Are you considering partnering with a new vendor but unsure how to kickstart the credit application process? Understanding the essentials of a vendor credit application can streamline your journey and pave the way for a successful business relationship. It's not just about filling out forms; it's about establishing trust and ensuring mutual benefit for both parties. Join us as we delve deeper into the intricacies of vendor credit applications and uncover tips to make the process seamless and effective!

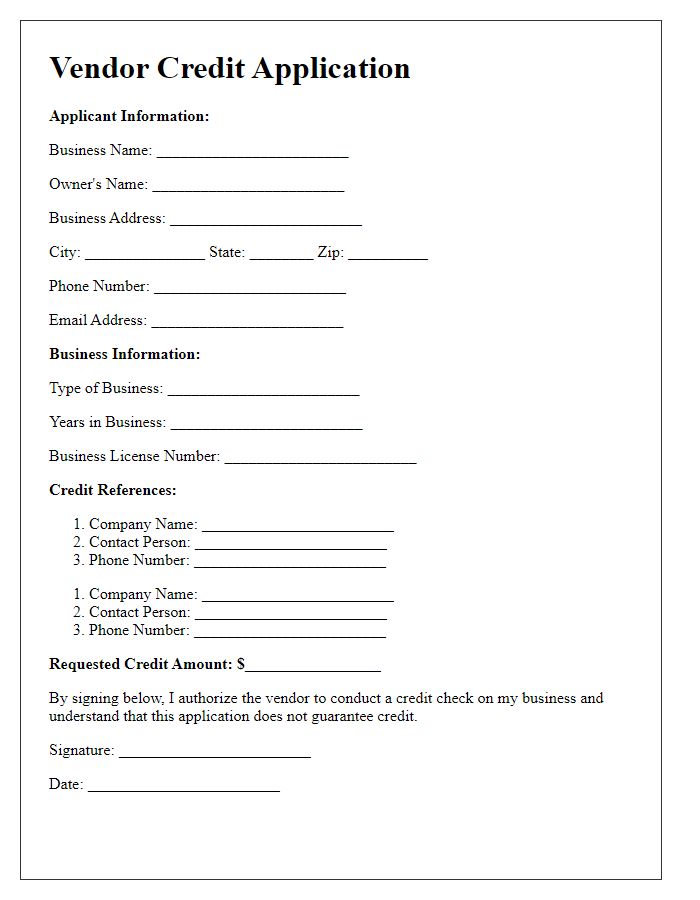

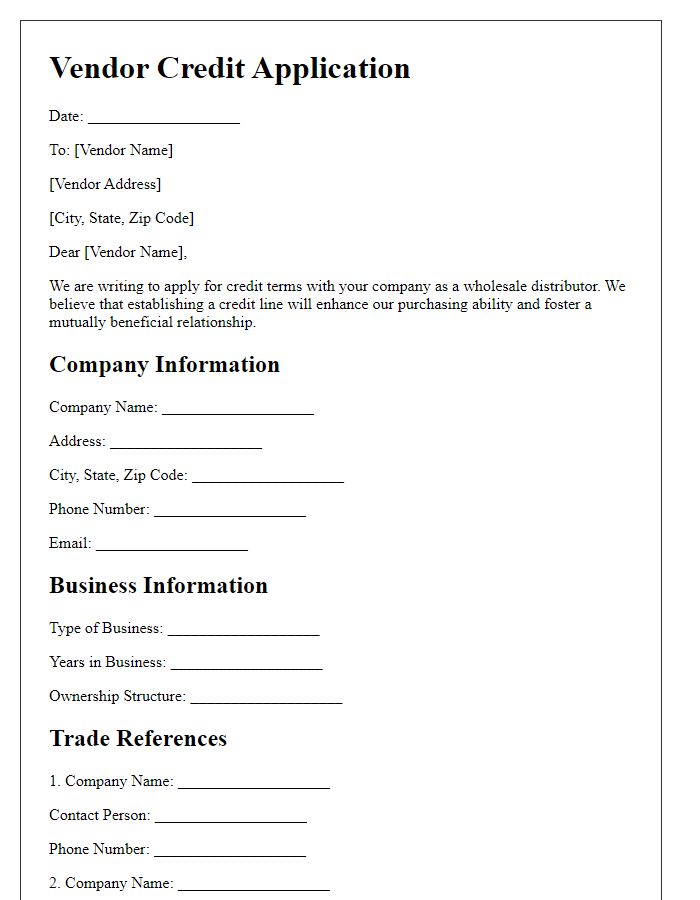

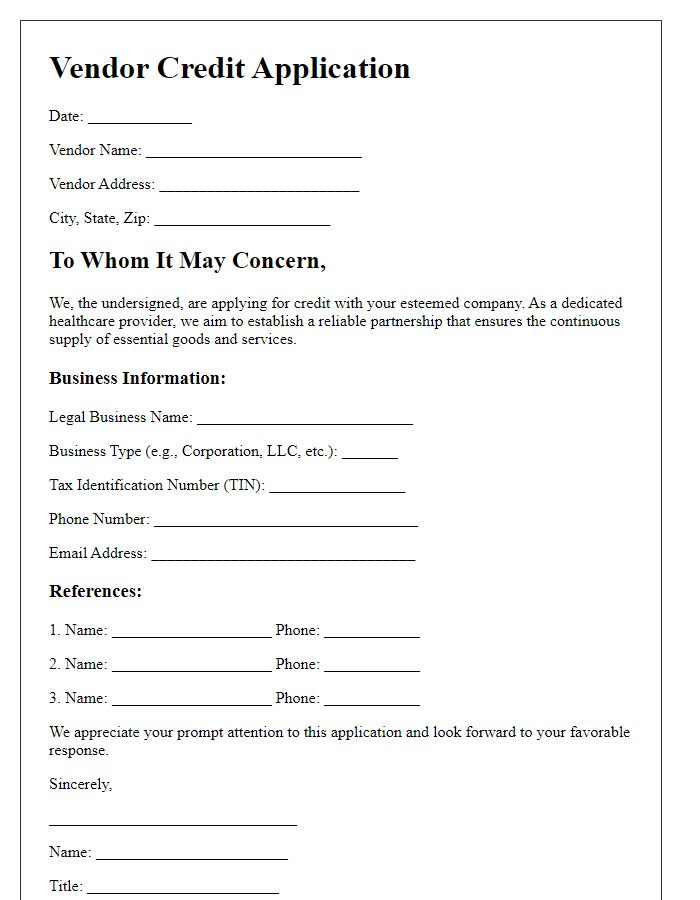

Business Information

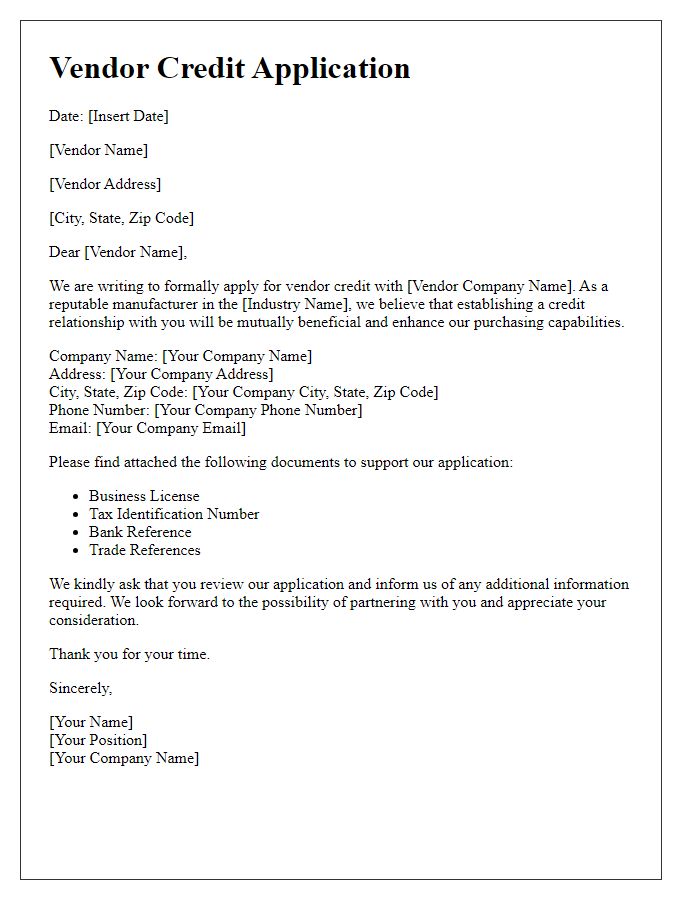

A vendor credit application typically requires detailed business information. This includes the legal business name, a unique identification number such as a Tax Identification Number (TIN) or Employer Identification Number (EIN), address, and contact details. The application also requests the business formation type, such as LLC (Limited Liability Company), Corporation, or Sole Proprietorship, alongside the state's registration, like California or Texas. Financial details may encompass bank references, annual revenue, and credit references from suppliers. An essential aspect is the authorized signatory section, where a designated individual, often a business owner or financial officer, provides signatures verifying the accuracy of the information submitted.

Credit Terms Requested

Vendor credit applications often necessitate a detailed outline of requested credit terms for clarity and efficient processing. Elements like payment duration, interest rates, and credit limits require specific attention. Typical terms may include Net 30, which allows 30 days for payment without interest, or 2/10 Net 30, offering a 2% discount if paid within 10 days. Credit limits could range from $5,000 to $50,000 depending on the vendor's assessment of creditworthiness, which may be influenced by the applicant's financial history and account standing with other suppliers. Documentation demonstrating income statements, bank details, and references from existing vendors often accompany these applications to substantiate the credibility of the credit request.

Financial Details

A vendor credit application requires detailed financial information to assess creditworthiness. Key figures include annual revenue, which indicates the scale of business operations, typically ranging from thousands to millions of dollars. Bank references providing information about account longevity and transaction history can showcase financial stability. A list of outstanding debts, including amounts and due dates, offers insight into existing financial obligations. The current ratio, representing current assets divided by current liabilities, is critical for evaluating short-term financial health, ideally above 1.5. Profit margins, usually expressed as a percentage of sales, reflect operational efficiency, with higher margins indicating better profitability. Finally, balance sheet details, encompassing asset ownership and equity stakes, contribute to an overall understanding of the company's financial standing in the industry.

Trade References

Vendor credit applications often require prospective buyers to provide trade references, an essential component for assessing creditworthiness. Trade references usually include contact information for previous suppliers, typically three to five businesses, where the applicant has established a credit relationship, outlining payment history and terms. Referenced companies should ideally operate within the same industry to validate trustworthiness. Accurate details such as full business name, phone number, address, and contact person ensure a streamlined communication process for the vendor evaluating the credit application. Positive trade references indicate reliability and financial stability, influencing the decision-making process in granting credit terms.

Authorization and Signatures

The vendor credit application process requires careful attention to detail, particularly in the Authorization and Signatures section. This section serves as a formal acknowledgment from the applicant, such as a business entity or individual, typically including key beneficiaries like the owner or financial officer. The signature represents a binding commitment to the terms outlined in the application, ensuring the vendor (a business entity supplying goods or services) verifies the accuracy of the information provided. Important details such as the date of signing and the applicant's printed name may accompany the signature, bolstering its legitimacy. Furthermore, inclusion of official titles like "CEO" or "Finance Manager" can clarify the authority level of the signatories, thereby influencing the vendor's decision-making process when evaluating creditworthiness.

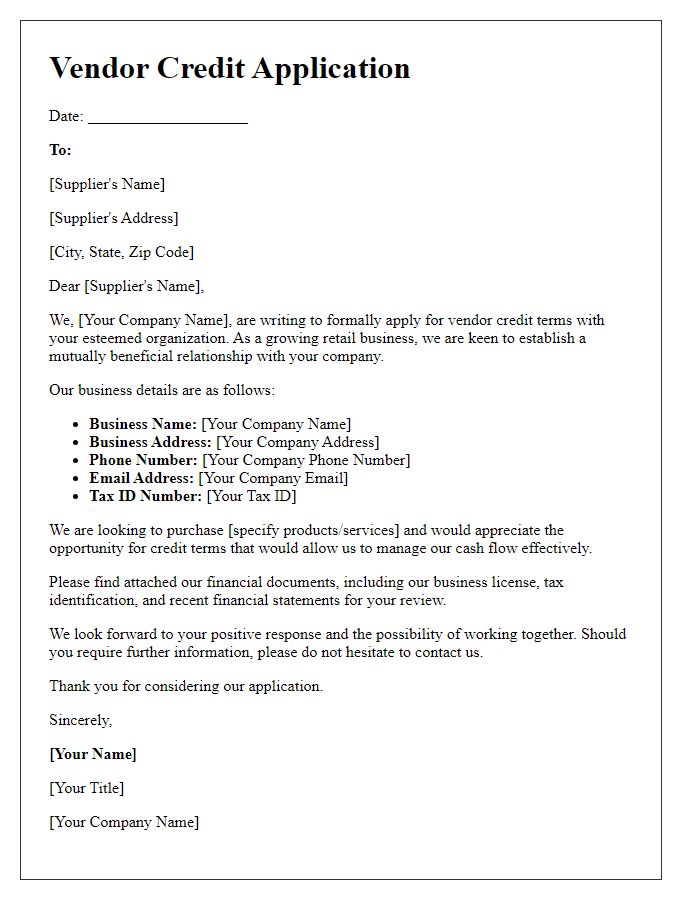

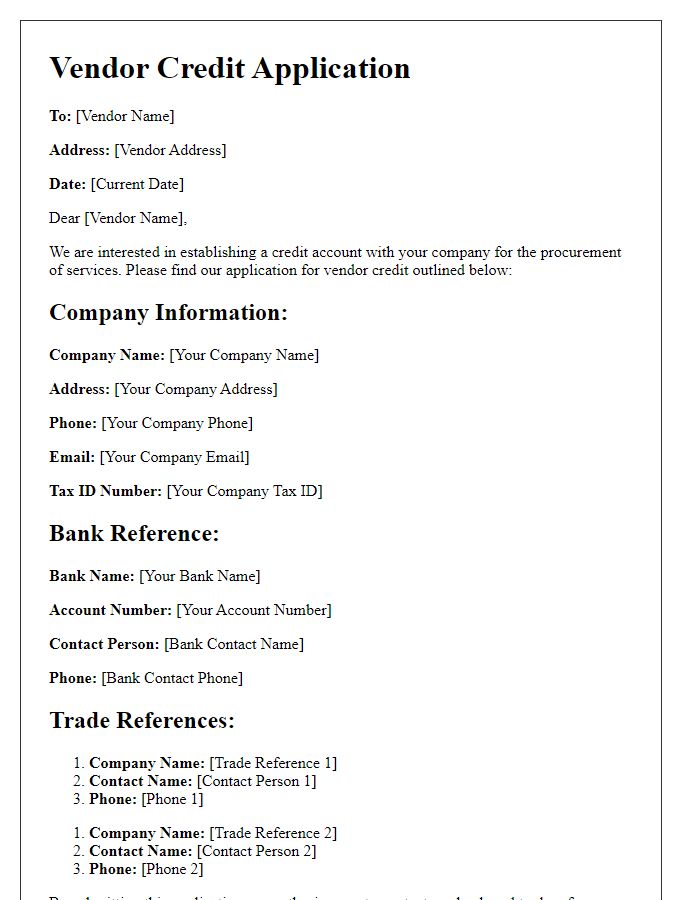

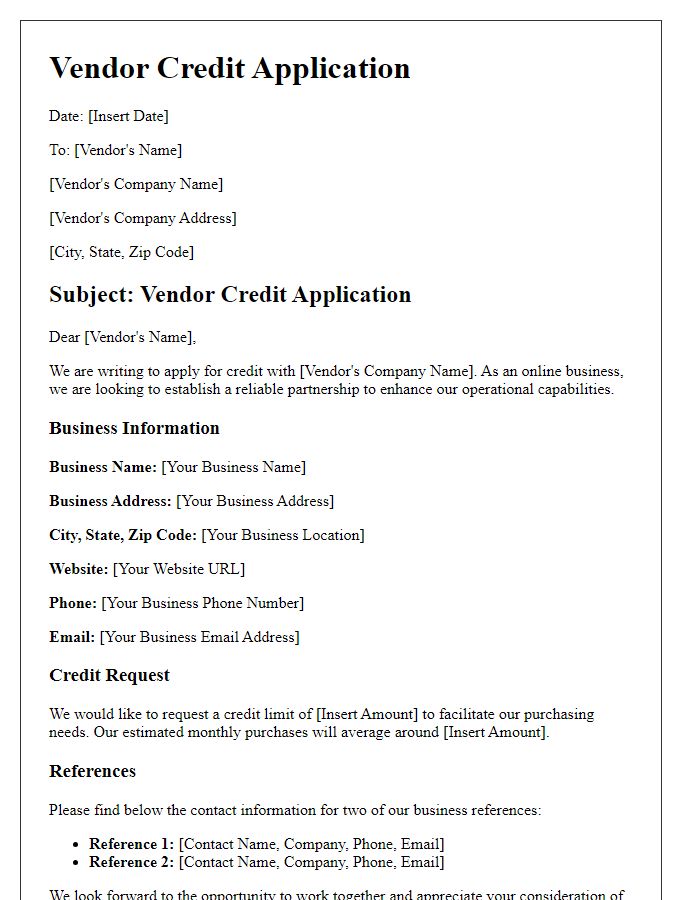

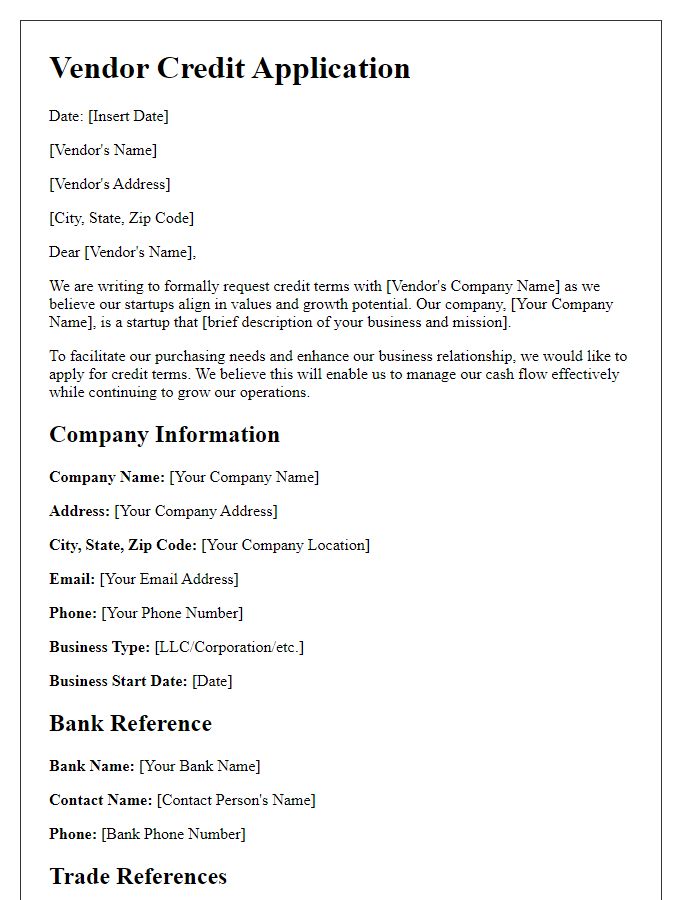

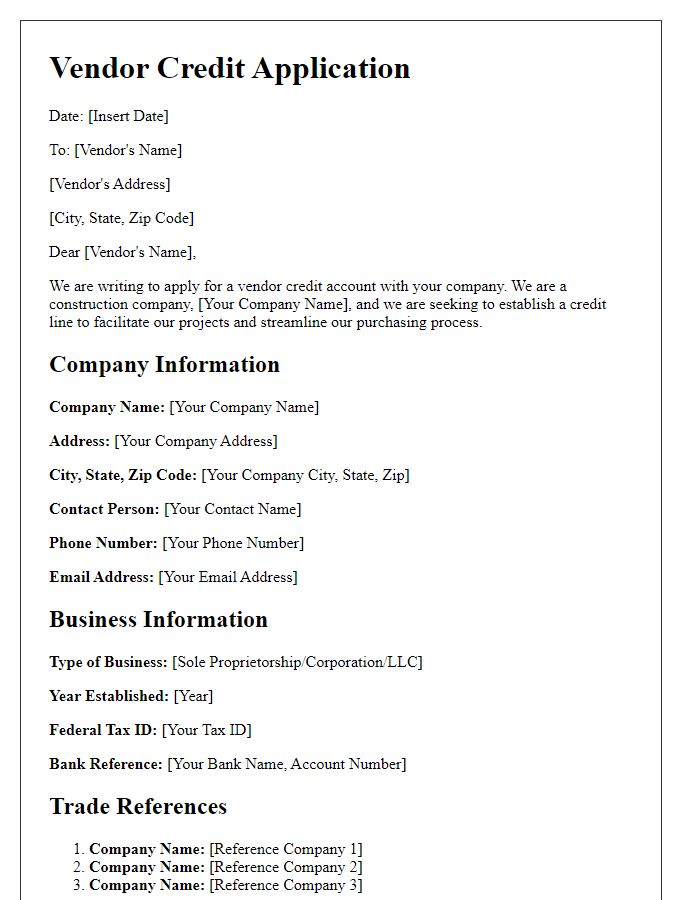

Letter Template For Vendor Credit Application Samples

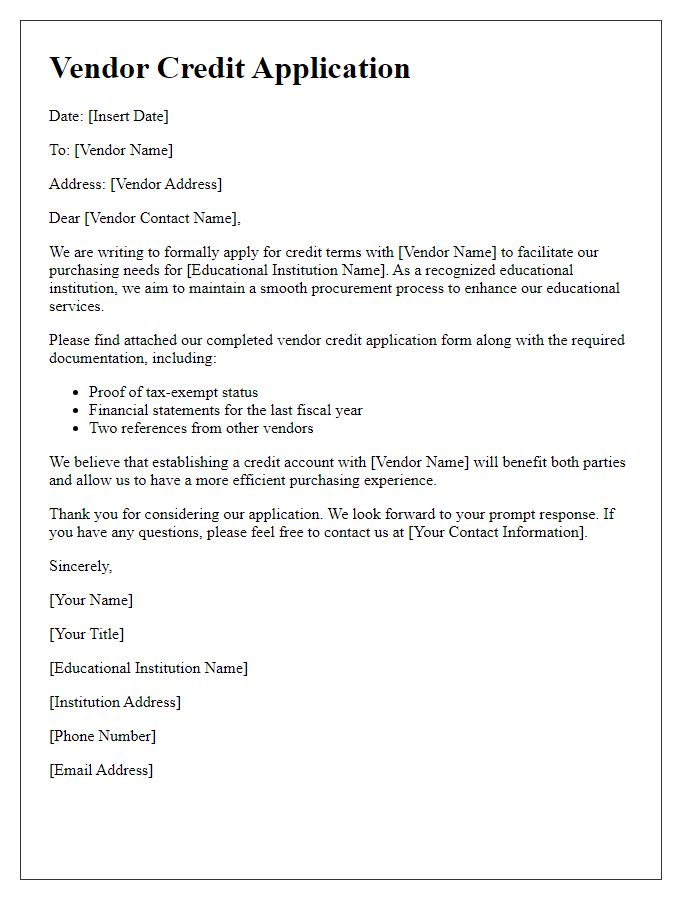

Letter template of vendor credit application for educational institutions

Comments