Preparing your taxes can feel like a daunting task, but having a solid checklist can make all the difference. In this article, we'll walk you through a comprehensive document checklist that ensures you have everything you need to make the tax preparation process smoother and more efficient. From gathering essential income statements to organizing your deductions, we've got you covered with all the tips and tricks you might need. So, grab a cup of coffee and let's dive into the detailsâread on to get started!

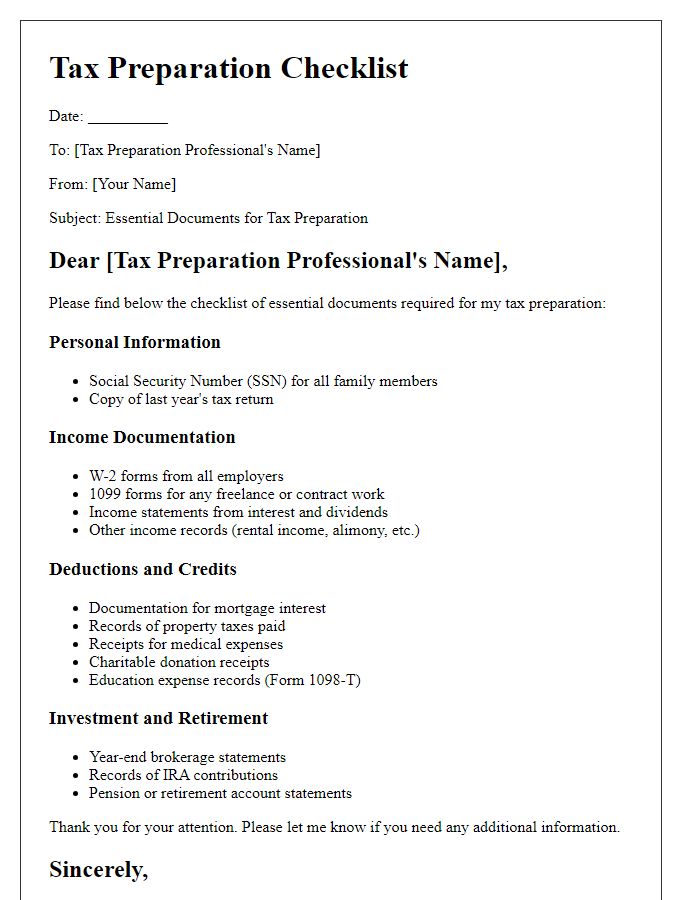

Personal Information

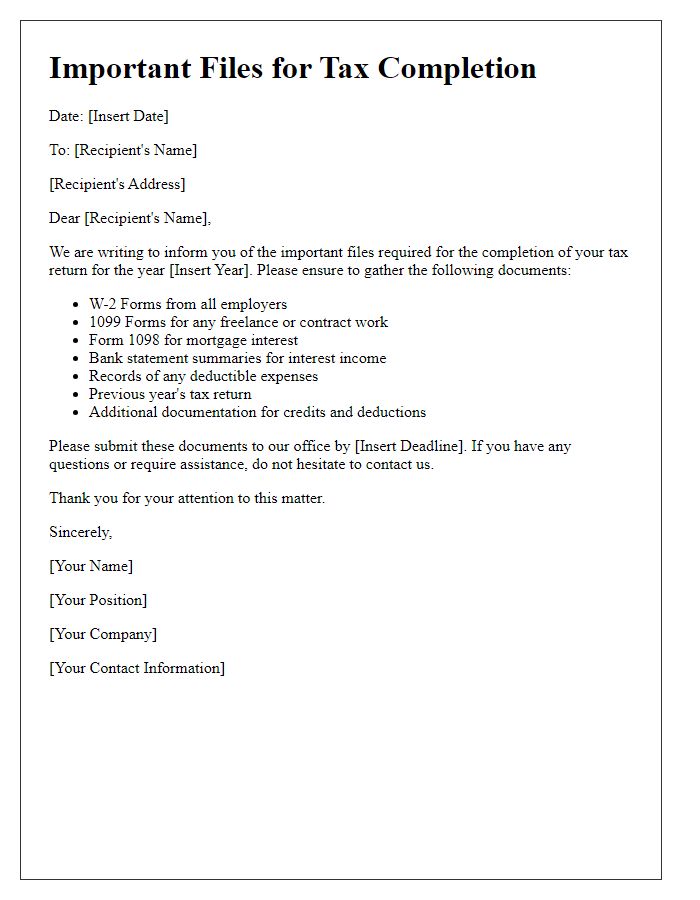

When preparing for tax season, gathering essential personal information is crucial. Begin with your Social Security number (SSN), a unique identifier essential for filing. Collect W-2 forms from employers, which report annual wages and taxes withheld. If self-employed, prepare 1099 forms detailing income received. Document any dependents, requiring their names, SSNs, and dates of birth for tax credits. Also, gather records of health insurance coverage, such as Form 1095-A for those enrolled in health exchanges. Include bank account details for direct deposit of refunds, ensuring effective financial transactions. For deductions, compile receipts and documents related to mortgage interest, property taxes, and charitable contributions, enhancing the accuracy of your filing.

Income Documentation

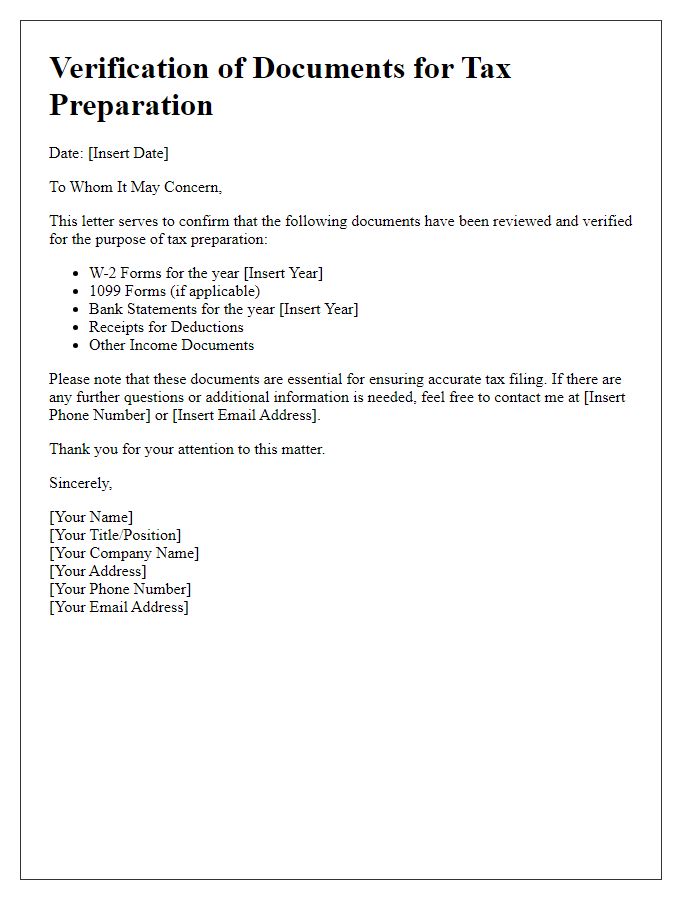

Essential income documentation for tax preparation includes W-2 forms, issued by employers, detailing annual wages and tax withholdings for each employment. 1099 forms, necessary for freelance or contract work, categorize various incomes such as self-employment (1099-MISC) and interest (1099-INT). Additional statements from financial institutions may include bank interest earnings and dividends. Records of unemployment benefits, Social Security income, or pensions must also be collected, as they significantly impact taxable income. For rental income, comprehensive records of income and expenses related to rental properties enhance accuracy in reporting. Accurate documentation ensures compliance with the Internal Revenue Service (IRS) regulations and simplifies the filing process, particularly during annual tax deadlines in April.

Deductions and Credits

Tax preparation requires careful documentation for deductions and credits to maximize tax savings. Charitable contributions (donations to qualified organizations) need receipts, while medical expenses (for unreimbursed qualified costs) require itemized records. State and local taxes paid (property taxes, income taxes) should also be documented. Child tax credit eligibility hinges on dependent information, including Social Security numbers and age verification. Educational credits necessitate Form 1098-T (tuition payments from educational institutions). Records of home office deductions (if applicable) are essential, including square footage and use percentage. Collecting and organizing these documents promptly ensures a smoother and more efficient tax filing process.

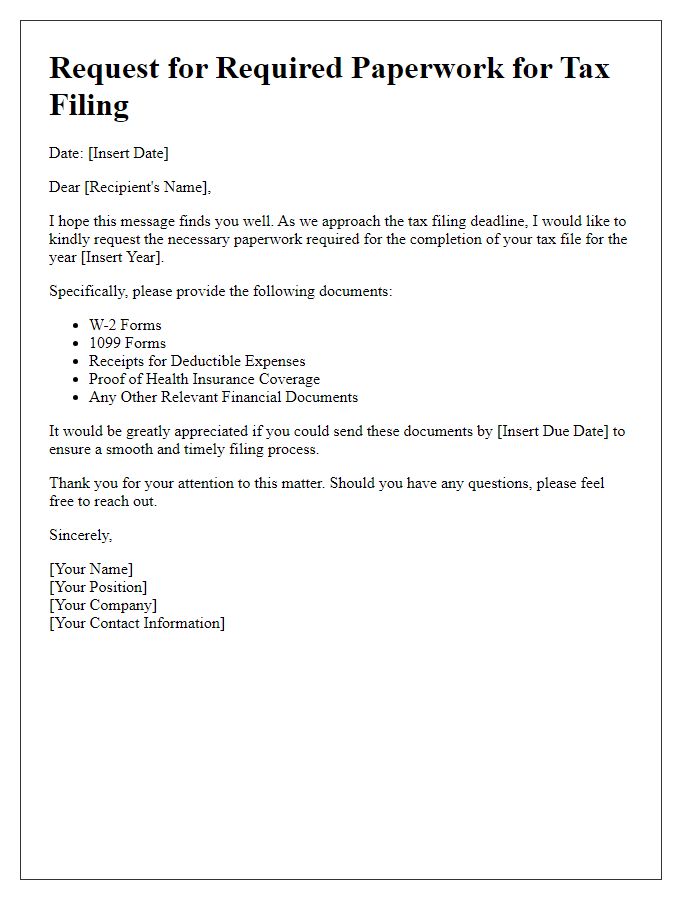

Tax Forms and Statements

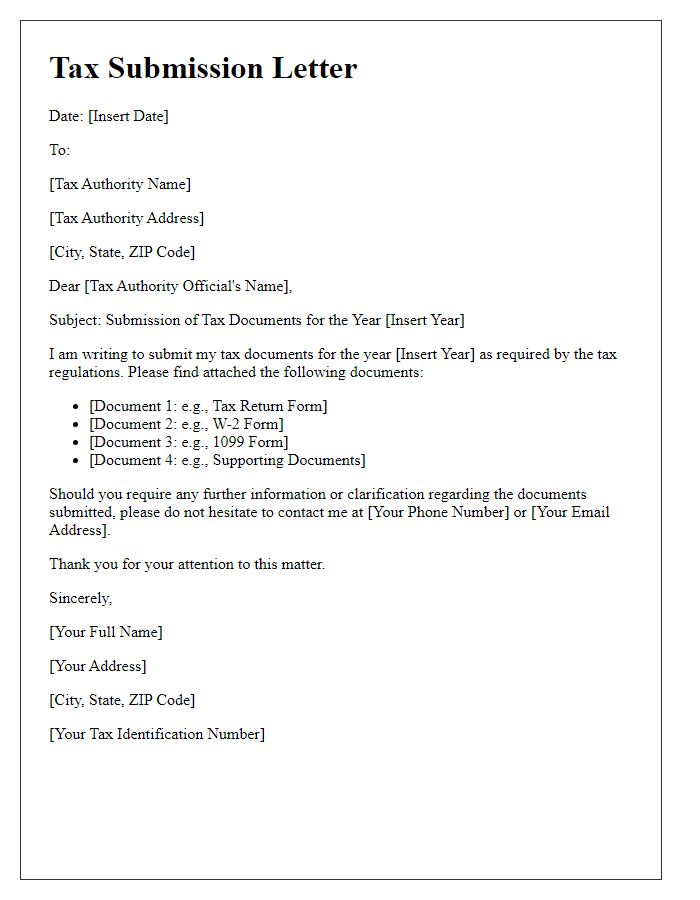

Tax preparation requires meticulous organization of tax forms and statements, essential for accurately reporting income and expenses. Key documents include W-2 forms, which report annual wages and tax withheld, as well as 1099 forms detailing various types of income like freelance earnings, interest, or dividends. In addition to these, taxpayers should gather Schedule A forms for itemized deductions, mortgage interest statements from lenders, and property tax receipts that help reduce taxable income. Health Savings Account (HSA) contribution forms may also be necessary, particularly for taxpayers with medical expenses. Self-employed individuals must include profit and loss statements from their businesses, promoting a comprehensive overview of income against expenses. Ensuring all relevant documents are collected streamlines the filing process, minimizing the likelihood of errors and potential IRS audits.

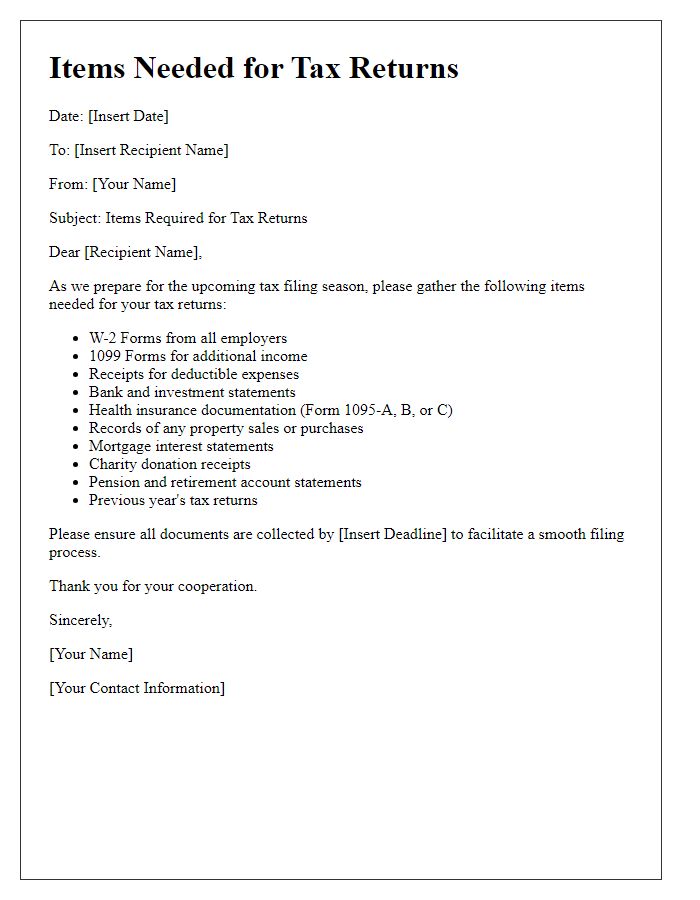

Prior Year Tax Return

Prior year tax returns serve as essential reference documents during tax preparation, providing valuable information on income, deductions, and credits reported to the Internal Revenue Service (IRS). These documents include personal details such as name, Social Security number, and filing status, alongside financial data like total income, taxable income (which may differ year to year), and taxes paid. Taxpayers should also ensure that copies of any relevant schedules, such as Schedule A for itemized deductions or Schedule C for business income, accompany the return to facilitate a comprehensive review. Accessing prior year returns assists in tracking changes in tax laws, possible carryovers, and adjustments to income that may arise in the current tax year within the United States. Keeping these documents organized enhances the accuracy of the current year's tax filings and maximizes potential refunds.

Comments