Hey there! As we wrap up another fiscal period, it's important to share some insights and updates that may affect our financial outlook and planning. This time of year presents a great opportunity to reflect on our progress and set the stage for future growth. We'll cover key highlights, challenges we faced, and the steps we're taking to ensure a smooth transition into the next period. Stick around to learn more about our financial strategies and how you can play a role in our continued success!

Company name and logo

The fiscal period closure process at Acme Corporation, a multinational company known for its innovative consumer electronics, involves meticulous evaluations of financial documents, including balance sheets, income statements, and cash flow statements. During this critical phase, which often concludes in December, financial analysts compile performance metrics from all departments, such as sales, marketing, and manufacturing, ensuring compliance with Generally Accepted Accounting Principles (GAAP). The financial report, typically released in January, provides stakeholders with insights into the company's earnings performance, budget variances, and investment initiatives for the upcoming fiscal year. This period also necessitates a comprehensive audit by external firms, aiming to validate financial accuracy and integrity, which enhances stakeholder trust.

Fiscal period start and end dates

The fiscal period closure update is essential for maintaining accurate financial records and ensuring compliance with regulatory standards. The current fiscal period started on January 1, 2023, and is set to end on December 31, 2023. Accurate tracking during this time is vital for generating financial statements and reports, ensuring the timely completion of audits, and preparing for budget forecasts. Special attention must be given to revenue recognition (following ASC 606 guidelines), expense allocations, and inventory valuations during this period. Adherence to these timelines ensures a smooth transition into the next fiscal year, starting January 1, 2024.

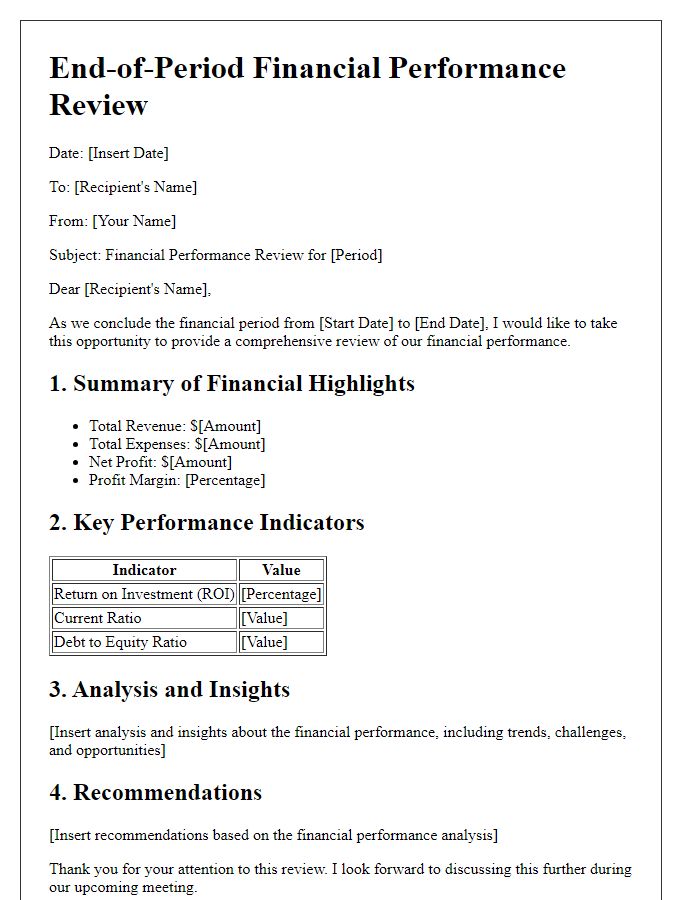

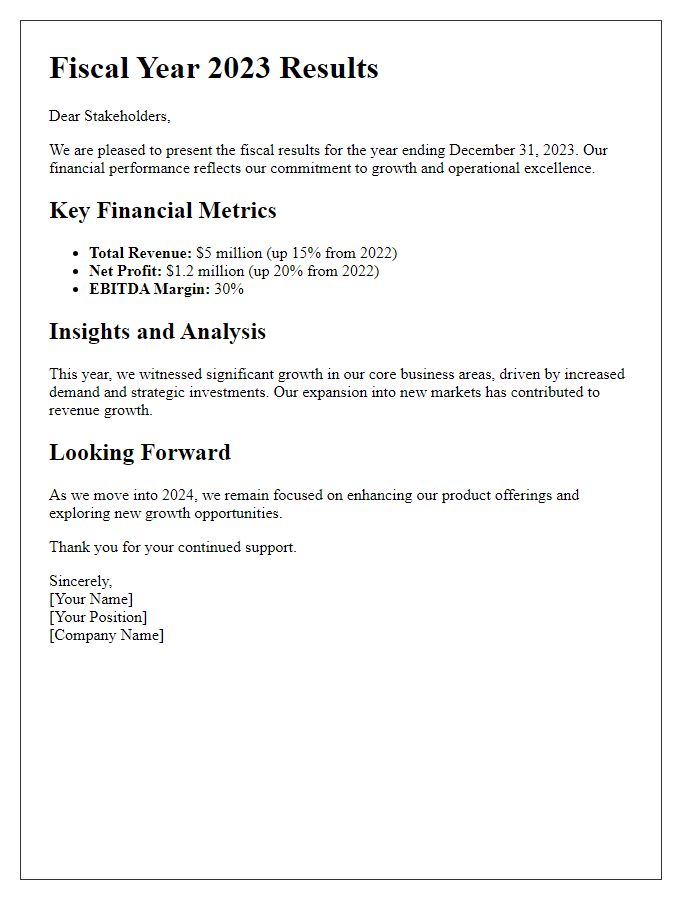

Summary of financial activities

During the fiscal period closure, comprehensive financial activities were conducted to assess the performance and financial health of the organization. Revenue streams, including gross sales from the retail division totaling $2.5 million and service income of $1.2 million, were meticulously analyzed. Operating expenses reached $1 million, with significant costs attributed to employee salaries ($600,000) and administrative expenses ($200,000). Additionally, inventory evaluation showed a closing balance of $500,000, reflecting a turnover rate of 4 times during the period. Cash flow analysis indicated a net inflow of $300,000, contributing to a strong liquidity position. Financial ratios, including the current ratio of 2.5 and a debt-to-equity ratio of 0.4, further demonstrated a stable financial foundation, positioned for future growth.

Key deadline reminders

The fiscal period closure is a critical process for organizations, necessitating thorough attention to key deadlines to ensure compliance and accuracy. Important milestones include the submission of financial statements due by January 15, 2024, which must encompass all transactions and reconciliations for the preceding quarter. Additionally, the preparation of tax documents is essential, with a submission deadline set for February 28, 2024, to avoid penalties. Internal audits should commence by January 5, 2024, allowing sufficient time for review and adjustments. Furthermore, departmental reports must be finalized and submitted by January 10, 2024, to facilitate consolidation into the overall financial summary. Timely adherence to these deadlines, crucial for maintaining financial integrity, will enhance clarity and success in the overall fiscal year-end process.

Contact information for inquiries

The fiscal period closure update is a critical point for financial reporting, ensuring accuracy and compliance within organizations. Timely communication regarding closures and updates is essential for stakeholders, including the accounting department and external auditors. For inquiries related to this period's financial data and transactions, please contact the finance team. Utilize the provided contact number (555-1234) during business hours for immediate assistance. Email inquiries can be directed to finance@companyname.com, where a dedicated team will respond within 24 hours. This process ensures clarity and transparency, fostering trust among all parties involved in the fiscal management cycle.

Comments