Are you struggling with managing accounts receivable and ensuring timely collections? It's a common challenge for many businesses, but having an effective collection strategy can make all the difference. In this article, we'll explore practical tips and proven techniques to streamline your receivables process and improve cash flow. Join us as we delve into the essentials of an efficient accounts receivable collection strategy!

Clear communication of outstanding balance details.

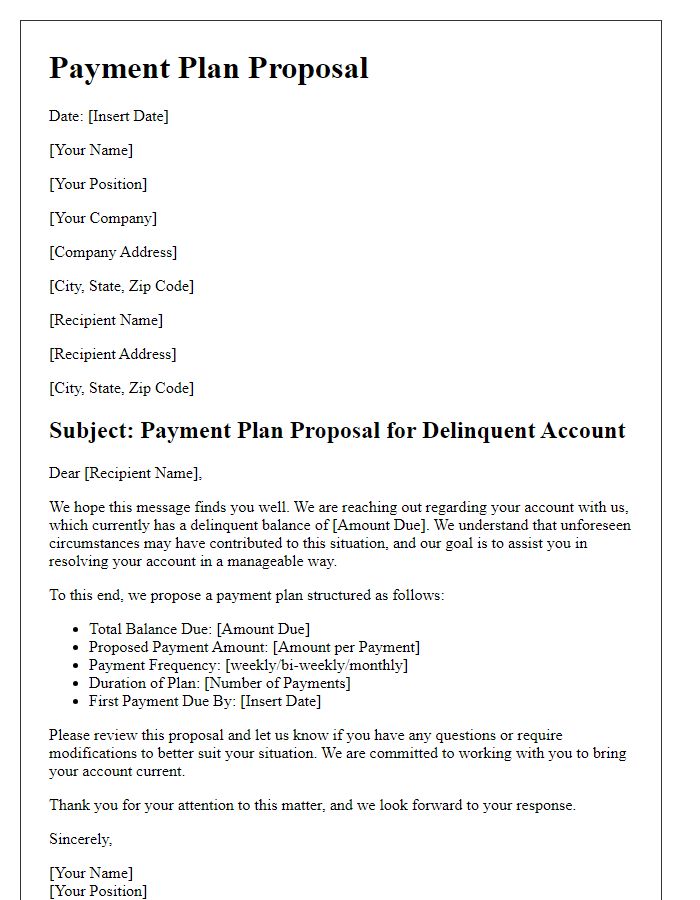

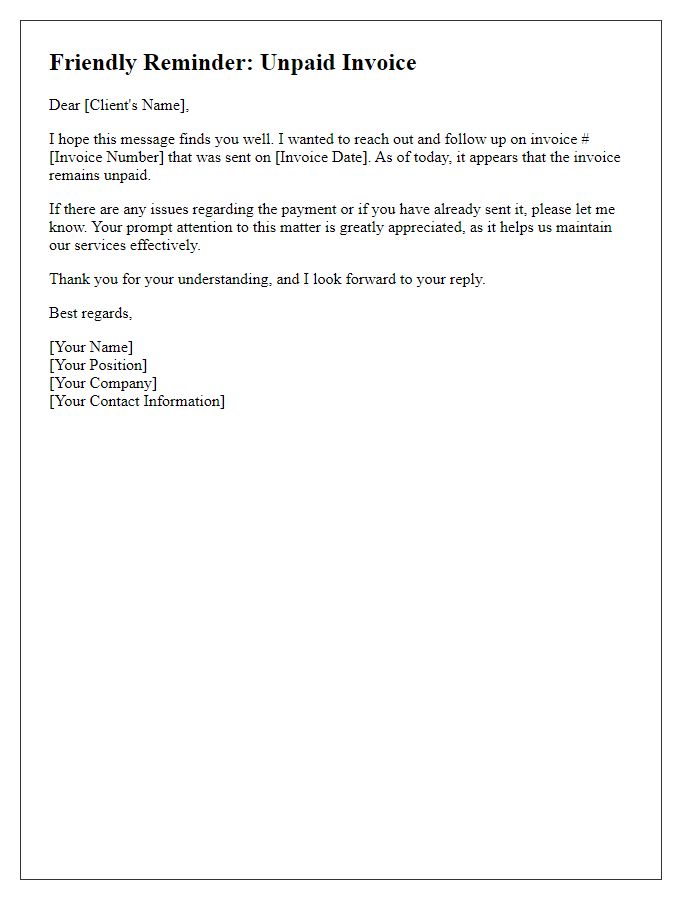

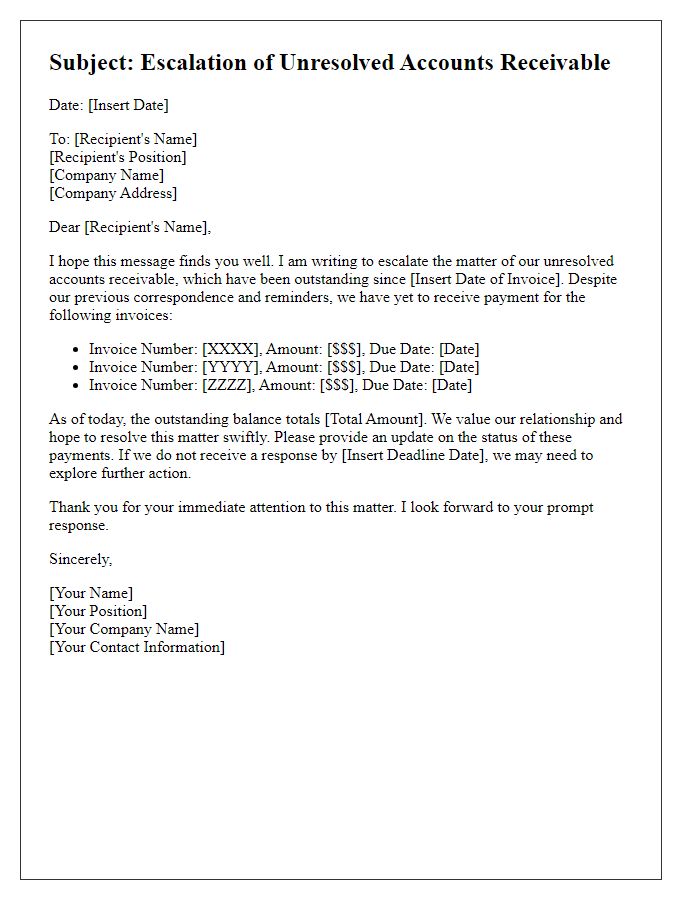

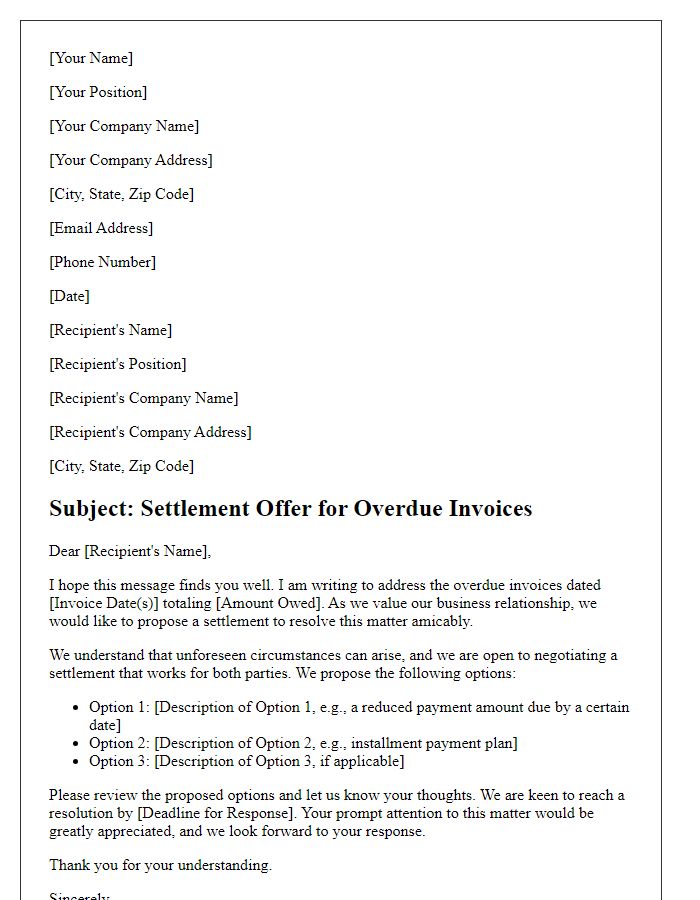

A well-structured accounts receivable collection strategy emphasizes clear communication of the outstanding balance details. Businesses should utilize a systematic approach that includes timely reminders and personalized outreach for each delinquent account, ensuring that clients understand specific amounts owed, invoice numbers, and due dates. For example, outlining an outstanding balance of $5,000 from Invoice #12345, due on September 30, 2023, enables clarity. Providing clear instructions for payment methods and available options, such as bank transfers or online payment portals, ensures convenient access for clients. Additionally, maintaining a record of previous communication attempts, including the date and method of contact, enhances accountability in follow-up efforts. Finally, offering incentives for early payment or establishing flexible payment plans can encourage prompt resolution of outstanding balances and strengthen client relationships.

Specific payment instructions and methods.

In a comprehensive accounts receivable collection strategy, clear payment instructions and methods are crucial for ensuring timely collections. Payment options such as bank transfers (ACH), credit card payments (Visa, MasterCard), and online payment platforms (PayPal, Stripe) should be explicitly outlined. Specify the bank account number and routing information for ACH transactions or the website link for online payments. Set clear deadlines, typically 30 days from the invoice date, for recipients to complete payments. Include details about late fees, such as a 1.5% monthly interest on overdue balances. Additionally, provide contact information for any queries or assistance, facilitating smooth communication. Establishing an easy-to-follow process decreases confusion and enhances the likelihood of prompt payments.

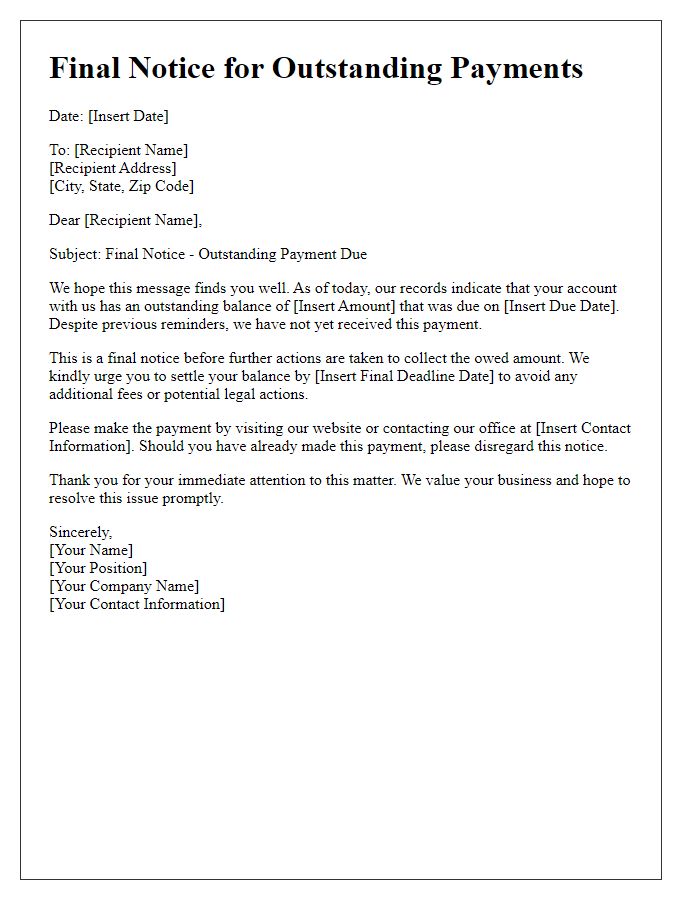

Deadline for payment and any associated late fees.

Accounts receivable collection strategies can significantly impact a company's cash flow. Establishing a deadline for payments, typically within 30 days from the invoice date, ensures timely financial operations. Late fees, often set at 1.5% per month of the overdue amount, can incentivize prompt payments and discourage delays. Clear communication of these terms enhances understanding and compliance. Implementing automated reminders through accounts management software can streamline the collection process and reduce the need for manual follow-ups. Furthermore, maintaining a positive relationship with clients while enforcing these deadlines can lead to improved payment behavior and customer loyalty.

Contact information for inquiries or disputes.

Efficient accounts receivable collection strategy necessitates maintaining clear contact information for inquiries or disputes to streamline communication with clients. Designating a specific email address, such as collections@companyname.com, enables clients to directly address concerns regarding their invoices or payment status. A dedicated phone line, such as +1-800-555-0199, provides immediate access for urgent inquiries, ensuring that clients receive timely assistance. Including detailed office hours, such as Monday to Friday, from 9 AM to 5 PM Eastern Standard Time, establishes clear expectations for response times. Additionally, incorporating a physical mailing address, such as 123 Business Rd., Suite 100, New York, NY 10001, allows clients to send documents or formal disputes if necessary, enhancing the avenue for effective resolution of any financial discrepancies.

Polite, professional, and firm language.

Accounts receivable management is crucial for business cash flow. Timely follow-up on outstanding invoices ensures financial stability. Businesses often implement collection strategies targeting overdue accounts. Key strategies include sending reminders, offering flexible payment plans, or negotiating settlements. Utilizing professional tone, consistently reinforcing payment terms, enhances effectiveness. Regular account reviews identify chronic late payers, allowing focused follow-up. Documented communication trails are essential for legal adherence. Training staff in conflict resolution improves interactions with clients. Regular analysis of collection rates can highlight areas needing improvement, optimizing the overall revenue cycle management.

Letter Template For Accounts Receivable Collection Strategy Samples

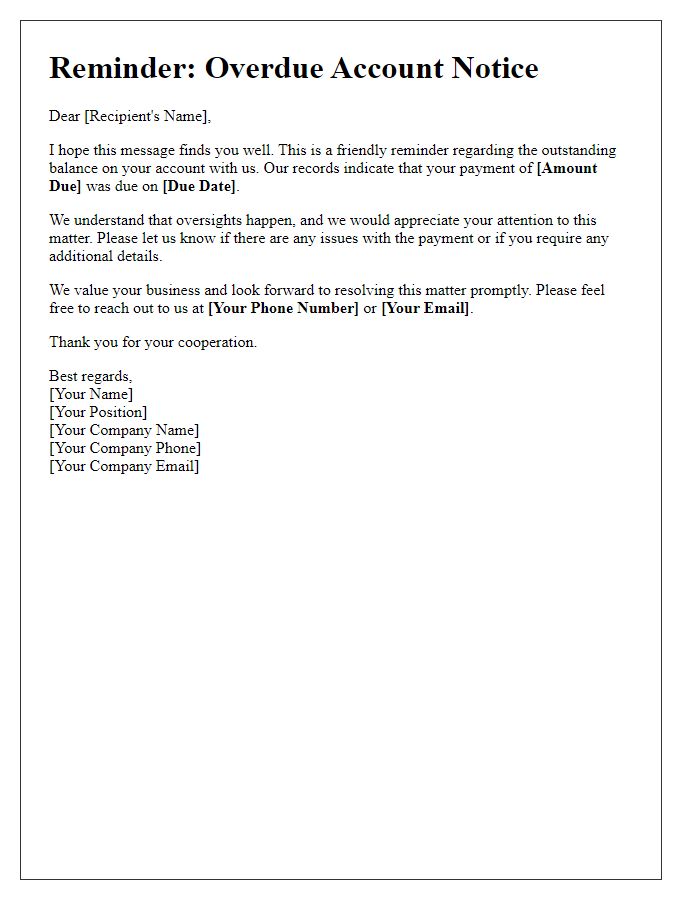

Letter template of professional reminder for overdue accounts receivable

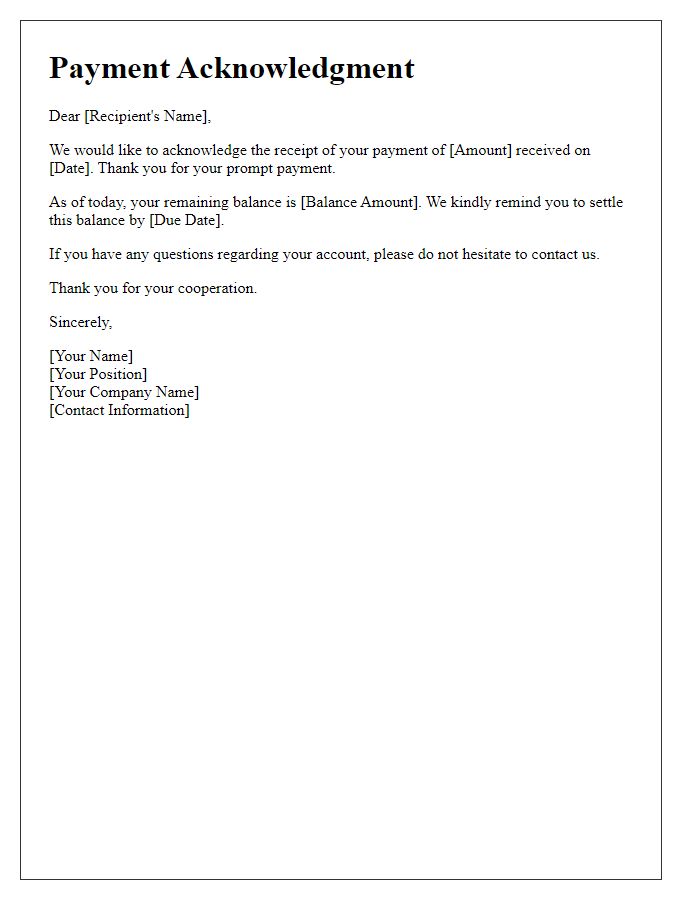

Letter template of acknowledgment of payment received with reminder of balance

Comments