Are you curious about the intricate world of forensic accounting? This specialized field digs deep into financial records to uncover discrepancies, fraud, and mismanagement, making it essential for legal and business matters. By employing a blend of accounting, auditing, and investigative skills, forensic accountants play a pivotal role in resolving complex financial disputes. If you want to learn more about the processes and techniques used in a forensic accounting investigation, keep reading!

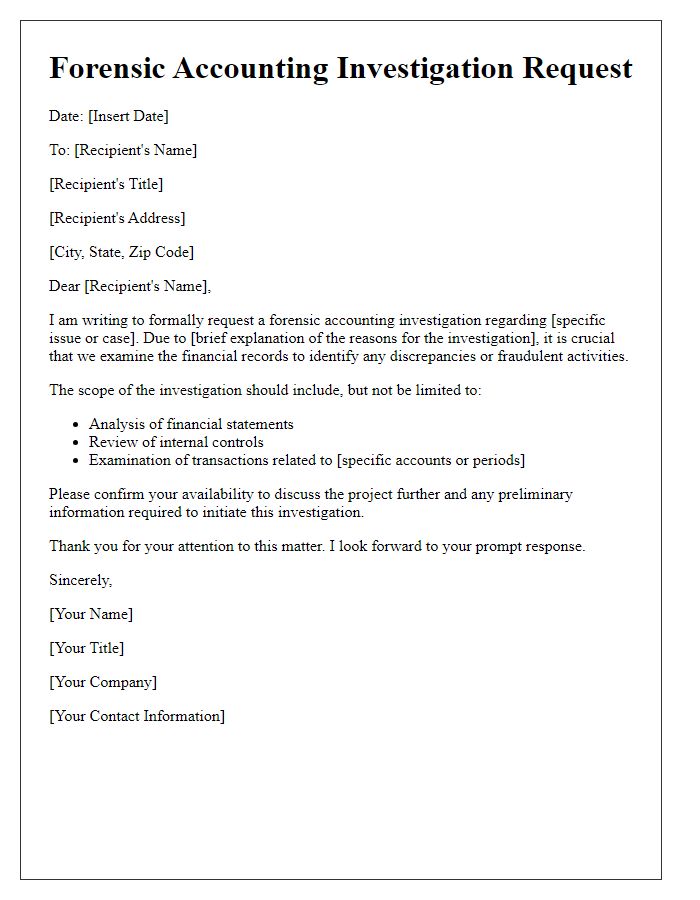

Introduction and Purpose

Forensic accounting investigations are crucial in uncovering financial discrepancies within organizations, such as corporations or non-profits, revealing potential fraud or embezzlement. These investigations typically aim to analyze financial records, including bank statements, invoices, and ledgers, to identify irregularities or patterns that indicate wrongful activities. Forensic accountants utilize specialized skills to collect and evaluate evidence that can be presented in legal proceedings, ensuring a thorough understanding of the financial mechanics involved. Employing various techniques, such as data analytics and interviews with personnel, enhances the investigation's effectiveness and promotes transparency within the fiscal operations of the organization. The ultimate goal of this process is to ensure accountability, safeguard assets, and uphold ethical standards in financial reporting and compliance.

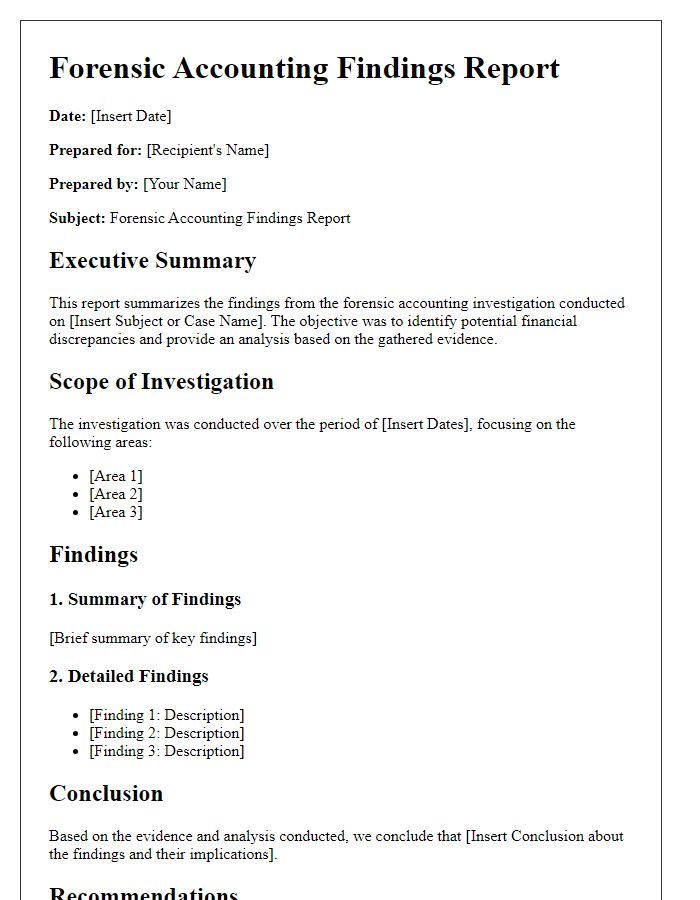

Scope of Investigation

The forensic accounting investigation scope encompasses the examination of financial records, transactions, and accounting practices to uncover discrepancies or fraudulent activities. Key elements include analyzing general ledgers, bank statements, and expense reports for irregularities. Specific focus is placed on high-risk areas such as asset misappropriation, revenue recognition issues, and financial statement fraud. Detailed examination of financial statements (balance sheet, income statement, cash flow statement) is essential to identify anomalies. The investigation may require interviews with personnel in locations (offices, warehouses) to gather insights. Use of forensic tools and techniques, such as data analytics and forensic software, will enhance the accuracy of findings. A comprehensive report will outline the methodologies employed, findings of significant relevance, and recommendations to mitigate future risks.

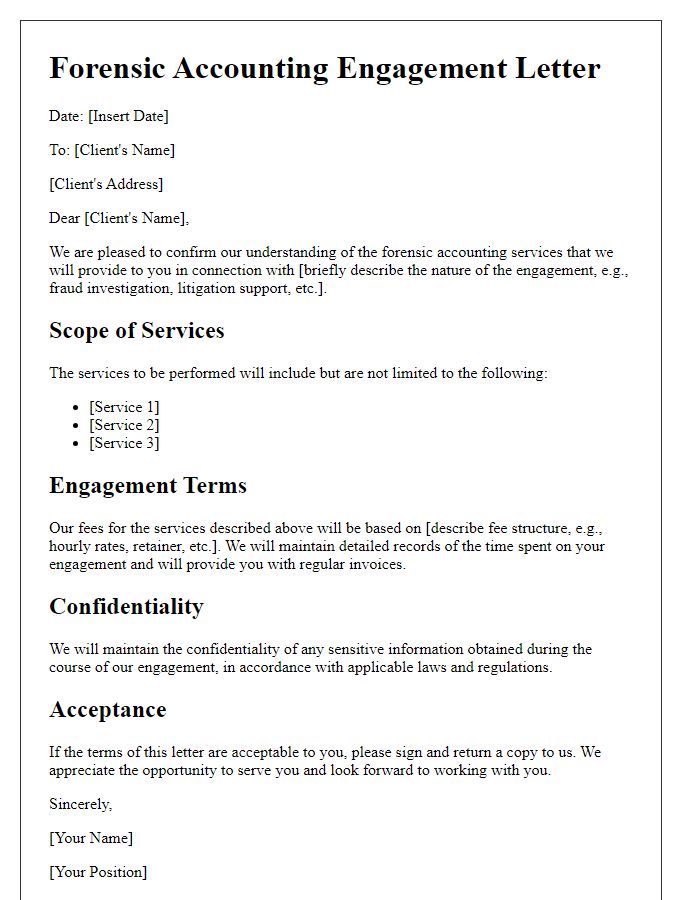

Confidentiality and Discretion

In forensic accounting investigations, confidentiality and discretion are paramount for protecting sensitive financial information. Financial transactions under scrutiny, such as those involving good faith estimates or fraudulent activities, require careful handling by forensic accountants to maintain the integrity of the inquiry. Detailed records of suspicious activities are identified and examined meticulously to ensure legal compliance during the analysis. Stakeholders, including business executives or legal representatives, must understand the importance of restricting access to findings, with measures taken to prevent unauthorized disclosures. This ensures that the investigative process remains non-intrusive and that all parties involved maintain trust while safeguarding their reputations and financial standing.

Roles and Responsibilities

In a forensic accounting investigation, key roles and responsibilities include the forensic accountant's analysis of financial documents, such as bank statements and invoices, to identify fraudulent activities or discrepancies. These professionals utilize specialized skills in auditing and investigative techniques to uncover hidden assets or unreported income. Collaboration with legal experts, such as attorneys specializing in fraud cases, is essential for interpreting findings within the legal framework. The investigation often takes place in various locations, including corporate offices and courtrooms, where evidence is presented. Additionally, forensic accountants may be involved in creating detailed reports summarizing their findings, which will aid in litigation or settlement processes. Maintaining confidentiality throughout the investigation is crucial to protect sensitive information involved in the legal proceedings.

Contact Information

Forensic accounting investigations often require a detailed and organized approach to compiling contact information. Relevant details include names of the individuals involved, their roles such as the lead investigator or the subject of the investigation, and their affiliation with organizations, such as law firms or corporations like Deloitte. Email addresses must follow the corporate domain format, and phone numbers should include the area code. Addresses need to be complete with street numbers, names, city, state, and ZIP codes. Additionally, including pertinent dates related to the investigation, such as the date of the initial inquiry or significant events like asset seizures, enhances the comprehensiveness of the documentation. Each entry should be clearly labeled for easy reference and cross-referencing amongst various stakeholders.

Comments