Are you considering transferring your asset management services but unsure where to start? Navigating the complex world of asset transfers can be daunting, but with the right guidance, it can be smooth and efficient. In this article, we'll cover everything from understanding the key steps involved to pinpointing the best practices for a seamless transition. So, grab a cup of coffee, settle in, and let's dive deeper into the ins and outs of asset management transfers!

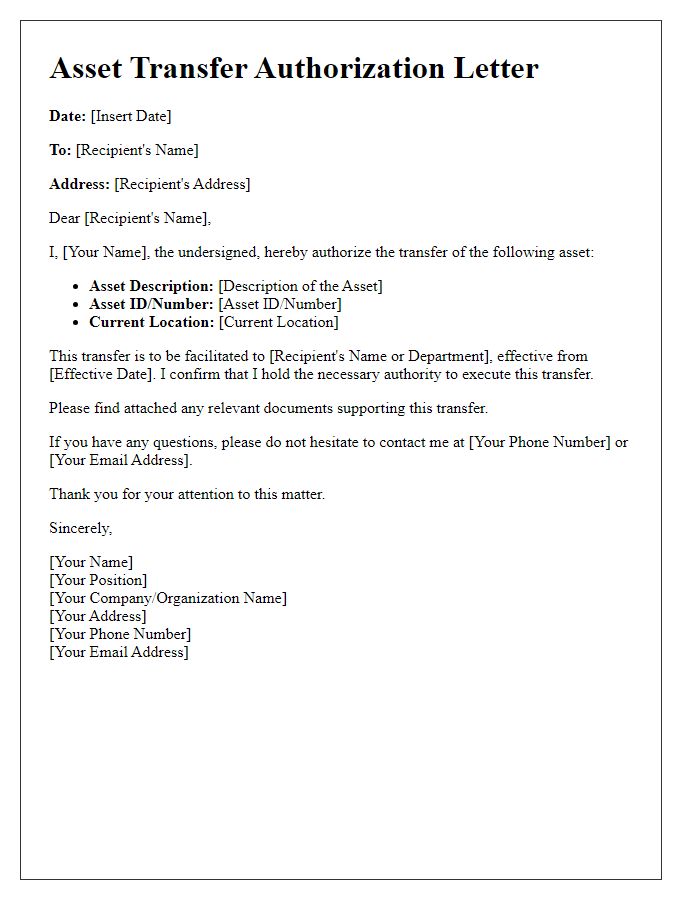

Contact Information: Sender and Recipient Details

Asset management transfers involve the systematic and formal documentation of ownership changes for financial assets. Precise contact information is crucial for identifying parties involved in the transaction. Sender details typically include the full name, physical address, email address, and contact number of the asset owner, ensuring clear communication. Recipient details similarly consist of the full name, physical address, email address, and contact number of the new asset holder. Including additional identifiers, such as tax identification numbers or account numbers, can streamline the transfer process and enhance security. Accurate records help facilitate smooth asset management transitions and maintain accountability.

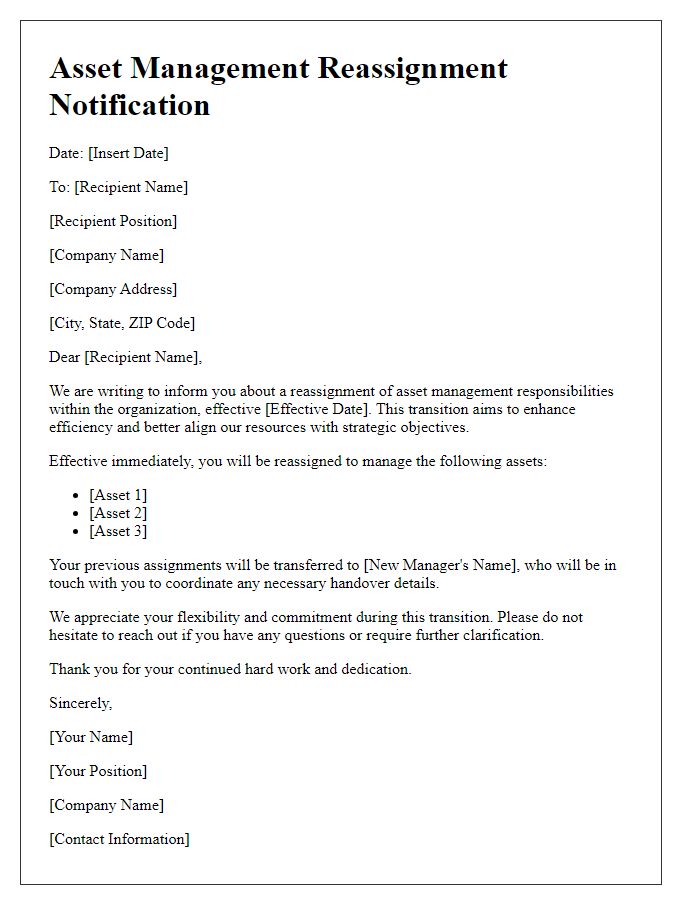

Subject Line: Clear and Specific

Asset management transfer involves a systematic process of transferring control and oversight of financial assets from one entity to another, typically within institutional finance or investment management contexts. This process is crucial for ensuring investment continuity, compliance with regulatory frameworks, and alignment with strategic financial goals. Key participants include asset managers, institutional investors, and custodians, all of whom play distinct roles in managing assets such as equities, bonds, and real estate holdings. A meticulous approach is required, with documentation reflecting asset values, performance metrics, and transaction histories, ensuring a seamless transition that upholds fiduciary responsibilities while minimizing operational risks.

Introduction: Purpose of Letter

The asset management transfer process involves the systematic reallocation of financial assets, such as stocks, bonds, and real estate investments, from one management firm to another, ensuring continuity and compliance with regulatory standards. This transfer may occur during organizational changes, like mergers or acquisitions, or due to a strategic decision to enhance portfolio performance. Proper documentation outlining asset details, values, and management instructions is critical for smooth execution. It is essential for both transferring and receiving entities to review asset performance reports, transition timelines, and any potential tax implications associated with the transfer. A successful asset management transfer depends on clear communication, thorough due diligence, and adherence to fiduciary responsibilities, ultimately safeguarding investor interests.

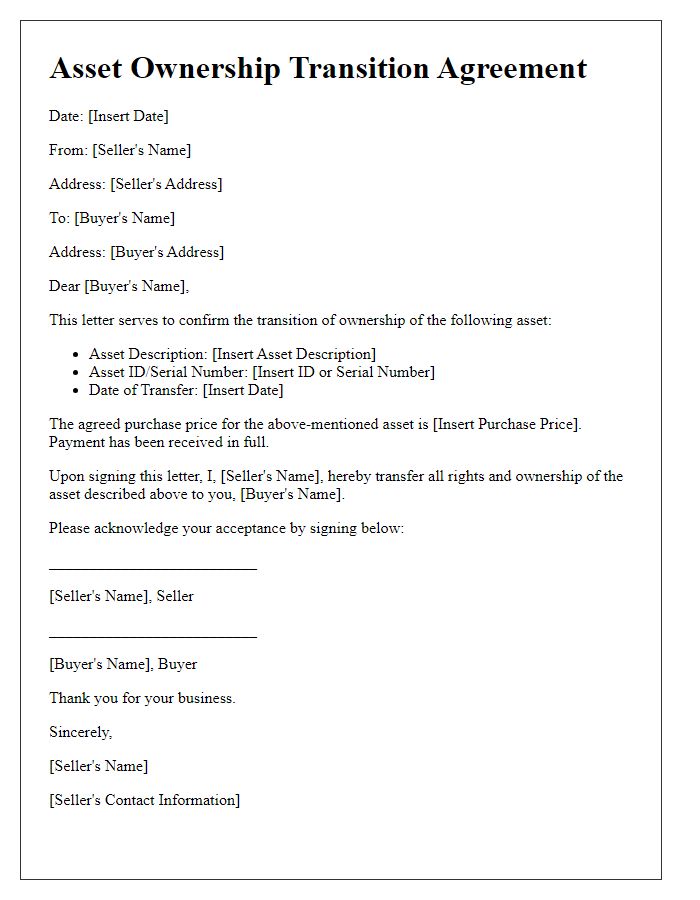

Asset Details: Description and Identification

Asset management transfers require clear documentation of asset details for effective tracking and management. Description includes the specifications of the asset, such as its type (e.g., computer, machinery), brand (e.g., Dell, Caterpillar), model number (e.g., XPS 13, 320B), and condition (new, used, refurbished). Identification can involve unique identifiers, such as serial numbers (e.g., 12345ABCDE), barcodes, or asset tags that aid in inventory control. Additionally, recording the purchase date (e.g., January 15, 2022), acquisition cost (e.g., $1,500), and current location (warehouse or office space) ensures that all relevant information is comprehensive for ongoing asset management processes.

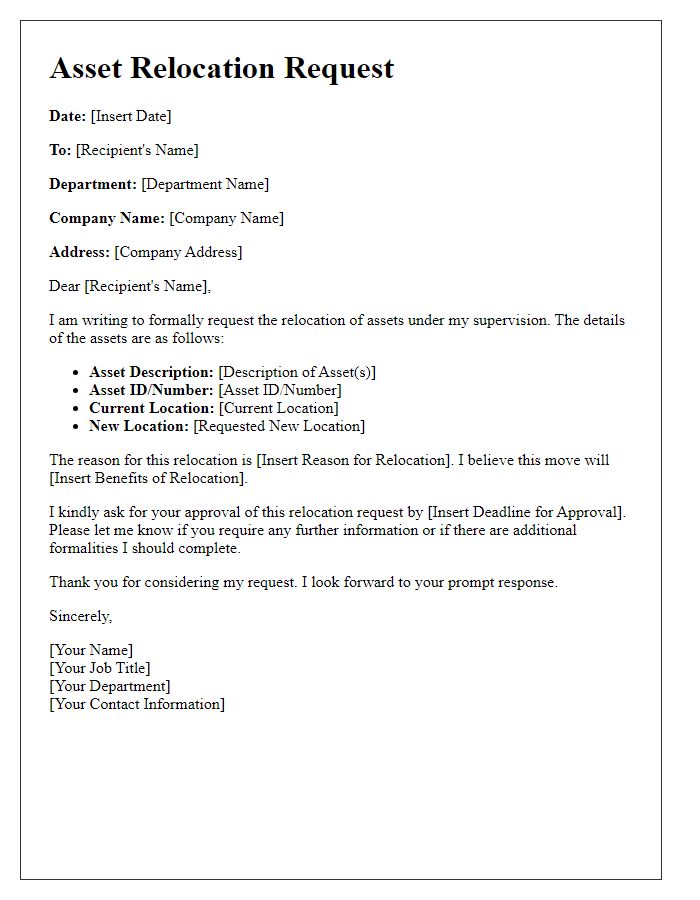

Transfer Instructions: Process and Deadlines

Asset management transfer involves detailed steps to ensure a smooth transition of responsibility. The first critical deadline occurs no later than two weeks prior to the intended transfer date. Complete all necessary documents, including the Asset Transfer Agreement (often requiring signatures from both parties). Ensure that current asset values are clearly documented, as this will influence valuation reports and tax implications (which can be significant based on jurisdiction). Notify all stakeholders involved in the management process, including financial institutions and compliance officers, to facilitate uninterrupted operations. Additionally, conduct a thorough review of the asset portfolio, encompassing real estate holdings (valued in the millions), equities (spread across various markets), and fixed-income securities (with maturity dates affecting liquidity). Confirm that all regulatory requirements are satisfied to avoid potential penalties or delays.

Comments