Are you considering equity financing for your business but feeling overwhelmed by the terms and conditions? Understanding the ins and outs of equity financing can be a game changer for your entrepreneurial journey. In this article, we'll break down key concepts and provide clarity on how to navigate the complexities of investment agreements. So, grab a cup of coffee and join me as we explore the essential aspects of equity financing that every business owner should know!

Purpose of Financing

Equity financing provides capital for businesses through the sale of shares to investors. This method is essential for growing companies seeking funds to expand operations, develop new products, or enter new markets. Investors, in exchange for their capital, obtain ownership interest, potentially influencing company decisions and benefiting from future profits. Funding usage can include technology upgrades, employee hiring, or marketing campaigns to enhance brand visibility. Equity financing may also support acquisitions, allowing businesses to integrate complementary assets or services, ultimately driving revenue growth and shareholder value. Understanding these aspects ensures informed investor relations and strategic planning.

Investment Amount

The investment amount in equity financing represents the total capital that an investor commits to a startup or company in exchange for ownership equity. For instance, a venture capital firm may invest $1 million in a technology startup, acquiring a 20% equity stake, which implies a post-money valuation of $5 million for the company. Understanding the investment amount is crucial for both parties, as it can significantly influence the company's financial structure and future fundraising efforts. In private equity deals, the investment amount may also reflect conditions precedent, such as achieving certain milestones or performance indicators, which ensures that the company meets agreed-upon objectives before the full capital is disbursed.

Valuation and Equity Percentage

Equity financing involves crucial terms such as valuation and equity percentage. Valuation refers to the estimated worth of a company, often determined during funding rounds, with methods like Comparable Company Analysis or Discounted Cash Flow. For instance, a startup may have a pre-money valuation of $5 million before a funding round, increasing to $7 million post-investment. The equity percentage represents the ownership stake offered to investors in exchange for capital. If an investor injects $1 million into a company valued at $5 million pre-money, they would receive 20% equity (calculated as $1 million divided by the new post-money valuation of $6 million). Understanding these terms helps both entrepreneurs and investors align expectations and make informed financial decisions.

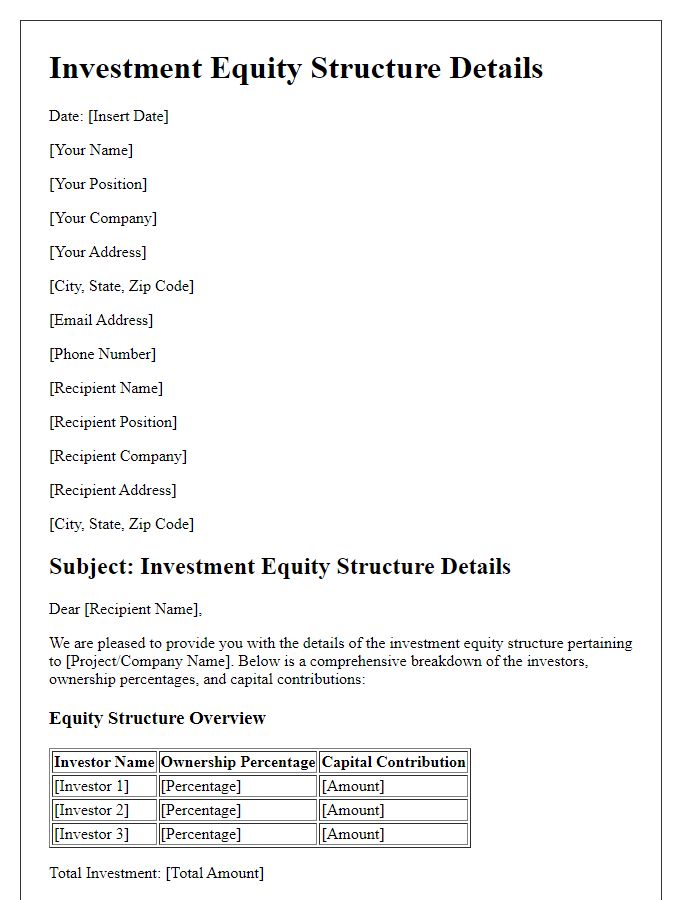

Use of Funds

In equity financing, the allocation of funds signifies the strategic financial management that drives company growth. Investments (typically ranging from $100,000 to several million dollars) are often earmarked for various purposes. Research and Development (R&D) often takes precedence, particularly in technology firms, accounting for up to 30% of funding. Marketing efforts may consume approximately 25% as companies strive to increase brand visibility in competitive markets, like Silicon Valley. Operational expenses (around 20%) are another critical factor, ensuring day-to-day business functions are maintained. Additionally, hiring skilled talent may represent about 15% of the budget, enhancing the organization's capacity for innovation. Finally, a portion of the funds, roughly 10%, may be retained for contingencies, safeguarding against unforeseen challenges that could affect business stability.

Exit Strategy

An effective exit strategy is crucial for investors in equity financing, typically outlining the method by which they will realize a return on their investment. Common exit strategies include initial public offerings (IPOs), allowing investors to sell shares publicly, mergers, which may provide immediate liquidity through acquisition by a larger firm, and buybacks, where the company repurchases shares at an agreed valuation. Key factors influencing the exit strategy include market conditions, company performance, and investor timelines. Investors typically seek to understand potential estimated timelines for exit, expected return on investment percentages, and associated risks in the chosen approach, ensuring alignment with financial objectives. Well-defined exit strategies can significantly enhance investor confidence and commitment during the financing process, fostering a conducive environment for capital raising efforts.

Comments