Are you feeling a bit overwhelmed by the complexities of estate tax evaluation? You're not aloneânavigating the ins and outs of tax obligations can be quite a challenge for many individuals. Understanding the intricacies of estate taxes is crucial for effective financial planning and ensuring that your loved ones are taken care of. So, let's delve deeper into the process and uncover some essential tips to simplify your estate tax evaluation journeyâread on for more insights!

Accurate Property Valuation

Accurate property valuation is crucial for estate tax evaluation, often mandated by tax authorities such as the Internal Revenue Service (IRS) in the United States. This process involves determining the fair market value (FMV) of real estate properties, which may include residential homes, commercial buildings, and vacant land. Professional appraisals (typically conducted by certified appraisers) are essential, as they consider various factors such as recent sales of comparable properties, market trends in specific locations, and property condition. In 2021, the average appraisal cost ranged from $300 to $500, depending on property complexity. Accurate valuations help ensure compliance with federal estate tax requirements, which in 2022 had a filing threshold of $12.06 million, avoiding potential penalties and ensuring equitable distribution among heirs.

Comprehensive Asset Inventory

A comprehensive asset inventory is crucial in the estate tax evaluation process, providing a detailed overview of valuable possessions and financial resources. This inventory should include properties (real estate holdings such as residential homes or commercial buildings located in metropolitan areas), investments (stocks, bonds, mutual funds with respective market values), personal property (jewelry, art collections, vehicles including their appraised values), and business interests (ownership stakes in privately held companies). Accurate asset valuation must consider current market conditions, legal documents, and any outstanding debts or mortgages (financial obligations tied to properties). Properly categorizing and documenting each asset not only streamlines the estate settlement process but also ensures compliance with federal regulations, like the IRS estate tax regulations, up to $12.92 million in exemptions according to 2023 limits.

Valid Legal Documentation

Valid legal documentation plays a crucial role in estate tax evaluation processes, ensuring compliance with Internal Revenue Service (IRS) regulations. Essential documents include the decedent's Last Will and Testament, which outlines the distribution of assets and appoints executors within specific jurisdictions like California or New York. A comprehensive estate inventory, detailing all assets such as real estate properties appraised at fair market values or investment accounts, is necessary to accurately calculate the gross estate. Additionally, estate tax returns (IRS Form 706) must be filed within nine months of the decedent's passing, requiring supporting documentation of debts and liabilities to ascertain net worth. Gathering beneficiary information, such as Social Security numbers and legal names, is vital for tax allocation. Properly organized and validated legal documentation facilitates a smoother evaluation, mitigating potential disputes among heirs.

Applicable Tax Deductions

In estate tax evaluation, applicable tax deductions significantly influence the overall taxable value of an estate, ensuring compliance with Internal Revenue Service (IRS) regulations. Common deductions include funeral expenses (up to a certain limit stipulated by IRS guidelines), debts owed by the decedent (such as mortgages and loans), and administrative expenses (including attorney fees, appraisal costs, and executor fees), which can total substantial amounts. Charitable contributions and state inheritance taxes paid also qualify as deductions, offering potential savings for beneficiaries. It's crucial to accurately document and substantiate each deduction during the estate tax filing process, as failure to do so may result in costly audits or penalties imposed by the IRS. Understanding these deductions can effectively minimize the estate's taxable value, thereby optimizing the financial legacy left to heirs.

Professional Appraisal Expert

Estate tax evaluations necessitate precise assessments, often performed by certified appraisal experts, such as those accredited by the American Society of Appraisers (ASA). These professionals utilize methods like the Sales Comparison Approach (SCA) to determine market values of valuable assets, including real estate located in areas like New York City or Los Angeles. They consider various factors: property condition, local market trends, comparable sale prices, and emotional nuances. Accurate appraisals influence estate tax liability and can significantly impact heirs' financial prospects. Compliance with IRS guidelines, requiring appraisals for estates valued over $11.7 million (as of 2021), further underscores the importance of professional evaluations in estate planning.

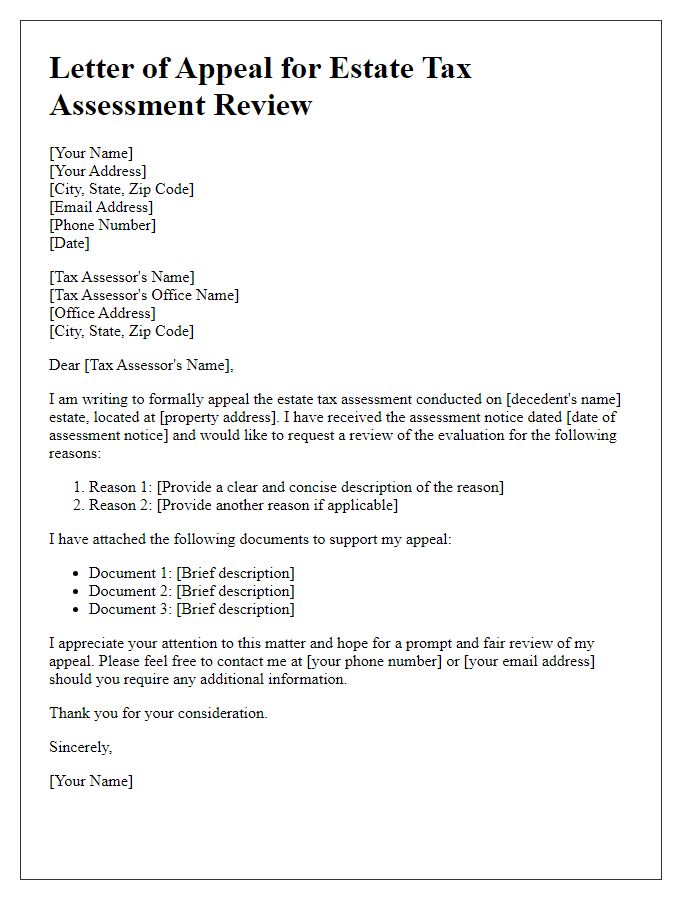

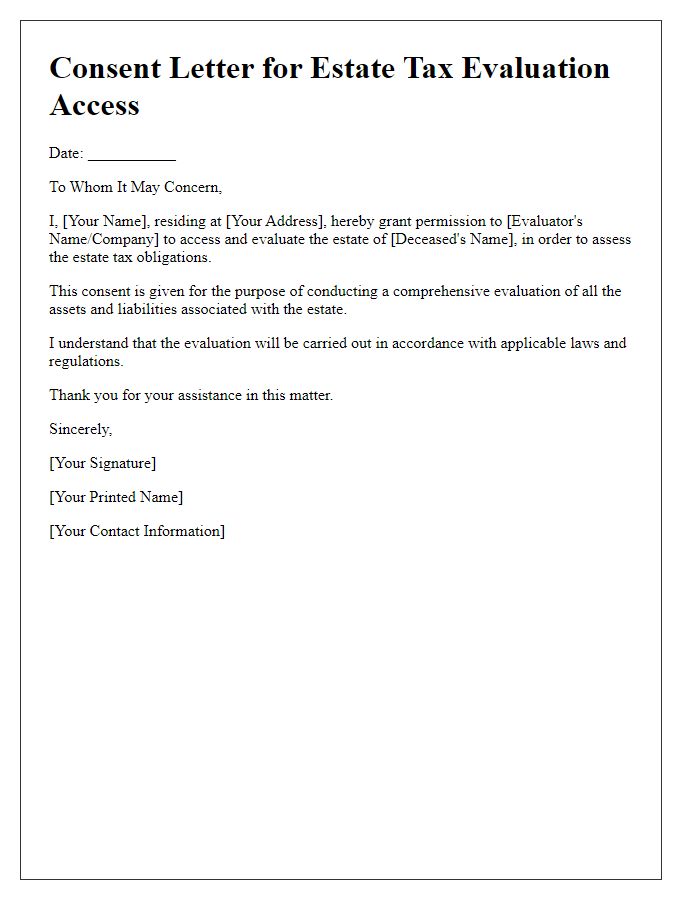

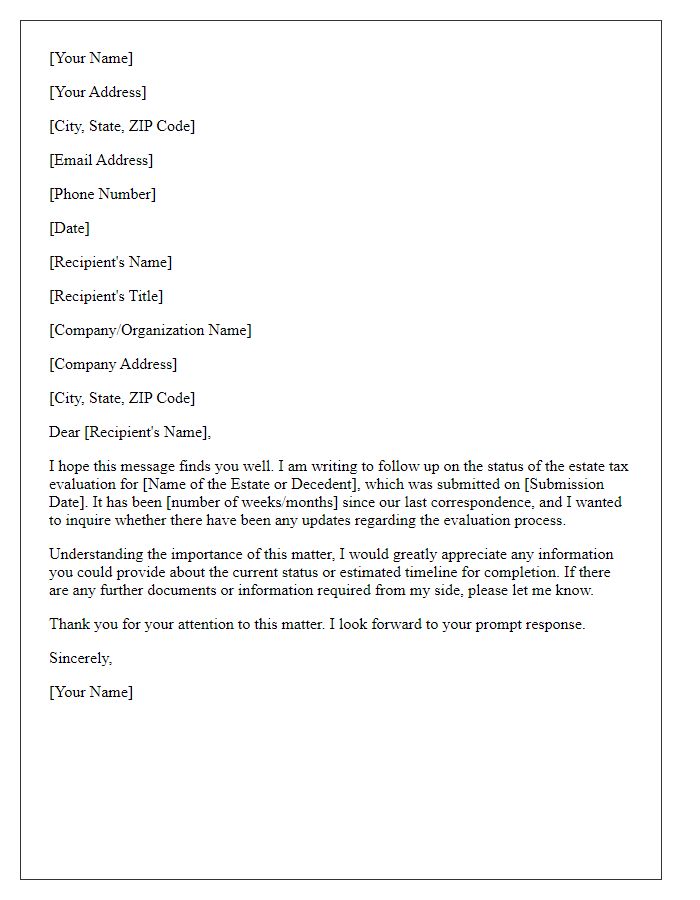

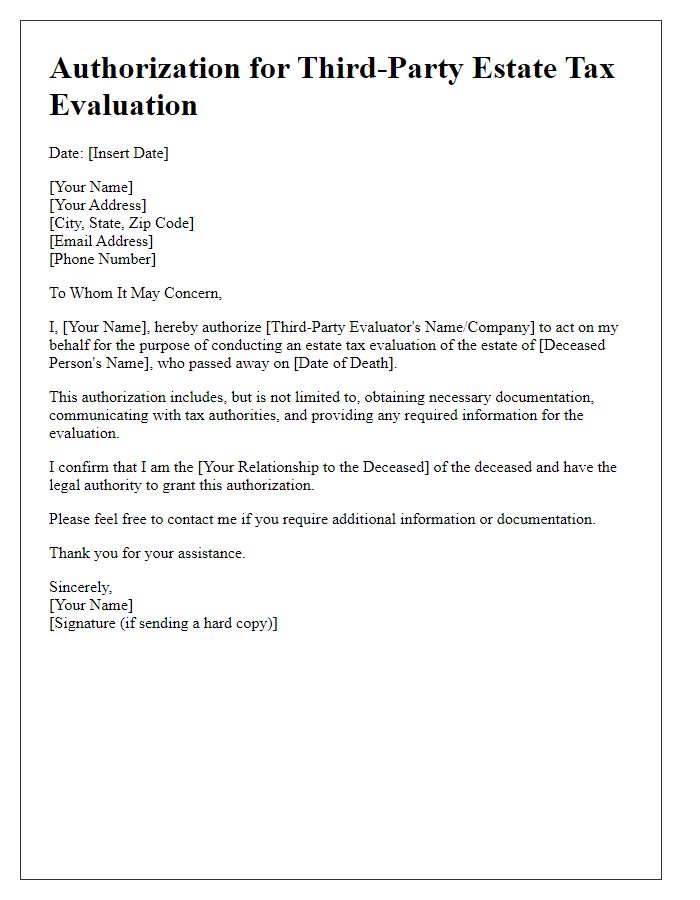

Letter Template For Estate Tax Evaluation Samples

Letter template of clarification request on estate tax evaluation criteria

Comments