Creating an investment policy statement (IPS) is a crucial step for any investor looking to ensure their financial goals are met with precision and clarity. An effective IPS serves as a roadmap, guiding your investment decisions based on your risk tolerance, time horizon, and overall objectives. By outlining specific strategies and parameters, it helps in keeping emotions at bay and maintaining a disciplined approach in fluctuating markets. Ready to delve deeper into how you can craft a tailored investment policy statement? Let's explore further!

Client Objectives and Goals

An investment policy statement serves as a comprehensive guide outlining a client's unique financial objectives and goals. It typically includes specific target returns set by the client, often aiming for a percentage growth rate per annum, such as 7 to 10 percent. It emphasizes risk tolerance, revealing whether the client leans toward conservative, moderate, or aggressive investment strategies. Moreover, the statement addresses time horizon considerations, such as short-term needs within five years or long-term goals exceeding ten years. Asset allocation preferences are also highlighted, indicating desired splits between equities, fixed income, real estate, and cash equivalents. Additionally, it reflects any ethical or social investment criteria the client may prioritize. This document is crucial for aligning investment strategies with the client's aspirations, ensuring clear communication, and guiding investment processes effectively.

Risk Tolerance and Capacity

An investment policy statement (IPS) outlines an investor's strategy and risk profile. Risk tolerance refers to the level of market volatility an investor can withstand, influenced by factors such as age (younger investors may tolerate more risk), financial goals (retirement at 65 years), and investment horizon (20 years of growth). Capacity for risk embodies an investor's financial stability (income sources like salary, dividends) to absorb potential losses without affecting overall financial health. This dual aspect helps tailor investment decisions, ensuring alignment with both emotional comfort and fiscal ability, guiding asset allocation (stocks, bonds, real estate) toward achieving long-term objectives like wealth accumulation or capital preservation.

Asset Allocation Strategy

An investment policy statement (IPS) should clearly outline an asset allocation strategy, detailing the distribution of investments across various asset classes. Diversification is key to managing risk, and typically involves a mix of equities (stocks), fixed income (bonds), and alternative investments (real estate, commodities). For example, a balanced portfolio might consist of 60% equities, emphasizing growth potential, and 40% fixed income, providing stability and income generation. Risk tolerance, investment objectives, and time horizon significantly influence asset allocation. Investors aged 30 may adopt a more aggressive stance, seeking higher returns, while those approaching retirement often prefer a conservative approach, wherein 70% of their assets may shift to fixed income for capital preservation. Regularly reviewing and rebalancing this allocation ensures alignment with changing market conditions and personal financial goals.

Investment Selection Criteria

Investment selection criteria play a crucial role in ensuring that investment decisions align with the overall financial goals and risk tolerance of an investor. Key factors involved in the selection process include asset class classification, such as equities (stocks) or fixed income (bonds), which impacts risk exposure and potential return. Historical performance metrics, including annualized returns and volatility, provide insights into past behavior, while economic indicators like interest rates and inflation trends help anticipate future performance. Additionally, due diligence on investment vehicles, such as mutual funds or exchange-traded funds (ETFs), involves evaluating management fees, expense ratios, and fund manager experience. Diversification strategies, including geographic distribution and sector allocation, mitigate risks by spreading investments across various asset types. Active vs. passive management approaches also affect selection, with active funds aiming to outperform benchmarks and passive funds tracking market indices. The alignment with ethical standards or socially responsible investing (SRI) principles can further refine selection criteria, supporting investments that reflect the investor's values.

Performance Monitoring and Review

Performance monitoring and review are critical components of an investment policy statement, focusing on the evaluation of investment outcomes against predetermined benchmarks. Regular assessments, typically conducted quarterly or semi-annually, allow stakeholders to analyze performance relative to market indices, such as the S&P 500 or NASDAQ Composite. During these reviews, key metrics like total return, risk-adjusted return (using measures like Sharpe Ratio), and volatility should be examined. Investment managers may also assess adherence to asset allocation targets, aligning with the predefined strategic asset mix, which could include 60% equities, 30% fixed income, and 10% alternatives. Rebalancing strategies might be discussed to ensure alignment with risk tolerance and investment objectives, as market fluctuations can lead to significant deviations from the target allocations. Documenting findings in detailed performance reports can facilitate informed decision-making and guide future investment strategies.

Letter Template For Investment Policy Statement Samples

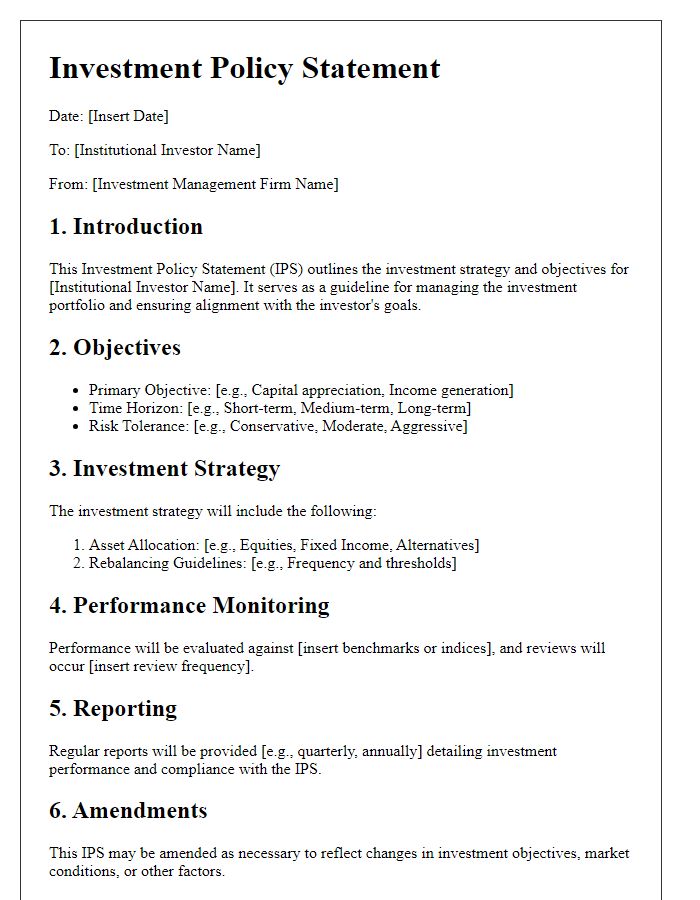

Letter template of Investment Policy Statement for Institutional Investors

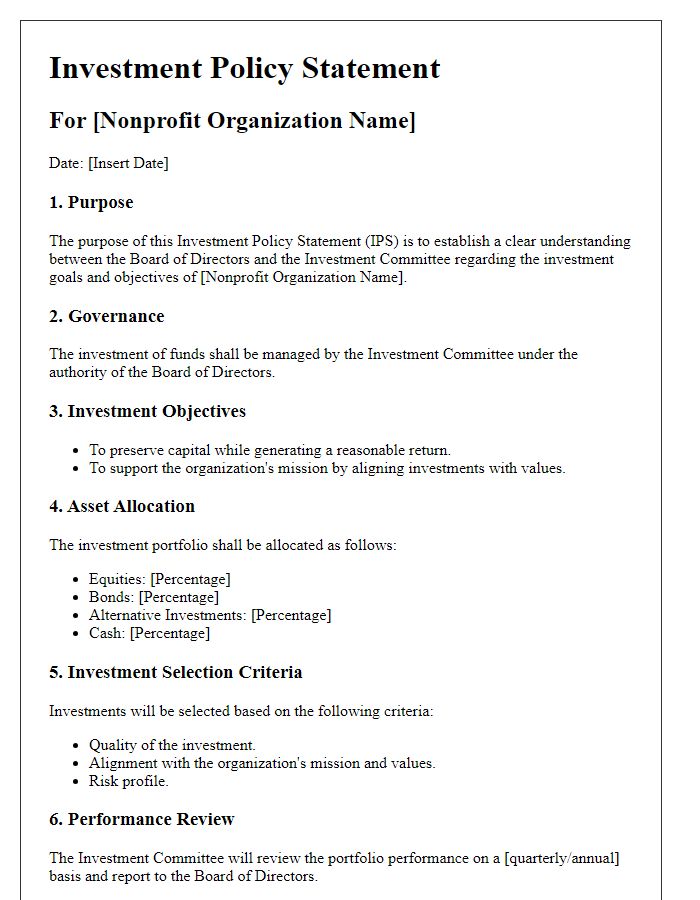

Letter template of Investment Policy Statement for Nonprofit Organizations

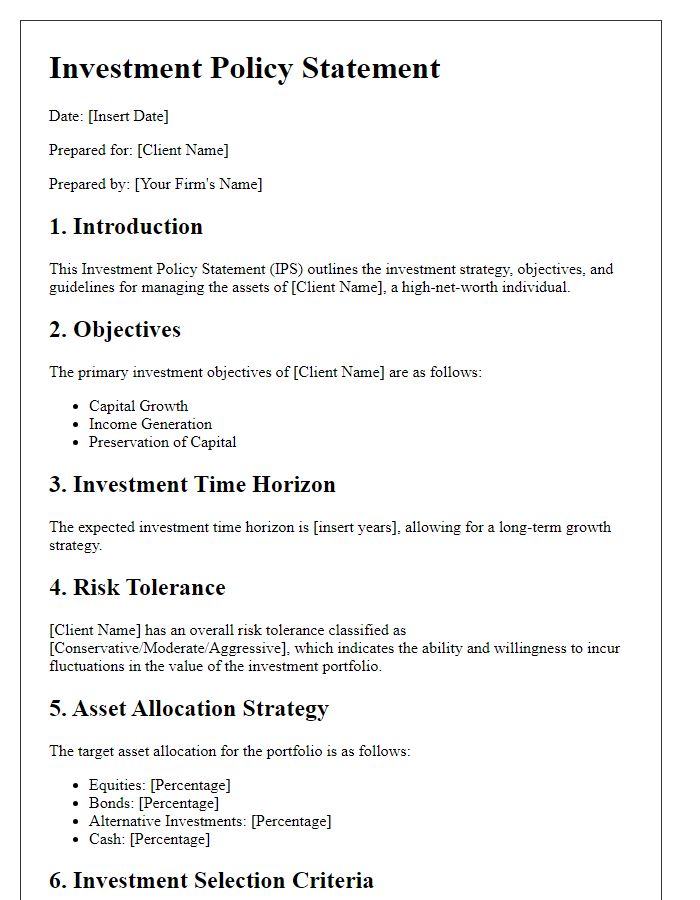

Letter template of Investment Policy Statement for High Net-Worth Individuals

Letter template of Investment Policy Statement for Corporate Investment Funds

Letter template of Investment Policy Statement for ESG-Focused Investments

Comments