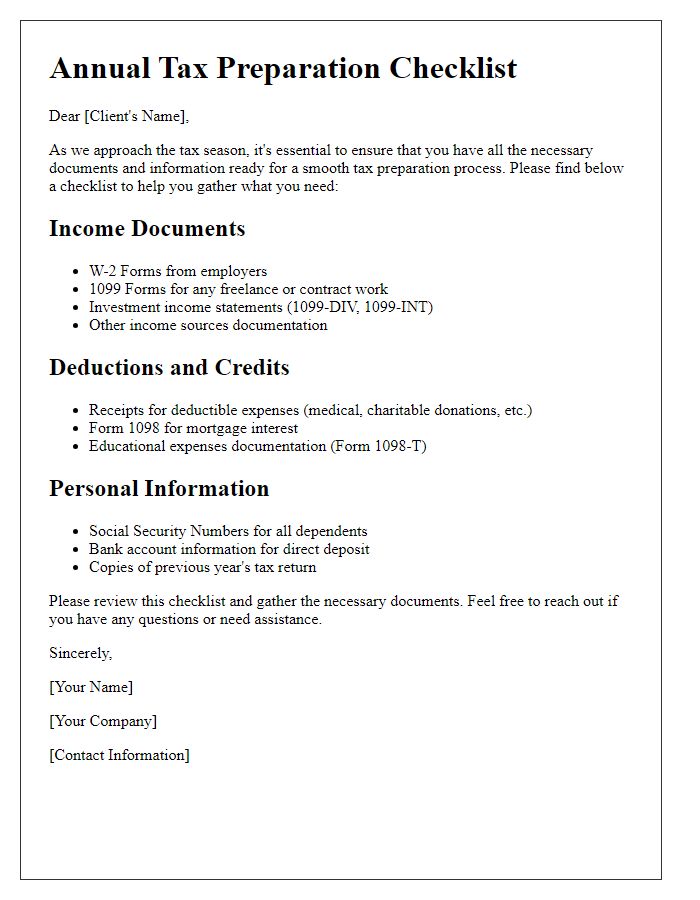

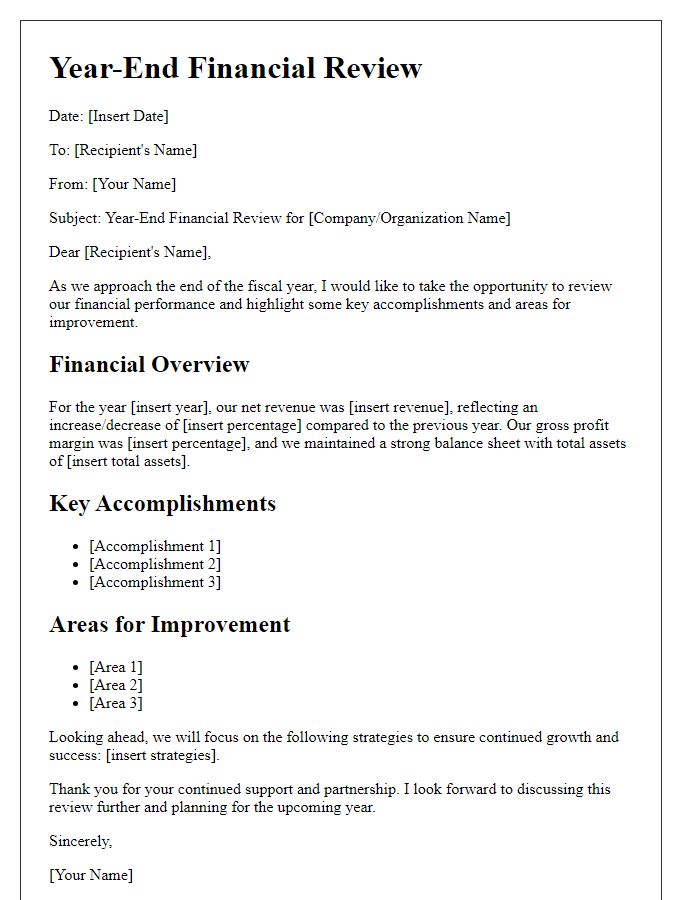

Year-end tax planning involves a comprehensive assessment of tax liabilities to optimize financial outcomes for the upcoming fiscal period. Individuals and businesses must gather documents like W-2 forms, 1099 statements, and expense records to accurately evaluate taxable income. Understanding the implications of tax brackets can influence strategic decisions regarding income deferral or accelerated deductions. Effective tax planning can also incorporate mechanisms such as retirement account contributions, which not only reduce taxable income but also enhance long-term savings, impacting future financial security. Additionally, familiarizing oneself with deductions and credits pertinent to specific situations--such as education credits or business expenses--can significantly alleviate overall tax burdens, fostering a sound financial strategy as the year concludes.

Income deferrals and accelerations

Year-end tax planning strategies, specifically in income deferrals and accelerations, play a crucial role in optimizing tax liabilities. Deferring income (delaying receipt of payments until the next fiscal year) can be beneficial for individuals and businesses aiming to lower their taxable income for the current year, potentially keeping them in a lower tax bracket. For instance, self-employed individuals may consider postponing invoicing for services rendered in December to January. Conversely, income acceleration (receiving payments sooner) can be strategically executed to capture income within the current tax year, especially if expecting a higher tax rate in the next fiscal year. High-income earners could opt to receive bonuses or commissions before year-end to maximize current tax benefits. Additionally, considerations around capital gains and the timing of asset sales can further influence overall tax positioning for the upcoming year.

Deductions and credits optimization

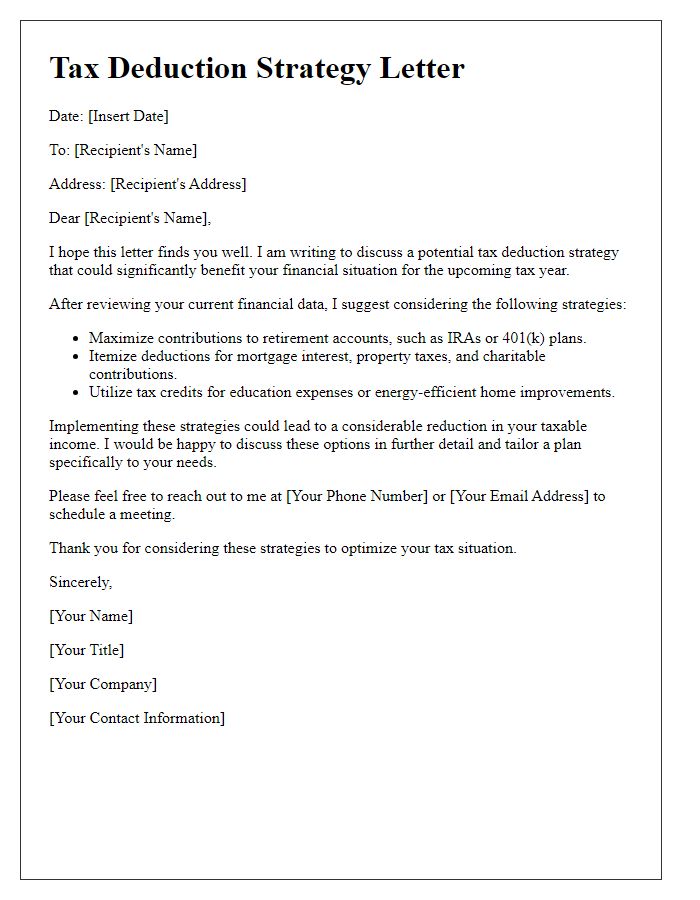

Year-end tax planning involves optimizing deductions and credits to minimize taxable income and enhance financial efficiency for individuals and businesses. Tax deductions, such as those for mortgage interest (up to $10,000 for state and local taxes combined) and charitable contributions (typically capped at 60% of AGI for cash contributions), can significantly reduce federal income tax liabilities. Tax credits, such as the Child Tax Credit (up to $2,000 per qualifying child) and the Earned Income Tax Credit (which can provide substantial refunds for low to moderate-income earners), directly reduce tax owed, thus increasing refund potential. Implementing strategies like maximizing contributions to retirement accounts (with a contribution limit of $22,500 for 401(k) plans in 2023) and utilizing Flexible Spending Accounts (FSAs) for dependent care can further enhance tax efficiency. Engaging a tax professional for personalized advice can provide additional insights based on individual financial situations and current tax legislation.

Investment evaluations

Investment evaluations are essential for maximizing tax efficiency and financial performance. Analyzing various asset classes like stocks, bonds, and real estate can reveal opportunities for capital gains realization or losses to offset future taxable income. Tax-advantaged accounts such as Individual Retirement Accounts (IRAs) and 401(k) plans provide unique opportunities for tax-deferred growth. The capital gains tax rate can differ significantly depending on holding periods; long-term gains are typically taxed at lower rates (0%, 15%, or 20% based on income levels), while short-term gains are taxed as ordinary income (up to 37%). Timing asset sales before year-end (December 31, 2023) allows investors to strategize gains and losses efficiently, optimizing their tax liabilities and enhancing overall portfolio performance. Regular reviews of tax-loss harvesting techniques can further improve the investment strategy significantly.

Retirement contributions strategies

Retirement contribution strategies play a crucial role in effective year-end tax planning for enhancing financial security during retirement years. Contributing to tax-advantaged accounts like 401(k) plans or Individual Retirement Accounts (IRAs) can reduce taxable income significantly, a strategy particularly important for high earners aiming to lower their federal tax bracket. For the tax year 2023, the contribution limit for 401(k) accounts is $22,500, with an additional catch-up contribution of $7,500 for individuals aged 50 and older, enabling a total potential contribution of $30,000. On the other hand, Traditional IRAs allow for a contribution of up to $6,500, with an extra $1,000 catch-up for those 50 and over. Taxpayers should also consider Roth IRAs, which provide tax-free growth and withdrawals if specific conditions are met. Maximizing contributions before December 31st can yield substantial tax benefits, along with enhancing retirement savings by leveraging employer matching programs, thus providing an excellent opportunity for individuals to secure their financial future.

Comments