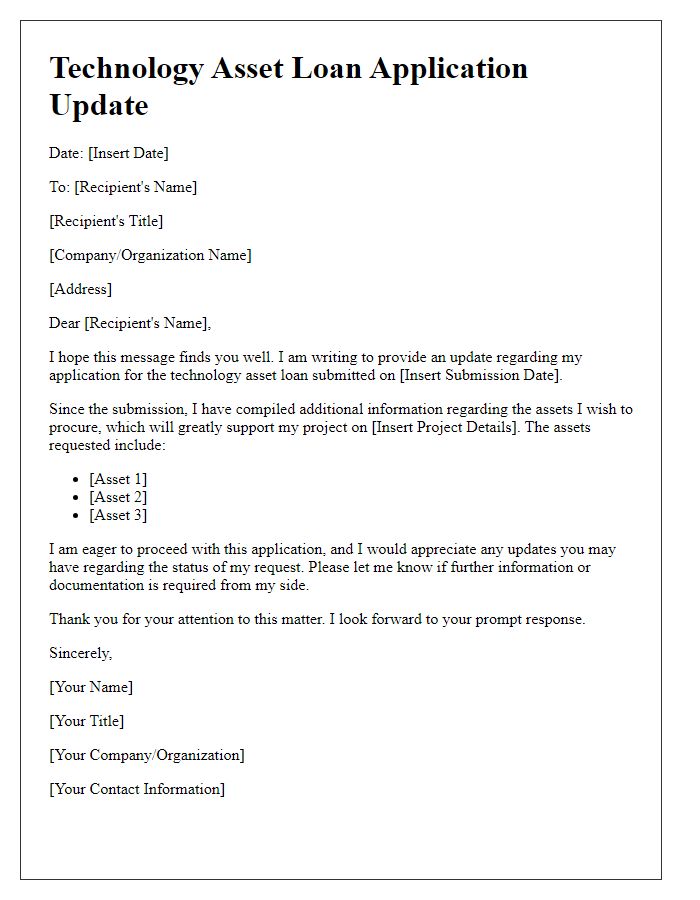

Are you navigating the often intricate process of securing a technology asset loan? Whether you're a business owner looking to upgrade your equipment or a student in need of a reliable laptop, understanding the approval process can make a significant difference. In this article, we'll break down the essential steps and tips to help you get your loan approved smoothly. Join us as we explore the ins and outs of technology asset loans and discover how you can set yourself up for success!

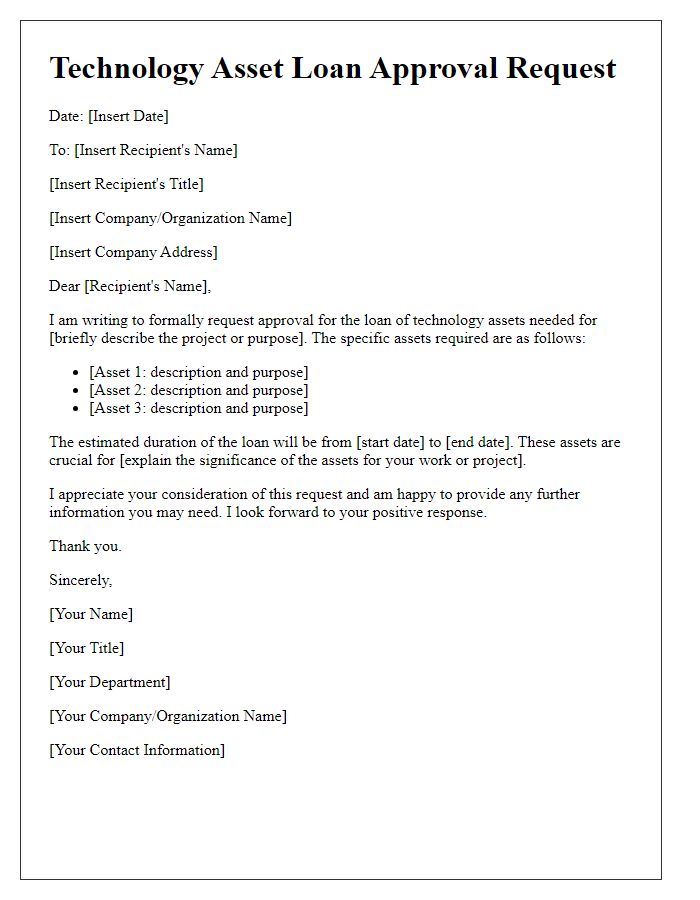

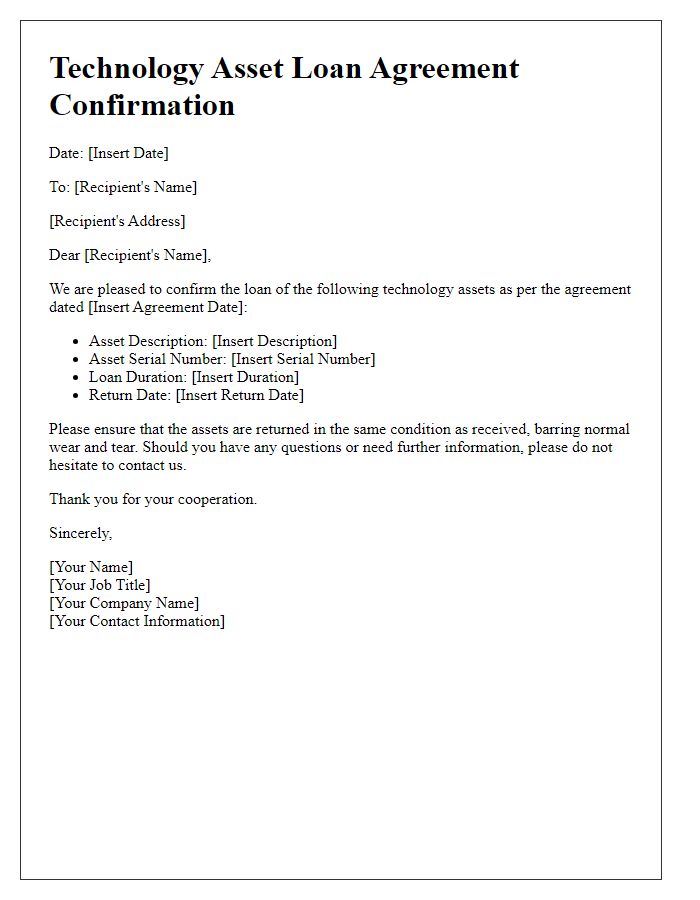

Clear identification of assets

The technology asset loan approval process requires precise identification of each item to ensure accountability and tracking within the organization. Key assets such as laptops (model Dell XPS 13, serial number 123456789), smartphones (model iPhone 13, IMEI number 9876543210), and projectors (model Epson PowerLite 1795F, serial number 1122334455) should be documented clearly. Each device's specifications, including processing power (e.g., Intel Core i7 for laptops), storage capacity (e.g., 256GB SSD), and age (e.g., purchase date January 2022), play a crucial role in the evaluation process. Proper labeling and tagging of assets enhance traceability and facilitate efficient management throughout the loan duration, minimizing loss or misuse risks.

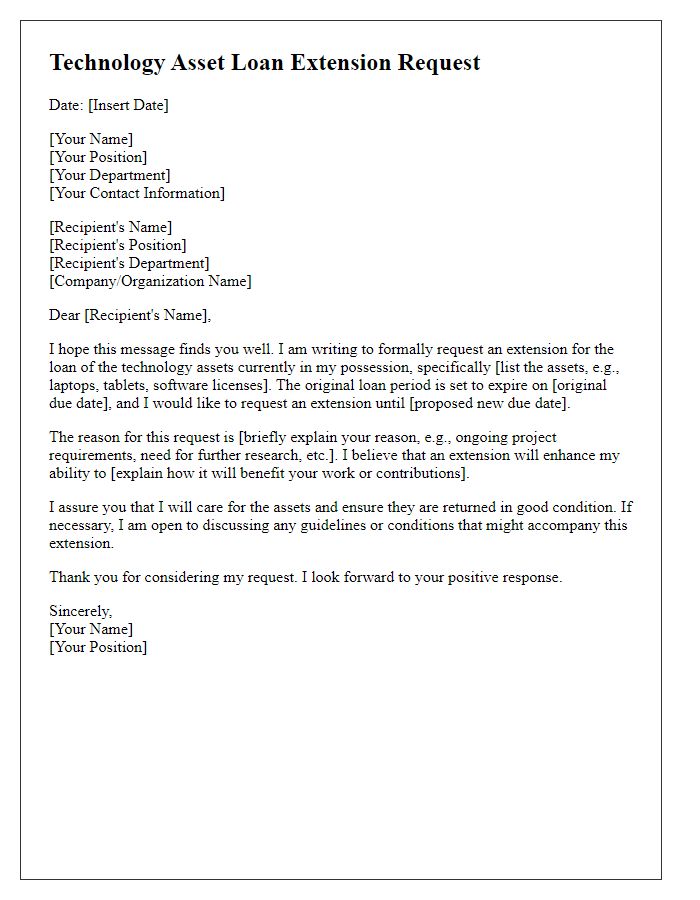

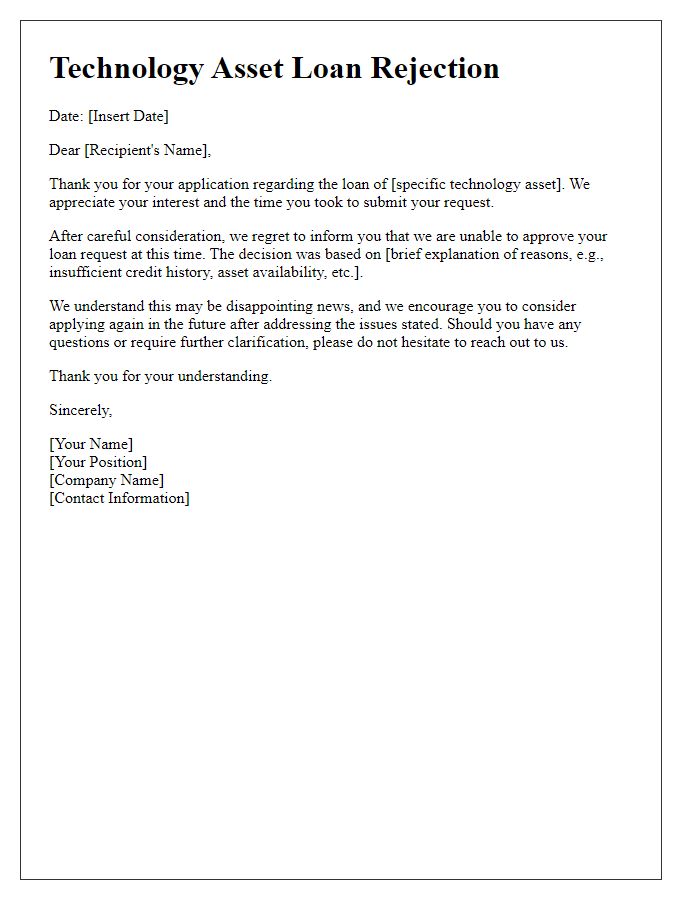

Loan terms and conditions

Technology asset loans often involve terms and conditions that outline the responsibilities of both the lender and the borrower. These agreements typically specify the loan duration, which may range from 1 month to several years, and interest rates, often fixed or variable, that can affect repayment amounts. Borrowers must maintain assets such as laptops or servers in good condition, with specifications regarding wear and tear clearly defined. Additionally, insurance coverage might be mandated to protect against loss or damage, while compliance with applicable laws or regulations is required during the loan period. Late fees are often stipulated for missed payments, with measures for default potentially including asset recovery protocols.

Risk assessment and collateral details

Technology asset loans involve risk assessment and collateral evaluation to ensure security and mitigate potential losses. A comprehensive risk assessment (evaluating factors like borrower creditworthiness and asset depreciation rates) is crucial for determining loan approval. Collateral in the form of valuable technological assets, such as high-performance laptops or cutting-edge servers, must be appraised to establish their market value. Specifics like serial numbers and brand models help ensure accurate identification. The loan amount often reflects a percentage of the collateral's appraised value (typically 70-80%), providing assurance to lenders. Clear documentation regarding asset condition (including previous repairs or warranties) is also essential for a thorough evaluation process.

Approval authority and signatures

The technology asset loan approval process involves submission to designated approval authorities such as the Finance Manager and IT Director. The Finance Manager, responsible for overseeing budget allocations and financial viability, requires formal signatures to validate the loan request. Simultaneously, the IT Director assesses the technology's compatibility and alignment with departmental needs before endorsing the request. Proper documentation, including asset details, valuation, and loan duration, must accompany the submission. Approvals typically processed within 5 to 7 business days receive signatures dated appropriately to ensure compliance with organizational policies. Adherence to these protocols guarantees transparency and accountability in technology asset management.

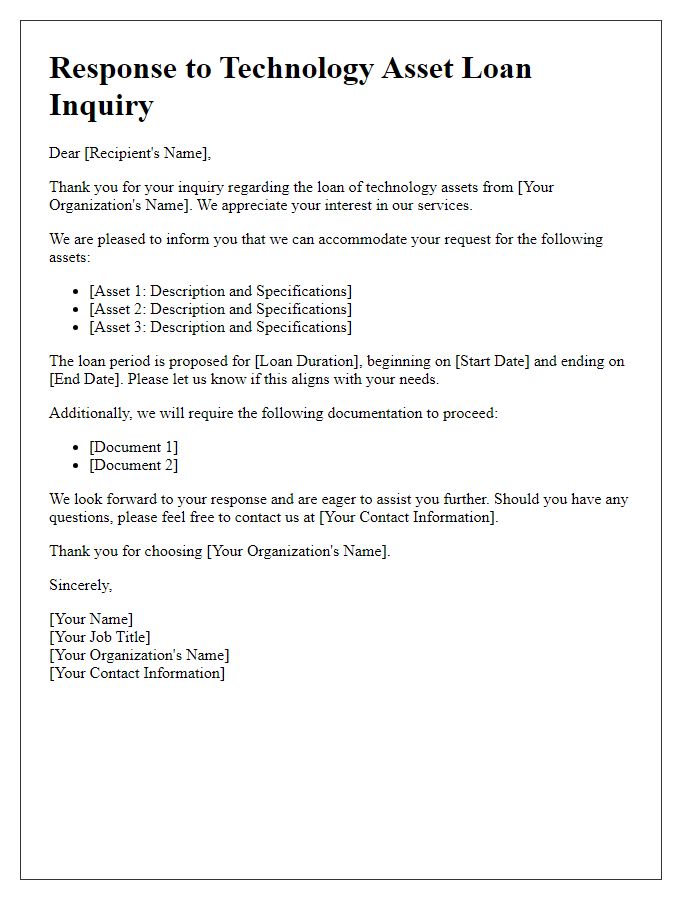

Contact information for inquiries

Technology asset loans, such as computers or smartphones, often involve approval processes that require specific contact information for inquiries. Important details include the name of the department managing the asset loans, typically referred to as Asset Management or IT Services Department. A direct contact number, often a dedicated phone line, allows borrowers to ask questions related to the loan process. An official email address, such as assetmanagement@company.com, facilitates written communication for clarification on loan terms or conditions. Additionally, a physical office location may be provided, which is often housed within a larger corporate campus, promoting in-person inquiries if needed. Ensuring that these contact details are readily accessible enhances the transparency of the loan approval process.

Comments