Hello there! If you've ever wondered how asset depreciation works and why it matters for your finances, you're in the right place. Understanding depreciation can help you maximize the value of your assets and make more informed decisions for your business or personal finances. In this article, we'll break down the essentials of asset depreciation reporting and provide you with a handy template to get started. So, let's dive in and explore the world of depreciation together!

Introduction to Asset Depreciation

Asset depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life. This accounting process is crucial for businesses to accurately reflect the value of their fixed assets, such as machinery, vehicles, and buildings, which typically experience wear and tear or obsolescence over time. For instance, a commercial printer purchased for $50,000 might have an expected useful life of five years, resulting in an annual depreciation expense of $10,000. This allocated expense not only helps in presenting a true financial position in financial statements but also plays a vital role in tax calculations, allowing businesses to deduct a portion of the asset's cost each year. Understanding asset depreciation is essential for financial reporting and strategic planning, ensuring compliance with accounting standards and regulations such as GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards).

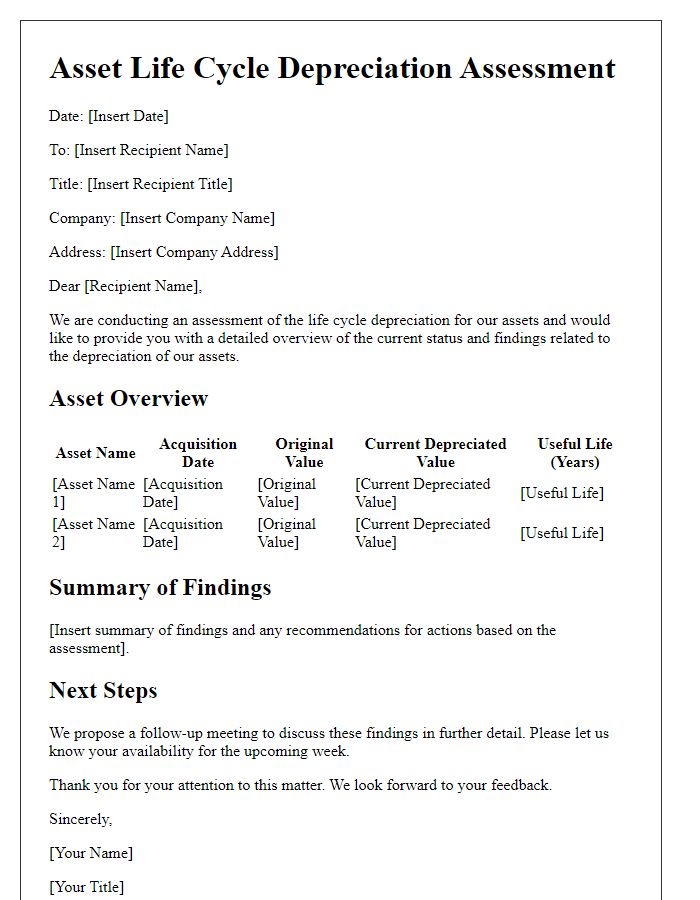

Asset Description and Identification

The asset identification process for the machinery involved in the automotive manufacturing facility consists of various key components, including a 3D CNC milling machine valued at $250,000. This CNC (Computer Numerical Control) machine, manufactured by Haas Automation Inc. in 2021, is equipped with high-speed processing capabilities that allow for precision machining of complex components. The asset is categorized under capital assets for financial reporting purposes, with a useful life estimate of 10 years. This depreciation report utilizes the straight-line method to allocate the annual depreciation expense evenly over the asset's lifespan, providing clear visibility into its declining value on the balance sheet each fiscal year. Additionally, the serial number 123456789 ensures unique identification for maintenance and warranty tracking, crucial for operational efficiency in the manufacturing process.

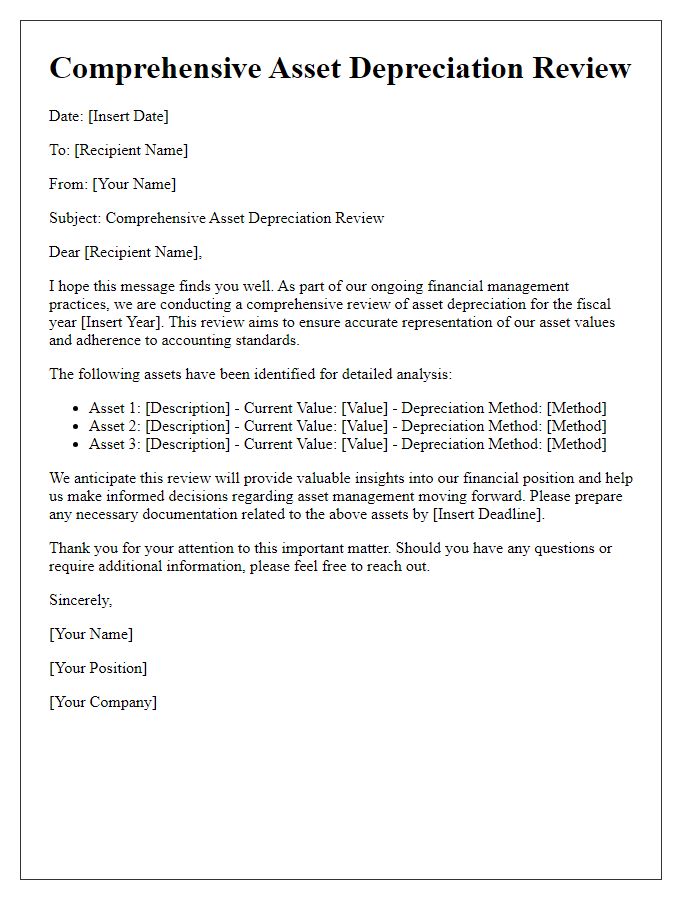

Depreciation Methodology

The depreciation methodology for asset valuation employs several strategies to account for the reduction in value of fixed assets over time. Commonly utilized methods include Straight-Line Depreciation, where an asset's cost is evenly allocated over its expected useful life (for example, a 10-year lifespan for commercial machinery); Declining Balance Depreciation, which accelerates the depreciation process, beneficial for assets with higher initial loss of value; and Units of Production, where depreciation is based on actual usage, often applied in manufacturing settings where machinery operates more intensively in specific periods. Investment in assets, such as vehicles, office equipment, or technology infrastructure, significantly influences financial statements, impacting net income and taxable income. Accurate depreciation tracking is crucial for compliance with accounting standards like GAAP (Generally Accepted Accounting Principles) or IFRS (International Financial Reporting Standards), ensuring precise financial reporting and asset management practices.

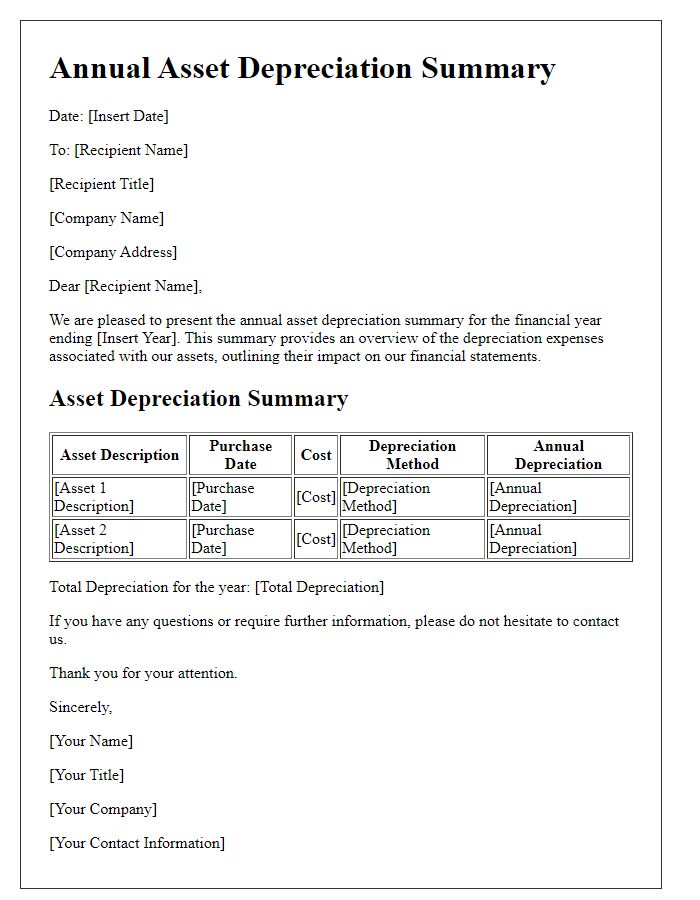

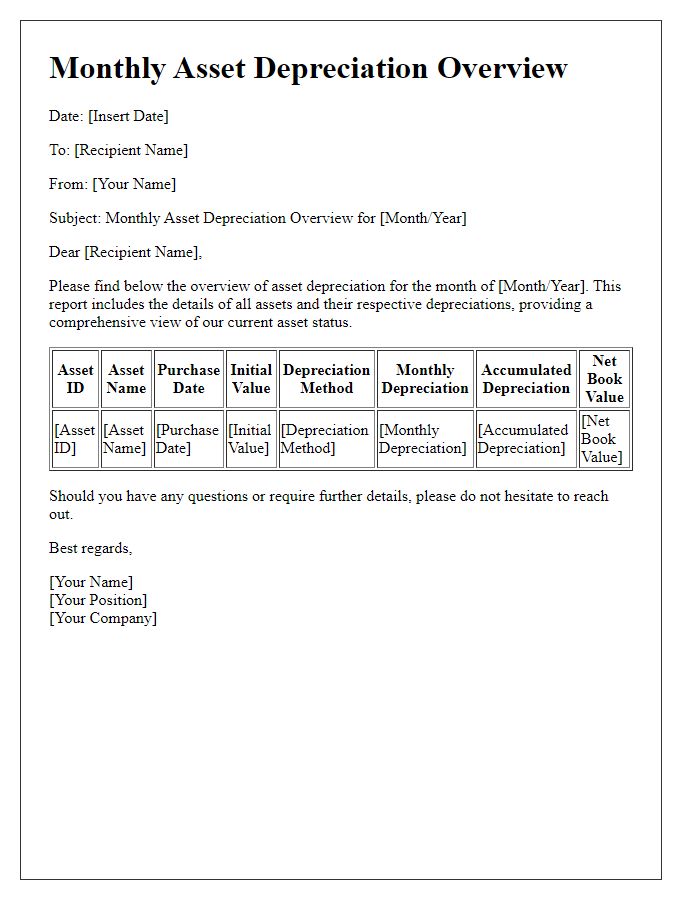

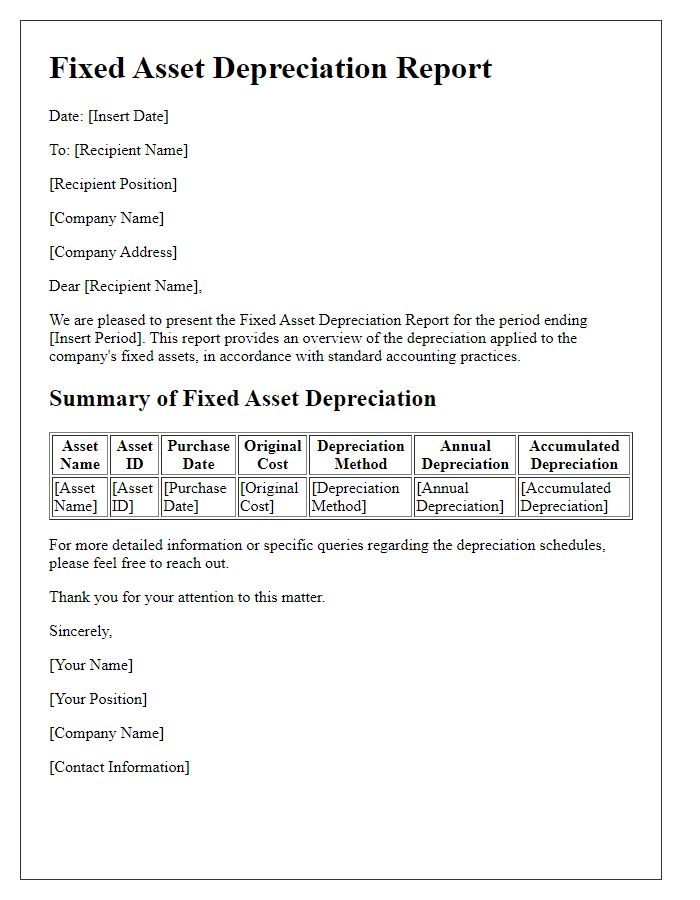

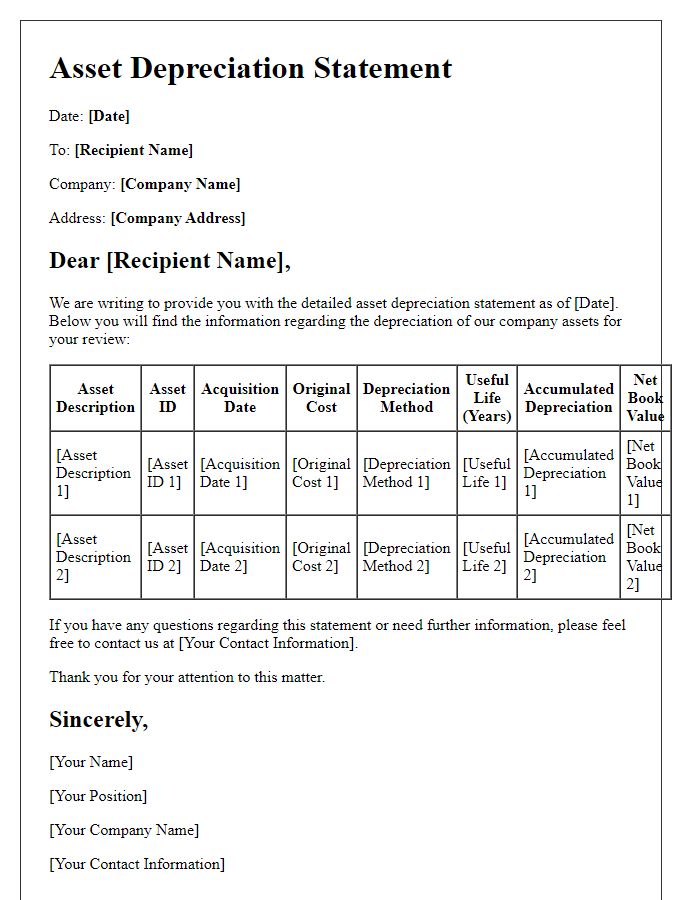

Calculations and Depreciation Schedule

The asset depreciation report provides detailed calculations and a depreciation schedule for fixed assets such as machinery, vehicles, and buildings. Depreciation methods, including Straight-Line and Double Declining Balance, determine the reduction in asset value over time based on useful life estimates (typically ranging from 5 to 30 years). For example, a manufacturing machine purchased for $150,000 with a useful life of 10 years will see an annual depreciation expense of $15,000 using the Straight-Line method. The depreciation schedule outlines annual breakdowns of expense, accumulated depreciation, and remaining asset value for each fiscal year, providing clear financial insights for stakeholders and aiding in tax reporting processes.

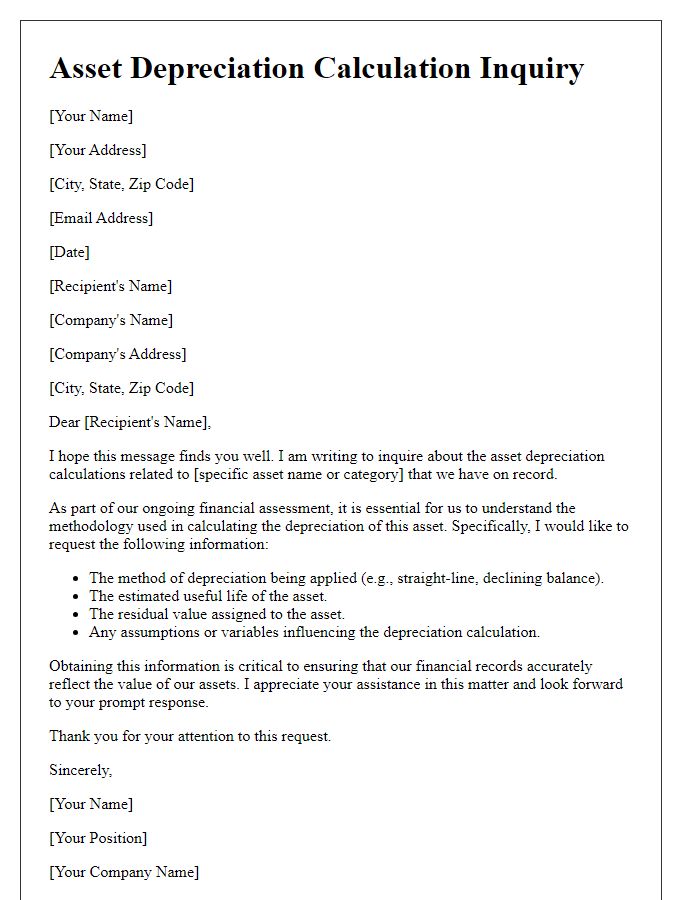

Conclusion and Recommendations

The analysis of asset depreciation, particularly for equipment utilized in manufacturing, reveals that certain assets, such as machinery and vehicles, have experienced significant declines in value over time, typically representing an average depreciation rate of 10-20% annually. Notable assets, like CNC machines or 3D printers, often require a re-evaluation of their remaining useful life and resale value after five years of service. Recommendations include adopting a systematic approach to track depreciation through appropriate accounting methods, like straight-line or declining balance, while conducting annual reviews of asset performance. Implementing a robust asset management system will enhance accuracy in reporting and forecasting, ensuring informed financial decision-making. Regular training for accounting staff on asset valuation techniques could further improve efficiency and precision in reporting, aligning depreciation practices with industry standards.

Comments