Have you ever found yourself in the midst of a complex business transaction, unsure of how to tackle the due diligence process? It's a crucial step that can make or break a deal, and having the right documents on hand is essential for a smooth review. In this article, we'll walk you through a comprehensive letter template designed to streamline your due diligence document requests, ensuring you ask for everything you need without missing a beat. Ready to enhance your approach and make the process easier? Let's dive in!

Recipient Information

Due diligence processes in corporate transactions often necessitate meticulously organized documentation from recipient organizations. Key recipient information includes the legal entity name, tax identification number, and address, ensuring clarity on the organization involved. Details such as the incorporation date provide insight into the company's history, while the list of key stakeholders, including directors and owners, establishes accountability. Furthermore, a comprehensive contact person--complete with phone number and email address--facilitates efficient communication during the information gathering phase, vital for assessing potential risks related to mergers and acquisitions, partnerships, or investments.

Clear Subject Line

A clear subject line is crucial for due diligence document requests, as it establishes the intent and urgency of the communication. Examples of effective subject lines include "Request for Due Diligence Documents - [Company Name]," or "Urgent: Document Request for Due Diligence Process - [Specific Deadline Date]." These subject lines ensure the recipient recognizes the importance of the request and can quickly identify the relevant documents needed for a thorough evaluation, particularly in contexts like mergers and acquisitions, investment assessments, or legal compliance. Clarity and specificity in subject lines help streamline communication, enhancing the efficiency of due diligence processes.

Purpose of Request

Due diligence involves a comprehensive appraisal of a business or individual to establish assets, liabilities, and commercial potential. This process often requires a detailed document request to gather pertinent information. Key documents may include financial statements (such as the last three years of income statements, balance sheets, and cash flow statements), legal agreements (including partnership contracts, leases, and intellectual property registrations), and operational records (such as employee contracts, compliance certifications, and regulatory filings). This inquiry aims to assess risks, validate claims, and ensure informed decision-making, ultimately influencing investment or acquisition outcomes.

Specific Documents Required

Due diligence in business transactions involves a thorough investigation into financial records and legal documentation to ensure compliance and make informed decisions. Financial statements, including balance sheets, income statements, and cash flow statements from the past three years, reveal a company's financial health and operational performance. Legal documents such as contracts, leases, and incorporation papers provide insight into obligations and rights. Intellectual property documentation, covering patents or trademarks, is essential to ascertain the value of proprietary assets. Employment agreements and organizational charts highlight human resources management and key personnel roles. Regulatory compliance records, including licenses and permits, ensure that the company operates within legal frameworks. Lastly, minutes from board meetings and shareholder meetings indicate governance practices. Collectively, these documents form a comprehensive picture of the entity under scrutiny, enabling informed decision-making.

Contact Information for Queries

Due diligence processes require comprehensive information gathering. Essential contact information should include names of primary contacts, their roles, and corresponding email addresses. Phone numbers are vital for immediate queries. For effective communication, specify office hours, ensuring prompt response times. Include additional contact methods such as instant messaging platforms, which can facilitate instant clarifications. Highlight the importance of maintaining confidentiality during the due diligence phase, emphasizing secure data exchange protocols to protect sensitive information.

Letter Template For Due Diligence Document Request Samples

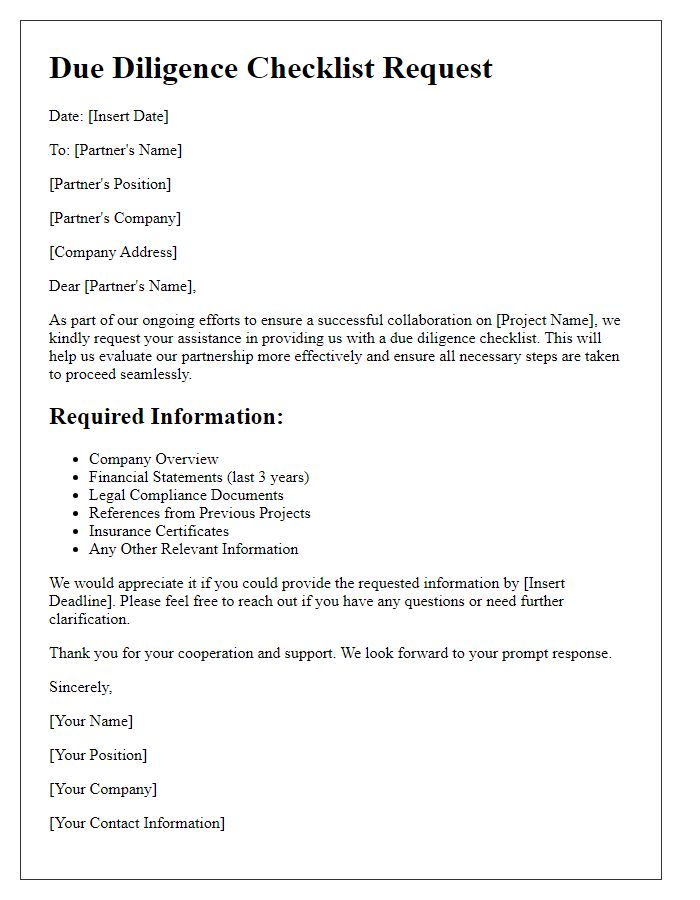

Letter template of due diligence checklist request for project partners.

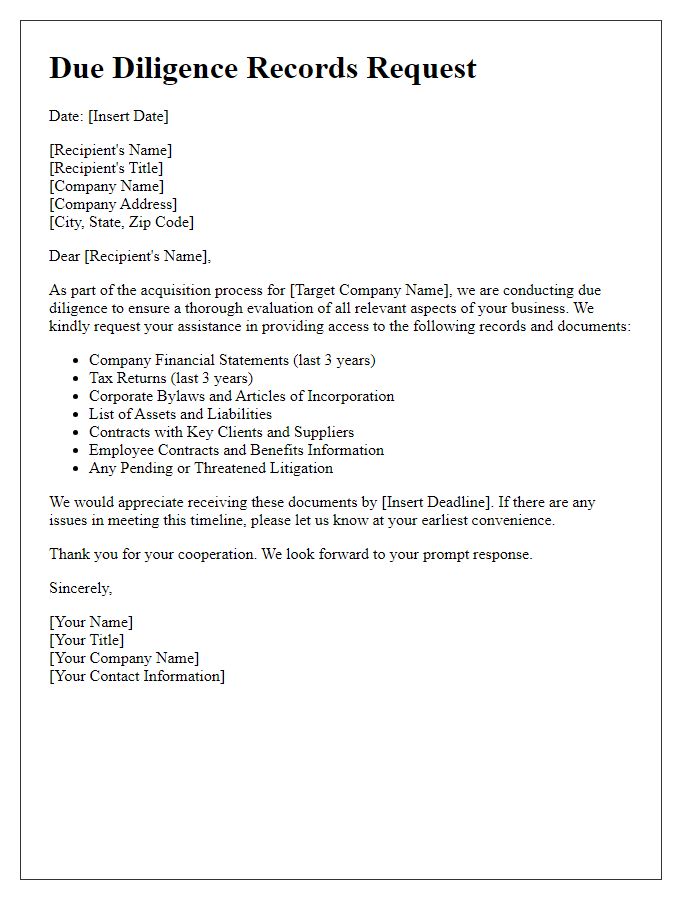

Letter template of due diligence records request for acquisition process.

Comments