In today's increasingly digital world, the risk of falling victim to fraudulent activities is higher than ever. It's crucial to be aware of the signs of fraud and understand the steps to take if you find yourself in such a situation. By reporting fraudulent activity promptly, you can help protect not only yourself but also others in your community. Ready to learn more about how to craft an effective fraud report? Keep reading!

Clear Statement of Allegation

Fraudulent activity can severely impact individuals and organizations, as seen in recent cases reported by federal agencies like the Federal Trade Commission (FTC). The alleged fraudulent scheme involves deceptive practices aimed at manipulating unsuspecting victims into disclosing sensitive information, often via phishing emails that appear legitimate. Fraudsters may use reputable company names like PayPal or Amazon to instill trust, leading to a spike in identity theft incidents in various regions, particularly in urban centers such as New York City and Los Angeles. Victims frequently report unauthorized transactions totaling thousands of dollars, highlighting the urgency for consumers to verify any unusual account activity. Furthermore, authorities encourage prompt reporting to help mitigate losses and support investigations aimed at apprehending perpetrators and safeguarding the community against future fraud occurrences.

Detailed Description of Incident

A fraudulent activity report detailing an incident can encompass a clear sequence of events surrounding financial misconduct. On June 15, 2023, at approximately 3:30 PM, an unauthorized online transaction occurred on a personal bank account belonging to Sarah Johnson, a resident of Los Angeles, California. The transaction, amounting to $1,200, originated from an unfamiliar web platform based in Singapore, purportedly linked to a travel service. The notification of this transaction was promptly sent via email, raising immediate suspicion. Within minutes, Sarah contacted her bank, Wells Fargo, where she discovered that her account had been compromised due to a phishing email received on June 12, 2023, that prompted her to input sensitive information. This incident highlights the growing threat of identity theft and digital financial crimes, requiring immediate attention from financial institutions to enhance security measures for consumer protection.

Evidence and Documentation

Fraudulent activity can severely impact financial institutions and individuals alike, requiring thorough documentation and evidence collection. Gathering materials such as bank statements (monthly records from institutions like JPMorgan Chase or Bank of America), transaction receipts (physical or digital proof from purchases), and communication records (emails or phone logs indicating suspicious conversations) is essential for outlining the occurrence clearly. It is vital to include any police reports (official documentation filed with local law enforcement agencies) or identity theft reports (complaints submitted to the Federal Trade Commission in the United States) to substantiate the claim. Additionally, photographs (digital images showing fraudulent activity) and screenshots (captures of online transactions indicating deceit) may provide critical visual evidence in support of the allegation. Each piece of evidence should be labeled and organized chronologically to ensure a comprehensive understanding of the fraudulent activities.

Impact and Consequences

Fraudulent activity can have severe repercussions for individuals and organizations alike. For example, identity theft, where personal information is stolen, can lead to financial losses amounting to thousands of dollars, affecting victims' credit scores (often dropping by over 100 points) and causing emotional distress. Businesses may face not only direct financial ramifications but also reputational damage, leading to a decline in consumer trust and potential legal consequences due to data breaches. In the U.S., the Federal Trade Commission reported nearly 2.8 million fraud complaints in 2022, illustrating the widespread impact. Additionally, the emotional consequences for victims, including anxiety and a sense of violation, can persist long after financial restitution. Comprehensive reporting and swift action are essential in mitigating these risks and restoring security.

Request for Action and Resolution

Fraudulent activity detection is critical for maintaining financial security, particularly in banking institutions such as Wells Fargo and Bank of America. Unauthorized transactions, typically exceeding $500, can lead to significant financial loss for customers. Reporting these incidents promptly ensures that protective measures, like transaction freezes and account monitoring, are implemented swiftly. Financial institutions often employ advanced security protocols, including real-time alerts and two-factor authentication, to prevent further fraudulent activity. In cases where personal information is compromised, identity theft protection services, covering up to $1 million in insurance, may be offered to affected clients. Immediate action is essential to mitigate damage and restore trust in financial systems.

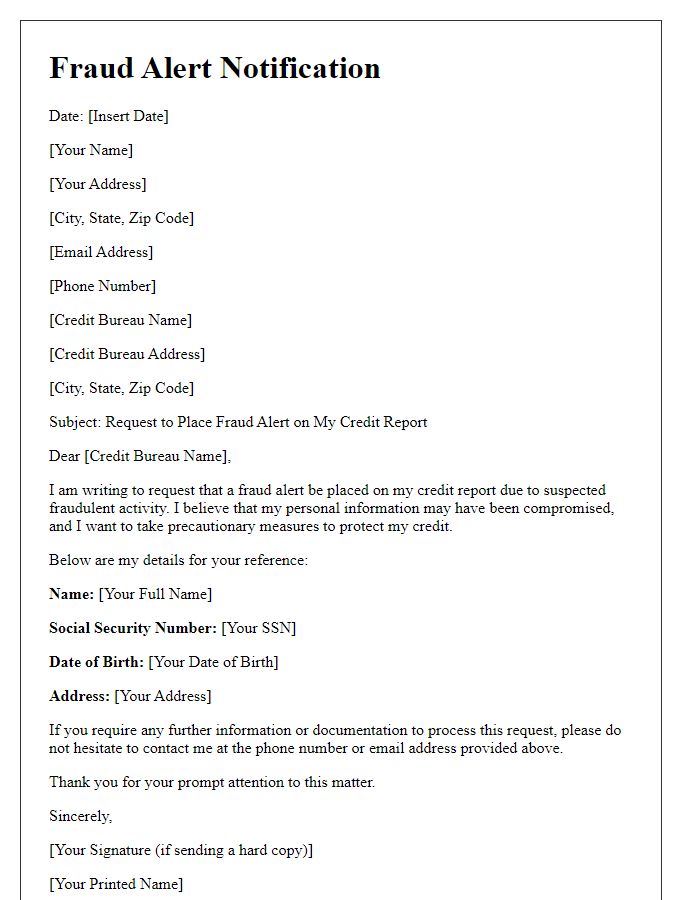

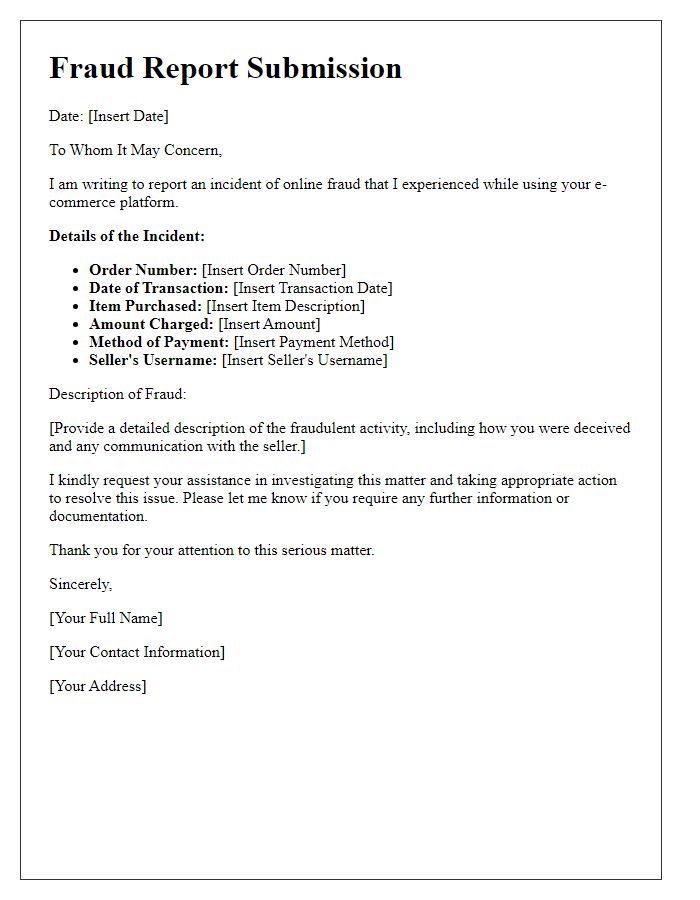

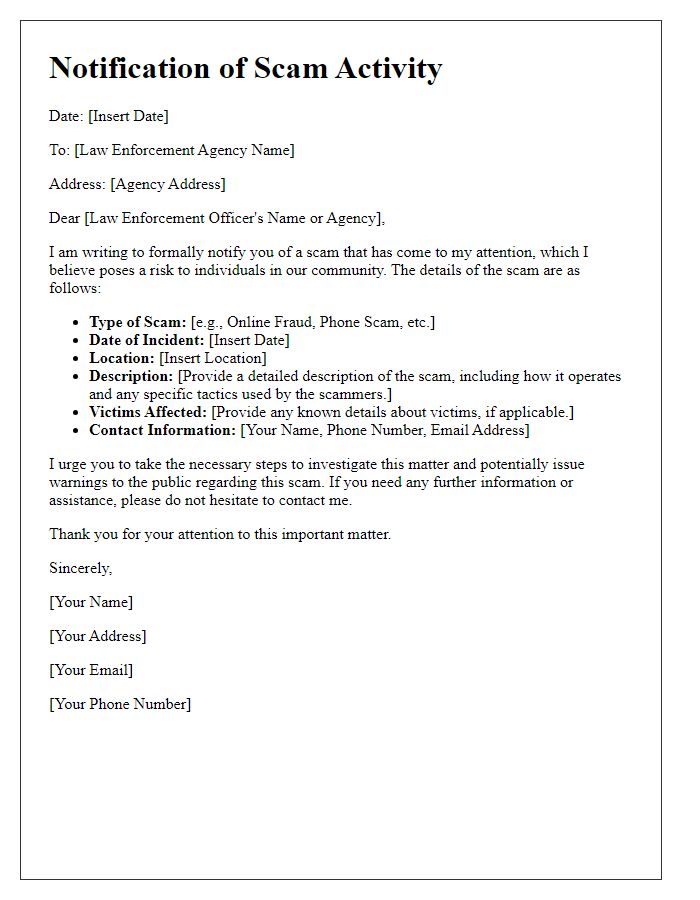

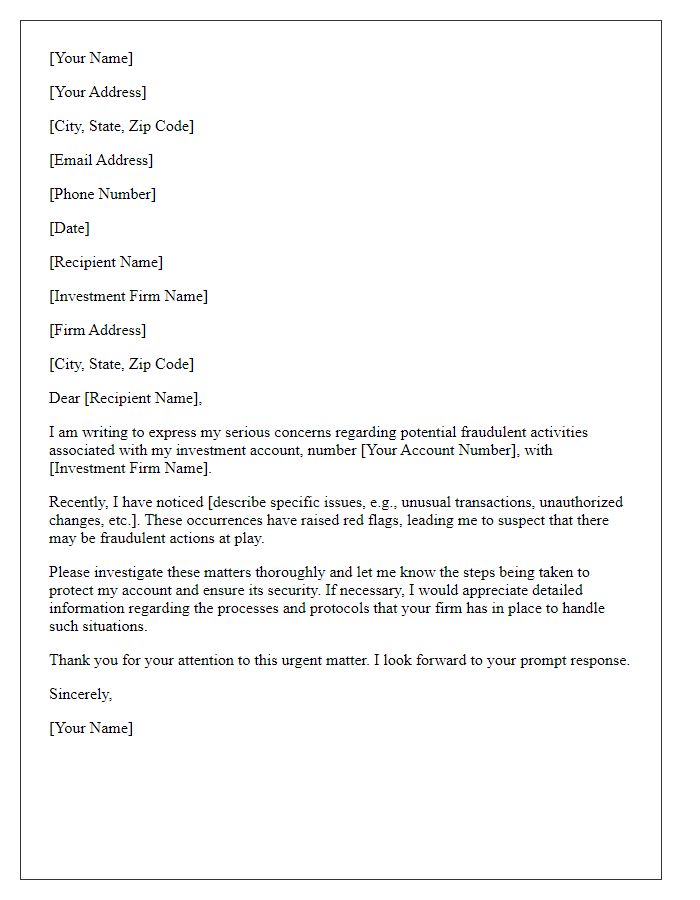

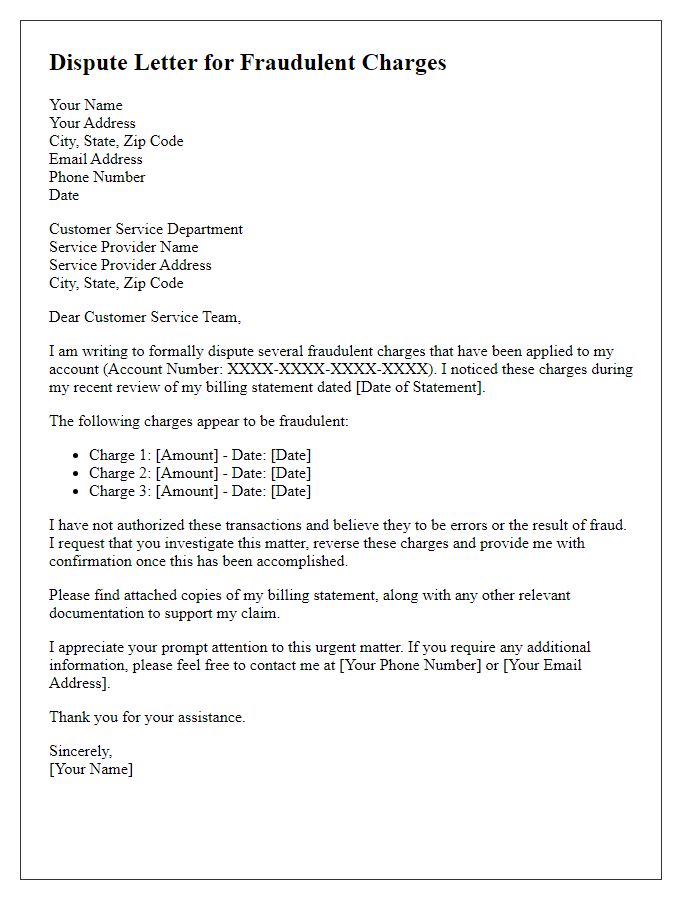

Letter Template For Fraudulent Activity Report Samples

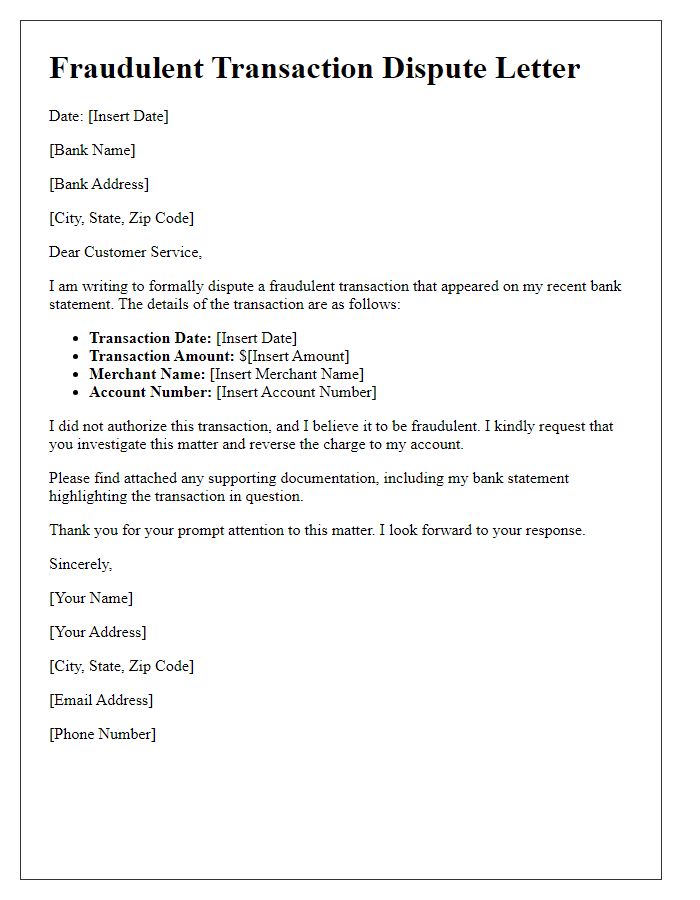

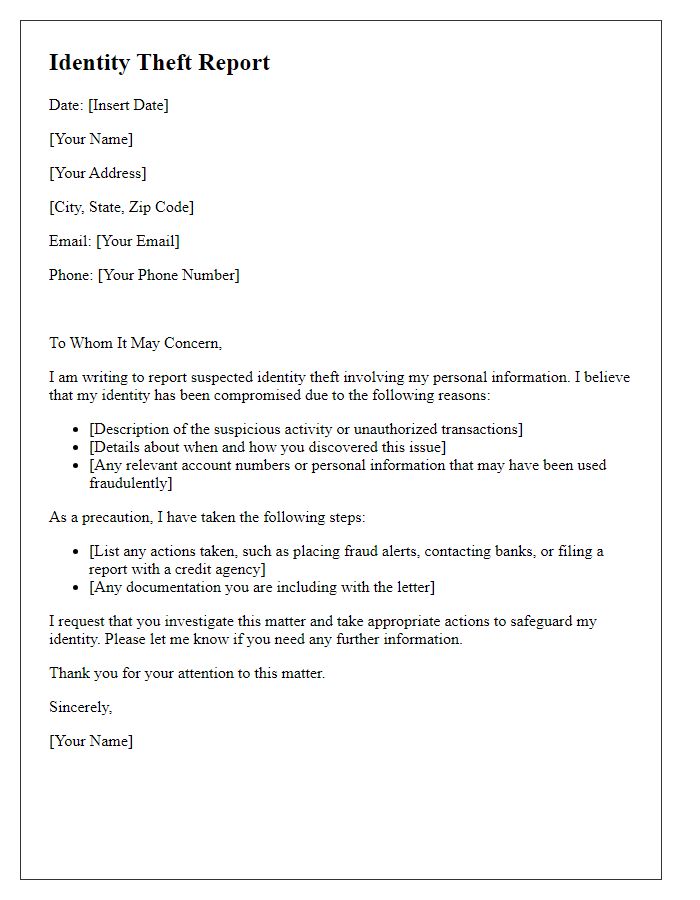

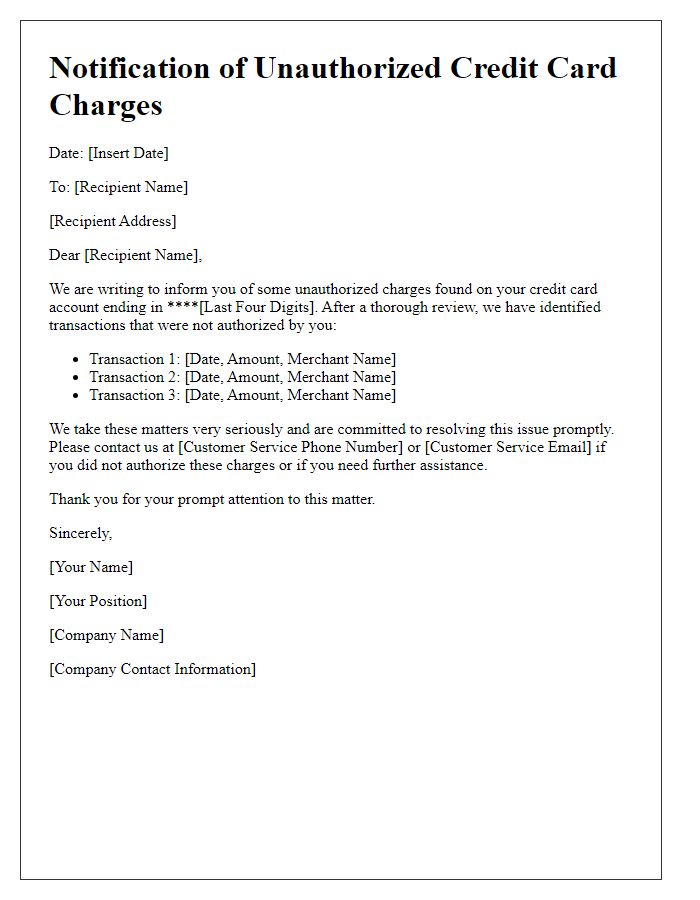

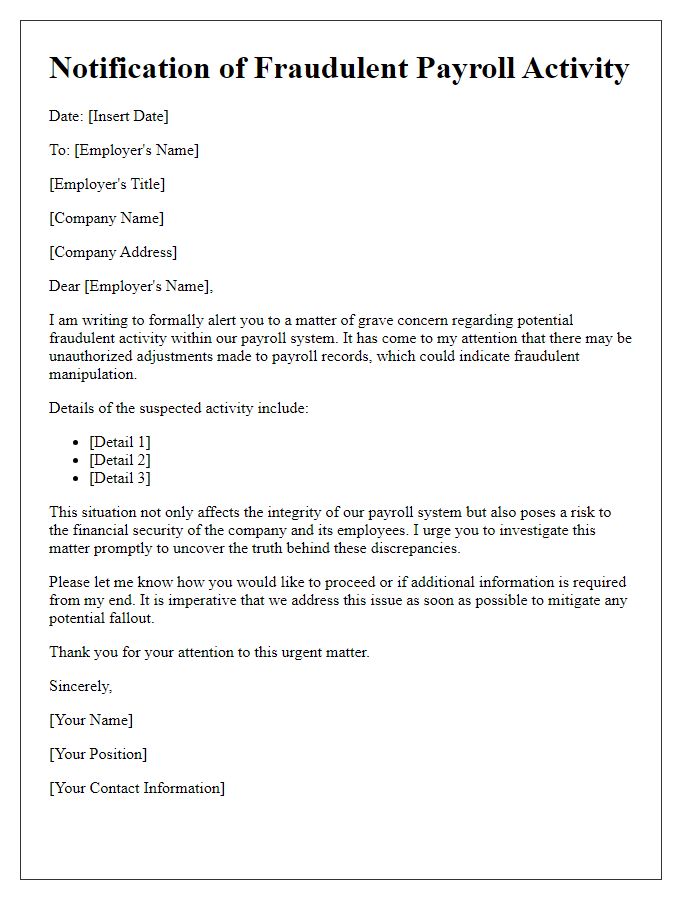

Letter template of fraudulent activity notification to financial institution.

Comments