Are you feeling the pressure of rising costs and cash flow challenges in your business? Renegotiating your vendor net terms can be a powerful strategy to gain the financial flexibility you need. By adjusting payment terms, you can create a win-win situation that helps both your business and your vendors. Join us as we explore effective techniques and tips for successful renegotiation that could transform your vendor relationships and improve your bottom line.

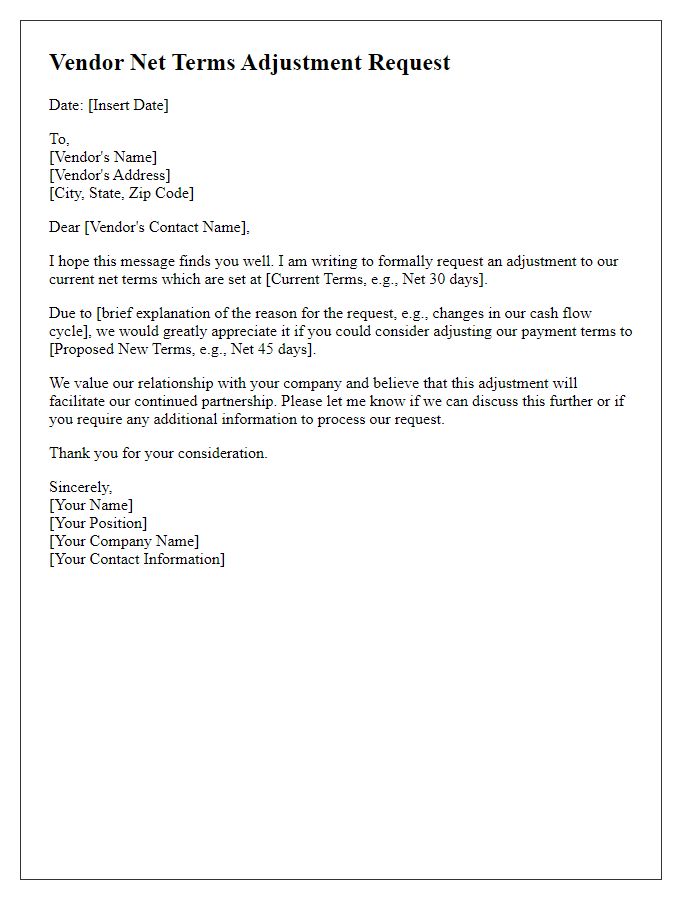

Clear subject line

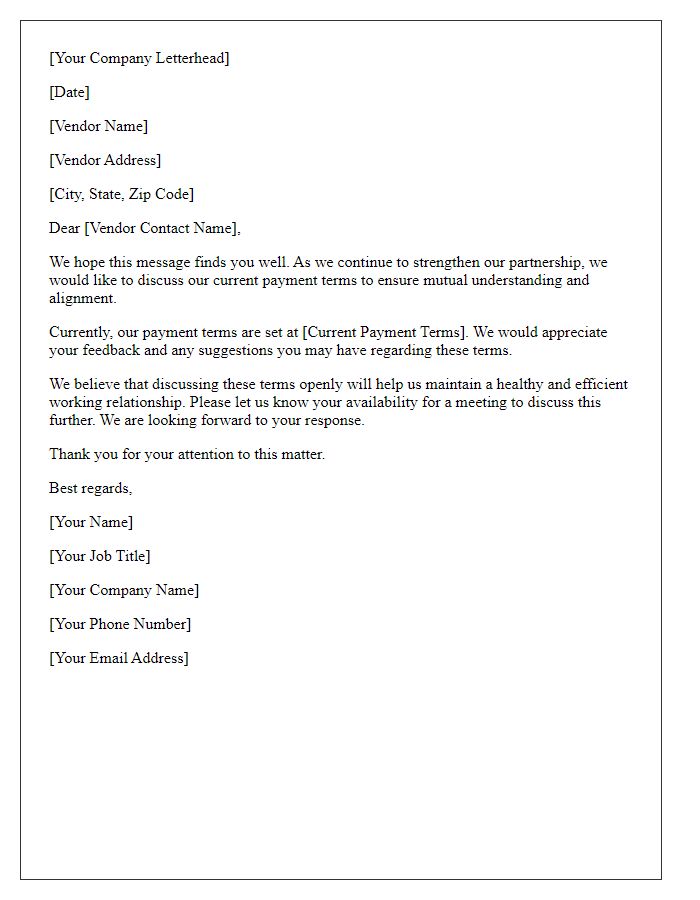

Negotiating Vendor Net Terms for Improved Cash Flow Management In many business contexts, vendor net terms refer to the payment arrangements established between a company and its suppliers, typically specifying the time frame in which invoices must be settled, such as Net 30 or Net 60 days. Renegotiating these terms can lead to increased operational flexibility. Companies often seek to extend payment periods from 30 to 60 days, providing enhanced liquidity. Factors driving this negotiation might include seasonal sales fluctuations, supply chain constraints, or strategic financial planning to optimize cash flow. Effective communication with vendors, highlighting mutual benefits and maintaining strong relationships, plays a crucial role in achieving favorable net terms.

Professional greeting

Vendor net terms renegotiation focuses on altering payment conditions to improve cash flow for businesses. Organizations often seek extended net terms (such as 60 or 90 days) instead of standard 30-day terms. Key factors include the vendor's willingness to accommodate requests, the volume of purchases, and the reliability of on-time payments. Effective communication is essential during these discussions, emphasizing mutual benefits for both parties. Understanding industry standards and having clear justifications for the desired changes strengthens negotiation positions. Building strong vendor relationships fosters collaboration and encourages favorable outcomes.

Current terms overview

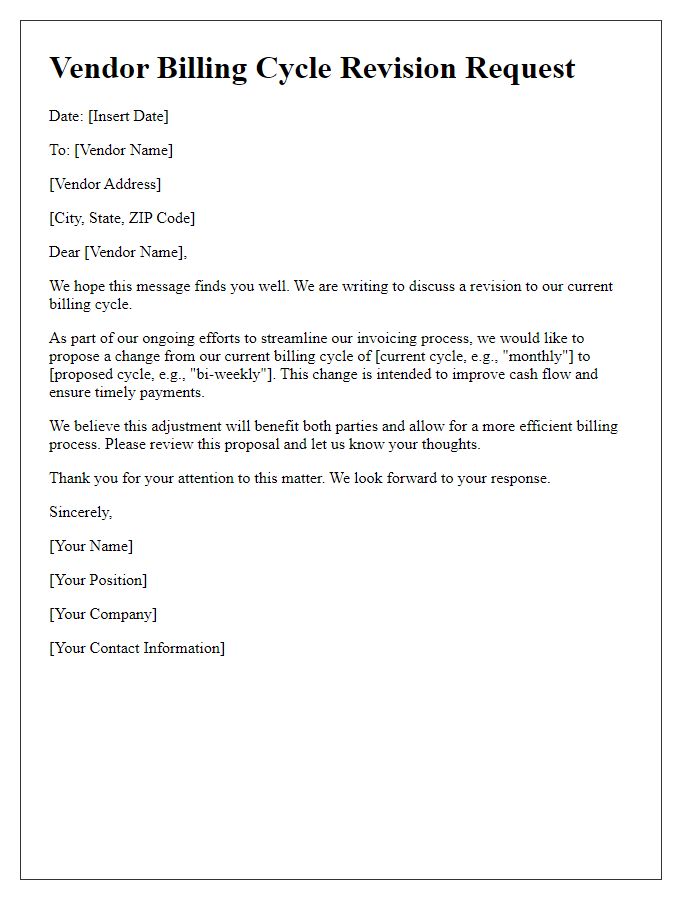

Current vendor net terms often dictate payment conditions, including the time frame for settling invoices and the discounts applied for early payments. Standard net terms like Net 30 or Net 60 specify that payments are due within 30 or 60 days respectively from the invoice date. These terms influence cash flow management, especially for businesses operating in dynamic sectors such as retail or manufacturing, where cash flow cycles can significantly impact operational efficiency. Analyzing current terms includes assessing recent payment patterns, vendor performance, and market fluctuations, particularly when negotiating changes to maintain competitiveness and nurture vendor relationships. Adjustments may lead to more favorable conditions, encouraging early payment discounts or extended payment periods, thereby improving liquidity for ongoing projects.

Reason for renegotiation

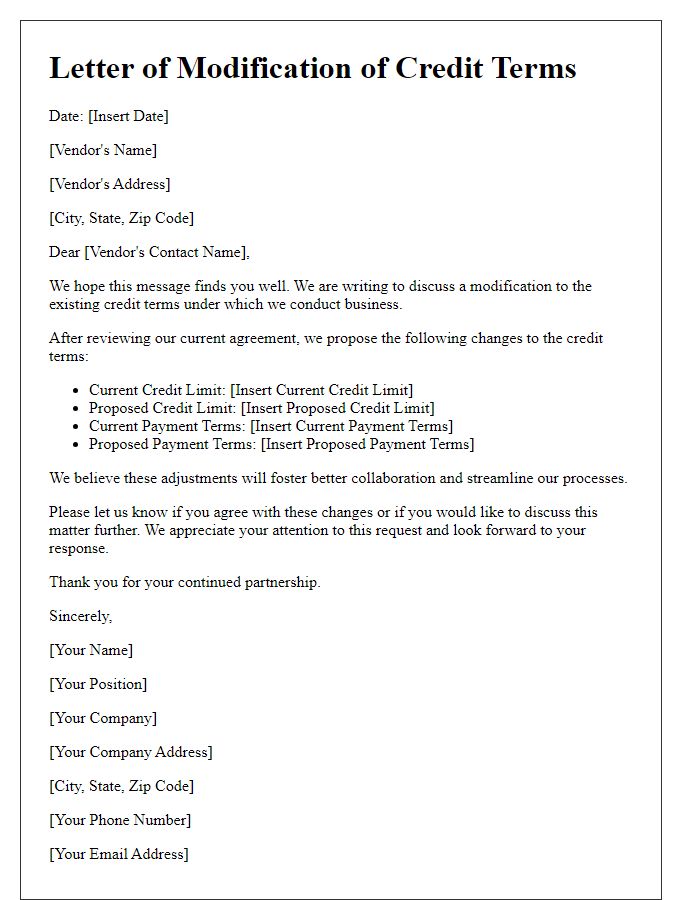

Renegotiation of vendor net terms often arises from various factors impacting cash flow, market conditions, or strategic business goals. Companies may seek longer payment terms (extending from the customary 30 days to 60 or 90 days) to alleviate financial pressure, especially during periods of economic downturn or unexpected decreases in revenue. Additionally, changes in industry norms, such as competitors adopting more favorable payment structures, can drive the need for renegotiation. Increased operational costs or fluctuations in supplier pricing may also necessitate adjustments in payment terms to maintain liquidity and ensure continued business collaboration. Businesses aim to foster strong relationships with vendors while optimizing their own financial stability through these changes.

Proposed new terms

Negotiating new vendor net terms can optimize cash flow and improve business relationships. Key factors include extending payment amounts from the standard 30 days to 60 days, allowing more flexibility for budget allocation. Adjusting early payment discounts from 2% within 10 days to 3% may encourage prompt payments while benefiting both parties. Introducing bulk purchase terms for orders exceeding $10,000 can incentivize larger transactions. Additionally, establishing a quarterly review of terms ensures alignment with market conditions and strengthens collaborative efforts. Clear communication of these proposed changes enhances understanding and fosters a productive partnership.

Comments