Are you ready to dive into the world of financial risk assessment? Understanding the potential pitfalls and opportunities in your financial landscape can be a game changer for your business. Our comprehensive report not only highlights the key risks involved but also offers actionable insights to help you navigate them effectively. Join us as we unpack these essential concepts and invite you to explore our findings in detail!

Executive Summary

The financial risk assessment report focuses on evaluating the potential risks affecting the financial stability of Company XYZ, a leading player in the renewable energy sector. The analysis identifies key risk factors, including market volatility characterized by fluctuations in crude oil prices and changing regulations impacting renewable energy credits, which can significantly influence cash flows. The report highlights the company's current debt-to-equity ratio of 0.6, which suggests a moderate level of leverage that may expose the firm to interest rate hikes. Additionally, foreign exchange exposure is examined, particularly in relation to the company's operations in Europe, where the Euro has shown increased volatility. Mitigation strategies involving diversification of revenue streams and enhanced hedging techniques are recommended to buffer against identified risks, ensuring sustainable growth and maximizing shareholder value in a dynamic economic landscape.

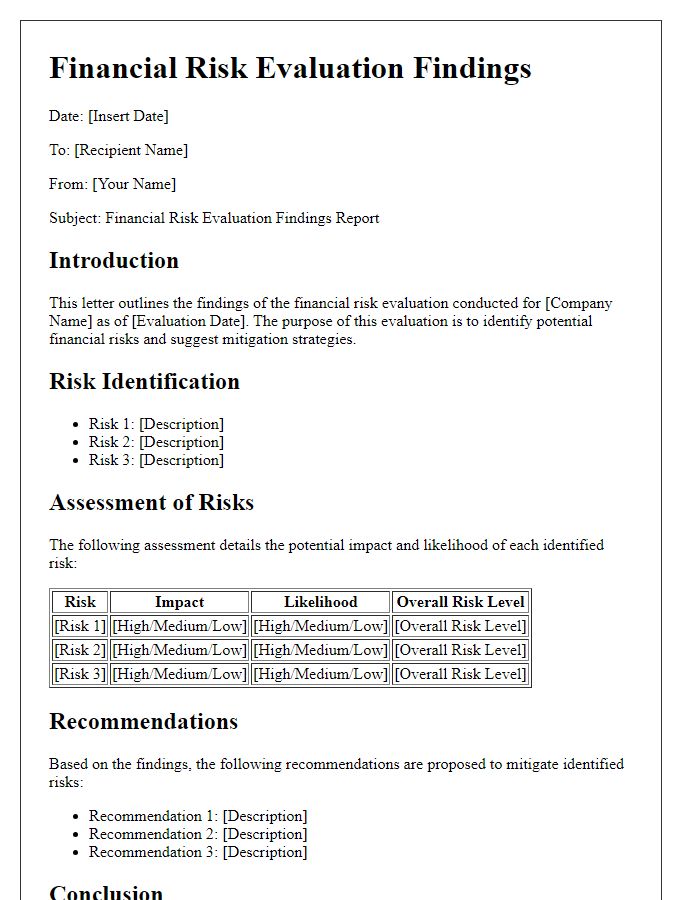

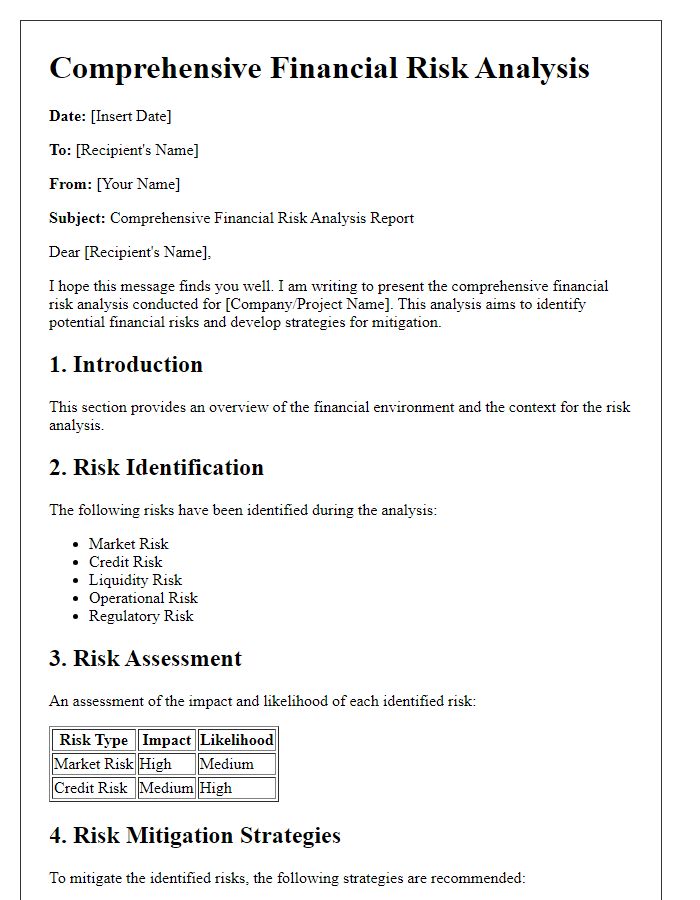

Risk Identification and Analysis

Financial risk assessment involves identifying and analyzing potential risks that may affect an organization's financial health. This process includes evaluating various types of risks, such as credit risk (the chance of borrower default), market risk (fluctuations in market prices), operational risk (failures in internal processes), and liquidity risk (inability to meet short-term financial obligations). Key metrics such as Value-at-Risk (VaR) provide quantitative assessments of potential losses under normal market conditions. The analysis also examines historical data, current market trends, and external factors like economic indicators, regulatory changes, and geopolitical events. A comprehensive risk matrix is often employed to prioritize risks based on their likelihood and impact. Effective risk management strategies can mitigate significant threats, ensuring financial stability and sustainable growth for organizations.

Risk Mitigation Strategies

Risk mitigation strategies play a crucial role in financial risk assessment for organizations. Identifying risks such as credit risk, operational risk, and market risk is the first step. Tools like Value at Risk (VaR) methodologies help quantify potential losses, while stress testing assesses resilience under extreme conditions. Implementing controls like diversification reduces dependence on a single income source, while insurance protects against unforeseen events. Regular audits and compliance checks ensure adherence to regulations, particularly for publicly traded companies like those in the Fortune 500. Companies also utilize hedging techniques such as options and futures contracts to manage currency and commodity price fluctuations. Continuous monitoring of key performance indicators (KPIs) is essential for timely adjustments to strategies, helping to safeguard financial stability in a volatile market environment.

Impact Assessment

A financial risk assessment report focuses on evaluating potential adverse effects on an organization's economic stability. Key metrics such as revenue fluctuations, operational costs, and capital access are integral to this analysis. The impact assessment quantifies risks, assigning numerical values to potential losses, measured in terms of percentage decreases in profit margins or increases in operating costs. Scenarios like market downturns or regulatory changes (e.g., tax reforms) are examined for their effects on cash flow projections. Quantitative models, such as Value at Risk (VaR), are employed to estimate the upper limits of financial exposure, while qualitative assessments address reputational risks and stakeholder confidence, critical to maintaining investor relations. Geographic factors, such as location-specific economic conditions, can further influence financial resilience and risk management strategies.

Recommendations and Action Plan

The financial risk assessment report highlights critical vulnerabilities within the organizational financial framework. Key risks identified include credit risk, market risk, and operational risk, each with potential monetary impacts exceeding millions of dollars. Recommendations for mitigation emphasize diversifying the investment portfolio across various asset classes, strengthening credit evaluation processes, and enhancing liquidity management to maintain operational continuity during market fluctuations. An action plan outlines steps to implement advanced risk management software by Q2 2024, conduct quarterly risk workshops for staff training, and establish a risk monitoring committee to review financial exposures regularly. All measures aim to create a sustainable financial environment capable of withstanding adverse economic conditions.

Comments