Are you considering the exciting journey of acquiring a tech startup? Understanding the intricacies of a well-crafted acquisition proposal can make all the difference in securing a successful partnership. With the right approach, you can outline your vision, articulate the benefits, and maintain a conversational tone that resonates with the founders. Dive into our article to discover essential tips and a customizable letter template to streamline your acquisition process!

Introduction and Purpose

A technology startup acquisition proposal introduces the strategic intent to acquire a rapidly growing company in the software industry, focusing on innovative solutions such as artificial intelligence and data analytics. The purpose of this acquisition is to enhance market share and achieve synergies by leveraging the target company's cutting-edge intellectual property and talented workforce. Increasing demand for cloud-based services and digital transformation solutions underlines the significance of this proposal. The aim is to integrate advanced technologies that can drive revenue growth and improve customer experiences, ultimately positioning the combined entity as a leader in the highly competitive tech landscape.

Business Synergies and Benefits

A technology startup acquisition proposal highlights the potential business synergies and benefits from the merger of two innovative entities. Enhanced revenue streams can be achieved through combined resources and expertise in fields such as machine learning (ML) and artificial intelligence (AI), particularly in the fast-growing sectors of healthcare and finance. The integration of proprietary technologies, like advanced data analytics platforms, can create a competitive edge in the market. Additionally, access to a broader customer base from both organizations can lead to increased market share. A collaborative work environment can promote knowledge sharing and talent retention, empowering teams to innovate further. These factors contribute to long-term scalability, fostering resilience against economic fluctuations in the tech industry.

Financial Offer and Valuation

Tech startups seeking acquisition often undergo meticulous financial evaluations to establish a robust valuation basis. Factors include projected revenue growth, customer acquisition costs, and market share analytics, especially in competitive landscapes like Silicon Valley. Comparable company analysis might reveal valuations ranging from 3x to 10x revenue multiples, depending on growth stage and sector performance. Due diligence processes frequently encompass assessments of intellectual property assets, customer retention rates exceeding 70%, and EBITDA margins. An enticing financial offer may incorporate cash components, equity stakes, or profit-sharing arrangements, ensuring alignment of interests between the acquiring firm and the startup founders, ultimately enhancing strategic synergies.

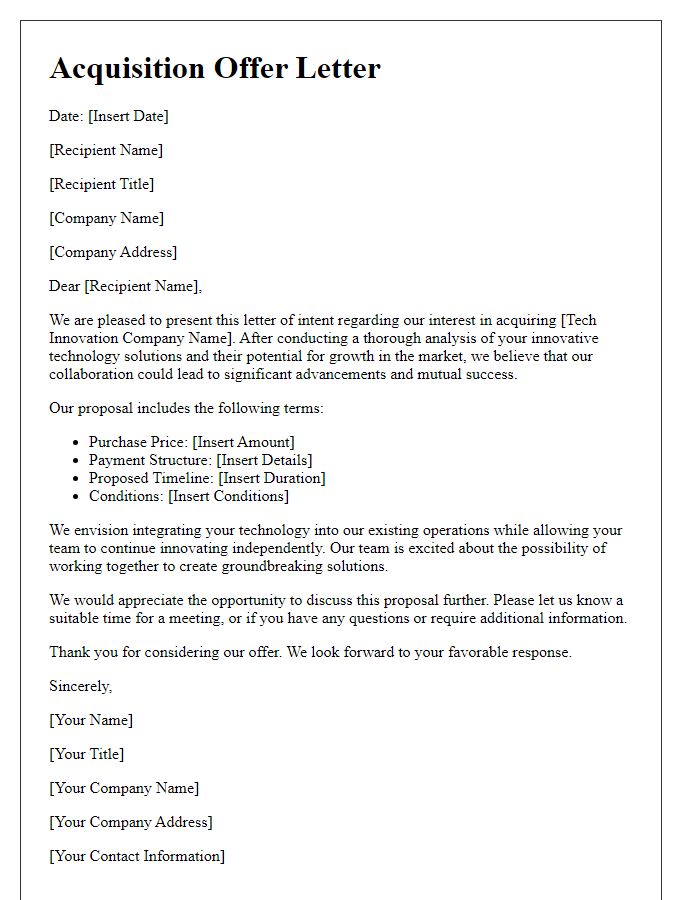

Terms and Conditions

A comprehensive acquisition proposal for a tech startup typically includes critical elements such as valuation metrics (determined by revenue streams, user growth rates, and market share), terms of payment (cash, stock options, or a combination), and due diligence requirements (financial audits, legal compliance, and operational assessment). Consideration for employee retention plans (stock options or performance bonuses) and transition periods (timeframes for integration) are crucial for smooth operations post-acquisition. Additionally, non-compete clauses (restricting founders from starting similar ventures for specified durations) and confidentiality agreements (protecting sensitive information during negotiations) form an essential part of the terms and conditions, ensuring an ethical and legally sound transition.

Confidentiality and Next Steps

A confidentiality agreement is crucial in the context of a tech startup acquisition proposal, ensuring that sensitive information remains protected during negotiations. Key details include the names of the involved parties, the definition of confidential information--such as proprietary technologies, financial data, and business strategies--and the duration of confidentiality, typically spanning three to five years. Next steps involve due diligence, where both parties evaluate financial statements, intellectual property, and market position to assess the value and compatibility of the acquisition. Establishing a timeline for discussions and setting up regular meetings to address concerns foster a transparent exchange, ultimately leading to a potential agreement that aligns with strategic objectives.

Comments