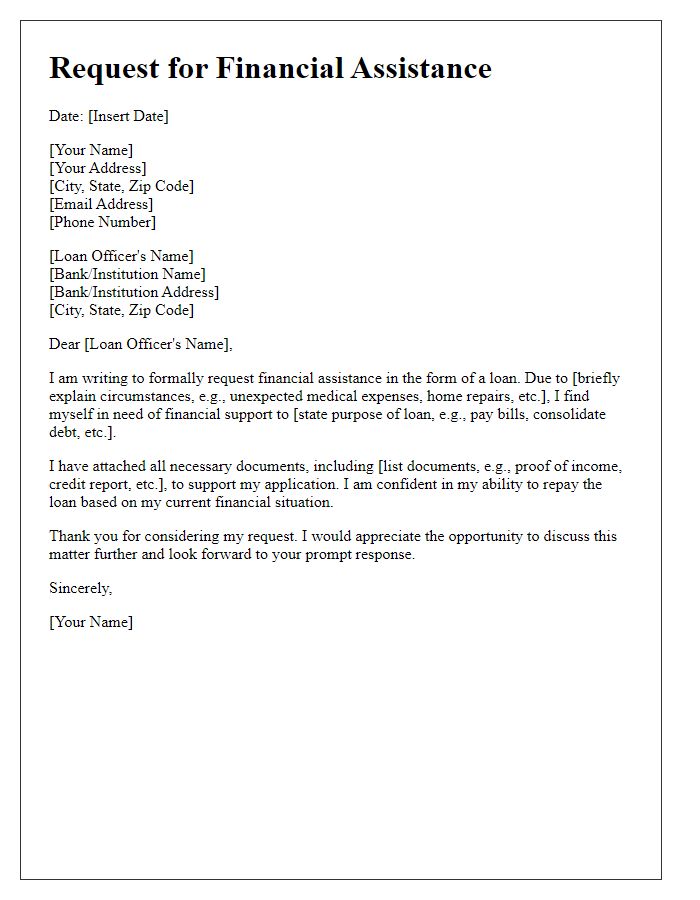

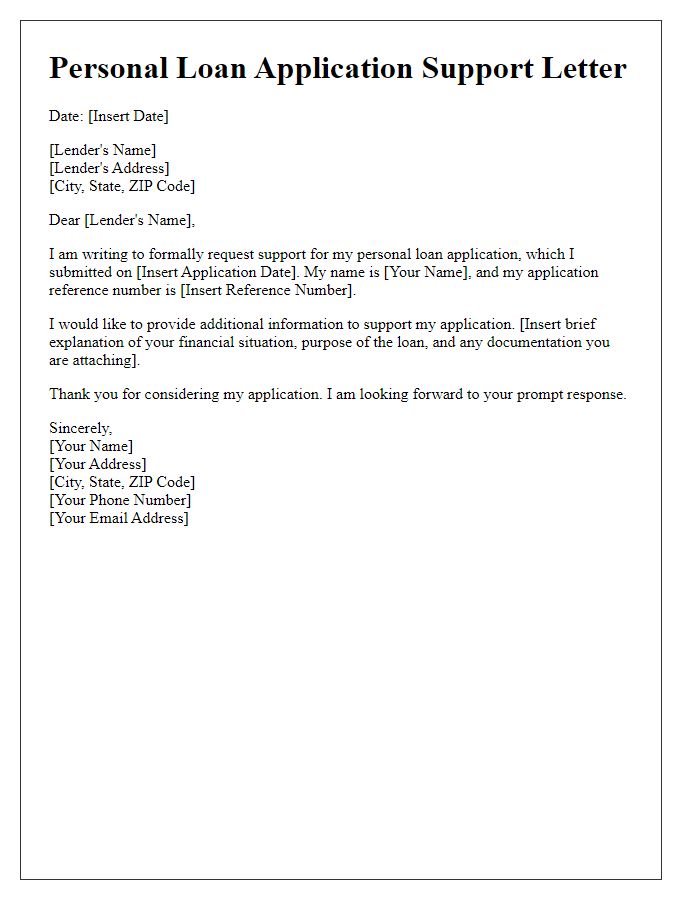

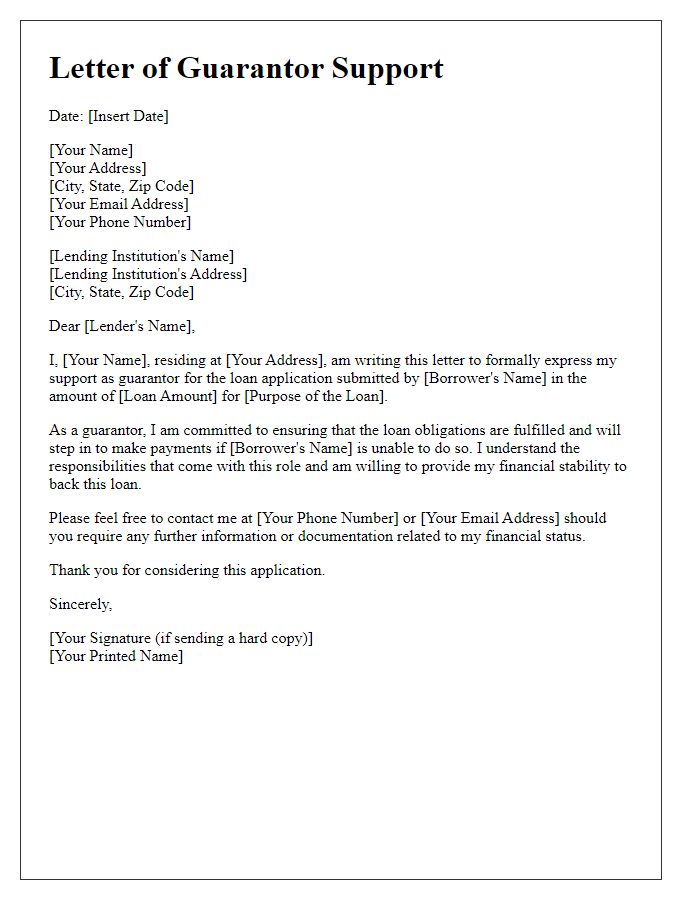

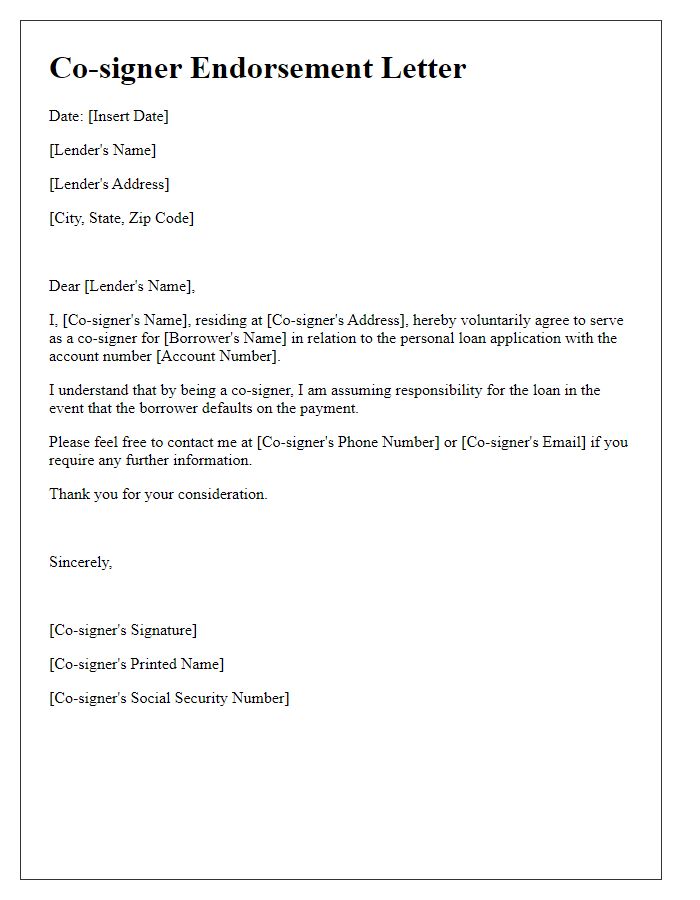

When it comes to securing a loan, a strong support letter can make all the difference. This crucial document not only highlights your credibility but also reassures lenders of your reliability. Crafting a compelling letter can be straightforward, focusing on your financial history, employment stability, and intention for the loan. If you're looking for tips and examples on how to create an effective loan application support letter, read on!

Applicant's financial stability and income.

A strong applicant's financial stability hinges on various crucial factors, including consistent income levels, reliable employment history, and comprehensive credit ratings. Individuals seeking loans often provide details such as annual income (preferably exceeding the median income level for their region, typically defined by the U.S. Census Bureau), employment status within established companies (e.g., working for Fortune 500 firms), and credit scores (FICO scores ideally above 700). Additionally, applicants may present documentation of assets (like savings accounts with substantial balances or property ownership), as well as ongoing financial obligations (including current loans and monthly expenses). This financial profile is essential for lenders, influencing approval rates and interest terms for loans, particularly in competitive markets like housing, where properties are often valued at hundreds of thousands of dollars.

Purpose and amount of loan requested.

A loan application requesting financial assistance typically specifies its intended purpose and the exact amount being sought. For example, an individual may apply for a personal loan of $15,000 to consolidate existing debt, aiming to reduce monthly payments and interest rates. Alternatively, a small business might seek a loan of $50,000 for expansion, including purchasing new equipment and increasing inventory for a retail location in downtown Chicago, ensuring enhanced capacity to meet customer demand. In both instances, stating the purpose clarifies the necessity for the funds, while the specified amount provides a clear objective for the lending institution to consider.

Credit history and score.

A strong credit history and high credit score are critical factors that lenders examine when evaluating loan applications. The credit score, typically ranging from 300 to 850, reflects an individual's creditworthiness based on their financial behavior, including payment history, credit utilization, and outstanding debts. A score above 700 is generally considered good, indicating reliable repayment. Credit history encompasses the length of time an individual has maintained credit accounts, the diversity of credit types (such as revolving credit cards and installment loans), and any negative marks like late payments or bankruptcies. Maintaining a healthy credit profile, with timely payments and low credit utilization (ideally below 30%), significantly enhances the likelihood of loan approval and favorable interest rates. Regularly reviewing credit reports from major bureaus--Equifax, Experian, and TransUnion--ensures accuracy and allows the individual to identify areas for improvement.

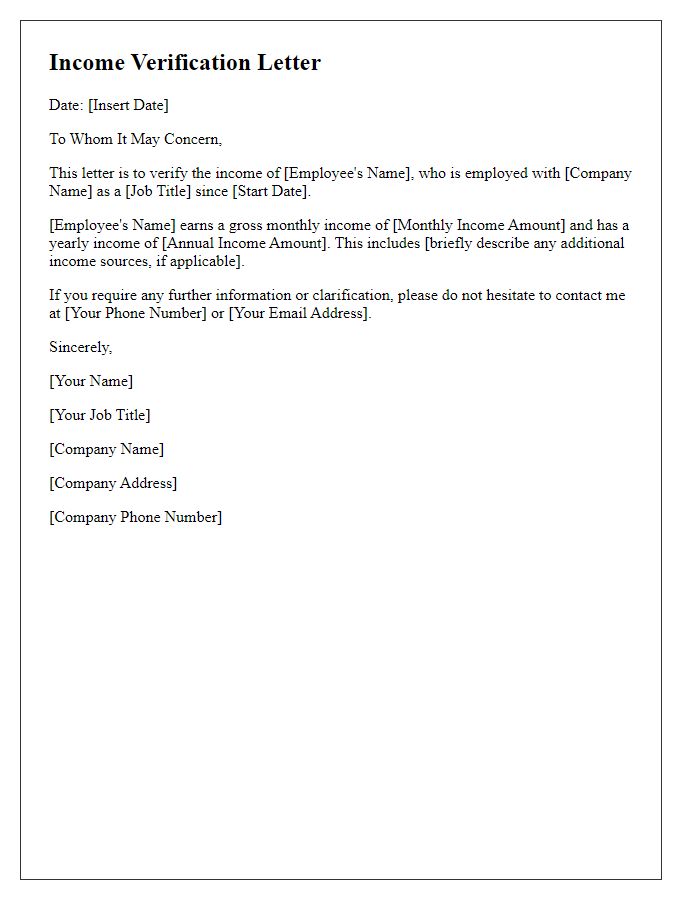

Employment verification and duration.

Employment verification is a critical aspect of the loan application process, particularly for individuals seeking financial support for large purchases. Lenders often require confirmation of employment status to assess the stability of income. Employment duration is equally important; typically, a timeframe of at least two years in a current position, such as that with major corporations like Amazon or Google, can significantly enhance a loan application. This verification process typically involves direct communication with human resources departments or employment verification services. Ensuring that documentation such as pay stubs and tax returns aligns with the employment verification can expedite approvals. In addition, self-employed applicants must provide comprehensive financial statements alongside proof of work duration to secure favorable loan terms.

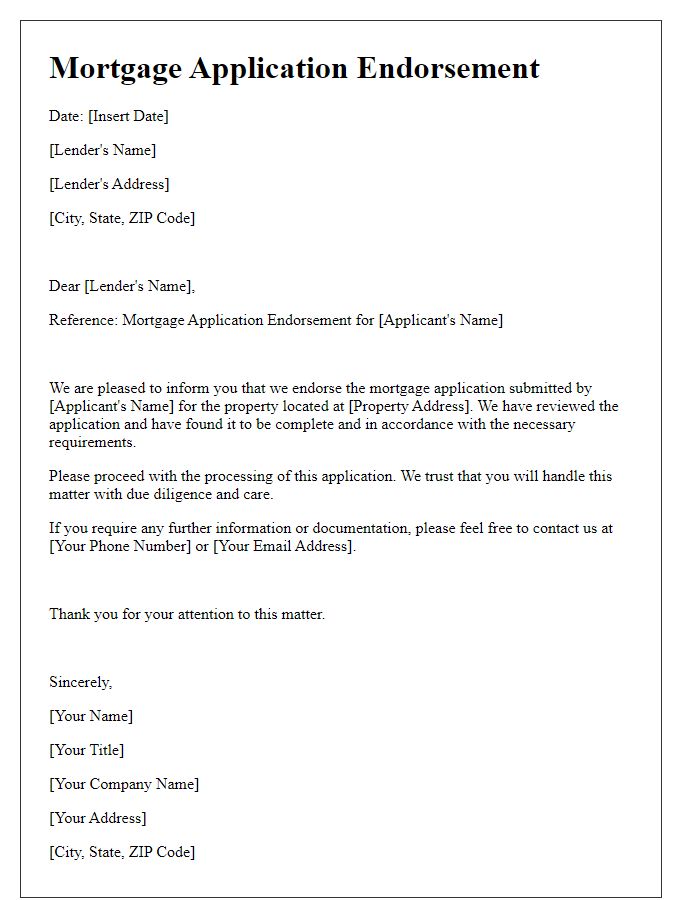

Assets and collateral details.

High-value assets, including real estate properties, vehicles, and savings accounts, play a crucial role in securing loan applications. For instance, residential properties in urban locations like Los Angeles, valued over $500,000, can significantly strengthen an application. Additionally, luxury vehicles such as a 2022 Tesla Model S, worth approximately $80,000, can serve as viable collateral. Financial assets, including a savings account with a balance exceeding $50,000, also provide assurance to lenders regarding repayment capacity. Detailed documentation, such as property deeds, vehicle titles, and bank statements, enhances credibility during the loan evaluation process. Providing comprehensive asset information can expedite approvals and improve loan conditions.

Comments