Have you ever found yourself puzzled over a financial statement that just doesn't add up? It's not uncommon to encounter discrepancies in your financial records, and addressing these errors promptly is crucial for maintaining accuracy and integrity. In this article, we'll guide you through the process of crafting a clear and effective letter template for requesting financial data corrections. So, let's dive in and ensure your financial documents reflect the truthâread on to discover how to make your correction request seamless!

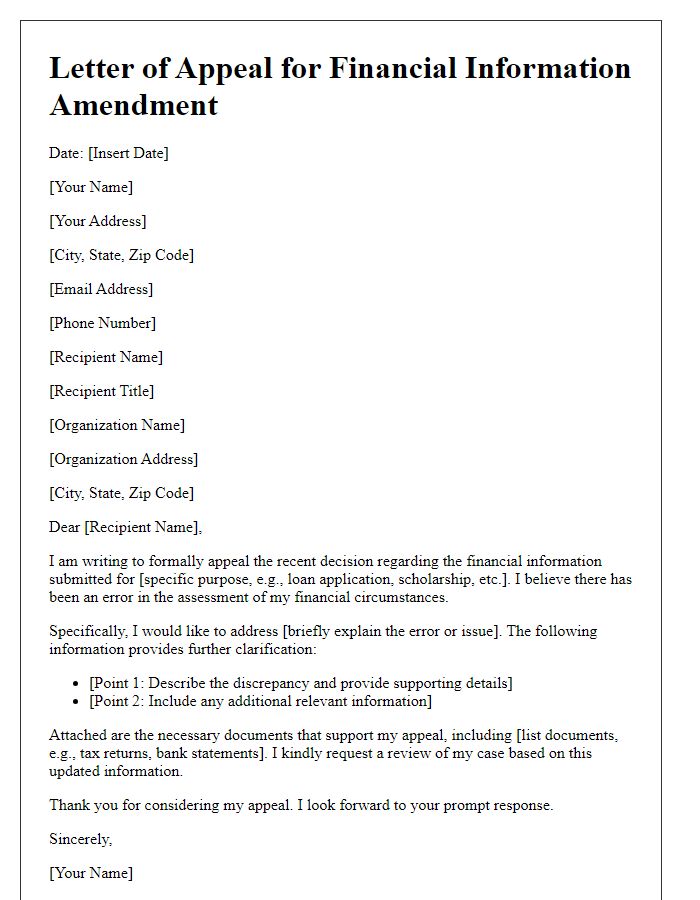

Accurate account information

Accurate account information is essential for maintaining the integrity of financial records. Discrepancies often arise from data entry errors or system malfunctions. Financial institutions such as banks (e.g., JPMorgan Chase, Bank of America) typically utilize proprietary software that requires meticulously checked inputs. Incorrect information can lead to miscalculations in statements, affecting crucial metrics like account balance, transaction history, and interest accrual. Timely corrections are vital to prevent issues such as overdraft fees, credit score impacts, or payment delays. Ensuring precision in financial data not only fosters trust but also complies with regulations set by governing bodies like the Financial Accounting Standards Board (FASB).

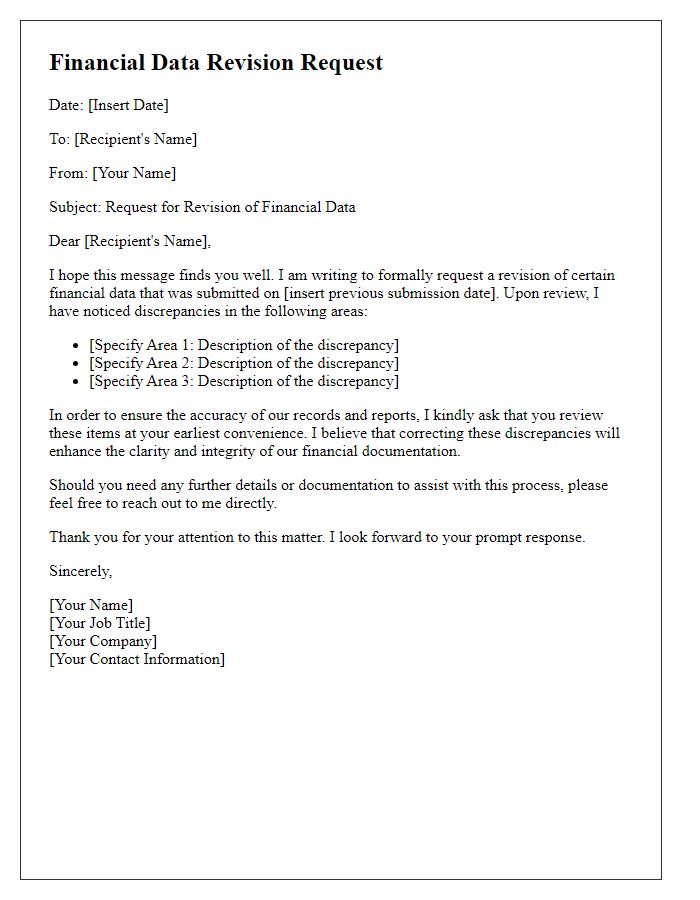

Detailed error description

Inaccurate financial reports can lead to significant discrepancies in accounting records, affecting overall business performance. For instance, a financial statement reflecting a revenue figure of $500,000 when the actual figure is $650,000 results in a $150,000 underreporting error. Such discrepancies may stem from data entry mistakes, incorrect formula application in Excel spreadsheets, or misclassification of expenses in accounting software like QuickBooks. Timely identification of these errors is crucial, as it impacts budget forecasting, tax liabilities, and investment decisions. An effective correction request should include specific details about the erroneous figures, the correct amounts, and documentation supporting the claim to facilitate prompt resolution.

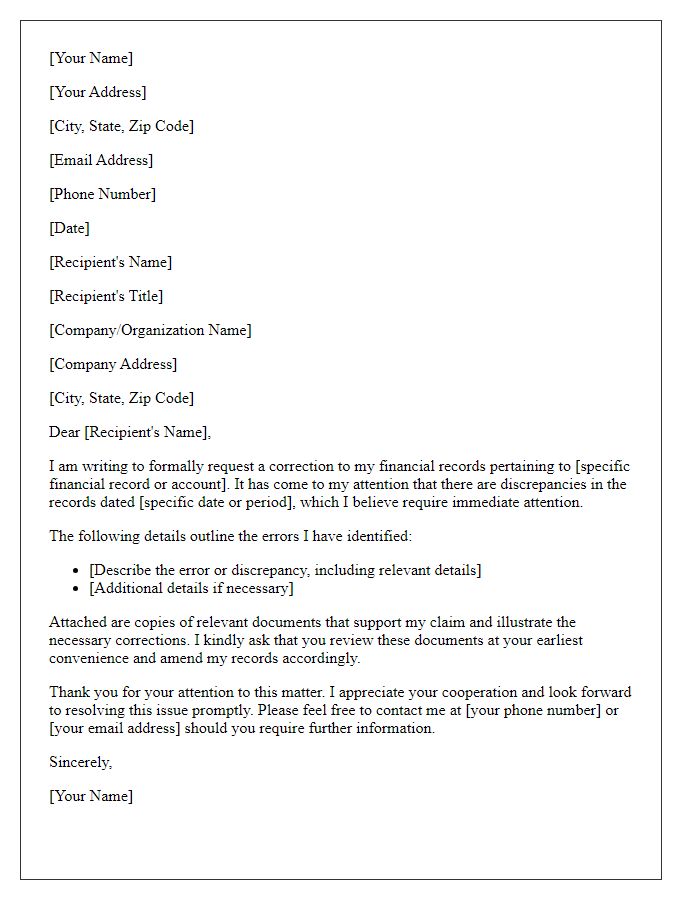

Supporting documents

A financial data correction request requires precise communication regarding discrepancies in financial information, often related to accounting records or transactions. Supporting documents may include recent bank statements highlighting inaccuracies, transaction receipts demonstrating erroneous entries, previous financial reports (including balance sheets or income statements) that illustrate differences, and relevant correspondence with financial institutions or stakeholders (like emails or official letters) that substantiate the claim for correction. Additionally, providing identification documents (such as a government-issued ID) may be necessary to validate the identity of the requester, ensuring the correction request is processed efficiently and accurately.

Clear correction request

A financial data correction request involves the timely and detailed revision of discrepancies in accounts or reports. Accurate financial records, such as balance sheets and income statements, are critical for stakeholders at entities like Fortune 500 companies. For instance, if a misreported revenue figure of $500,000 appears in the second quarter report, prompt notification (within 30 days) to the accounting department is essential. The request should include specific details like account numbers, transaction dates, and the nature of the error. Furthermore, attaching supporting documents, such as bank statements or invoices, enhances the validity of the correction. Maintaining transparency of these corrections fosters trust among investors and regulatory bodies, ensuring compliance with standards such as Generally Accepted Accounting Principles (GAAP).

Contact information for follow-up

A financial data correction request typically involves the need to amend inaccuracies in documented financial records, such as tax returns or account statements. Important identifiers such as Social Security Numbers or Account Numbers ensure proper tracking of the case. Accuracy is crucial in maintaining financial integrity and compliance with regulations set by the Internal Revenue Service (IRS) or financial institutions. Additionally, providing a detailed explanation specifying the errors, dates, and amounts is essential, as is including contact information like a phone number and an email address for prompt follow-up and clarification by the involved parties.

Comments