Are you tired of struggling with travel expense reports? Navigating the travel expense reporting process can often feel overwhelming, but it doesn't have to be! In this article, we'll break down the essential steps and provide you with a simple letter template to make submitting your expenses a breeze. So, grab a cup of coffee and join us as we simplify this process together!

Accurate categorization of expenses

Accurate categorization of travel expenses is essential for effective financial tracking and reporting. Categories such as airfare, accommodation, meals, transportation, and miscellaneous expenses should be clearly defined to ensure consistency. For instance, airfare may include domestic flights under $500 and international flights exceeding that amount, while accommodation details could specify nightly rates at hotels like Marriott or Hilton. Meals can be allocated based on per diem rates established by local regulations, which typically range from $50 to $75 per day for specific locations, including New York City or San Francisco. Transportation costs should encompass taxi fares, car rentals, or ride-sharing services such as Uber or Lyft. Adhering to these categorizations aids in budgeting, enhances transparency, and streamlines the reimbursement process for employees traveling for business purposes.

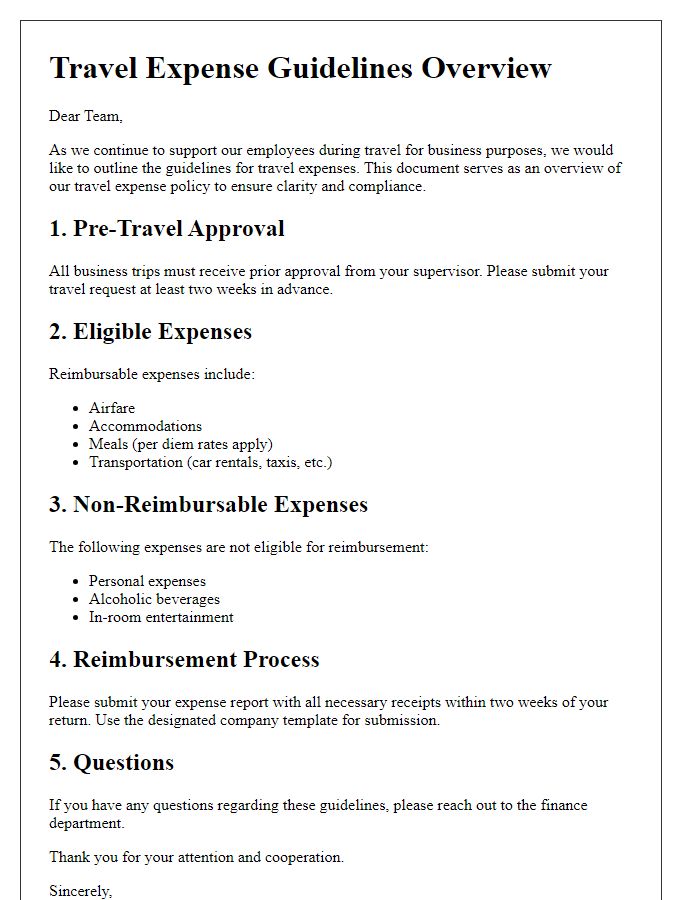

Compliance with policy guidelines

Travel expense reporting involves adhering to specific policy guidelines, such as those outlined by the Internal Revenue Service (IRS) for federal employees. Travelers should document all expenses meticulously, including transportation costs (airfare, train fares) and lodging (hotel reservations) within specified per diem rates. Receipts for all transactions exceeding $25 are essential for validation. Each report requires accurate dates (departure and return), destination (city, state), and purpose (business meeting, conference). Timely submission of expense reports, typically within 30 days post-travel, is critical to ensure compliance and reimbursements. Non-compliance may result in delayed payments or ineligibility for reimbursement. Keeping a clear audit trail demonstrates adherence to organizational policies and safeguards against potential financial discrepancies.

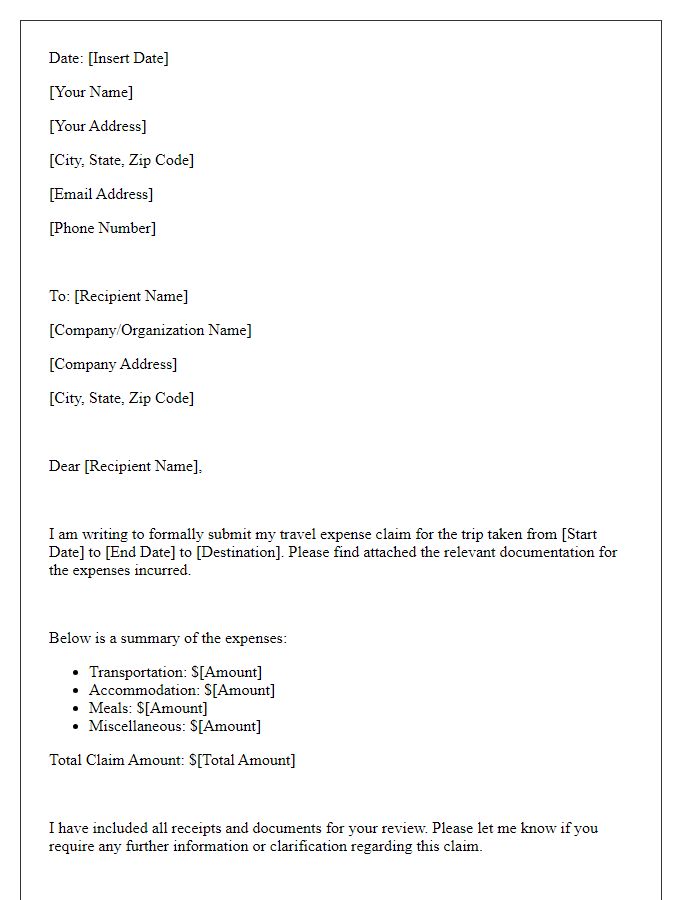

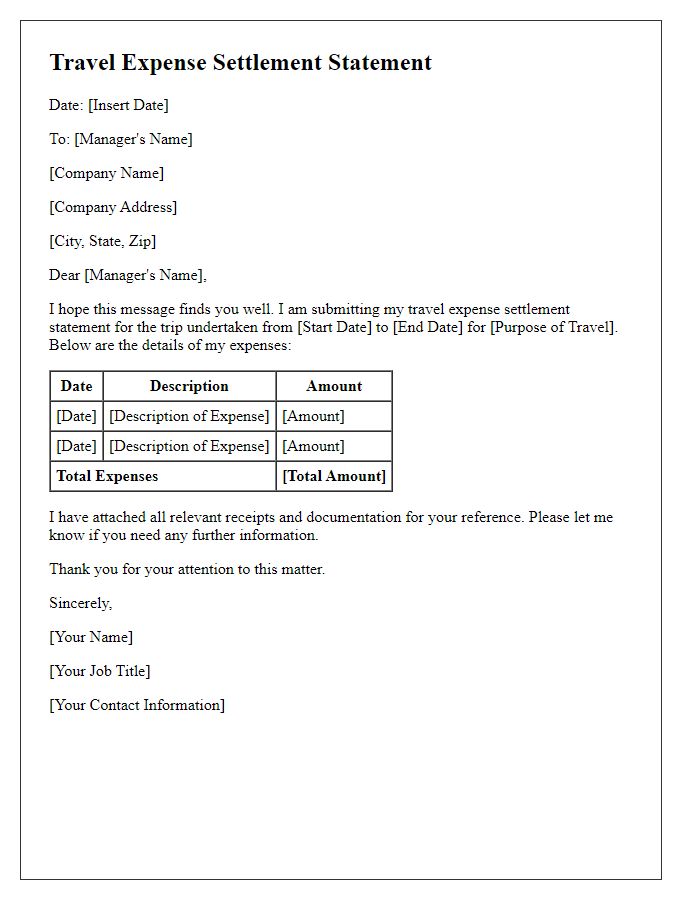

Detailed receipt documentation

Detailed receipt documentation is crucial for accurate travel expense reporting. Keep each receipt for expenses incurred during business travel, including transportation, accommodation, meals, and other miscellaneous expenses. Clearly itemize each expense with the date, location, and purpose of the expenditure. For example, a flight expense from New York to Los Angeles on March 15, 2023, should specify the flight number and ticket costs. Meal receipts should identify the establishment's name and the meal type (breakfast, lunch, dinner). Attach any relevant invoices for hotel stays, showing nightly rates and total charges. Ensure all documentation meets company policy and IRS requirements for reimbursement eligibility. Remember to maintain digital copies for backup, which can assist in case of discrepancies during the reimbursement process.

Timely submission protocols

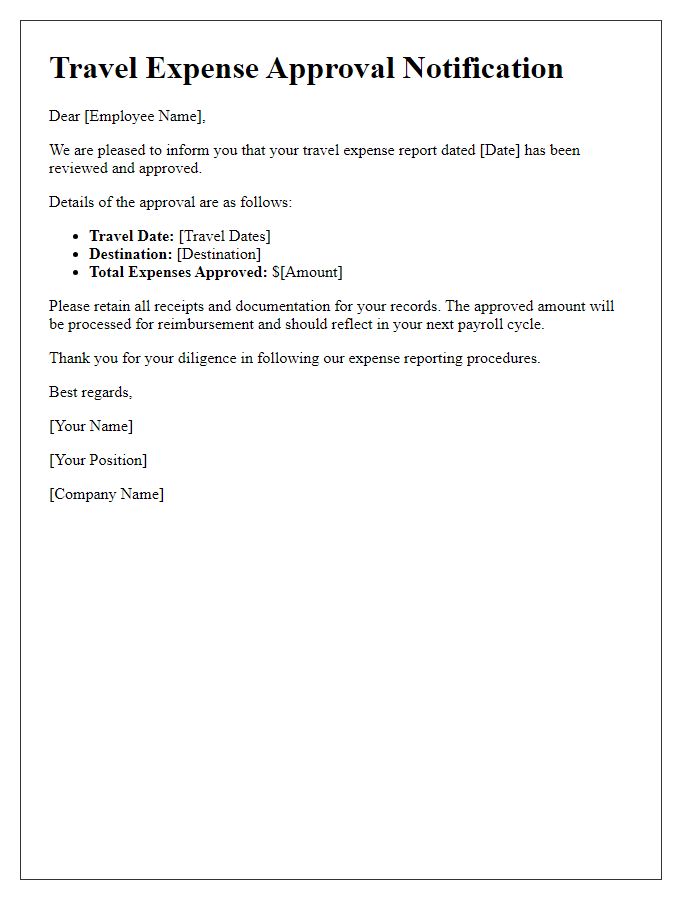

Timely submission of travel expense reports is crucial for efficient financial management within organizations. Employees must submit expense reports within five business days after their return from a business trip, ensuring adherence to company policies. Report submissions should include detailed documentation such as receipts for meals, lodging, and transportation costs, as well as any necessary approvals from supervisors or management. Accurate and organized reporting aids in faster reimbursement processing and maintains accurate records for the company's financial audits. Incomplete or late submissions may lead to delays in reimbursement and potential policy violations, impacting employee satisfaction and organizational efficiency.

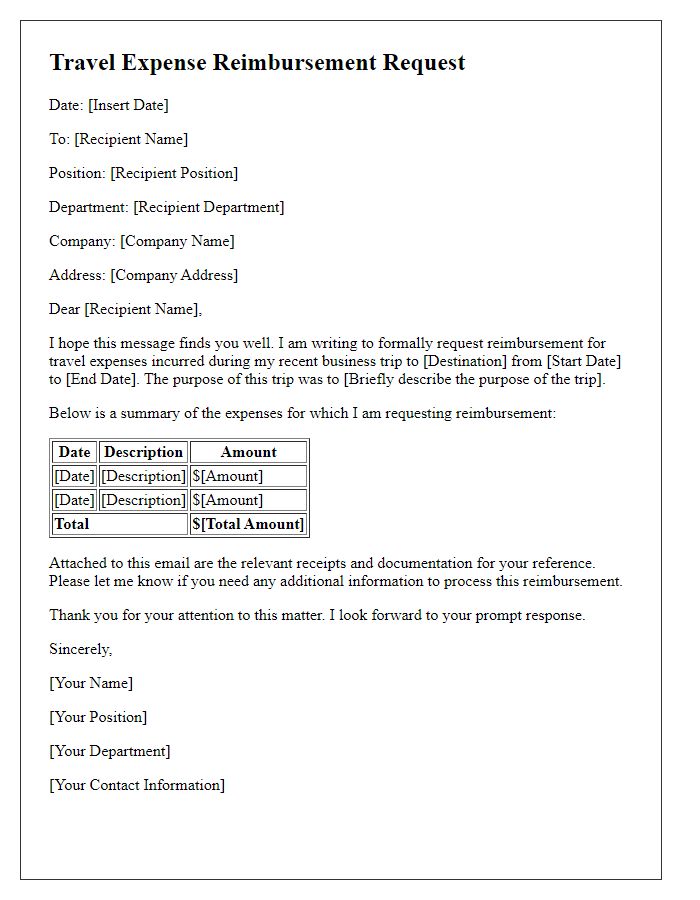

Clear reimbursement procedures

Clear reimbursement procedures are essential for efficient travel expense reporting, ensuring transparency and accountability. Employees must submit a comprehensive travel expense report within 30 days of returning from business trips. This report should include original receipts for all expenses, such as airfare (for instance, flights booked via reputable airlines like Delta), hotel accommodations (with invoices from establishments like Marriott), and daily meals (follow per diem rates of $50 for full days). Detailed itemization is required, including dates of travel (for example, from October 1 to October 5, 2023) and purpose of the trip (attending a conference in San Francisco). Additionally, expenses exceeding $100 must have prior approval from a manager (such as the department head Jean Smith). Once submitted, reports undergo a verification process within one week, with reimbursements issued through direct deposit typically within 14 days of approval. Clear documentation of policies is provided in the employee handbook to ensure understanding and compliance.

Comments