Are you tired of drowning in receipts and financial statements? Managing your books shouldn't feel overwhelming, and we're here to help! Our bookkeeping services offer a seamless way to keep your finances in order while you focus on what truly mattersâgrowing your business. Ready to discover how we can simplify your financial management? Read on to explore the benefits we provide!

Company Introduction

XYZ Bookkeeping Services, established in 2020, offers comprehensive financial management solutions for small to medium-sized enterprises (SMEs) across various industries including retail, healthcare, and technology. Our services encompass accounts receivable, accounts payable, payroll processing, financial reporting, and tax preparation. With a dedicated team of certified professionals, we ensure compliance with the latest regulations while providing personalized support tailored to each client's unique business needs. Utilizing advanced accounting software such as QuickBooks and Xero, we enhance accuracy and streamline financial processes. Our commitment to excellence and attention to detail has earned us a reputation for reliability within the local community, helping businesses thrive through transparent financial practices.

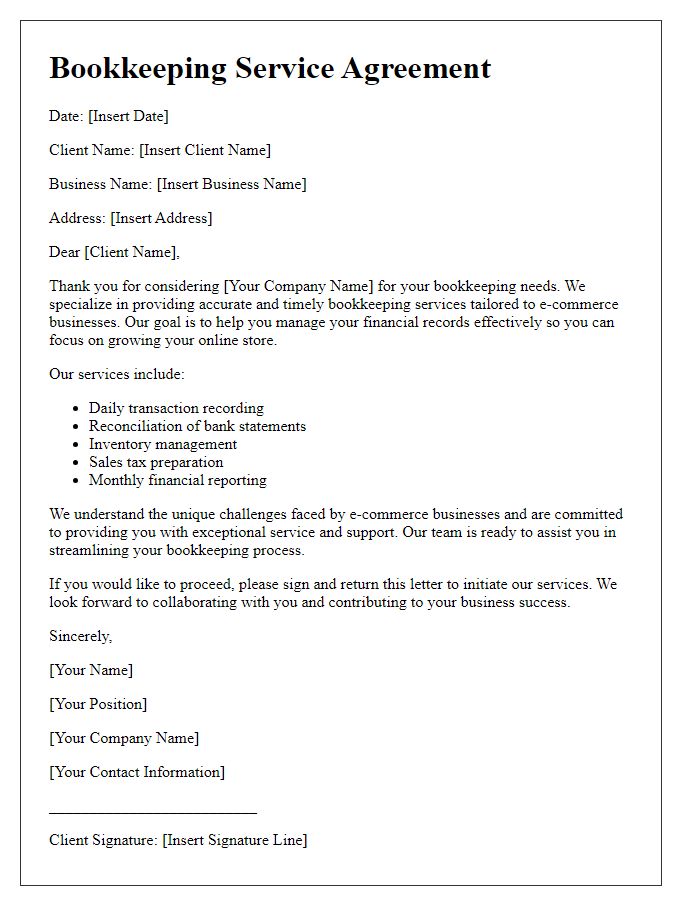

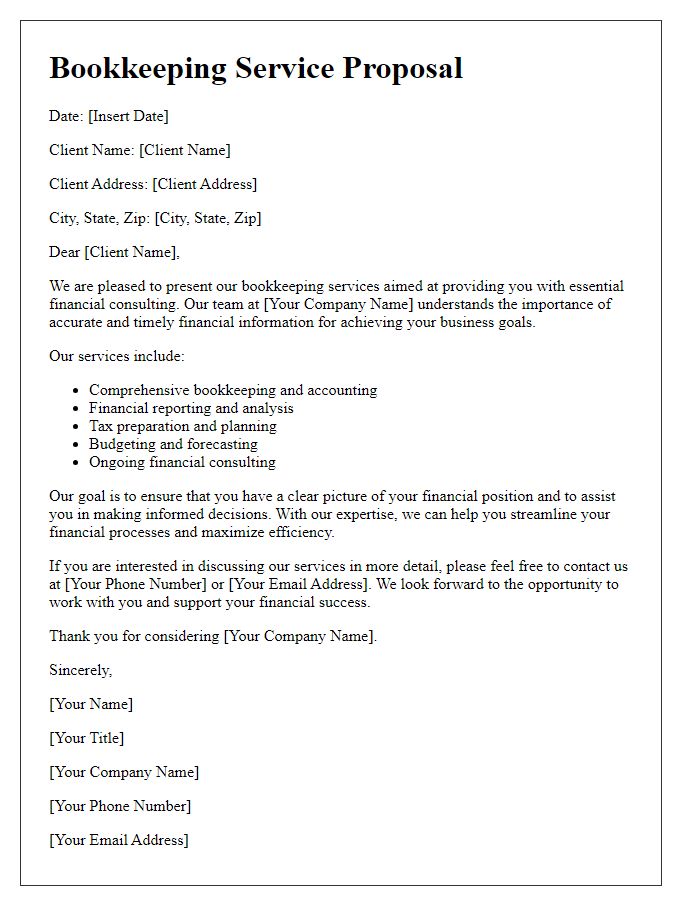

List of Services Offered

Bookkeeping services encompass a wide range of financial management tasks essential for businesses. These services include transaction recording (daily entries of invoices and expenses), financial statement preparation (monthly balance sheets and income statements for performance analysis), payroll processing (timely salary disbursement for employees), tax preparation (yearly filing and compliance with IRS regulations), and accounts receivable management (tracking incoming payments and outstanding invoices). Additionally, businesses may benefit from budget creation (detailed planning for projected income and expenses) and financial consulting (advisory services for improving financial health). A professional bookkeeping service can enhance operational efficiency and ensure compliance with financial regulations.

Unique Selling Proposition

Professional bookkeeping services streamline financial management for businesses, ensuring accuracy and compliance with regulations. Utilizing cloud-based software, such as QuickBooks and Xero, enhances accessibility and data security. Customized financial reports provide insights into cash flow patterns and expense tracking, supporting informed decision-making. Experienced bookkeepers, with certifications in accounting principles, can help reduce tax liabilities and improve financial planning. Moreover, outsourcing bookkeeping allows business owners to focus on core operations, increasing productivity and strategic growth. Making the smart choice to invest in professional bookkeeping can lead to significant long-term financial stability and success.

Call to Action

Bookkeeping services offer essential financial management for businesses of all sizes. Accurate record-keeping (tracking all financial transactions) ensures compliance with tax laws and helps in financial forecasting. This service typically includes accounts payable (money owed to suppliers), accounts receivable (money owed from customers), and payroll processing (calculating employee wages and tax deductions). Using up-to-date software like QuickBooks (a popular accounting program), bookkeeping can streamline operations, allowing business owners to focus on growth. Engaging with a professional bookkeeping service can also provide insights into financial health, helping businesses make informed decisions and ultimately improve profitability.

Contact Information

Professional bookkeeping services ensure accurate financial records for businesses. Detailed tracking of income, expenses, and transactions aids in budgeting, tax preparation, and financial reporting. Experienced bookkeepers leverage software tools like QuickBooks or Xero for efficiency, ensuring compliance with tax regulations and local laws. Regular account reconciliation prevents discrepancies and promotes transparency. By outsourcing these services, businesses can focus on growth while maintaining financial health. Quality bookkeeping supports strategic decision-making, providing insights into cash flow and profitability. Establishing strong financial foundations accelerates success in competitive markets.

Comments