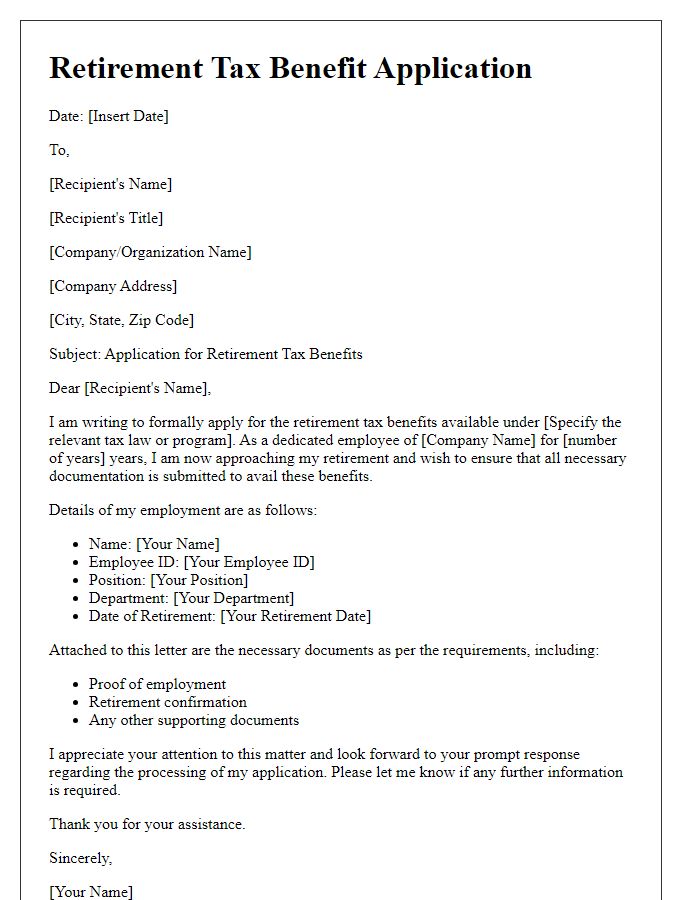

Are you considering retirement and wondering about the tax benefits that can come your way? Understanding retirement tax benefit schemes is crucial to maximizing your savings and ensuring a comfortable future. In this article, we'll explore various options available to you, from contributions to retirement accounts to potential deductions you may qualify for. So, let's dive in and discover how you can make the most of your hard-earned money!

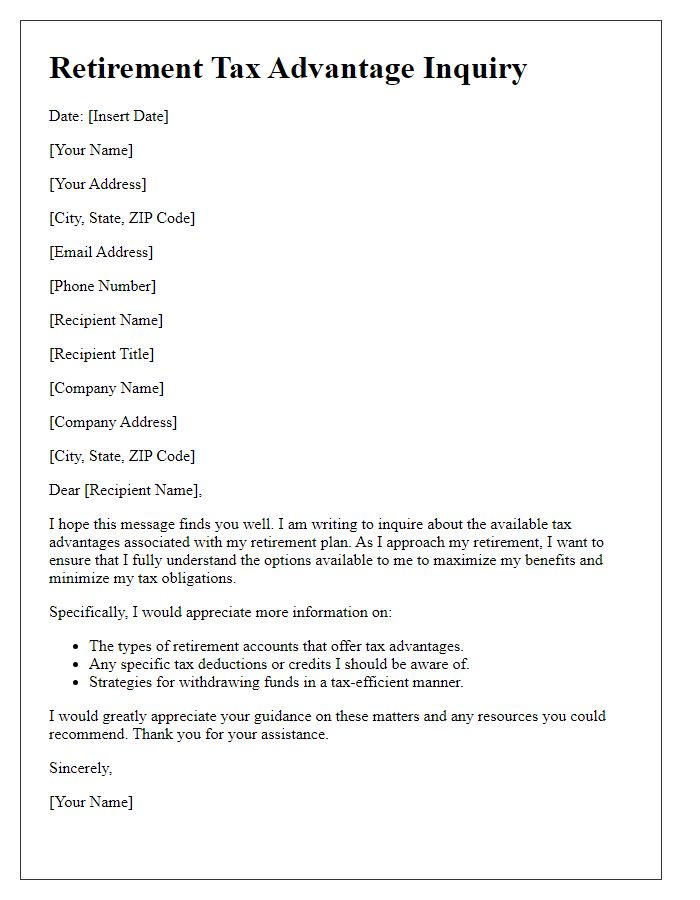

Tax-efficient withdrawal strategies

Retirement tax benefit schemes offer individuals strategic methods to withdraw funds while minimizing tax obligations. Key elements such as Individual Retirement Accounts (IRAs) and 401(k) plans provide advantageous options for tax-efficient withdrawals. Investors can utilize strategies like Roth conversions, allowing tax-free growth on investments, and Traditional IRA withdrawals, which may incur ordinary income tax rates depending on age and tax bracket. Maximizing tax benefits often involves staggered withdrawals over several years to maintain lower overall income levels, thereby reducing tax liability. Additionally, understanding the nuances of capital gains taxes on investments can further enhance retirement withdrawal strategies, leading to more financially sustainable retirement years.

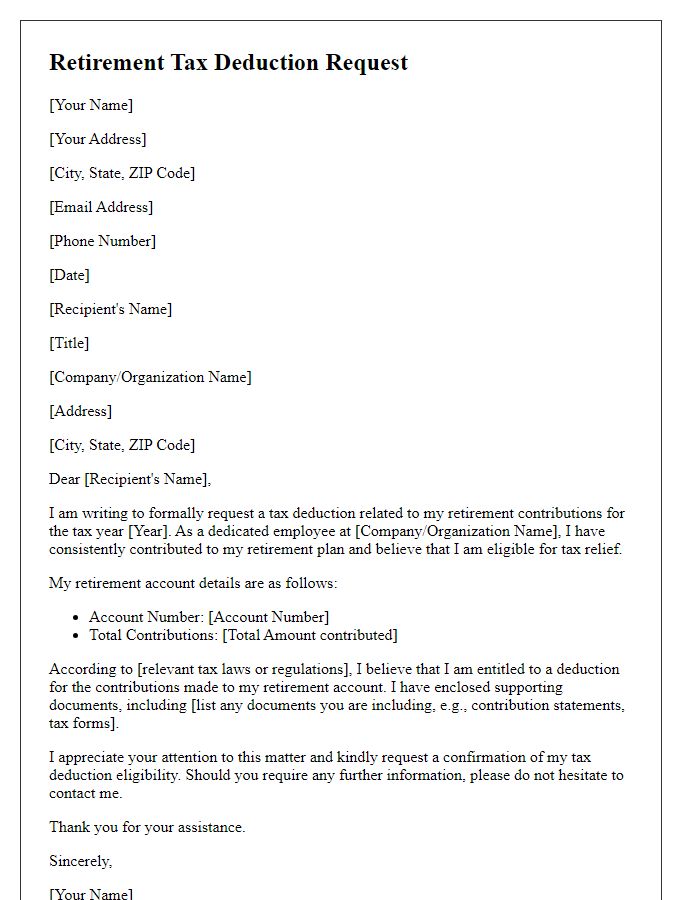

Compliance with tax laws and regulations

Retirement tax benefit schemes provide individuals the opportunity to optimize their financial standing upon retirement. These schemes, such as 401(k) and IRA in the United States, offer tax-deferred growth, allowing investments to compound without immediate taxation. Compliance with tax laws, like the Internal Revenue Code (IRC), is crucial to avoid penalties; for example, exceeding contribution limits can result in a 6% excise tax on the excess amount for each year. Additionally, understanding withdrawal rules, such as the age 59 1/2 penalty-free rule for distributions, is essential for effective planning. Engaging with a financial advisor can ensure that individuals adhere to regulations, maximizing the advantages while mitigating risks associated with retirement planning.

Detailed financial summary and projections

Retirement tax benefit schemes provide individuals with various tax advantages aimed at encouraging savings for retirement. For instance, 401(k) plans (qualified retirement savings accounts) allow participants to contribute up to $19,500 annually, with those aged 50 and older able to add catch-up contributions of $6,500. Traditional IRAs (Individual Retirement Accounts) permit contributions up to $6,000, providing tax deductions based on income levels up to $139,000 for single filers in 2023. Projections for these accounts highlight the power of compounding interest, with an estimated 7% annual return potentially doubling a $100,000 investment in roughly ten years. Additionally, tax deferral mechanisms enable individuals to reduce their taxable income, promoting long-term savings growth. Advisors recommend regularly evaluating investment performance and tax implications, especially as retirement age approaches, to optimize financial security in later years.

Eligibility criteria for tax benefits

Retirement tax benefit schemes, such as 401(k) plans in the United States or NPS in India, offer substantial tax advantages to encourage saving for retirement. Basic eligibility criteria typically include age (usually 18 years or older), employment status (must have earned income), and contribution limits (which vary annually, e.g., $20,500 for 401(k) plans in 2022). For instance, to qualify for specific tax deductions, individuals may need to contribute a minimum percentage of their income, and certain schemes may require participants to hold their accounts until reaching a specified retirement age, commonly 59.5 years. These criteria ensure that participants benefit from tax-free growth and potential tax deductions on contributions, incentivizing long-term saving habits.

Contact information for financial consultation

Retirement tax benefit schemes, such as 401(k) plans and IRAs (Individual Retirement Accounts), offer significant advantages for long-term savings. These schemes often allow pre-tax contributions, reducing taxable income during working years. In 2023, the contribution limits for a 401(k) plan can reach up to $22,500, while individuals over 50 can make catch-up contributions. Financial institutions and certified tax professionals can provide consultation, guiding individuals through options to maximize these benefits. Contact information for financial advisors, typically including phone numbers and email addresses, is crucial for personalized financial planning tailored to retirement goals.

Comments