When navigating the intricate world of tax audits, understanding the documentation requests can feel overwhelming. These requests are designed to clarify your financial situation and ensure compliance with tax laws. It's crucial to approach them with a clear plan and organized documentation to make the process as smooth as possible. Curious to discover more about how to efficiently handle these requests? Keep reading!

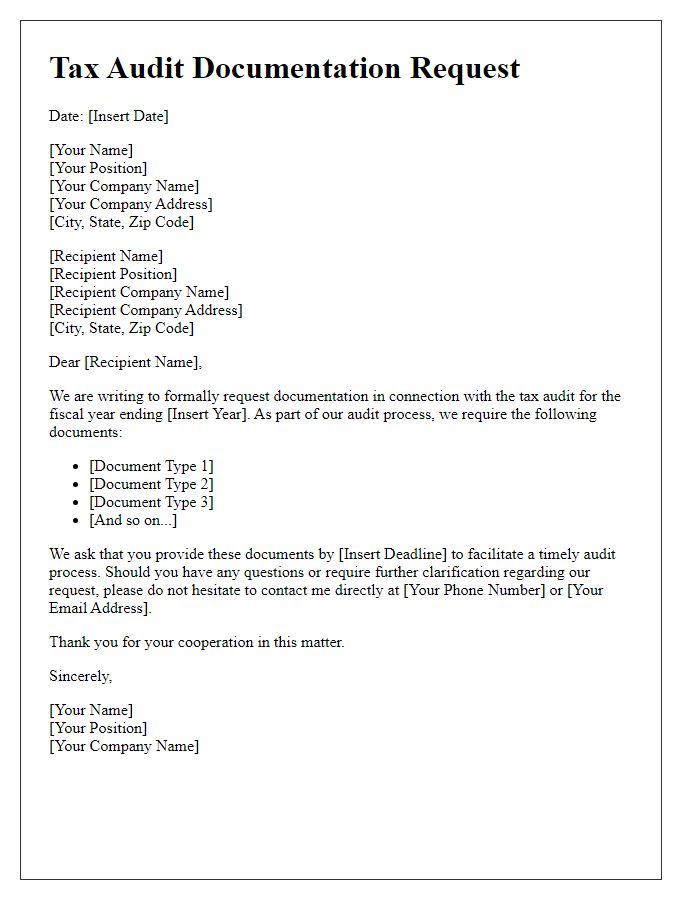

Specific Documentation List

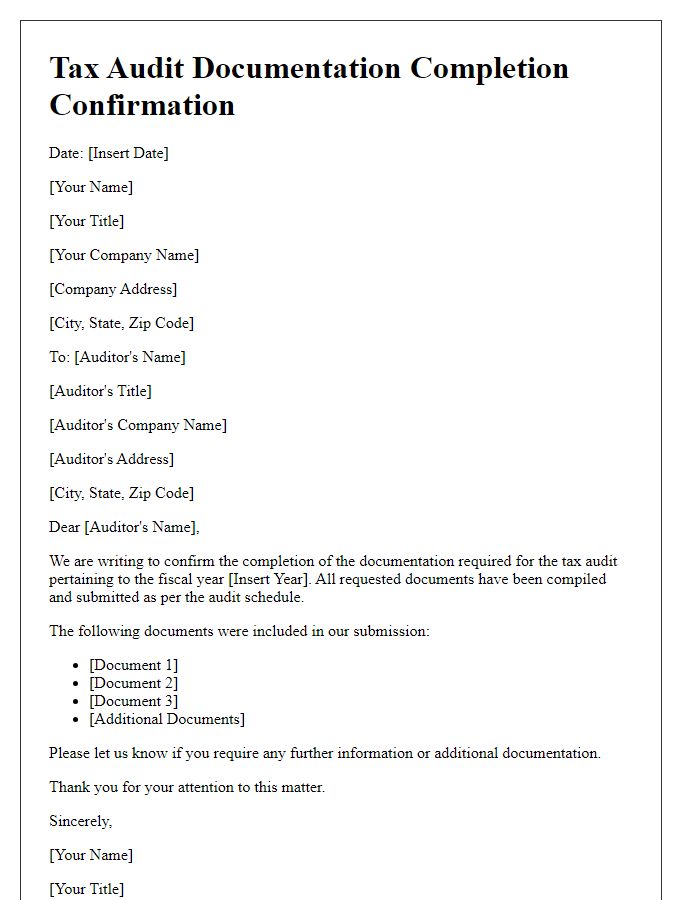

A tax audit can require specific documentation to ensure compliance, often including supporting financial records. Essential items include bank statements (detailing every transaction within the fiscal year), income statements (summarizing total earnings), receipts (for deductible expenses like office supplies or travel costs), and tax return copies (from previous years for comparison). Additionally, entities may need to provide payroll records (indicating employee wages) and invoices (proving business transactions). Each document serves as critical evidence to validate voluntary disclosures and clarify any discrepancies. Proper organization of these documents ensures a smoother audit process.

Clear Deadline

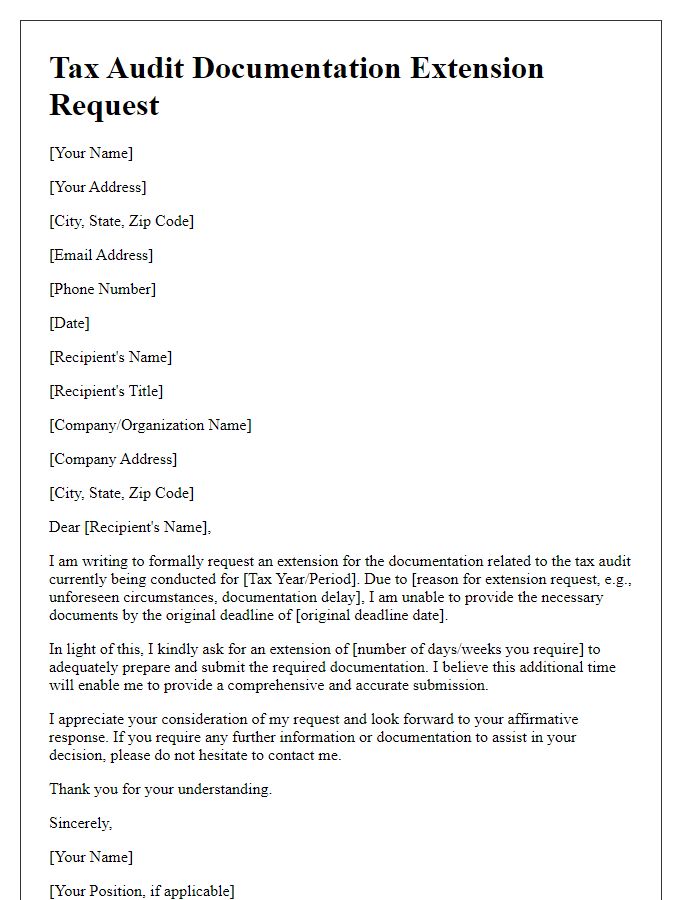

A tax audit documentation request requires careful attention to detail and clear deadlines to ensure compliance. Tax authorities often request specific documents, such as financial statements (like the balance sheet and income statement) for the fiscal year ending December 31, 2022, proof of income (like W-2 forms and 1099 forms), receipts for business expenses (with a focus on expenses over $100), and records of asset depreciation (including documentation on purchases made within the last three years). In this context, a clear deadline is crucial; for instance, the documentation must typically be submitted within 30 days of the request date, which can significantly impact the audit process. Furthermore, failure to meet these deadlines could result in penalties, or worse, additional scrutiny from the Internal Revenue Service (IRS) that could prolong the auditing process.

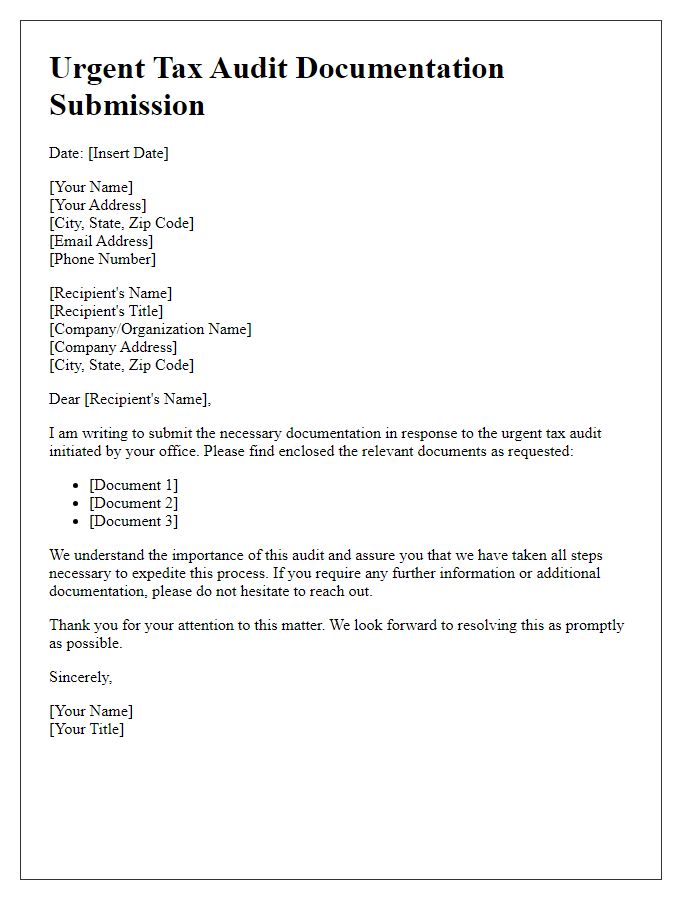

Contact Information

During a tax audit, maintaining accurate and complete contact information is essential for effective communication with various stakeholders, such as the Internal Revenue Service (IRS) or professional accountants. Typical contact details include the taxpayer's name, physical address, email address, and telephone number for direct correspondence. The physical address often refers to the primary residence or business location registered with the IRS, while the email address should be monitored for timely updates regarding audit statuses or necessary documentation requests. It is important to ensure that all provided contact information is current and accurate to prevent delays in the audit process and facilitate efficient communication between involved parties.

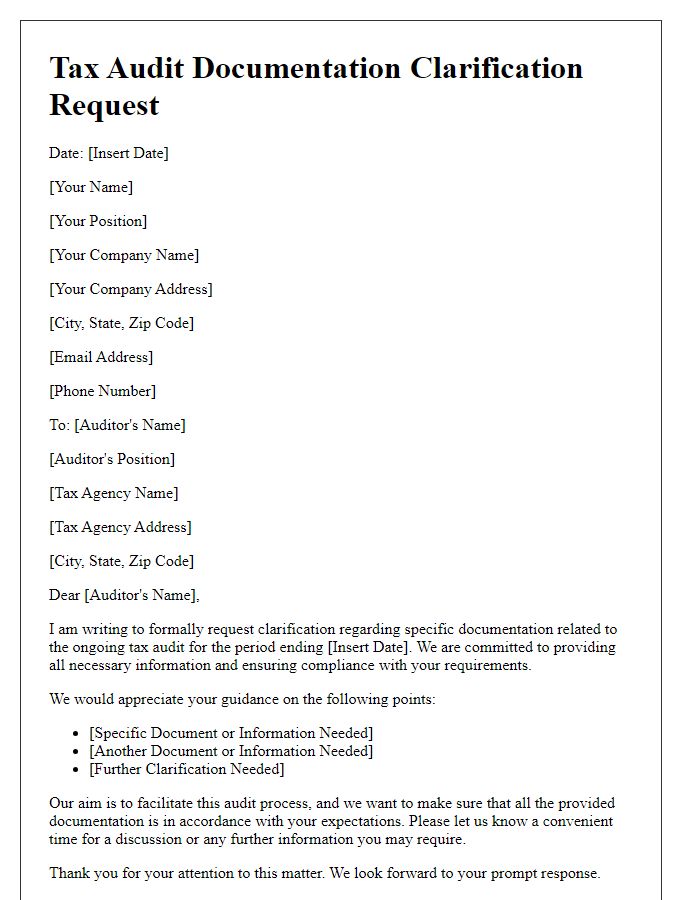

Compliance Instructions

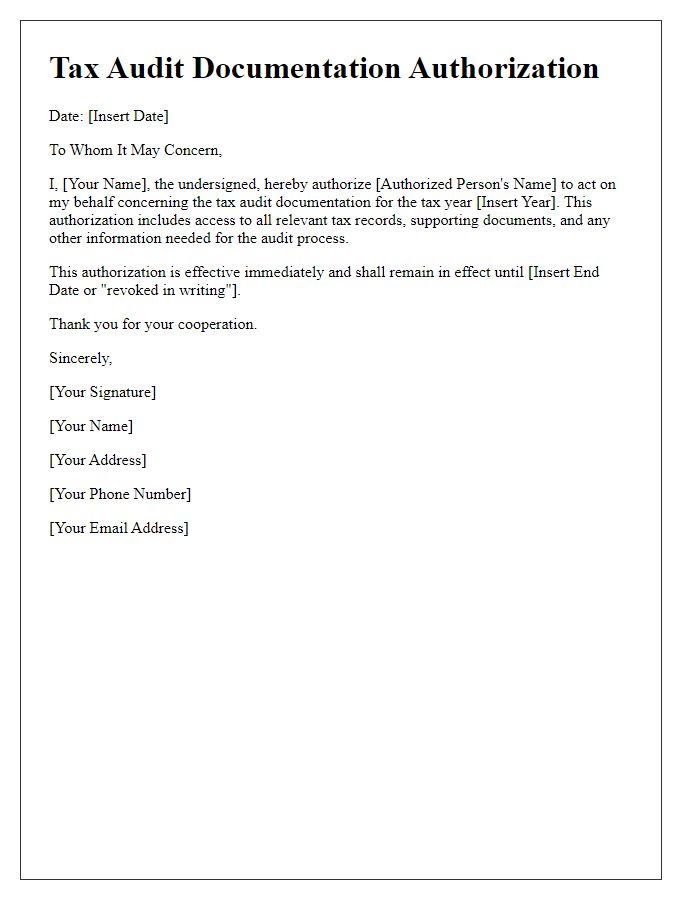

During a tax audit, documentation requests may include detailed records of financial transactions, such as ledgers and receipts, to ensure compliance with regulations. Auditors may seek supporting documents on claimed deductions, for instance, business expenses related to travel or office supplies. Specific time periods (e.g., January 2021 to December 2021) are often specified to narrow down the data. Detailed statements from banks (such as checking and savings accounts) and other financial institutions may be required to validate income sources. Additionally, invoices and contracts related to large purchases may help substantiate claims. Understanding the regulations governing specific tax codes and compliance guidelines is crucial for efficient document preparation and submission.

Confidentiality Assurance

Tax audits require meticulous documentation to ensure compliance with regulations set forth by the Internal Revenue Service (IRS) in the United States. Requests for documentation typically include statements regarding confidentiality assurance, emphasizing the safeguarding of personal and financial information. Financial records, such as income statements and expense receipts, must be prepared meticulously, aligning with guidance stipulated on the IRS website, ensuring that all data complies with privacy protocols. The retention period for such records usually spans three to six years, depending on the type of audit. Maintaining confidentiality not only protects sensitive data but also establishes a sense of trust with the auditor. Adhering to these protocols is crucial for a smooth auditing process.

Comments