Are you tired of confusing telecom bills and unexpected charges? You're not alone! In this article, we'll guide you through understanding credit adjustments on your telecom account, ensuring that you're not left scratching your head over your monthly statements. Curious about how these adjustments work and how to ensure you're getting the best value? Read on to discover more!

Account Information and Details

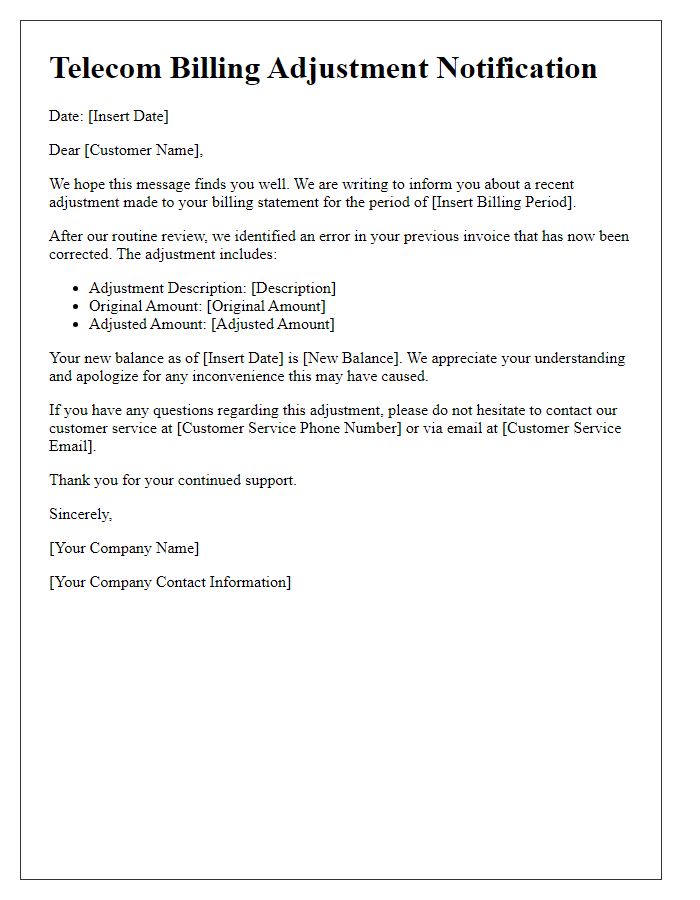

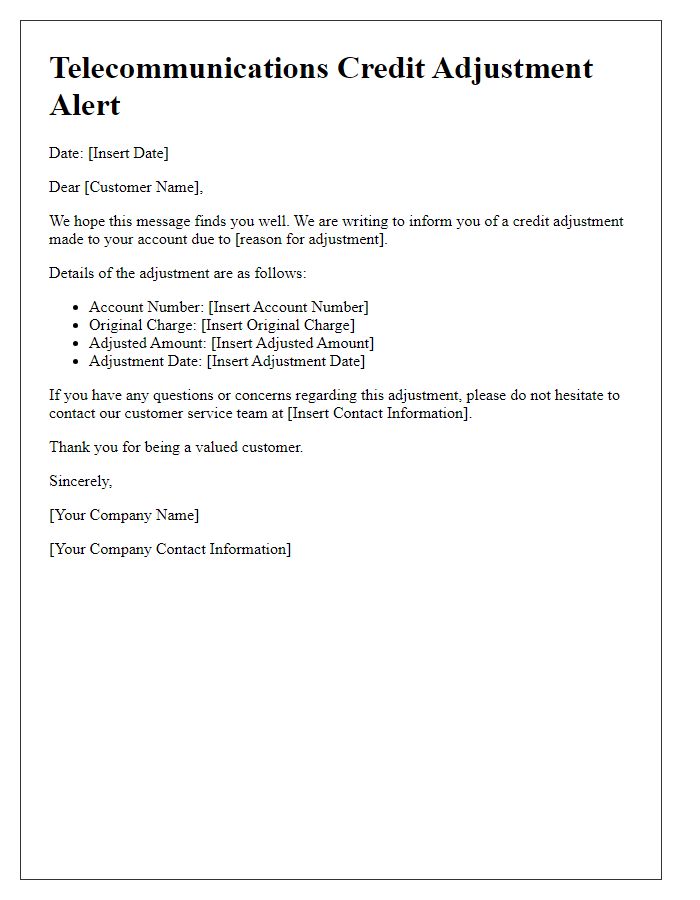

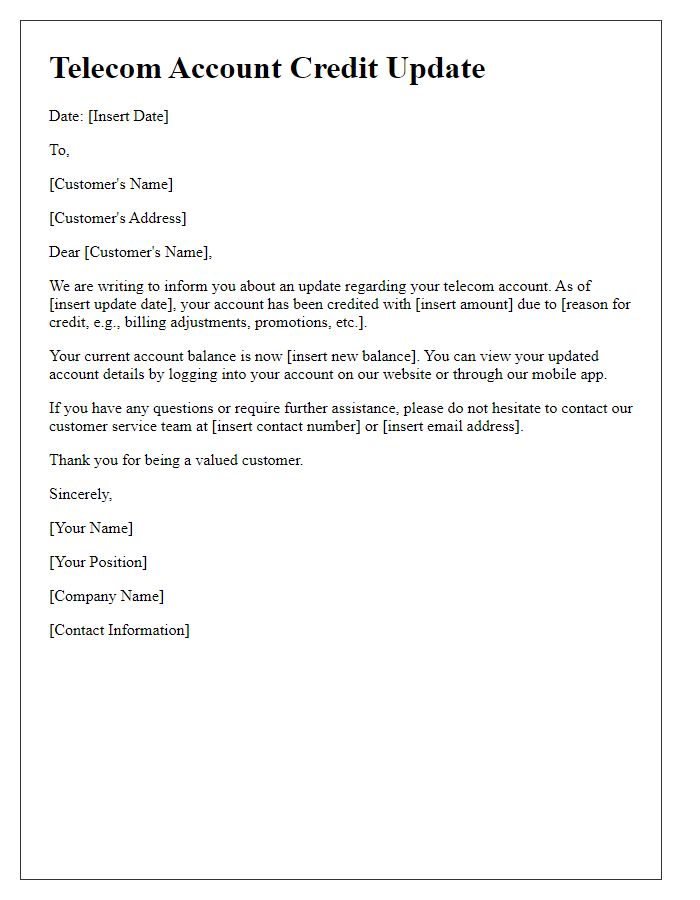

Telecommunication companies often issue credit adjustment notices for customer accounts. This process typically involves an account review where discrepancies or billing inaccuracies are identified. Customers might receive notifications for adjustments in service fees, data overages, or promotional credits that were not applied. Account details may include unique identifiers such as the customer account number, billing cycle dates, and service usage figures for the month. Specific events leading to these adjustments can involve service outages, overbilling incidents, or changes in contract terms, ensuring transparency in account management and customer relations. Notice templates often highlight these adjustments clearly, displaying the adjusted amounts, original charges, and final outstanding balance.

Reason for Credit Adjustment

Credit adjustments in telecom billing often arise from service outages, incorrect charges, or promotional discrepancies. System outages, such as unplanned service downtime lasting over 24 hours, may prompt adjustments to the monthly bill, reflecting an inconvenience to customer service. Incorrect charges can occur if a customer is billed for an upgraded plan that was never activated, requiring a meticulous review of the billing cycle and account settings to rectify. Promotional discrepancies, often linked to sign-up offers that promise discounts on a customer's first three billing cycles, necessitate accurate application to highlight transparency in billing and maintain customer satisfaction. Each adjustment ensures that billing practices align with legal regulations and customer expectations in a competitive telecom industry.

Amount of Credit Adjusted

Telecom companies frequently issue credit adjustment notices to inform customers of changes in their billing statements. These notices typically detail the specific amount of credit adjusted, such as $50, as well as the reason for the adjustment, which could include billing errors or service discrepancies. Customers should carefully review their monthly statements, especially if they are located in cities like New York or Los Angeles, where service plans may vary significantly. Understanding these adjustments helps maintain clarity in customer accounts, ensuring trust in their service provider's billing practices.

Effective Date of Adjustment

Telecom service providers often implement adjustments to customer accounts based on various factors such as billing errors or promotional offers. The effective date of the adjustment indicates when the changes reflect on the billing cycle. For instance, an adjustment due to a service outage might take effect from the billing period beginning on February 1, 2023, impacting the total amount due. The adjustment might include credits for service interruptions or overcharges, potentially ranging from $5 to $50, depending on the service plan and duration of the issue. Customers are typically notified through email or postal mail, ensuring they are informed about updated statements and any necessary actions required on their part.

Contact Information for Inquiries

Telecommunication service providers often issue credit adjustment notices to inform customers of changes to their billing. Accurate contact information is vital for customer inquiries regarding these adjustments. This includes the service provider's customer service phone number, typically available on their official website or account statement, as well as an email address for those who prefer digital communication. Facilitating easy access to representatives can enhance customer satisfaction. Additionally, the notice should reference specific billing periods, account numbers, and detailed descriptions of the credits applied to make the process clear and transparent.

Comments