Hey there! If you've ever found yourself in a situation where an overdue payment has slipped your mind, you're certainly not alone. Life gets busy, and sometimes we just need a gentle reminder to keep things in check. In this article, we'll explore how to craft an effective letter to address overdue payments, ensuring clear communication and maintaining a positive relationship. So, let's dive in and discover some tips that can help you navigate this situation with ease!

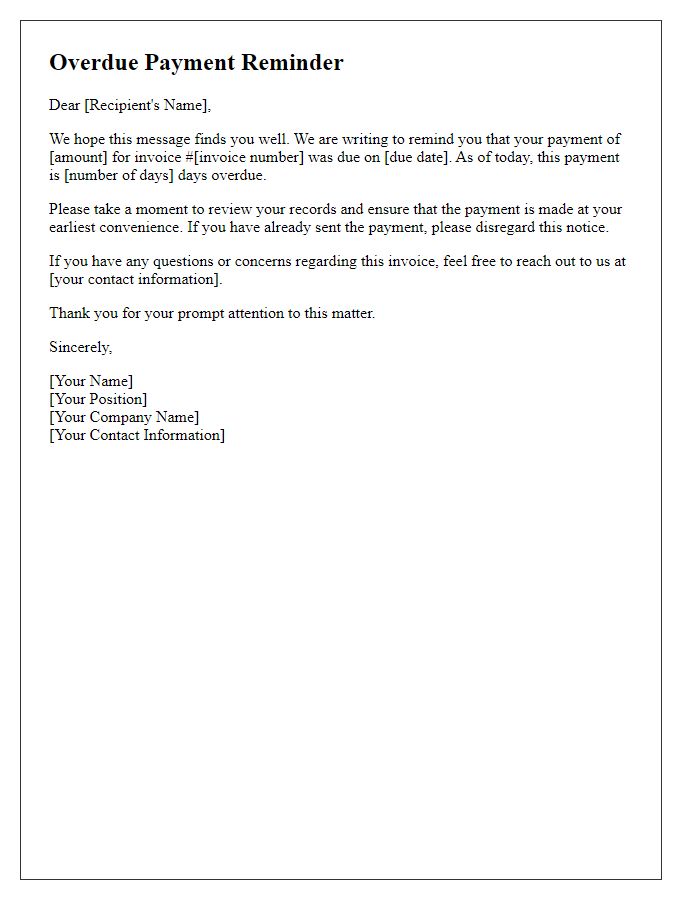

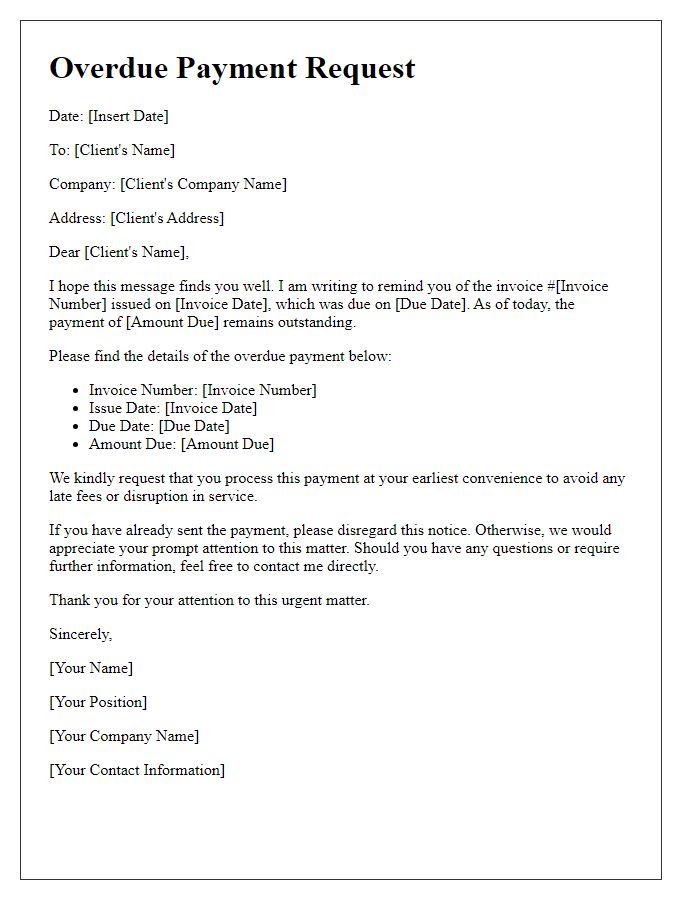

Clear Identification of Invoice Details

An overdue payment situation often arises due to specific invoice details that require clear identification. For example, an unpaid invoice from ABC Corporation dated August 15, 2023, with an invoice number 12345, is now 30 days overdue. The total amount due is $2,500, which covers services rendered, including web design and hosting fees from July 2023. A breakdown of the charges reveals a $1,500 fee for web design services and a $1,000 charge for hosting, both critical components for ensuring online presence. Timely payment is essential to maintain continuous service and avoid late fees, which can accumulate at a rate of 2% per month. Clear communication of these details can help resolve misunderstandings regarding overdue payments promptly.

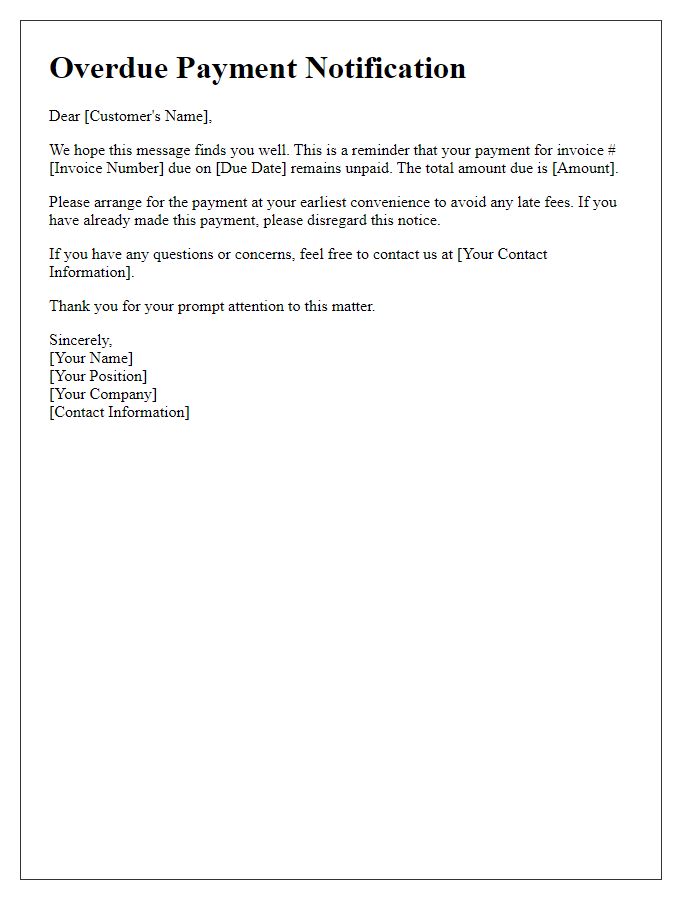

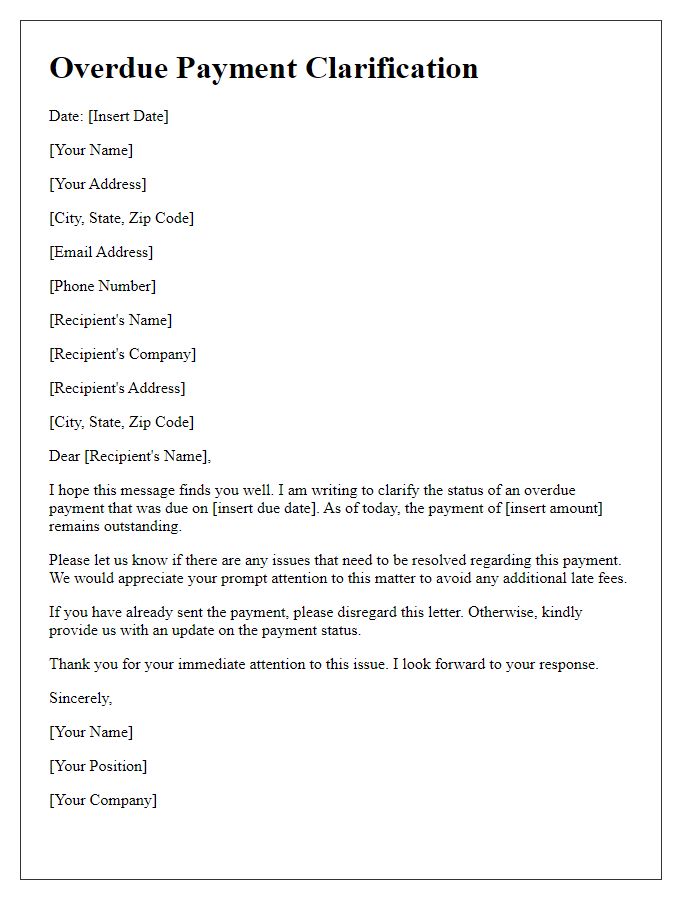

Polite Acknowledgment of Delay

Customers frequently face delays in payment processing due to various factors. Common issues include unexpected financial constraints or administrative oversights. Instances of overdue payments can strain business relationships, potentially resulting in service interruptions. Addressing this matter promptly is essential to maintain trust and accountability. Keeping a clear record of communication, including dates and amounts owed, will aid in resolving issues effectively. A polite acknowledgment of such delays fosters understanding and encourages timely payments in the future, essential for the financial health of any business.

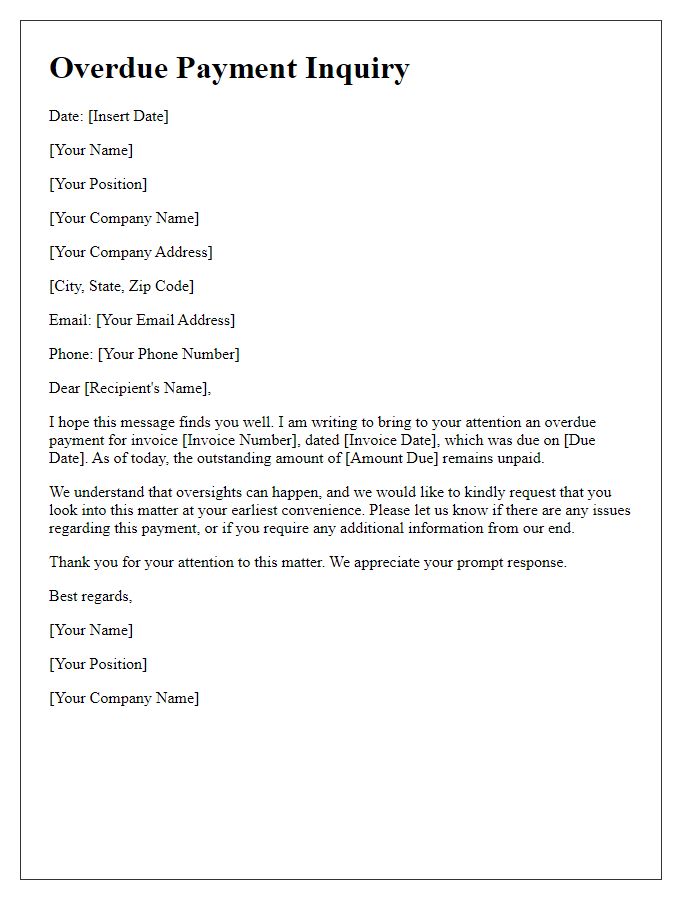

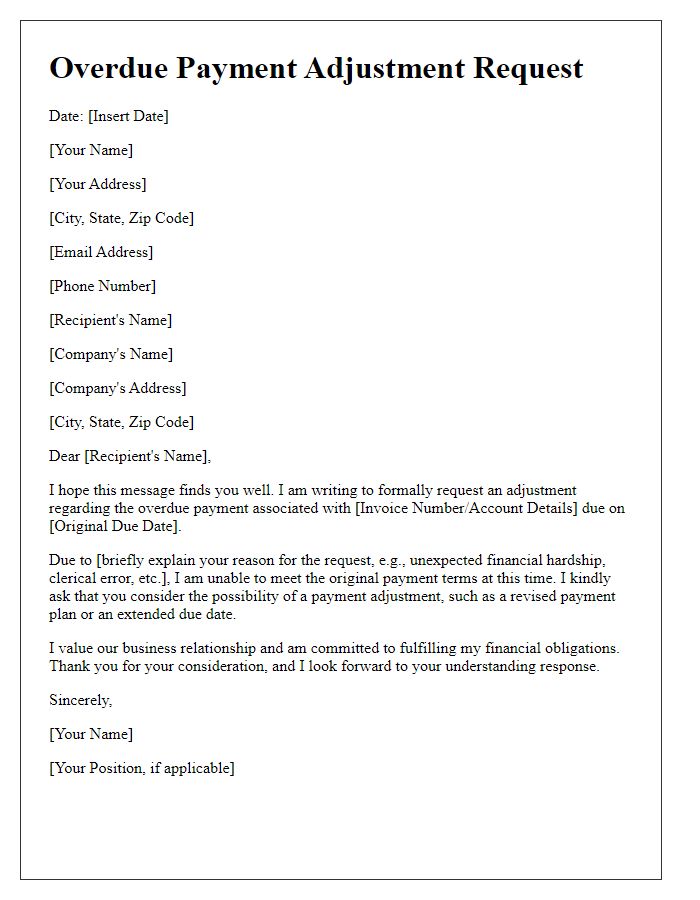

Concise Explanation of Reason

Overdue payments can arise from unforeseen circumstances such as unexpected medical expenses or job loss, impacting cash flow. In the case of the account linked to the previous invoice numbering (e.g., invoice #12345) dated March 15, 2023, the delay stemmed from a sudden medical emergency, resulting in significant out-of-pocket costs. Customers within a specific region, like New York, might experience additional financial stress due to increased living expenses. Therefore, reaching out promptly and discussing flexible payment options can facilitate a resolution, ensuring that both parties maintain a positive working relationship while addressing the outstanding balance.

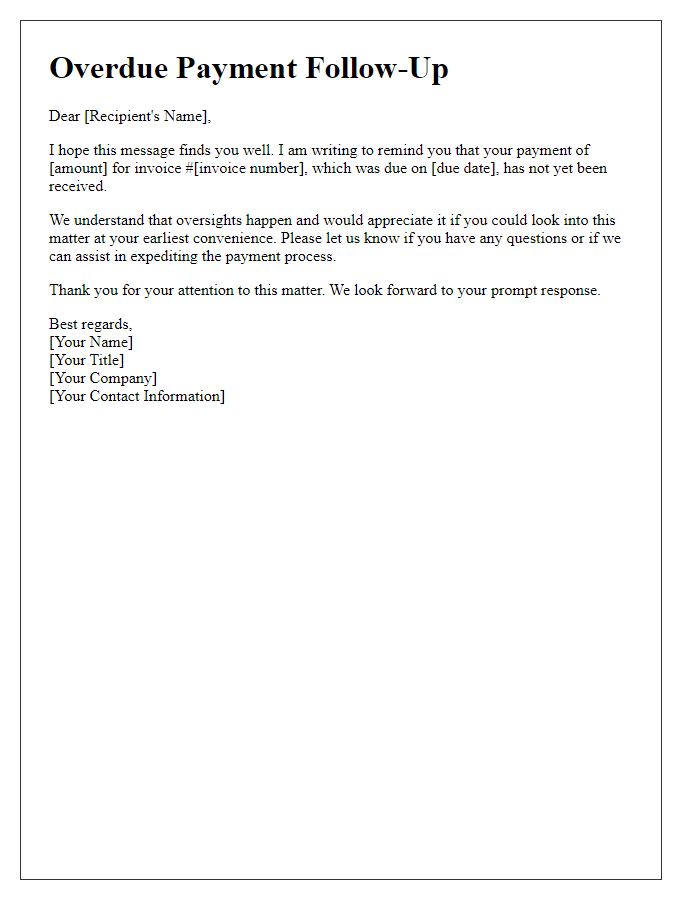

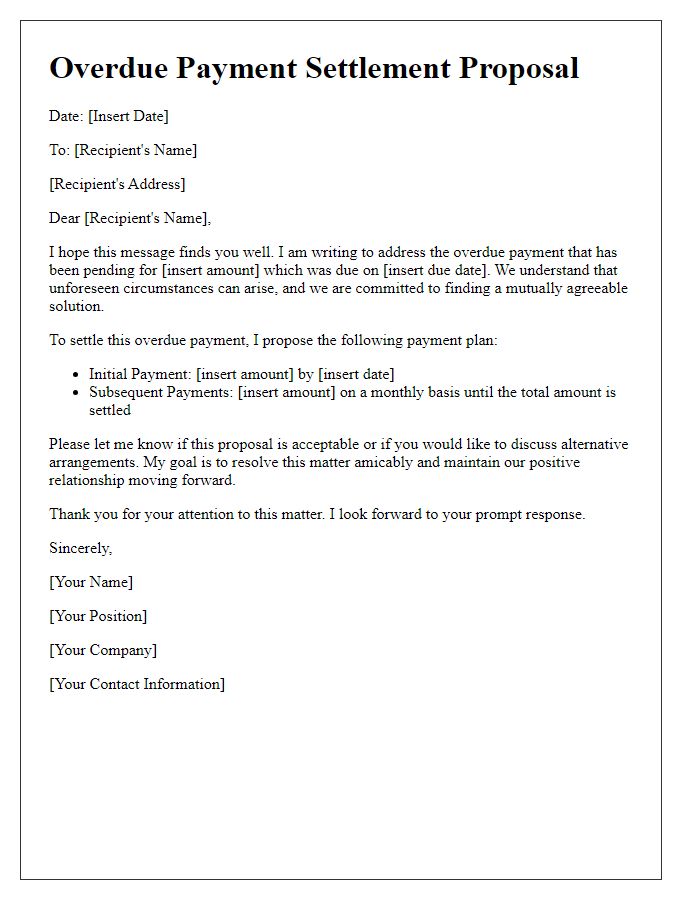

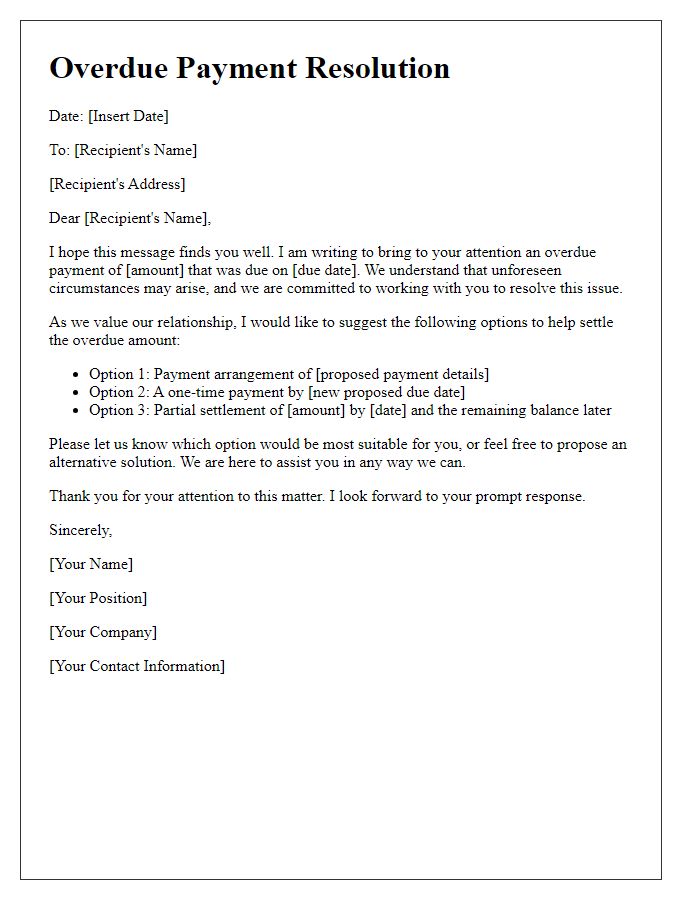

Assurance of Payment Commitment

Overdue payments can create issues for businesses and clients, affecting cash flow and trust. Many individuals and organizations maintain contractual agreements for services rendered or products delivered, typically outlining payment terms. In these agreements, due dates are established, often ranging from 30 to 90 days post-invoice. If payments exceed these deadlines, stakeholders may experience financial strain. Clear communication regarding payment delays is essential, reassuring affected parties of the commitment to fulfill obligations. For example, payment plans can be proposed, detailing specific dates and amounts to remedy the situation. This proactive approach fosters transparency and preserves long-term relationships in various sectors including finance, healthcare, and retail.

Contact Information for Further Communication

In case of overdue payments, utilizing effective communication is crucial for resolution. Relevant contact information should include a dedicated phone number (such as a customer service line), an email address (preferably monitored regularly for prompt responses), and physical mailing address for sending formal notices or documents. Additionally, including a specific contact person's name (like the billing manager) can direct inquiries efficiently. This targeted approach ensures that all parties remain informed, minimizing misunderstandings regarding account status and payment obligations.

Comments