Are you looking to confirm your account balance but don't know where to start? A well-crafted letter can simplify the process and ensure you receive the information you need. In this article, we'll provide you with a handy template that takes the guesswork out of account balance verification. Stick around to learn more about how to compose a clear and effective request!

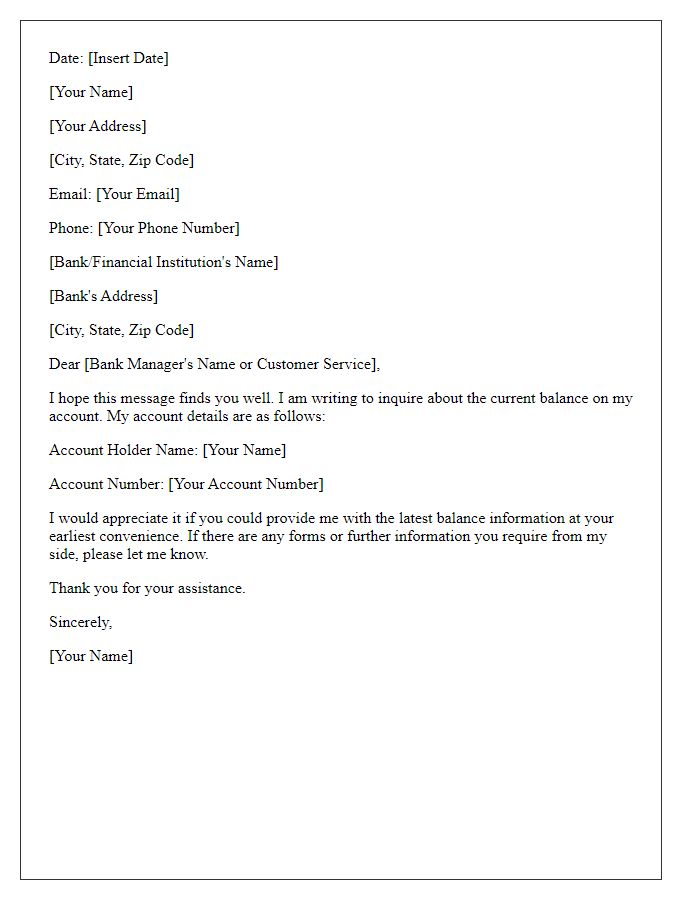

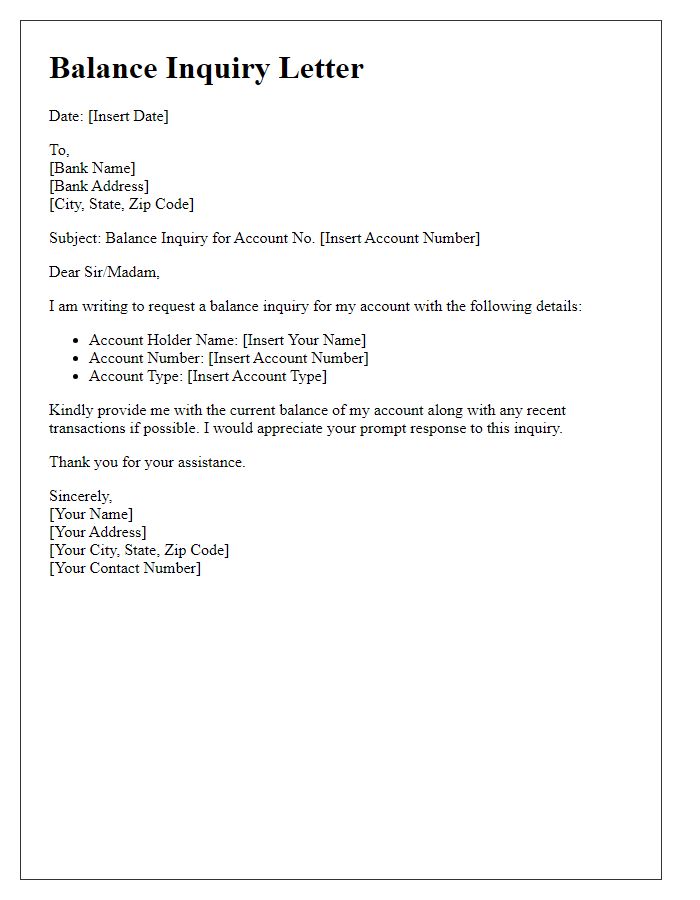

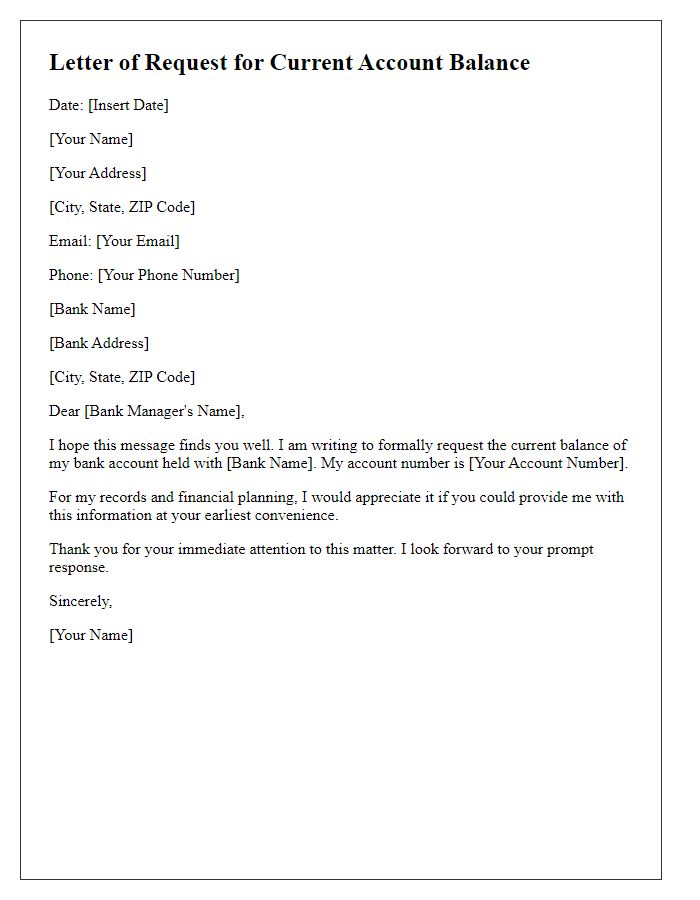

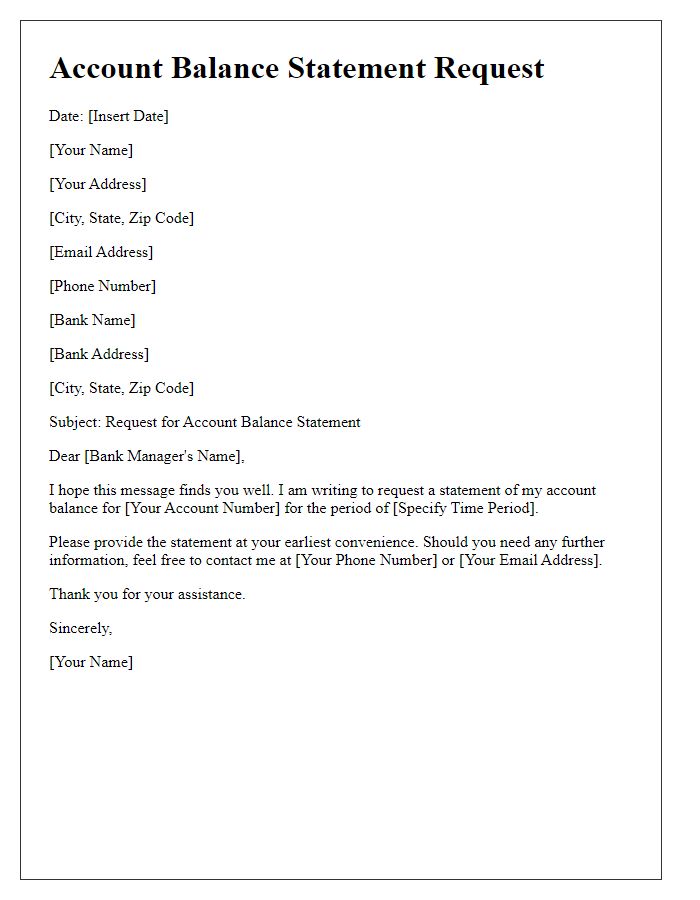

Recipient Information

When requesting account balance verification, it is essential to ensure that the recipient's information is accurate. This includes the recipient's full name, which should match the account records for verification purposes. The postal address, comprising street number, street name, city, state, and postal code, is vital for ensuring the communication reaches the correct individual or department. Additionally, the email address should be provided to facilitate quick and efficient correspondence, particularly for digital statements. Lastly, including a contact number allows for immediate clarification or follow-up if needed. Each detail contributes to the effectiveness of the verification process and safeguards against miscommunication.

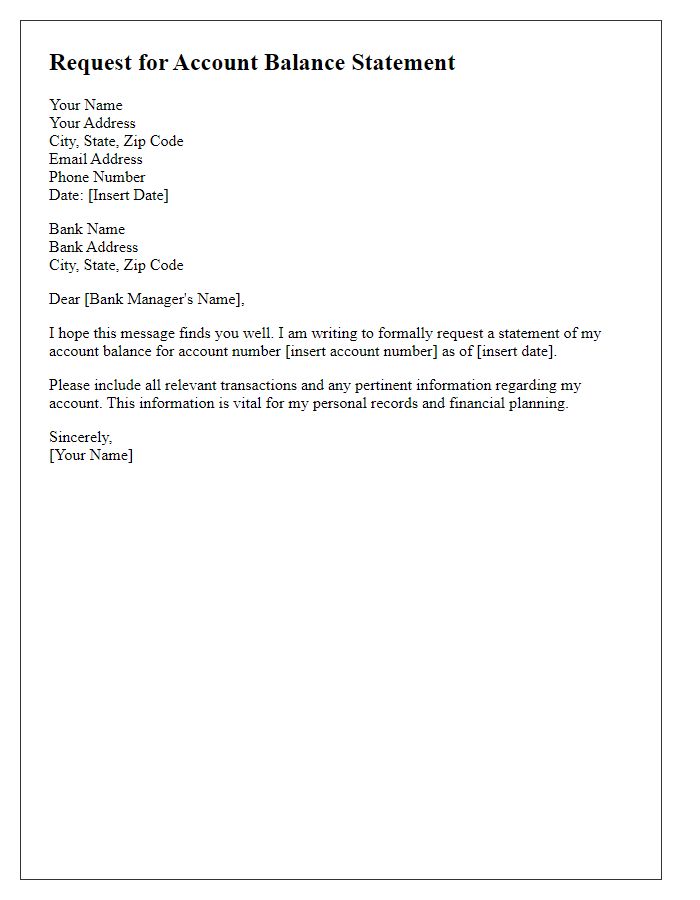

Account Details

Account balance verification is essential for maintaining accurate financial records. A checking account, for instance, might have multiple transactions occurring within a month, creating variances between expected and actual balances. Regularly reviewing the balance, which could be as low as $100 or as high as several thousand dollars, helps identify discrepancies. Using financial management apps like Mint or YNAB (You Need A Budget) can simplify this process. Additionally, reviewing bank statements from institutions such as JPMorgan Chase or Bank of America provides clarity on income and expenses. Regular audits of savings accounts, for example, with interest rates of 0.01% to 2.5%, ensure that all funds are accounted for and properly allocated.

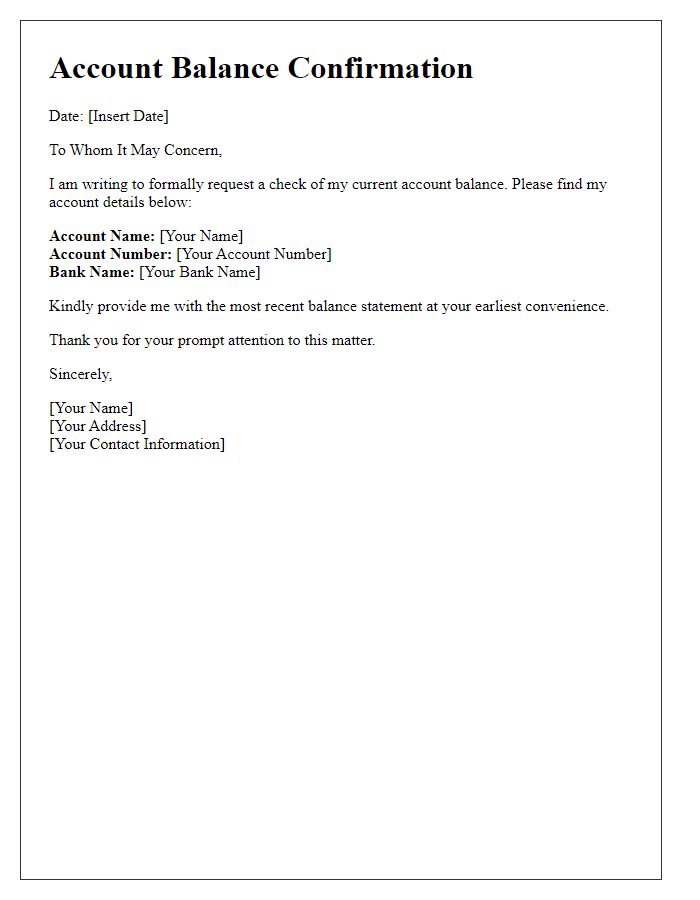

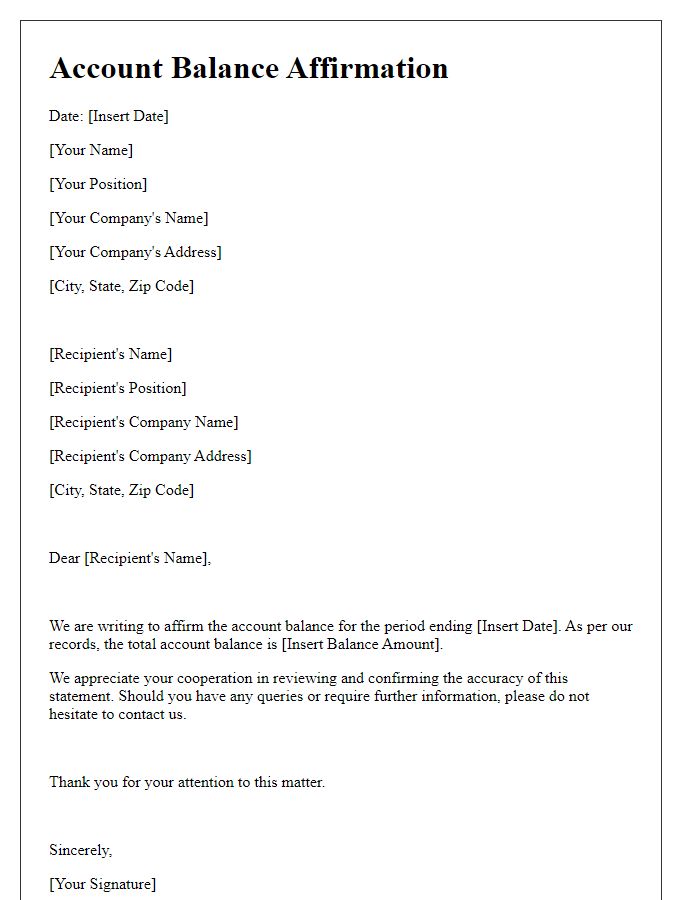

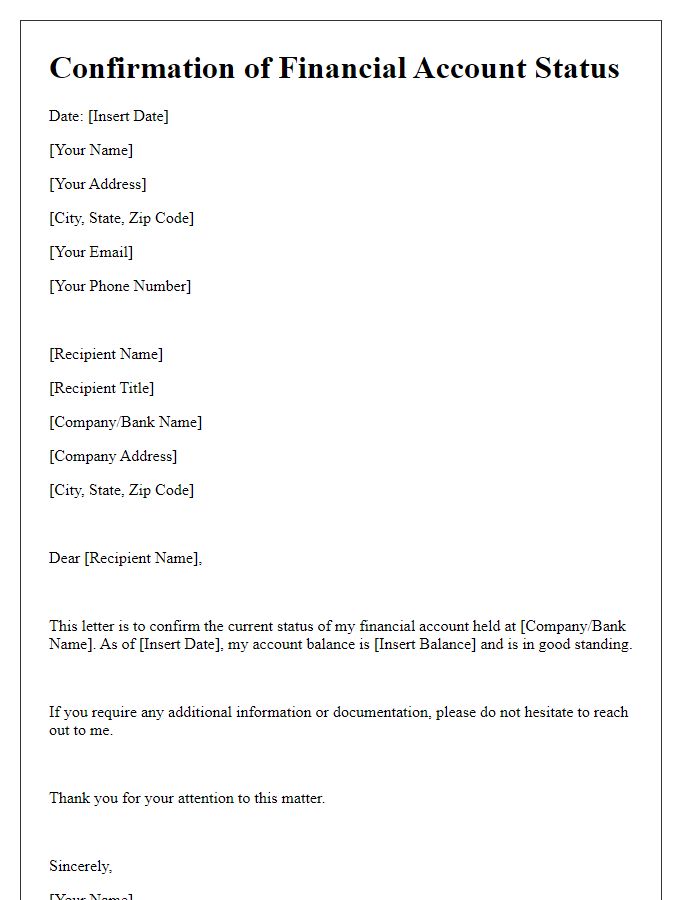

Verification Purpose

Account balance verification is crucial for maintaining financial accuracy and transparency in banking transactions. Financial institutions, such as banks or credit unions, conduct these verifications to ensure that account balances are correct according to their records. The verification process typically involves cross-referencing transactions logged over a specific period, including deposits, withdrawals, and fees. This confirmation is essential for business entities and personal account holders alike. It helps prevent errors, fraud, or discrepancies that could lead to financial loss. Regular communication between account holders and the bank ensures that any issues are promptly addressed, enhancing trust in financial operations.

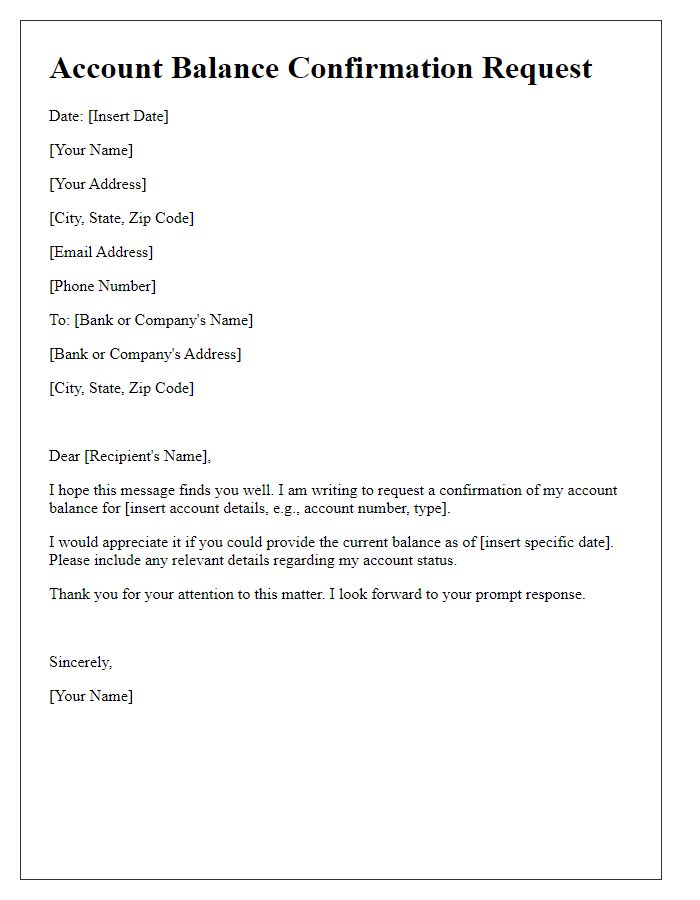

Request for Confirmation

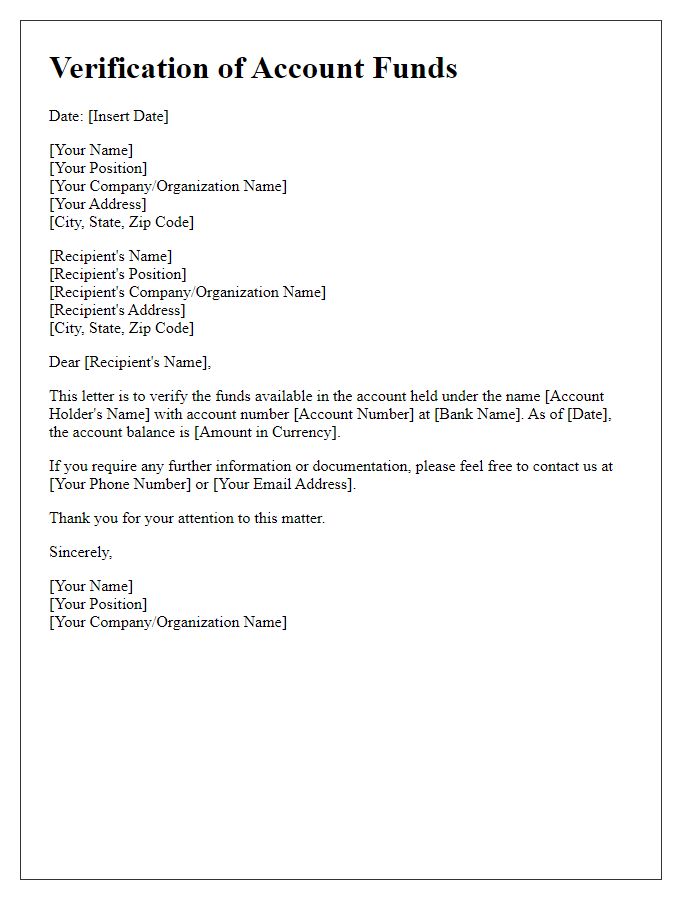

Monthly account balance verification is an essential financial practice, particularly for corporate entities, banks, and organizations seeking clarity on financial standing. This process typically occurs at the end of each month, aligning with fiscal reporting periods, wherein statements from financial institutions or accounting software are meticulously compared to internal records. Entities like XYZ Bank, known for their auditing protocols, may be contacted to confirm current balances, transactions, and any discrepancies that could impact fiscal integrity. This ensures accuracy in financial documentation, compliance with regulatory requirements, and upholding transparency for stakeholders during quarterly reviews.

Contact Information

Account balance verification is essential for maintaining accurate financial records. Businesses often utilize account statements detailing transactions and balances for auditing or tax preparation purposes. A verification request typically includes essential contact information, such as the organization's name, address, and phone number. It may also specify the account number, required verification periods (e.g., January to December 2023), and the specific format for receiving the confirmation (e.g., email or postal service). Ensuring accurate communication can expedite the verification process, fostering transparency between parties involved.

Comments