Are you looking to transfer your prepaid account balance but aren't sure how to get started? It can be a bit confusing navigating the necessary steps and paperwork, but fear notâthis guide will clarify everything for you! We'll provide you with a handy letter template that simplifies the process and ensures your balance transfer is smooth. So, stick around as we dive into the details and help you through this potentially tricky task!

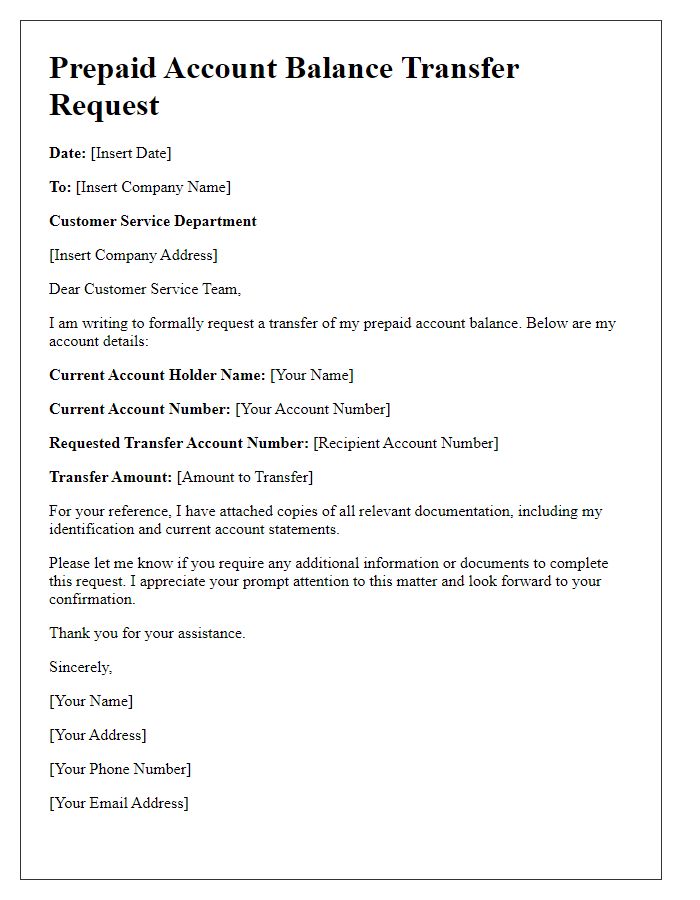

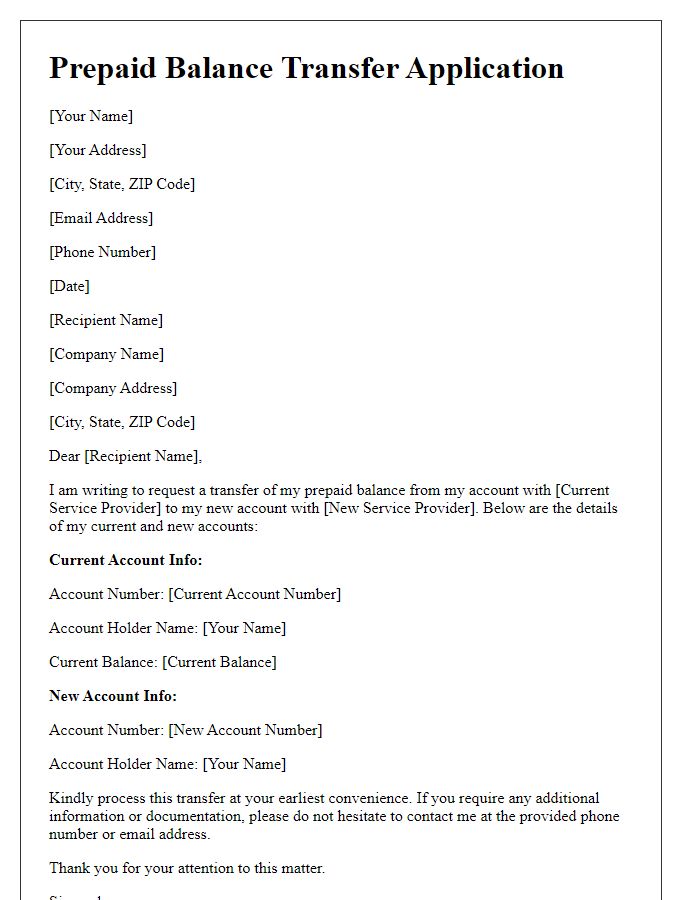

Account Holder Information

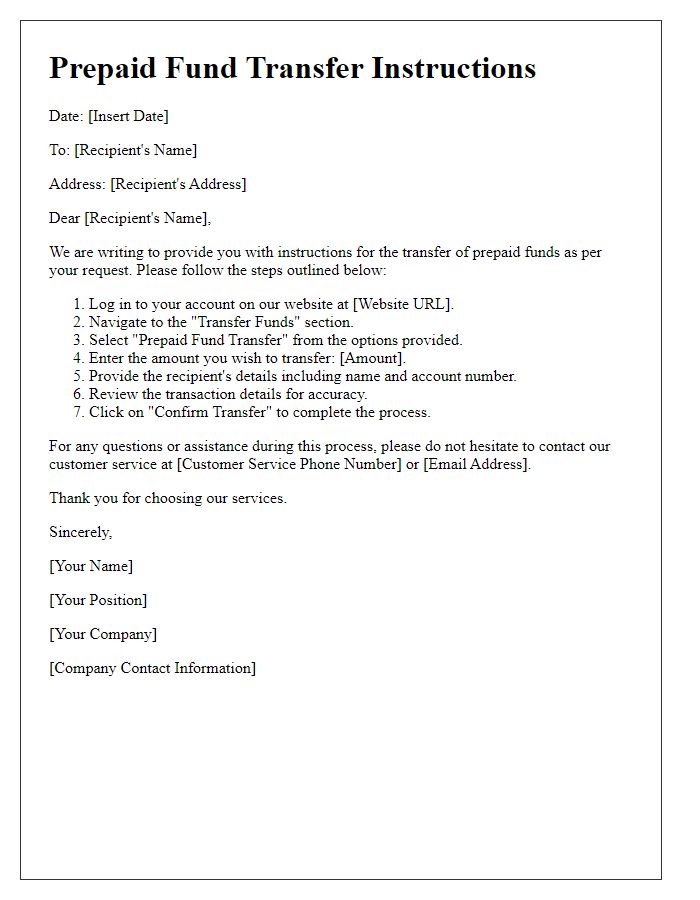

The prepaid account balance transfer process is crucial for maintaining financial flexibility and accessibility. Account holder information typically includes vital details such as a unique account number, name associated with the account (for verification purposes), contact information (including phone number and email), and the balance amount available for transfer. In transactions involving telecom companies or online payment platforms, security protocols are essential to protect user data. Transferring balances can occur through various channels including mobile apps, websites, or direct customer service interactions, ensuring that users can manage funds conveniently. For effective transfers, documentation such as identification may be required to comply with regulatory standards set forth by financial authorities.

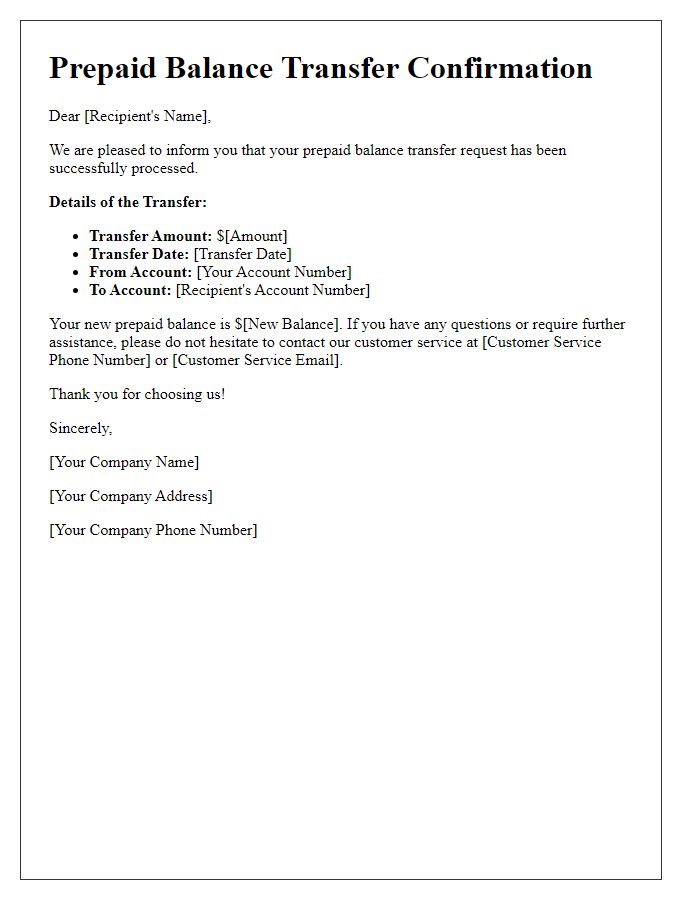

Account Details

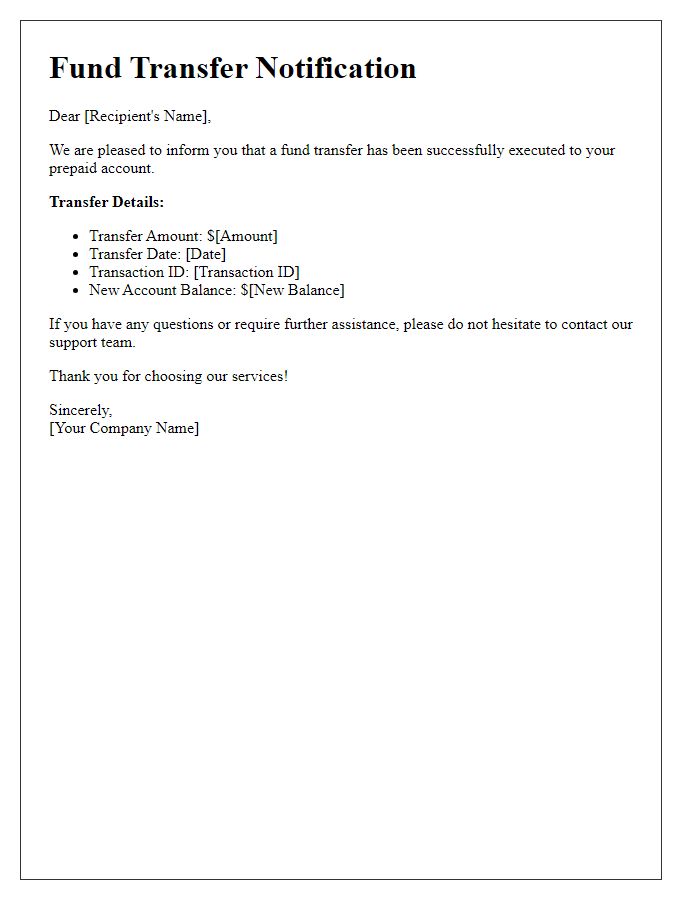

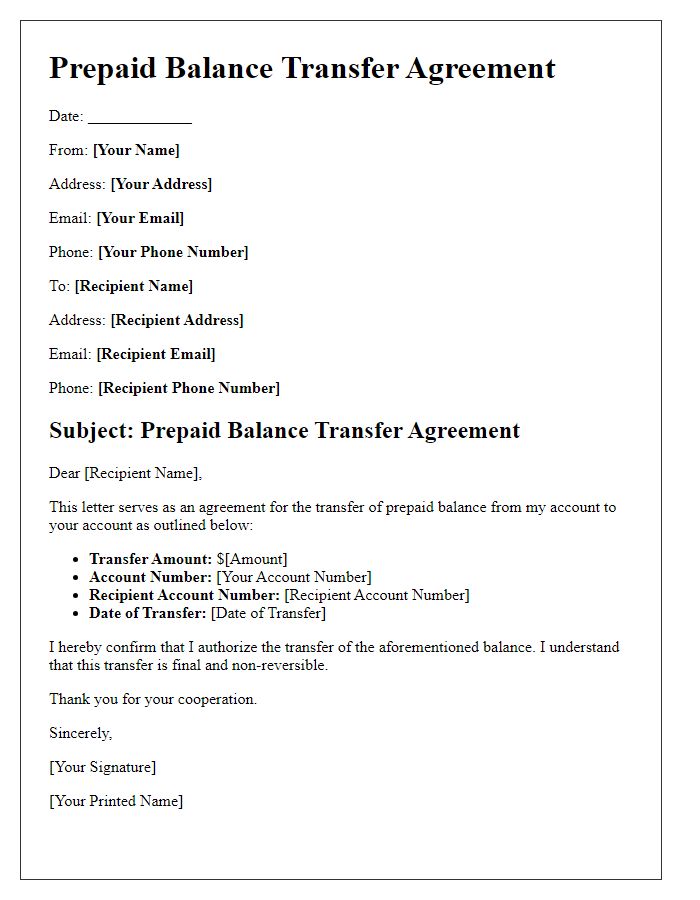

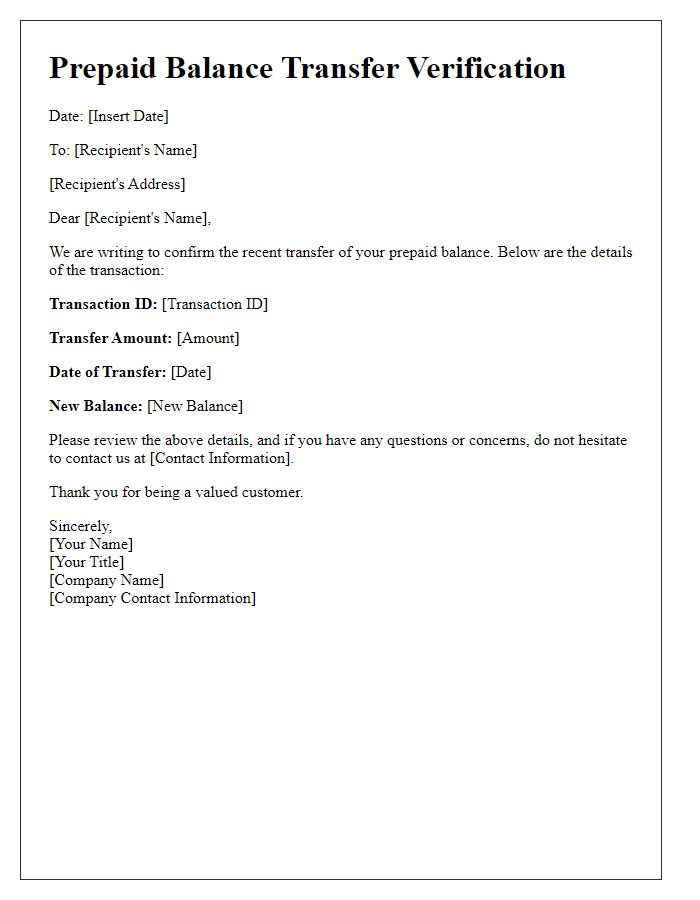

A prepaid account balance transfer involves the movement of funds from one prepaid account to another, typically requiring details such as the account number, account holder name, and balance amount. For instance, a user may wish to transfer $50 from a PayPal prepaid account to a Vanilla Reload prepaid card. The process, usually scheduled through the payment platform's interface, can take anywhere from minutes to a few hours based on both accounts' verification statuses. Additionally, transaction fees may apply, impacting the total amount received in the target account. Each financial institution may have specific guidelines regarding limits on transfer amounts or frequency, crucial for users to understand before initiating the transaction.

Transfer Amount

Transferring funds from a prepaid account allows users to manage their finances effectively. A prepaid account, often linked to financial services like Visa or Mastercard, can have balances ranging from $10 to several thousand dollars. Users typically initiate transfers through mobile applications or online platforms, selecting specific amounts such as $50 or $100. Transactions usually process within minutes, but some may take up to 3 business days, depending on the service provider. Security measures, including encryption and two-factor authentication, ensure that the transfer remains safe, safeguarding users' personal information against unauthorized access.

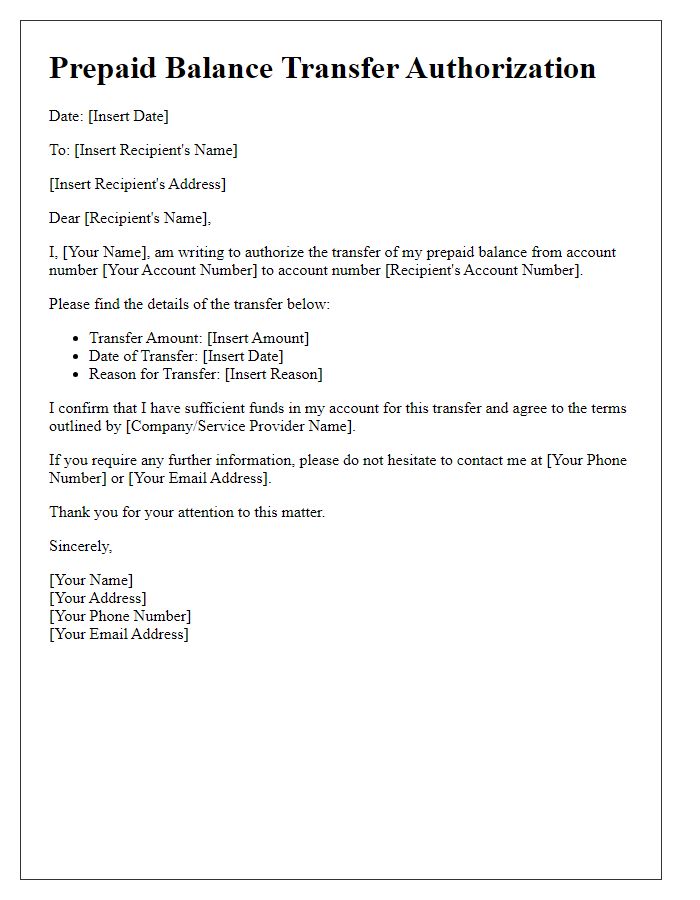

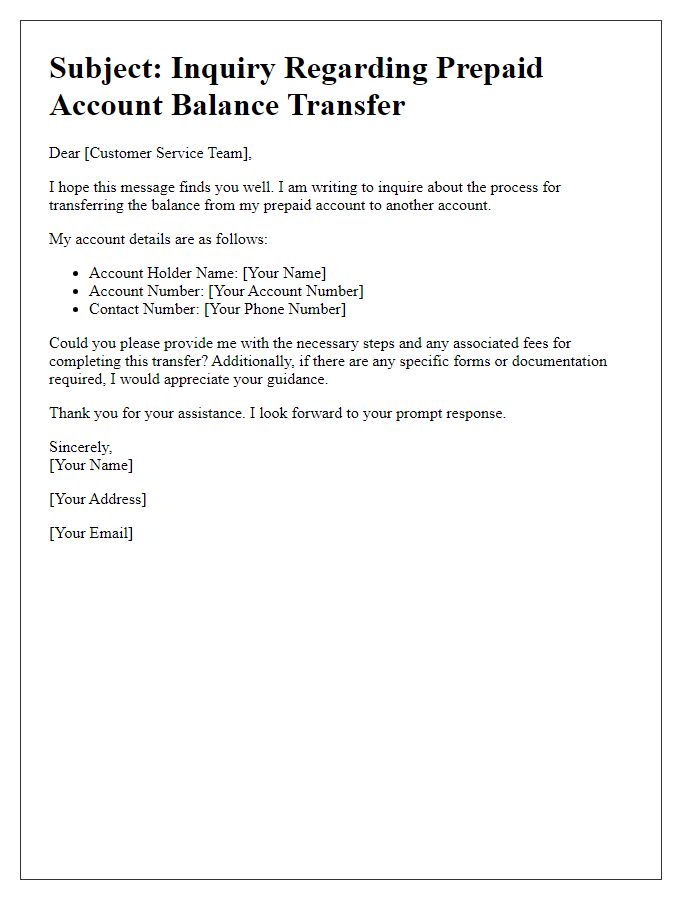

Recipient Account Information

Prepaid account balance transfers involve various steps and essential details for successful transactions. First, the recipient's account information must be accurate, including the account number (a unique identifier assigned to the prepaid account) and the name of the account holder (the individual or entity that owns the account). Additionally, transaction reference numbers (alphanumeric codes that provide a record of the transfer) should be noted for tracking purposes. Different providers like PayPal or Venmo may have varying requirements, but typically, details such as the amount to be transferred and the date of the transfer (which can affect availability of funds) are also key. Ensuring all information is secure and verified helps prevent errors or unauthorized transactions, especially considering the rise in digital financial fraud.

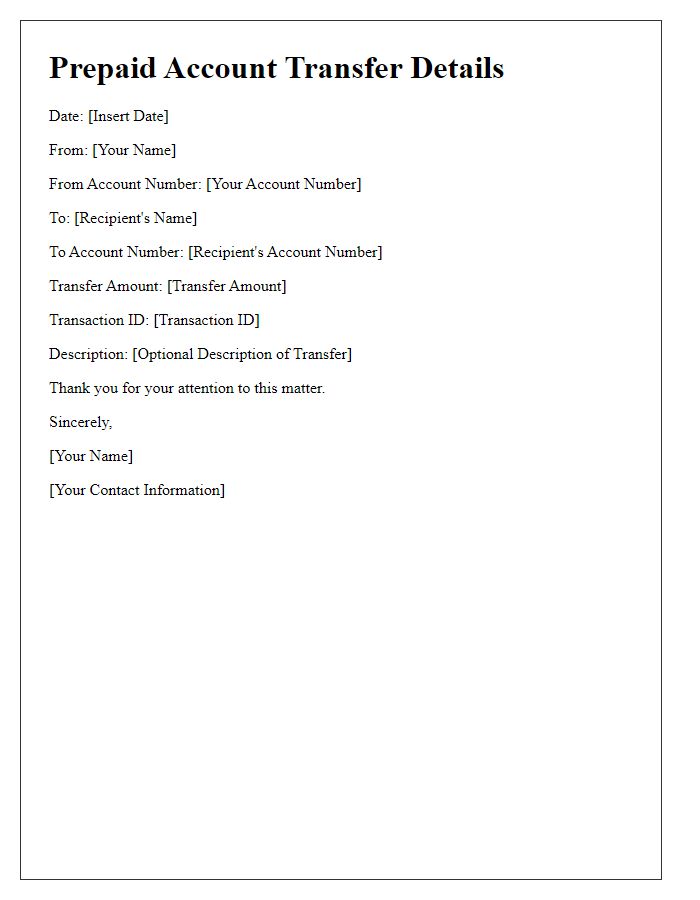

Authorization and Signature

Prepaid account balance transfer requires clear authorization from account holders. Essential details include account numbers, transfer amounts, and specific instructions regarding destination accounts. Signatures must be provided to validate the transfer request, ensuring compliance with financial regulations. Notifying both sending and receiving parties about the transfer process is crucial for maintaining transparency and security throughout the transaction.

Comments