Ending a business partnership can be a challenging yet necessary step, and having a clear, well-crafted letter can help ensure that the process is smooth. In this article, we'll guide you through the essential elements that should be included in your termination letter, from expressing gratitude for the collaboration to outlining any final obligations. It's important to approach this situation with professionalism and clarity, as it can impact both parties moving forward. So, let's dive into the nitty-gritty of crafting an effective termination letter that sets the stage for a respectful conclusion to your partnership.

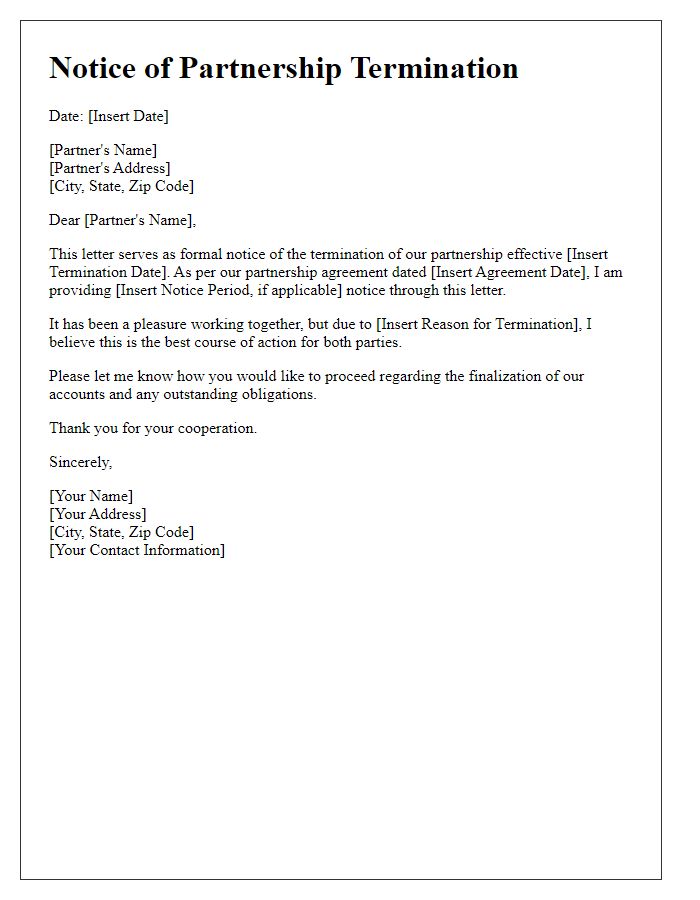

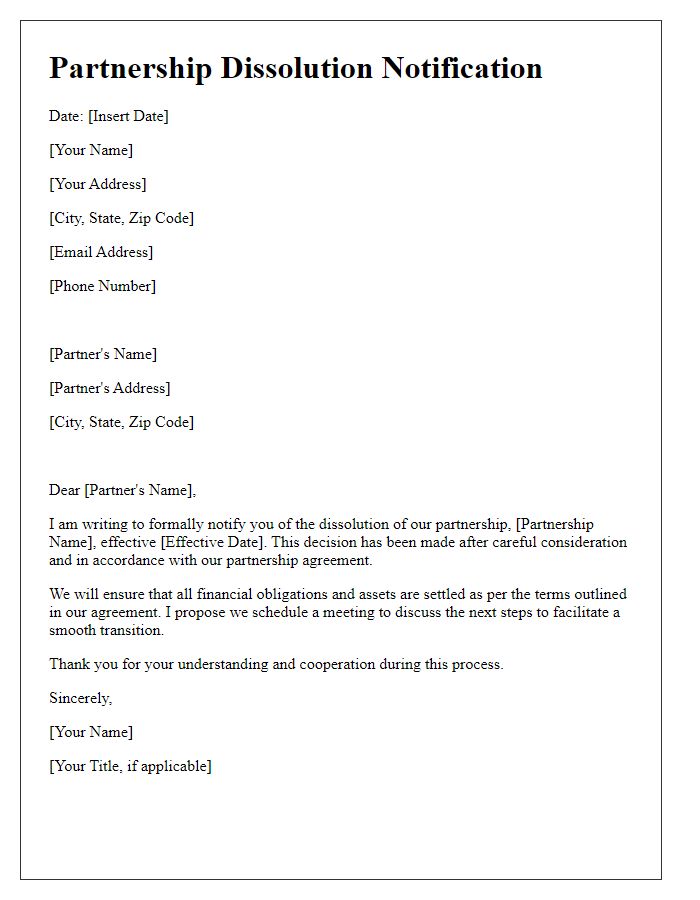

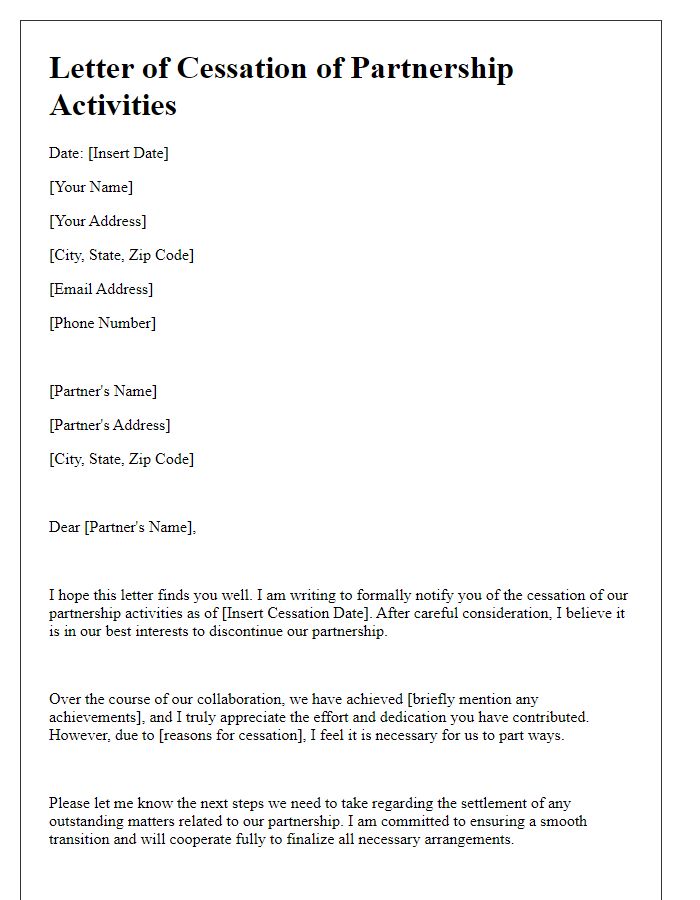

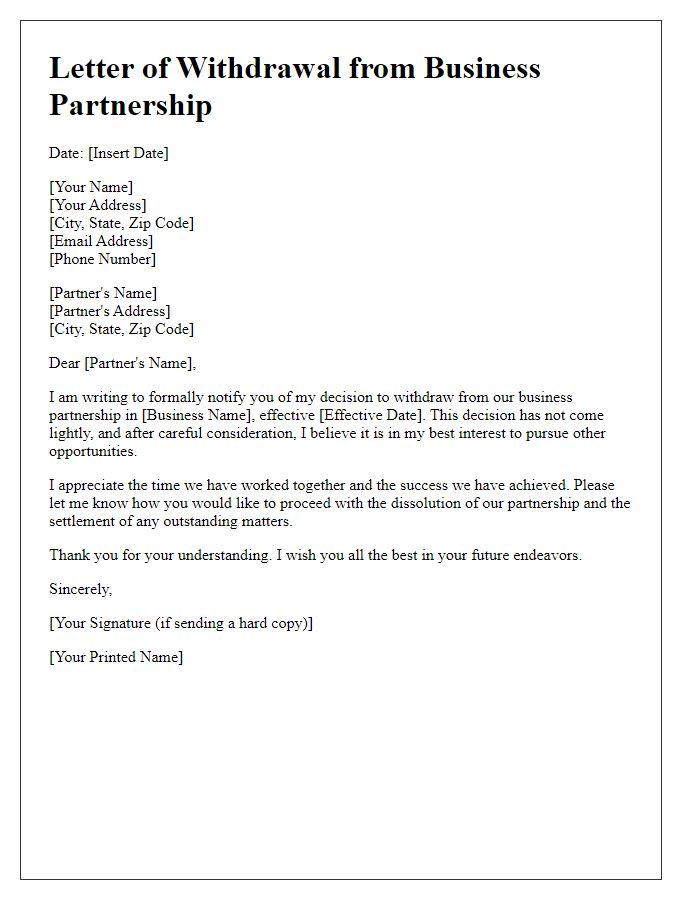

Clear Subject Line

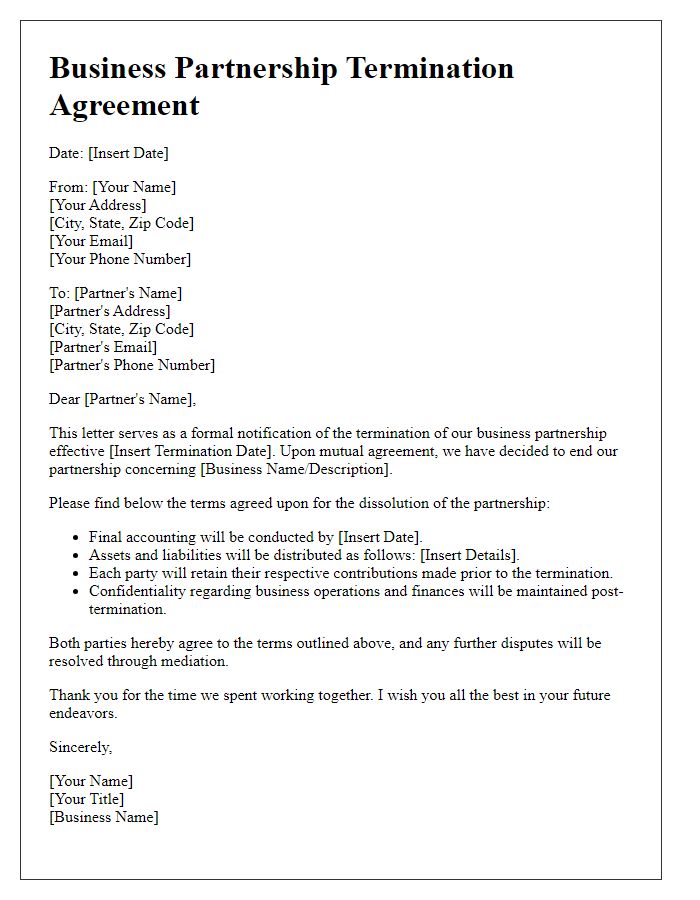

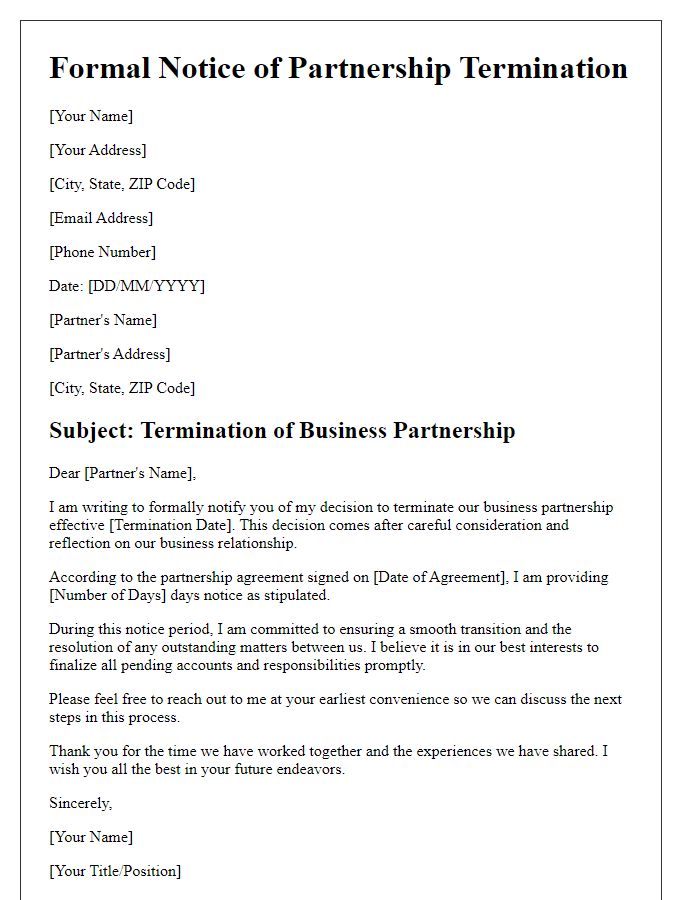

A formal business partnership termination can lead to significant changes requiring careful consideration. Clauses in contracts, such as exit strategies or buy-sell agreements detailed in Partnership Agreements, ensure responsibilities are clear. Notable events, like the signing of the partnership agreement, might reference previous successful projects, indicating collaboration history. Correspondence may be sent from corporate headquarters located in cities like New York or San Francisco, directly influencing regional market dynamics. Final settlements must align with laws governing business practices, such as the U.S. Uniform Partnership Act, to avoid potential disputes over shared assets or liabilities. Communication channels should remain professional to preserve industry reputation and ensure a smooth transition for both parties involved.

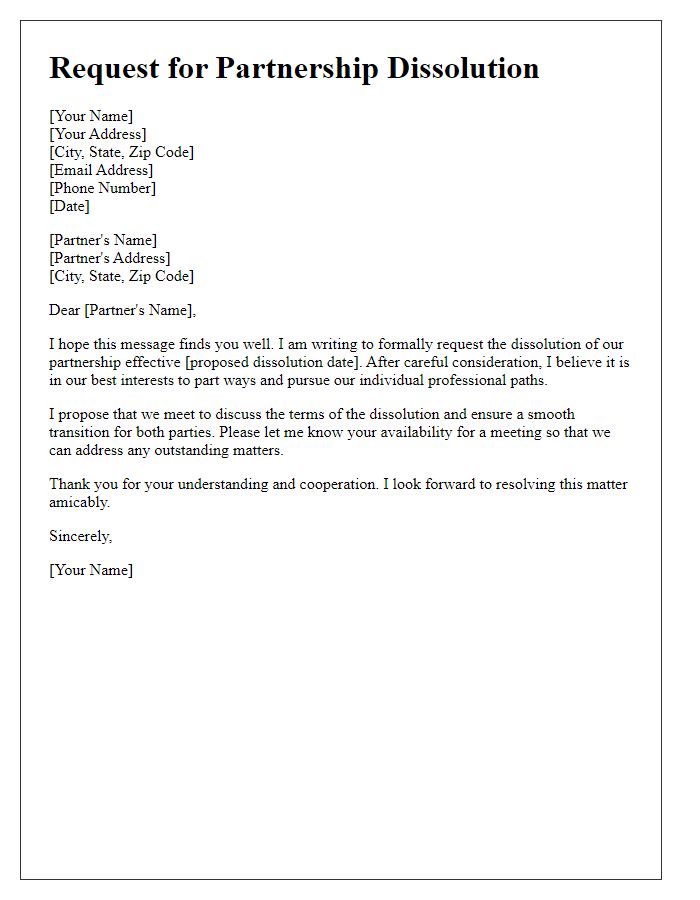

Effective Date

A business partnership termination letter formalizes the conclusion of a collaborative business agreement, addressing the specific details about the effective date. The effective date marks when the termination officially takes effect, which can be crucial for settling financial obligations, distributing assets, and addressing any liabilities incurred during the partnership. Clear communication of the effective date helps prevent misunderstandings among partners, stakeholders, and third parties involved. The letter should include the reason for termination, specific duties required post-termination, as well as mention of any remaining contractual obligations. It ensures a smooth transition, allowing both parties to move forward independently in their respective business endeavors.

Reason for Termination

Termination of a business partnership can occur for various reasons, including breaches of contract, financial instability, or differences in vision. Financial instability (negative cash flow exceeding 15% over three consecutive quarters) can lead to an inability to meet operating expenses in a timely manner. Breaches of contract may arise when one partner fails to fulfill agreed commitments, such as not providing required capital contributions (example: $50,000 initially promised). Divergent visions, often highlighted during annual strategic planning meetings (scheduled every July), can create friction, making collaboration challenging. The partnership may also face external pressures, like changes in market conditions (e.g., decline in market share of 20% within a fiscal year), prompting a reevaluation of the partnership's future. Ultimately, the decision to terminate should consider the long-term implications for all parties involved.

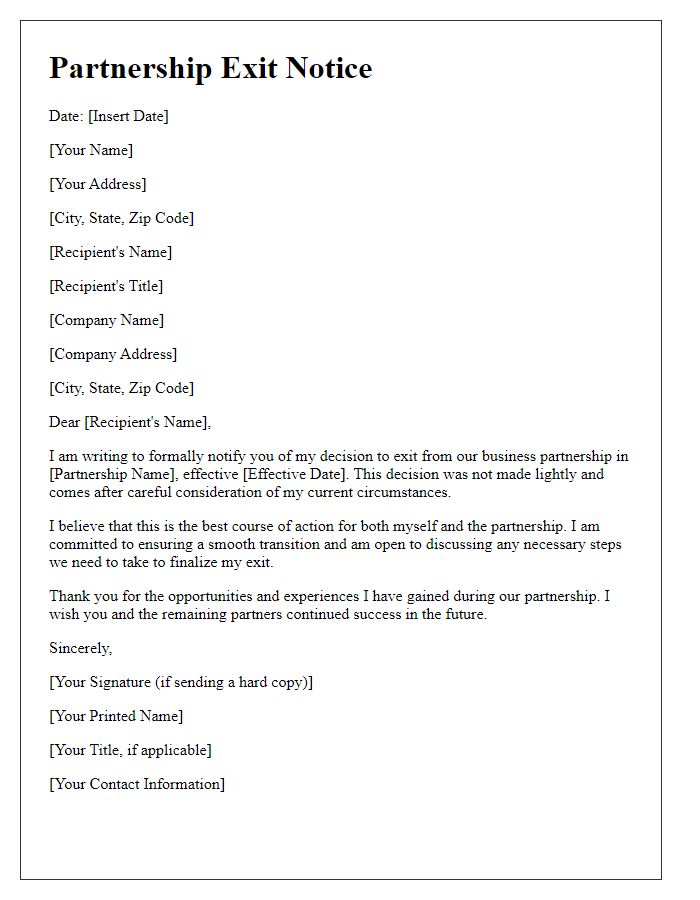

Asset and Liability Division

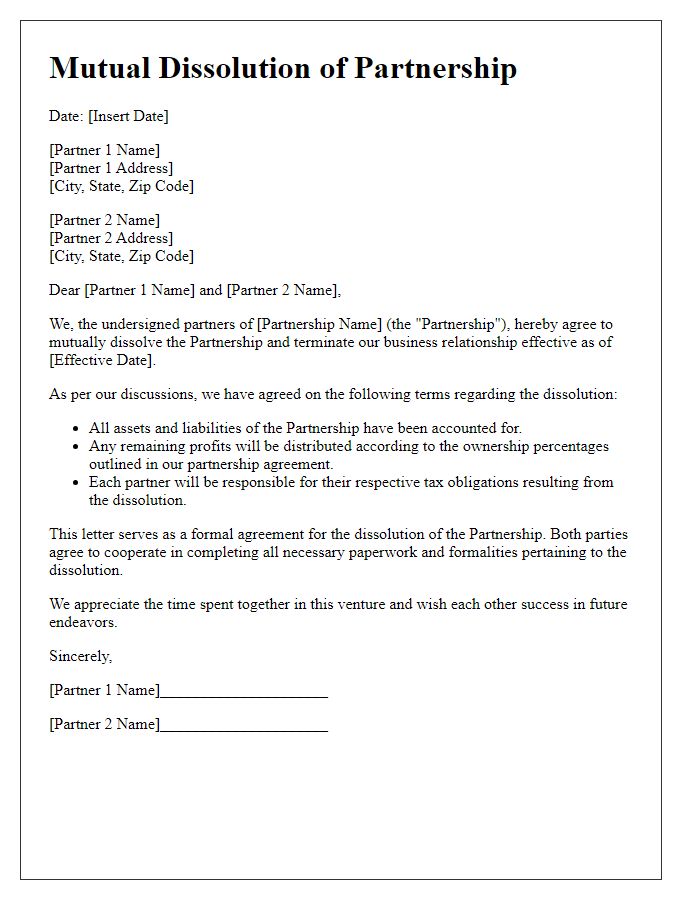

In terminating a business partnership, a thorough and clear division of assets and liabilities is crucial for a smooth transition. The business's total assets, including properties, equipment, and intellectual property, must be appraised and divided based on the original partnership agreement formulated during the inception phase. It is imperative to identify and calculate outstanding liabilities, such as loans, unpaid invoices, and legal obligations, to ensure all debts are settled before any division occurs. Each partner's initial investment and percentage share should guide the distribution process, ensuring compliance with applicable business laws in the relevant jurisdiction, such as the Partnership Act of 1890 in the UK or state partnership laws in the United States. All agreements should be documented formally, signed, and witnessed to avoid future disputes and clearly indicate the effective date of the termination of the partnership.

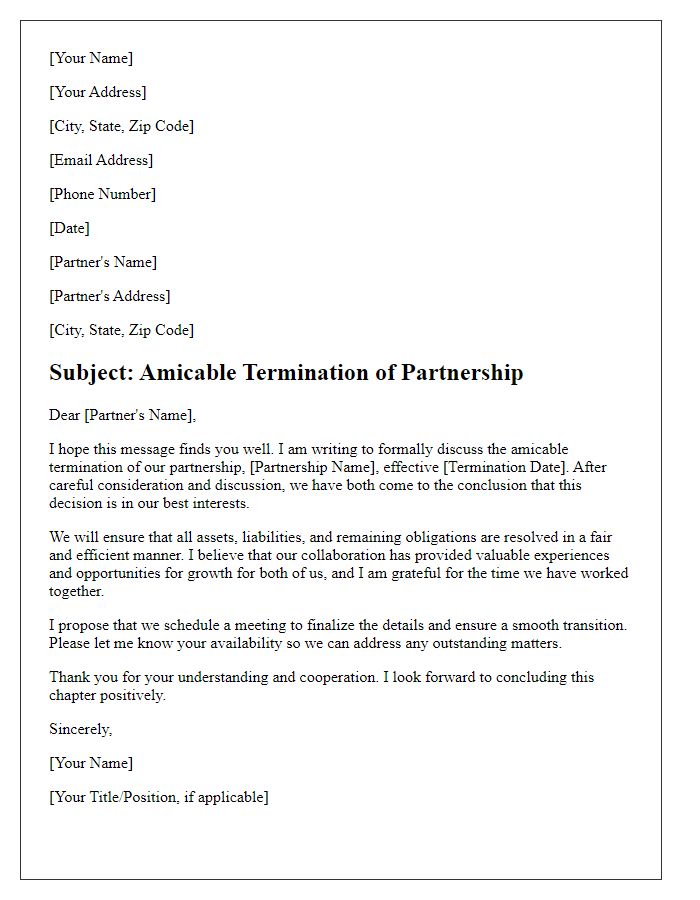

Formal Closing Statement

The formal termination of a business partnership requires clear communication about the dissolution process. A structured closing statement includes key details such as dates, involved entities, and the reason for termination. It should confirm the date the partnership will officially cease operations, which is often set 30 days post-notification. The statement must outline responsibilities regarding financial settlements, including the distribution of assets or liabilities, ensuring compliance with local business laws. It is also vital to mention any required notifications to government agencies, such as the local Secretary of State, to formally register the dissolution. Clear guidance on how to handle ongoing customer relationships or pending contracts provides additional clarity, ensuring all parties are informed of their obligations. This formal closure helps preserve professional relationships and provides a documented record of the partnership's end.

Comments