Are you looking to make a change to your accounting procedures but don't know where to start? Writing a letter to communicate these amendments can be straightforward and effective. In this article, we'll provide you with a customizable letter template that can help guide you through the process of formalizing your accounting procedure changes. So, let's dive in and discover how you can streamline your accounting practices together!

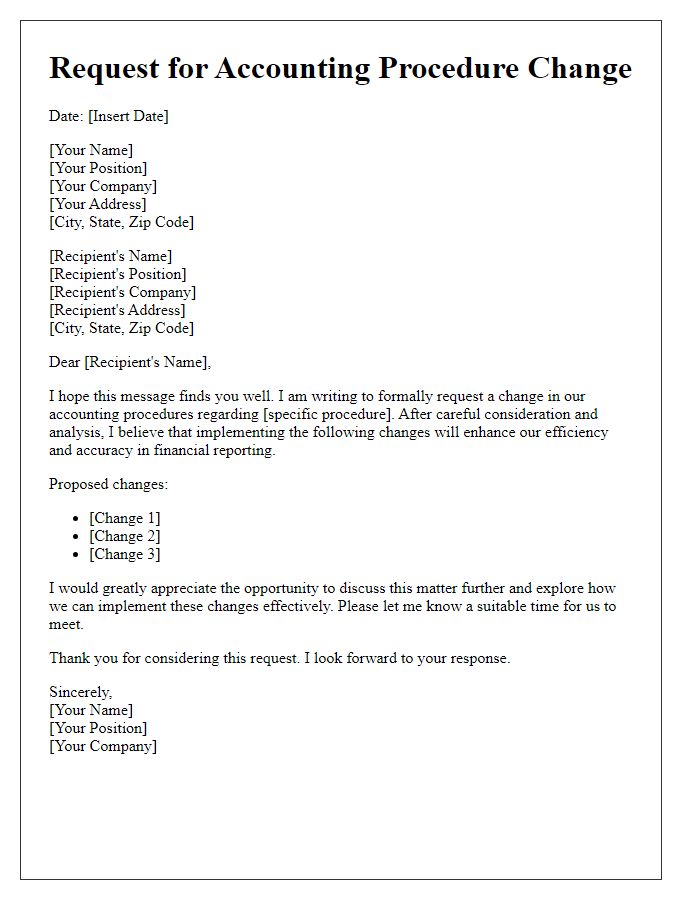

Clear Subject Line

The accounting procedure amendment requires a concise and clearly defined subject line for effective communication. A well-structured subject line, such as "Amendment to Accounting Procedure: [Specific Procedure Name or Date]," enables recipients to quickly grasp the purpose of the correspondence. Clarity in the subject line can facilitate quicker reviews and approvals, as stakeholders, including accountants, financial analysts, and compliance officers, can immediately identify the document's significance. This practice is essential for streamlined workflows, especially in larger organizations where numerous financial procedures and policies exist. Anticipate potential follow-up actions or queries based on the content of the amendment to ensure comprehensive understanding among all recipients.

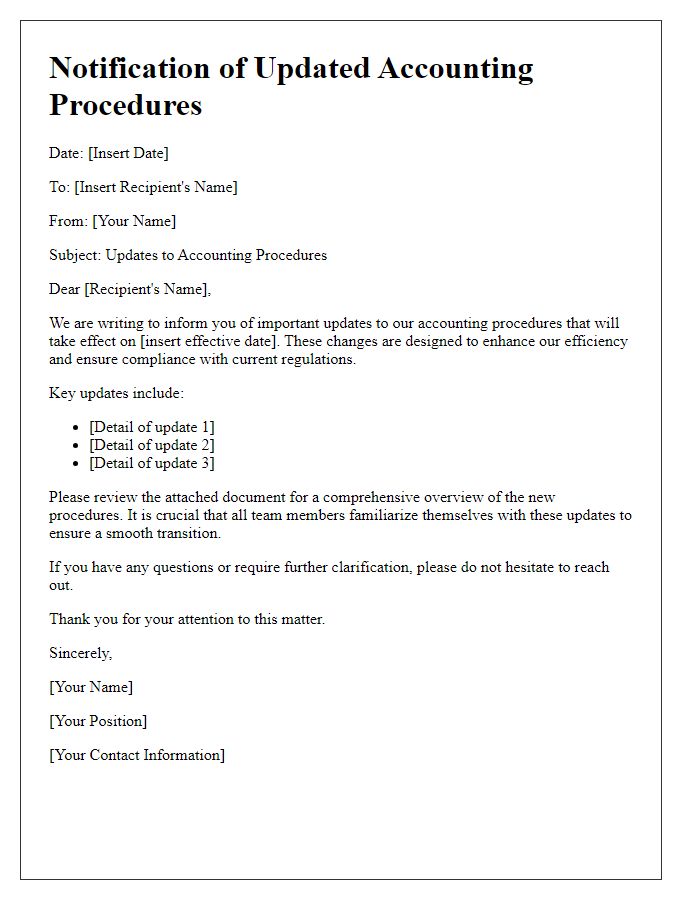

Company Logo and Contact Information

Company logos represent brand identity, conveying professionalism and trustworthiness. Contact information should include crucial elements such as physical address, telephone number (typically a 10-digit format), and email address (standardized format). Amendments to accounting procedures may encompass significant changes in financial reporting guidelines, compliance standards, or software transitions, impacting operations. It is essential to communicate such amendments clearly, outlining specific procedures, effective dates, and training opportunities for staff, ensuring a seamless transition and adherence to updated regulations (such as GAAP or IFRS standards). Clear visual presentations, including bullet points and headings, can enhance comprehension.

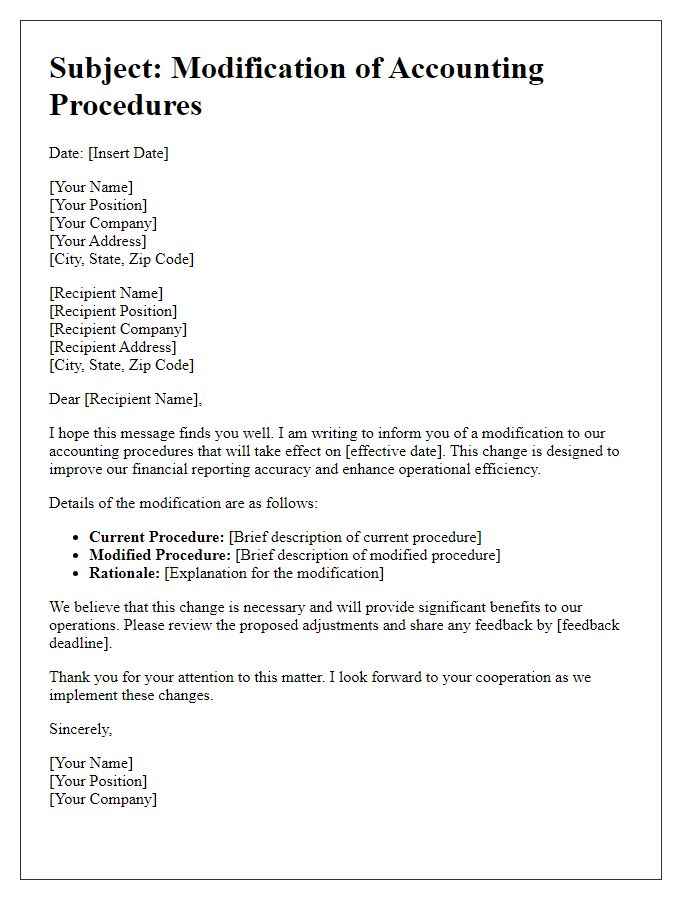

Detailed Amendment Description

Amending accounting procedures involves the introduction of new processes, revising existing methods, or enhancing documentation standards to comply with regulatory requirements or organizational goals. For instance, the adoption of International Financial Reporting Standards (IFRS) requires adjusting the way financial statements are prepared to ensure transparency and consistency within global markets. A detailed amendment in processes may include the integration of automated accounting software, which streamlines workflows and minimizes human errors, resulting in improved accuracy (error rate reduction of up to 90% in certain cases). These amendments also necessitate revising internal controls to secure financial data against fraud, ensuring compliance with the Sarbanes-Oxley Act (SOX) as well as implementing regular training programs for staff to keep them informed about policy changes and technological upgrades. An assessment of the financial impact of these amendments through cost-benefit analysis helps gauge the efficiency and effectiveness of the new procedures.

Rationale for Change

The rationale for amending accounting procedures focuses on enhancing accuracy, efficiency, and compliance within financial reporting. Recent audits highlighted discrepancies in account reconciliations, specifically within the general ledger (with particular attention to variations exceeding 10% in account balances), necessitating a thorough revision. Implementation of automation tools might reduce human error significantly-- for instance, the estimated error rate of 5% seen in manual reconciliations could be curtailed. Additionally, regulatory changes from the Financial Accounting Standards Board (FASB) in 2023 emphasize the need for stricter adherence to revenue recognition principles, demanding an updated framework for internal controls. Addressing these challenges promotes transparency and builds stakeholder trust in financial statements. Furthermore, adopting industry best practices, such as in the adoption of cloud-based accounting systems, positions the organization favorably within increasingly competitive markets.

Implementation Date and Instructions

On October 1, 2023, the accounting department will implement revised procedures for recording transactions accurately. The updated policy includes detailed instructions for entering data into the financial management system (such as QuickBooks or SAP). Key modifications outline the steps for verifying invoices, processing payments, and reconciling accounts month-end. Training sessions will be scheduled on September 25, 2023, to ensure all staff members understand the new processes. Compliance with these amendments is crucial for maintaining accurate financial records, ensuring adherence to regulatory standards, and improving overall operational efficiency.

Comments