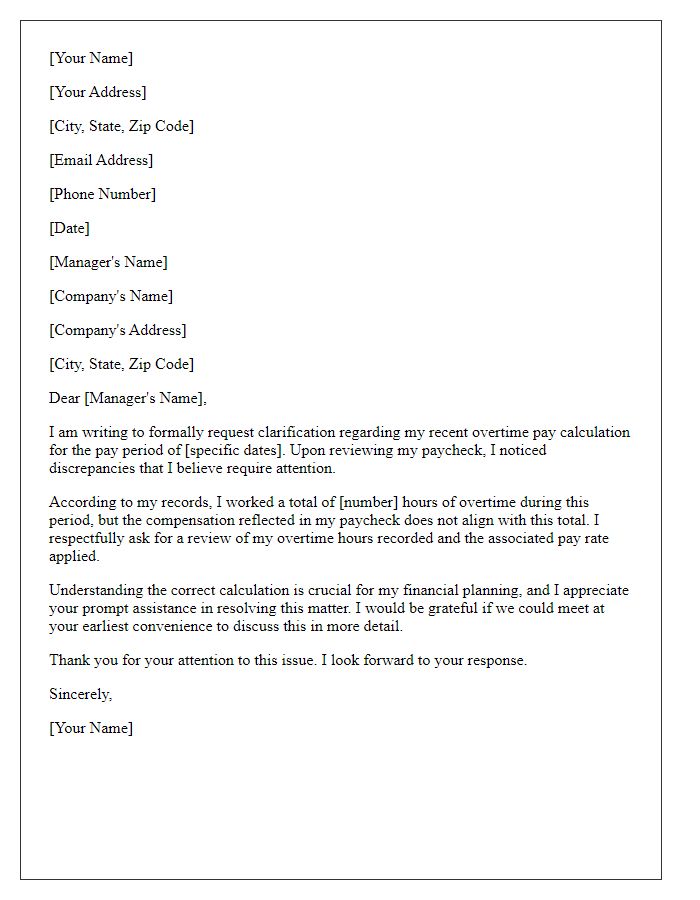

If you've ever found yourself in a bind over overtime pay, you're not alone. Navigating through the complexities of labor laws and company policies can be daunting, but it doesn't have to be. In this article, we'll guide you through a clear and effective letter template that can help you articulate your concerns and seek a fair resolution. So, let's dive in and discover how to advocate for your rights when it comes to overtime pay!

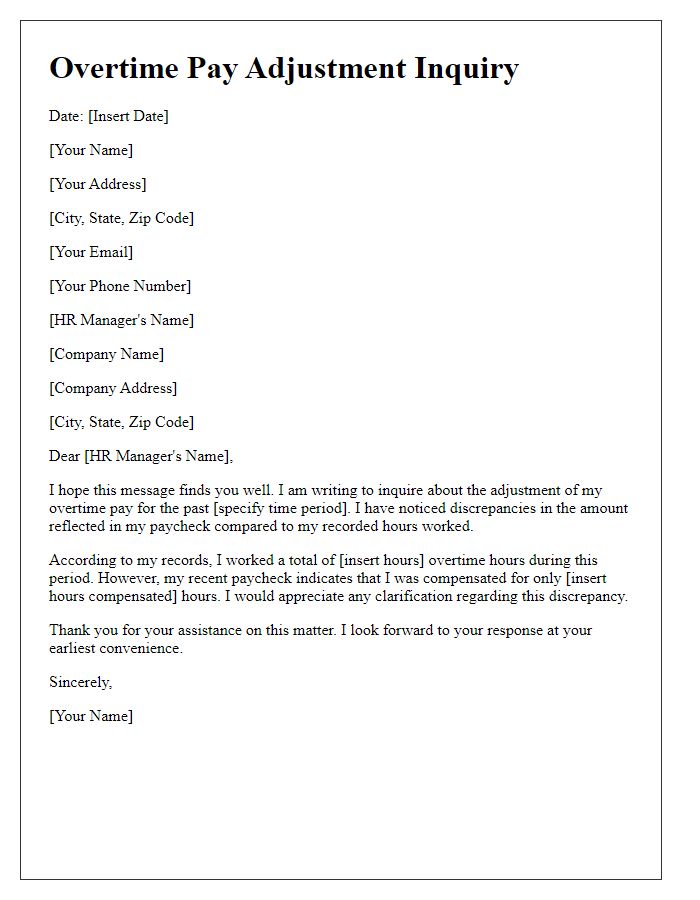

Employee Information

An overtime pay dispute resolution involves understanding employee rights under the Fair Labor Standards Act (FLSA) in the United States, which mandates hourly workers must be compensated at a rate of one and a half times their regular hourly wage for hours worked exceeding 40 in a workweek. Employees should provide specific details, including the total number of overtime hours accrued (e.g., 10 hours during the last payroll period) and the corresponding pay period (e.g., October 1 to October 15, 2023). Important identifiers such as employee name, employee ID, and department name must be included to accurately process the dispute. Additionally, a record of communication with supervisors or HR regarding the dispute should be documented, which may include dates and subjects discussed, to support the resolution process.

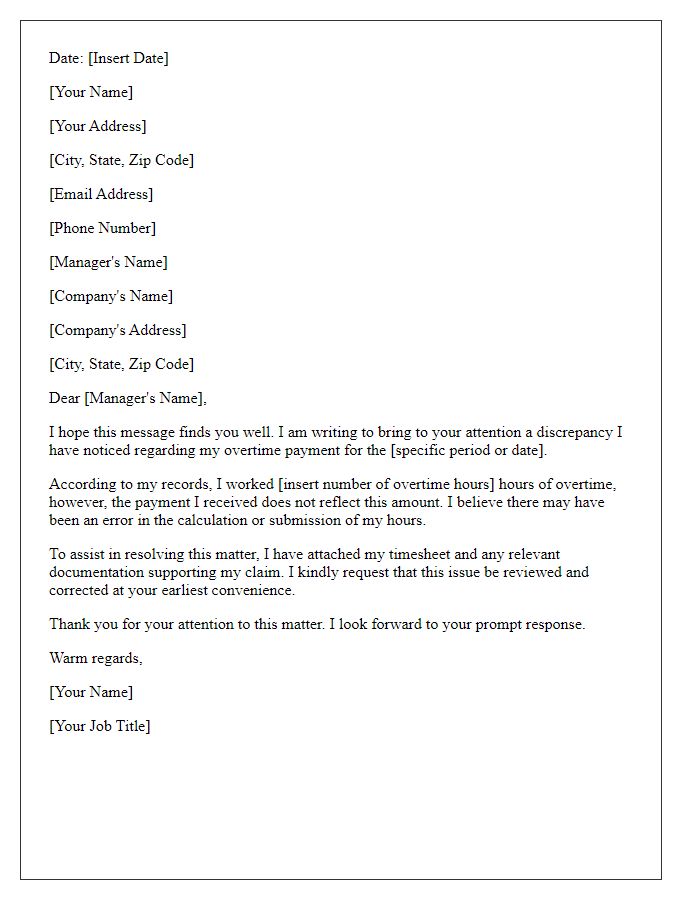

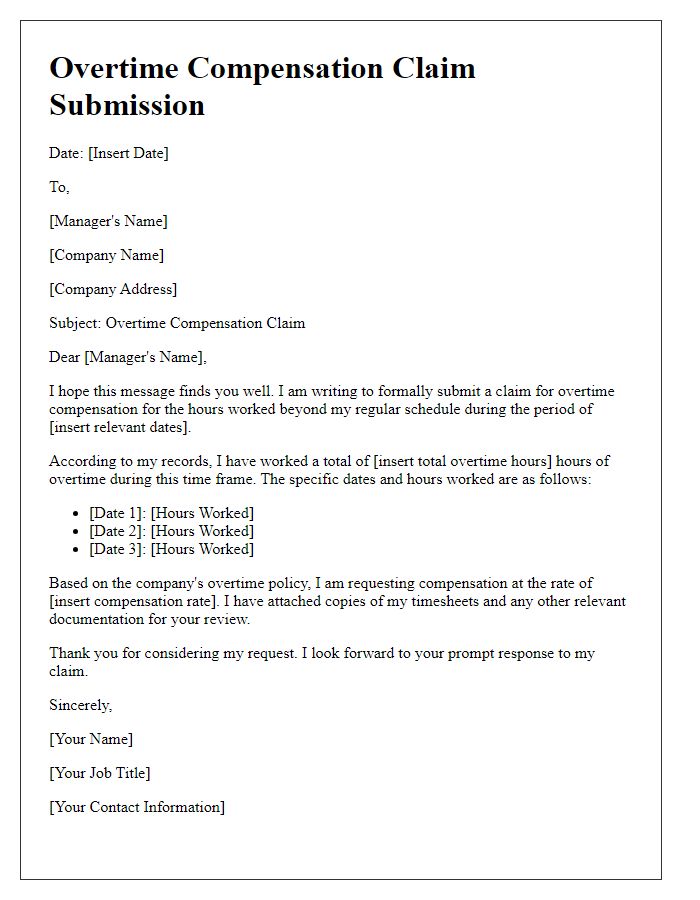

Detailed Work Hours Summary

A detailed work hours summary is essential for resolving overtime pay disputes. This document should include specific dates, total hours worked, and regular versus overtime hours for clarity. For example, a worker may outline 5th to 11th November 2023, detailing shifts from 8:00 AM to 6:00 PM, indicating 40 hours of regular time. Additional entries should illustrate overtime hours worked beyond the standard 40, such as logging five hours on 10th November (from 6:00 PM to 11:00 PM) to capture the total of 45 hours. Each entry should reflect the applicable hourly wage for regular hours and time-and-a-half for overtime, ensuring accurate records for payroll review. Cross-referencing with company timekeeping system records can provide further validation of the claimed hours. A precise summary supports a clear case when disputing discrepancies in paid wages, facilitating effective dialogue with human resources or management.

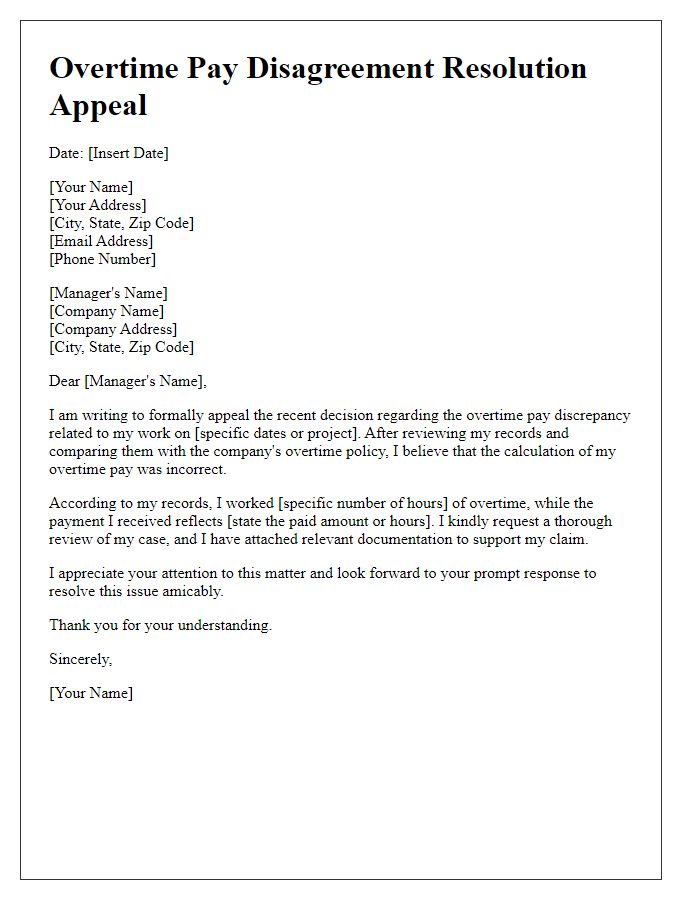

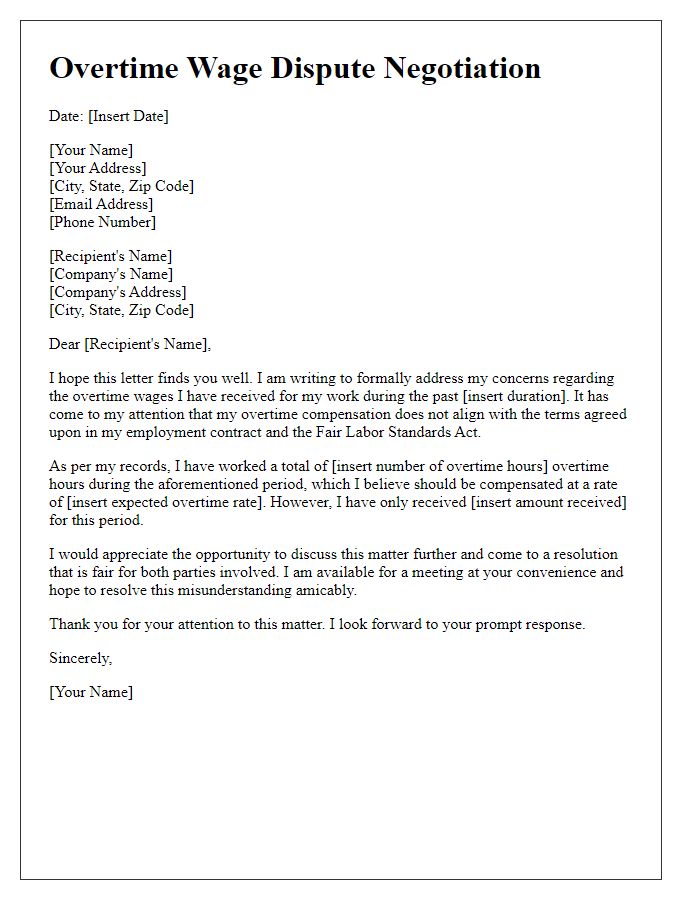

Employment Contract and Overtime Policy Reference

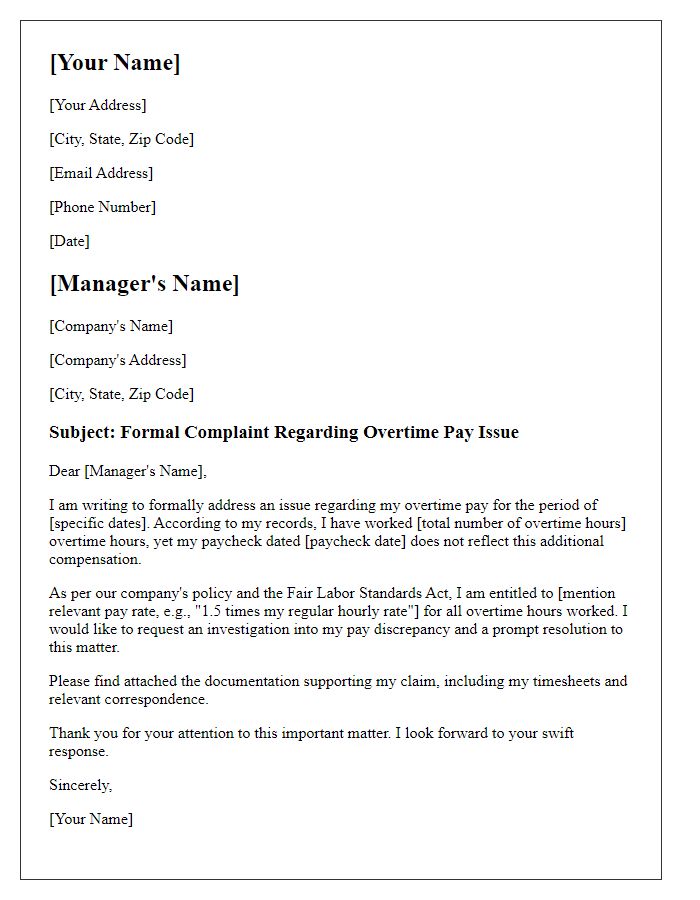

Overtime pay disputes can arise when employees, such as those working in retail or healthcare, believe they are not compensated fairly for hours worked beyond the standard 40 per week. Employment contracts (binding agreements detailing employee responsibilities and compensation) typically outline expected work hours and pay rates, while overtime policies (guidelines governing additional pay for extra hours) clarify eligibility and calculation methods. Most federal and state laws mandate that non-exempt employees receive at least one-and-a-half times their regular hourly rate for overtime hours, often causing disputes when discrepancies occur. Effective resolution requires referencing specific sections of the employment contract and overtime policy, alongside relevant labor regulations, to facilitate a fair settlement process and ensure compliance with legal standards.

Clear Justification for Dispute

Overtime pay disputes often arise when employees, such as those in retail stores, believe they are owed compensation for hours worked beyond the standard 40 hours per week. Accurate records of worked hours, often documented using time sheets or digital timekeeping systems, may indicate discrepancies between total hours worked and hours paid. The Fair Labor Standards Act (FLSA) dictates that non-exempt employees are entitled to receive time and a half for any hours worked over 40 in a workweek. In a specific case involving a retail employee at a store in New York City, the employee logged 50 hours in one pay period but received pay for only 40 hours, resulting in a clear case for dispute. Documentation, such as pay stubs, time clock records, and written communication with supervisors, serves as essential evidence to support claims for unpaid overtime benefits. Establishing a clear justification based on labor laws and documented evidence is critical in resolving such disputes effectively.

Contact Information for Follow-up

During a payroll dispute concerning overtime compensation, clear communication is crucial. Employees must ensure that their contact information, including email address and phone number, is updated for follow-up inquiries. The Human Resources department at the workplace, typically located in corporate offices, should be contacted to initiate the dispute resolution process. Documentation such as time cards, pay stubs, and company policies on overtime, usually outlined in the employee handbook, must be compiled for reference. If unresolved through internal channels, contacting state labor boards, such as the Department of Labor in the United States, could provide additional support and guidance on legal entitlements. Prompt responses and thorough records are essential for effective resolution.

Comments