Are you looking for a clear and effective way to draft a letter requesting audit trail documentation? Crafting the perfect request can make all the difference in ensuring transparency and accountability in your processes. In this article, we'll walk you through an easy-to-use template and share tips to personalize your request for maximum impact. Keep reading to discover how you can streamline your audit process and maintain robust documentation practices!

Clarity of Request

An audit trail documentation request, crucial for compliance and accountability, requires precise clarity to ensure that the expected information is retrieved efficiently. Key elements include specifying the time frame (e.g., from January 1, 2023, to December 31, 2023) during which transactions occurred, the types of records needed (such as access logs, modification records, or data deletion logs), and the involved entities (like user accounts or specific departments). Indicating the purpose of the request enhances understanding, especially for regulatory audits or internal reviews, and ensures thorough processing by the responsible team. The request should also highlight any specific formats desired (PDF, CSV) and the urgency of the timeline for response, aligning with operational needs and reporting requirements.

Specific Documents Required

An audit trail documentation request typically involves gathering critical records related to financial transactions, compliance, or operational activities, serving as a reliable reference for verifying adherence to regulations. Key documents may include transaction logs, which detail timestamps and involved parties, invoices that provide itemized billing information, correspondence emails containing approval or rejection communications, and access records from systems that capture user interactions. Additionally, bank statements reflecting deposits and withdrawals, contracts outlining terms and obligations, and policy manuals that guide organizational practices ensure comprehensive coverage for the audit's scope. Each document plays a vital role in illustrating internal controls and enhancing accountability within the organization.

Relevant Time Frame

Audit trail documentation is essential for ensuring transparency and accountability in financial transactions. The relevant time frame for such documentation typically spans from January 1, 2020, to December 31, 2022, covering significant fiscal periods, including quarterly reviews and year-end audits. Key events during this period include compliance checks and financial reconciliations, which were conducted at multiple locations, such as the headquarters in New York City and regional offices in London and Tokyo. Detailed records, including transaction logs, user access reports, and system changes, will provide insights into access and activities during this critical time frame. These records help in validating compliance with financial regulations set forth by organizations like the Financial Accounting Standards Board (FASB) and ensuring adherence to internal policies.

Purpose of Audit

The purpose of an audit trail is to provide a comprehensive account of all transactions and modifications within a system, such as financial databases or electronic health records. A thorough audit trail can enhance accountability by tracking user actions, timestamps, and affected entities. It plays a crucial role in compliance, as regulations like the Sarbanes-Oxley Act enforce transparency and accuracy in financial reporting. Furthermore, during forensic investigations, an effective audit trail assists in identifying unauthorized activities, ensuring data integrity, and maintaining trust among stakeholders. Implementing a robust audit trail mechanism requires meticulous record-keeping and adherence to industry standards, ultimately benefiting organizations by mitigating risks and enhancing overall operational efficiency.

Contact Information

Audit trail documentation serves as a critical component in maintaining transparency and accountability within organizations, especially those subject to regulatory compliance such as financial institutions or healthcare providers. A thorough audit trail should include timestamps, user identification, and system interactions to track changes made to data. For optimal documentation processing, contact information needs to be accurately recorded, ensuring that inquiries can be directed efficiently. Essential details include the name of the requester, their role within the organization, the department they belong to, and a reliable contact number or email address for follow-up questions. Properly organized audit trails enhance data integrity and reinforce trust in the organization's processes.

Letter Template For Audit Trail Documentation Request Samples

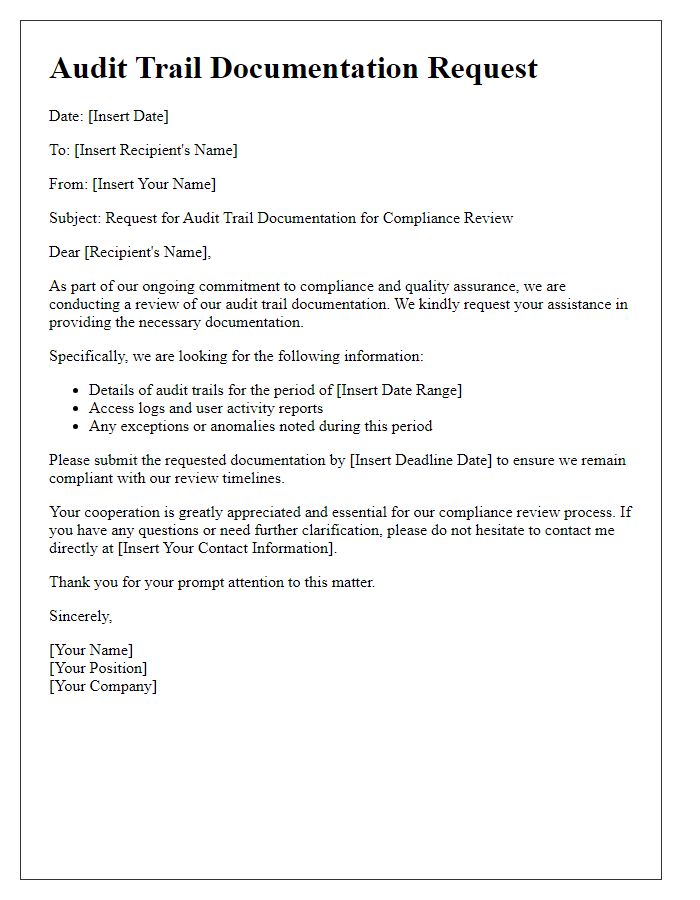

Letter template of audit trail documentation request for compliance review.

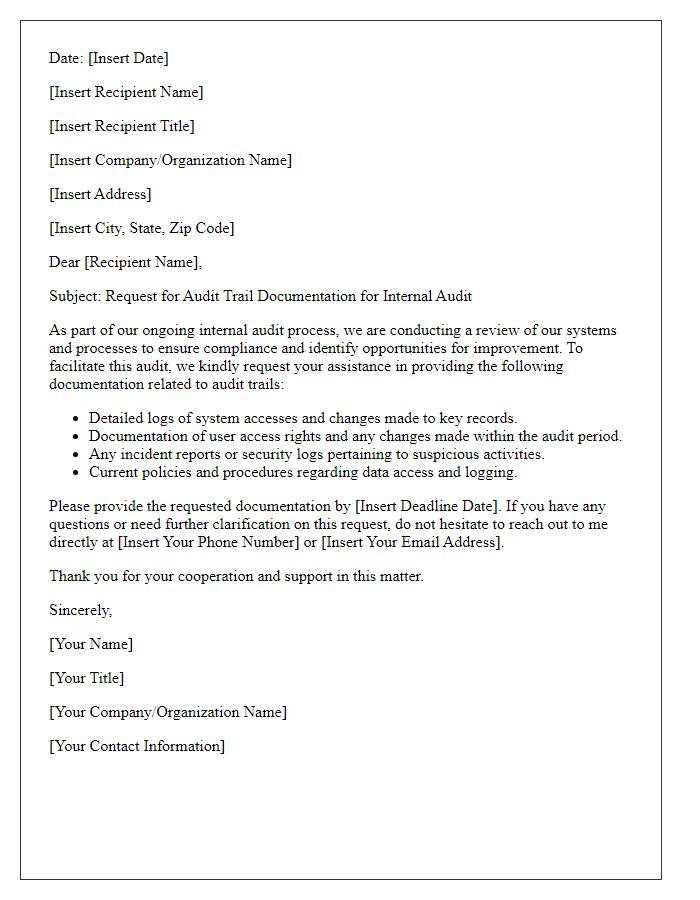

Letter template of audit trail documentation request for internal audit purposes.

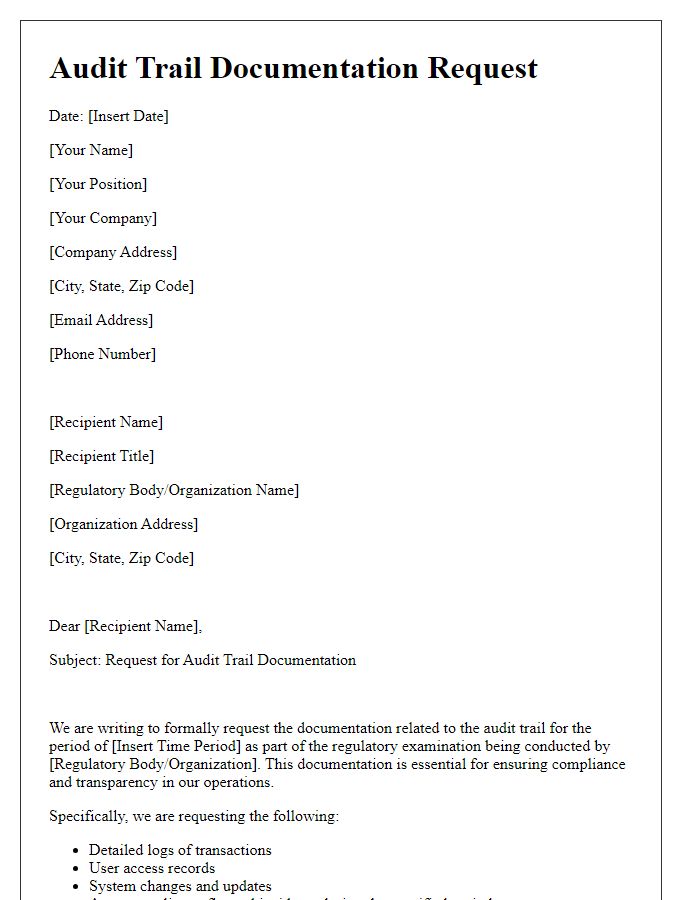

Letter template of audit trail documentation request for regulatory examination.

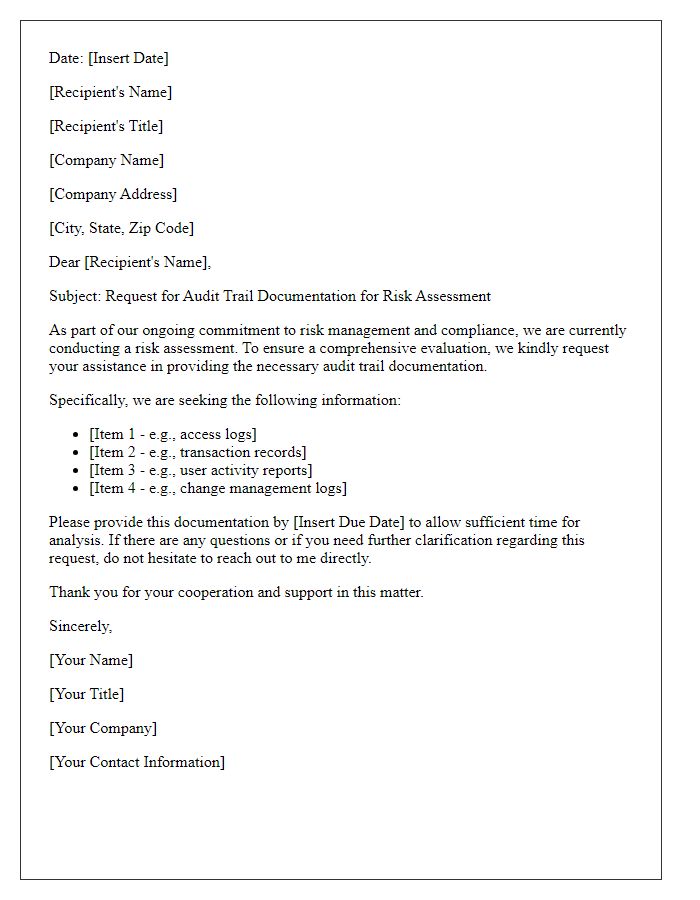

Letter template of audit trail documentation request for risk assessment.

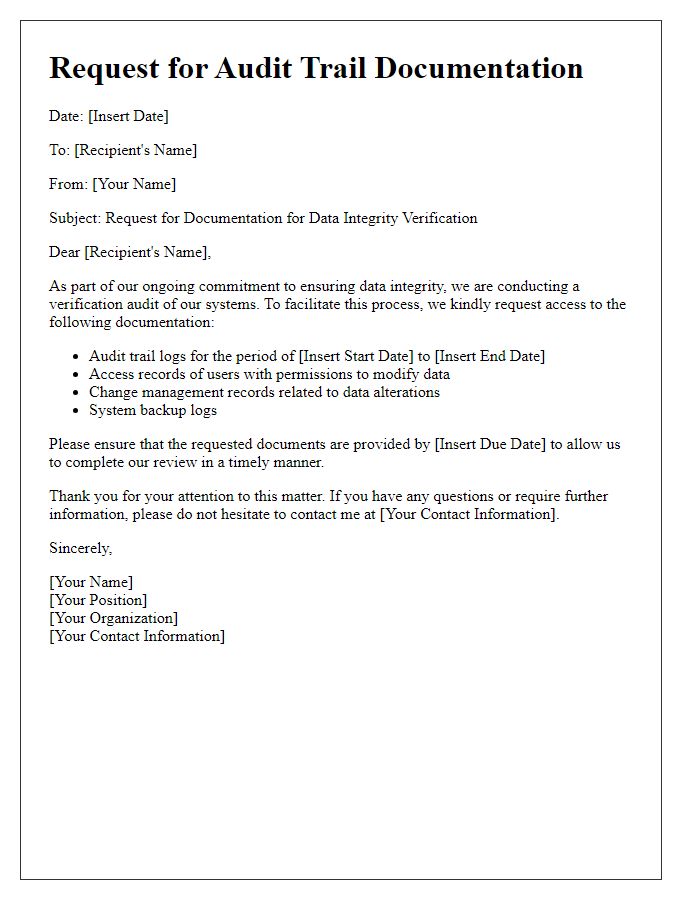

Letter template of audit trail documentation request for data integrity verification.

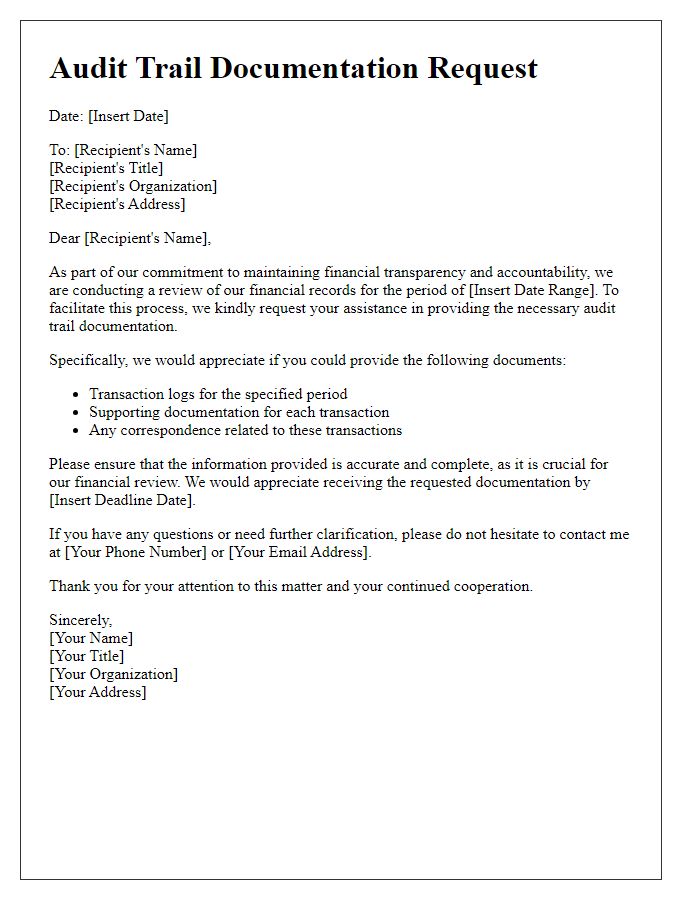

Letter template of audit trail documentation request for financial transparency.

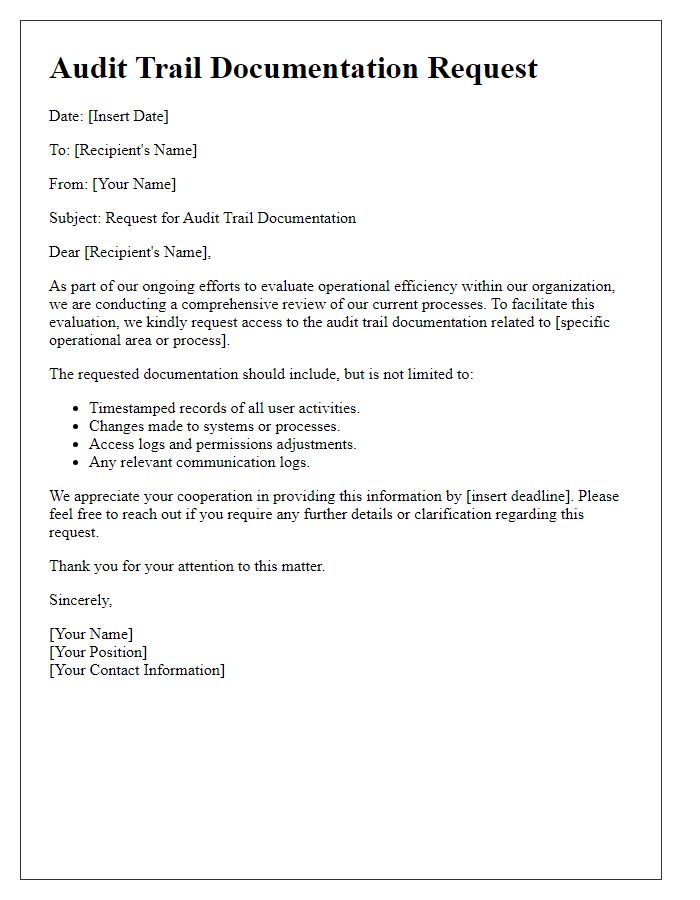

Letter template of audit trail documentation request for operational efficiency evaluation.

Letter template of audit trail documentation request for security assessment.

Letter template of audit trail documentation request for client account review.

Comments