Feeling caught off guard by unexpected fees can be incredibly frustrating, and you're definitely not alone in this sentiment. Many consumers have found themselves facing surprise charges that seem to come out of nowhere, leaving them scratching their heads and reaching for their pens to express their concerns. Writing a well-crafted complaint letter can be a powerful way to address these issues and seek a resolution. So, if you want to learn how to effectively voice your concerns and advocate for yourself, read on for some helpful tips!

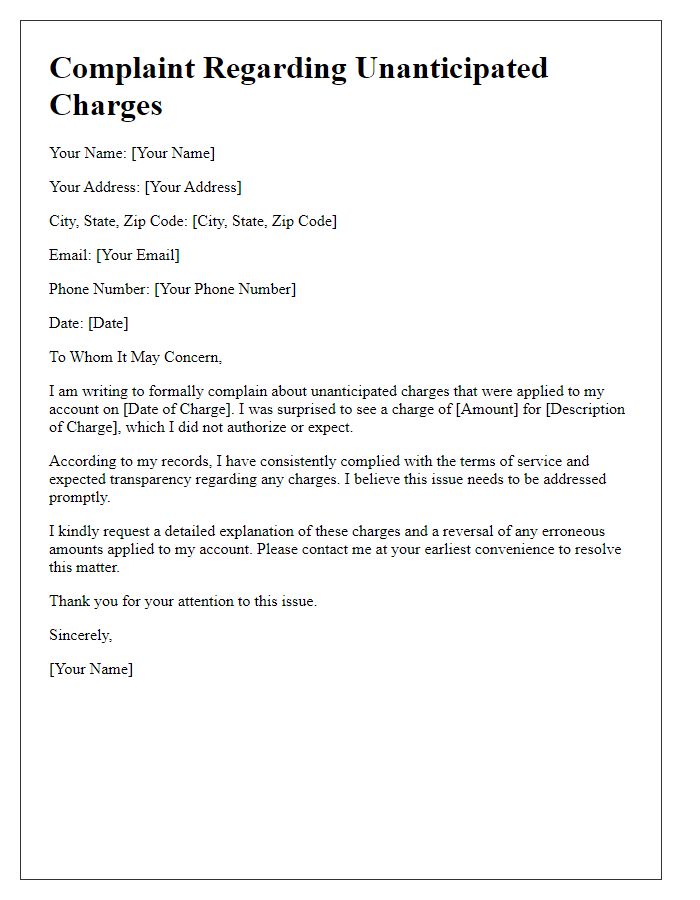

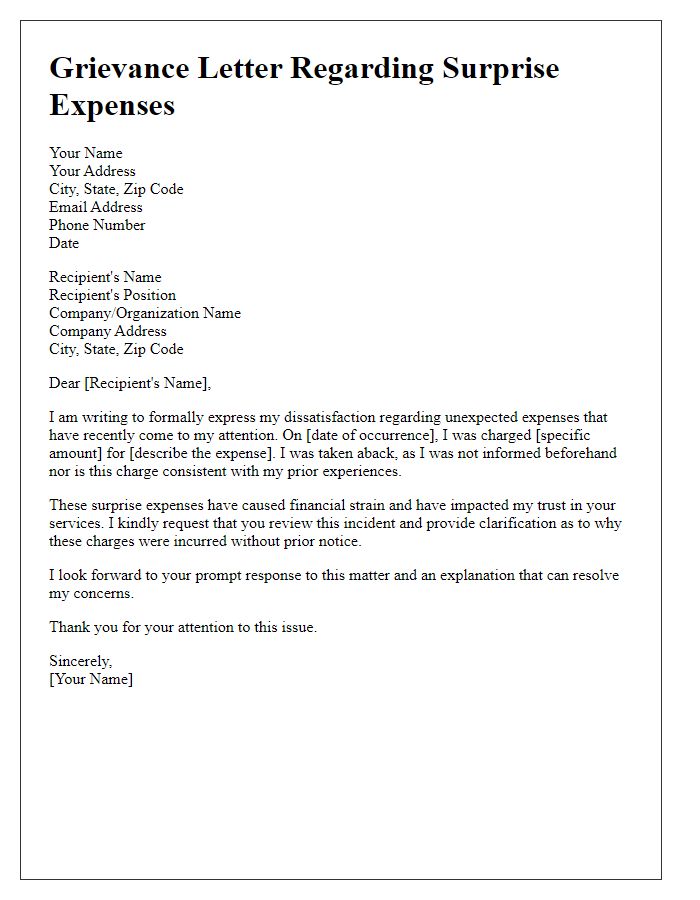

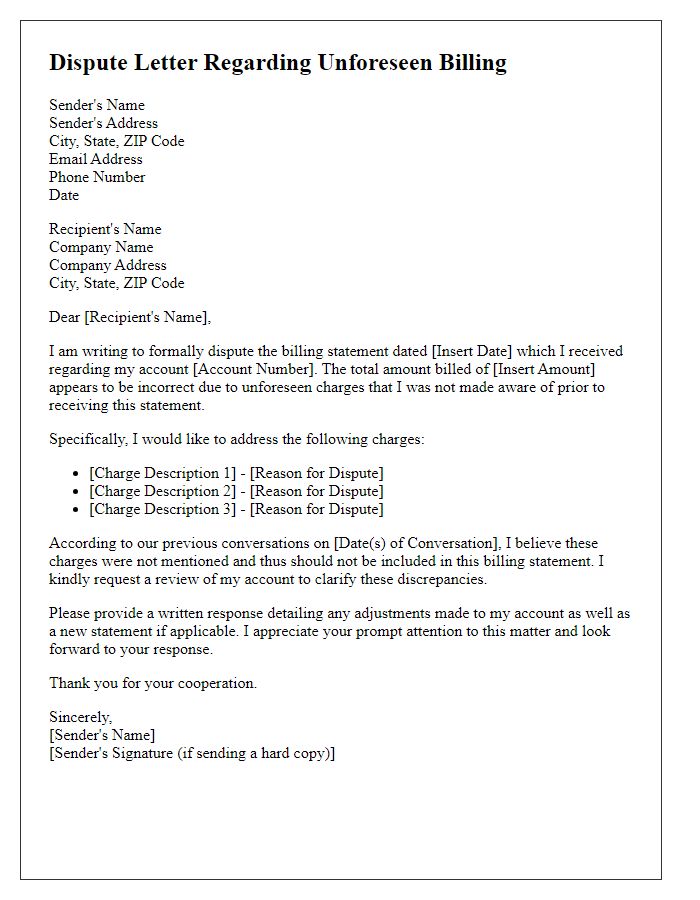

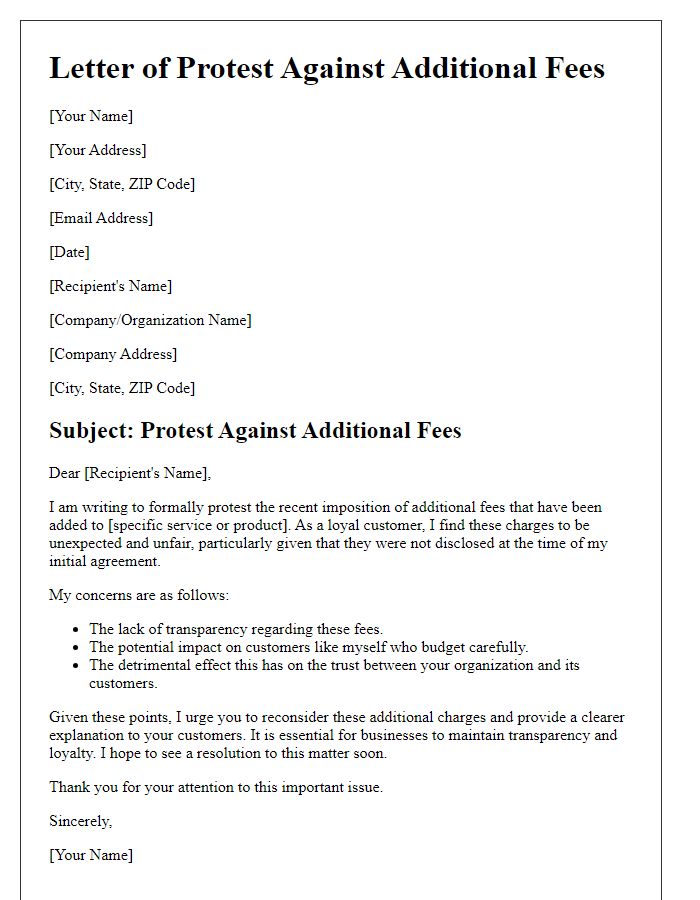

Clear Subject Line

Unexpected fees on my recent bank statement have caused significant confusion and frustration. On October 5, 2023, I reviewed my account with Bank of America and noticed a charge labeled "Monthly Maintenance Fee" of $12, despite being aware that my account type, a Student Checking Account, typically incurs no such fees. Specifically, I have maintained a minimum balance of $500, which should exempt me from these charges. Additionally, a separate transaction on the same day indicated a "Service Fee" of $15, without any prior notice or explanation provided. Such inconsistencies in fee application violate Federal Trade Commission regulations regarding transparency in banking, necessitating an urgent review of my account and a rectification of these unexpected charges.

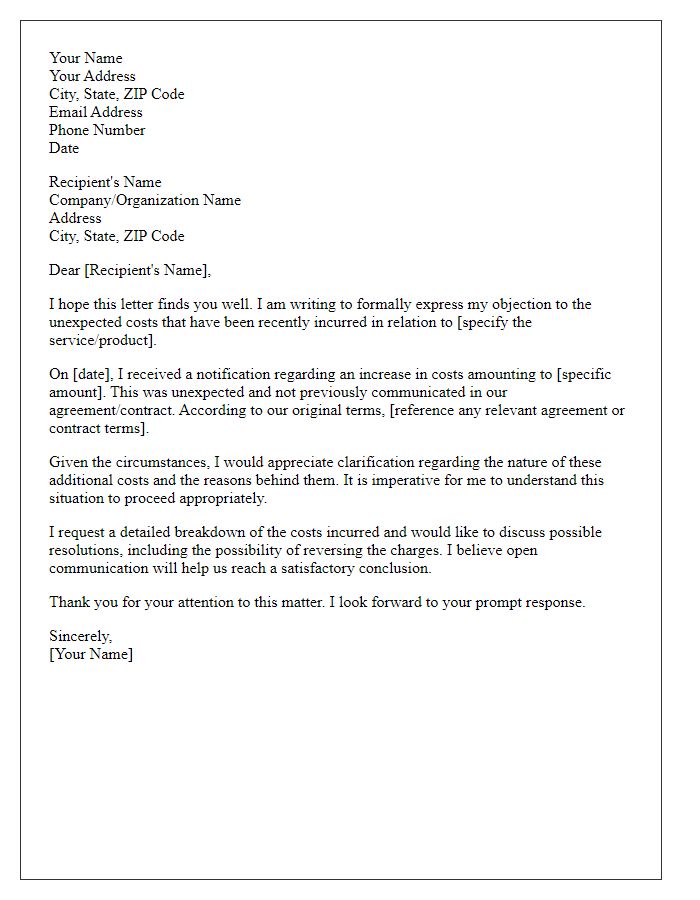

Recipient's Contact Information

Unexpected fees can lead to significant frustration for customers, particularly when associated with financial products and services. For example, some banks impose monthly maintenance fees ranging from $5 to $15 if account balances fall below a designated threshold, such as $500. Additionally, subscription services may add charges for late payments, often amounting to $10 or more after a grace period of 5 days. Customers may find it disheartening to encounter these fees without prior notice or clear communication. Awareness of these policies is crucial, as customers often expect transparency from businesses, which can enhance trust and satisfaction while mitigating complaints.

Detailed Account Information

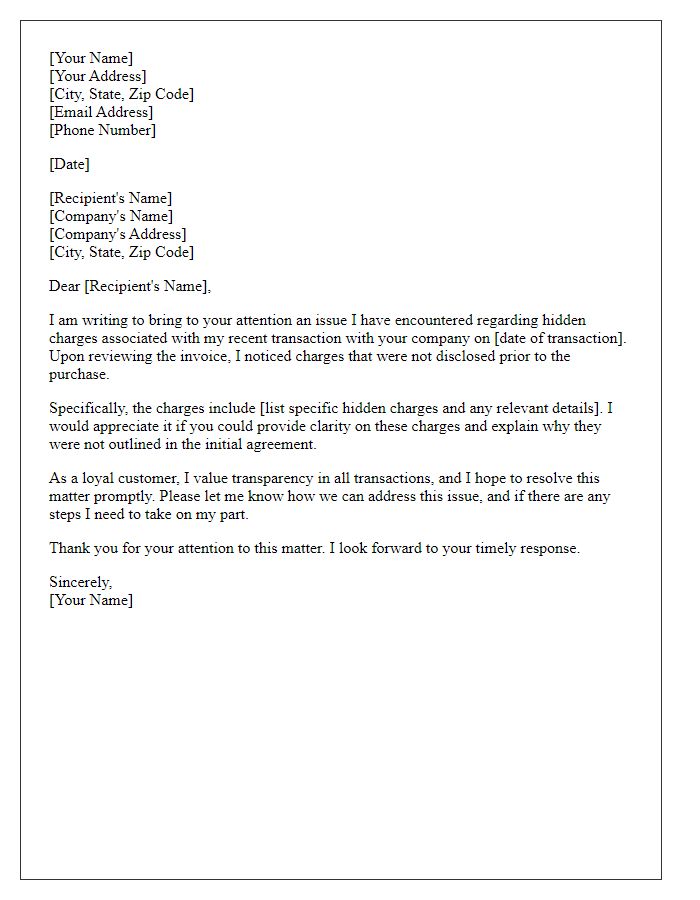

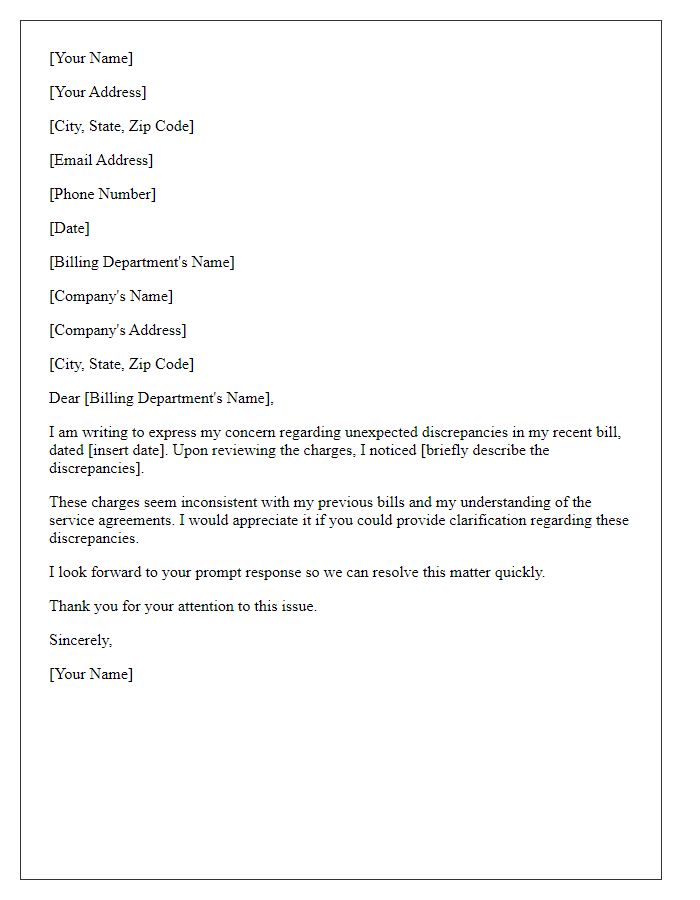

Unexpected fees on billing statements can create significant confusion and frustration for customers. Many establishments, particularly in the financial industry, may implement additional charges without prior notice, leading to dissatisfaction. For instance, a consumer may notice a charge labeled as an "account maintenance fee" or "overdraft fee" on their monthly statement, which can range from $10 to $50, depending on the organization. Stating the specific date of the transaction, the exact amount charged, and referencing any relevant account numbers can enhance the clarity of the complaint. It is crucial for the customer to articulate their expectation of transparency regarding fees for services provided by institutions such as banks or utility companies. Documentation such as previous statements, advertisements promising no fees, or terms of service can support the claim and reinforce the request for resolution.

Specific Description of Fees

Unexpected fees can lead to frustration for consumers. For instance, a bank may impose monthly maintenance fees of $15 on a checking account, which is not typically disclosed upon account opening. Ancillary charges, such as overdraft fees, often amount to $35 per transaction, compounding quickly if multiple overdrafts occur within a short timeframe. Additionally, credit card companies might add foreign transaction fees, typically around 3%, for purchases made outside the home country without prior warning. Establishments such as gyms may enforce cancellation fees, which can range from $50 to $100, resulting in additional financial burdens for customers seeking to terminate their memberships. This lack of transparency undermines trust in service providers.

Requested Resolution or Action

Unexpected fees often arise in various industries, creating confusion and discontent among consumers. For instance, bank transactions can incur hidden fees totaling over $50, negatively impacting customer relationships. Communication service providers may include unexpected charges, such as equipment rental fees around $10 monthly, which can lead to costly surprises on billing statements. In many cases, lack of transparency in pricing strategies contributes significantly to consumer dissatisfaction. Thus, addressing these issues with appropriate resolution strategies, such as waiving fees or providing clearer communication about charges, is crucial for rebuilding trust. Companies must prioritize transparency in their billing practices to enhance customer loyalty and satisfaction long-term.

Comments