Negotiating payment terms with suppliers can feel daunting, but it doesn't have to be! Open communication is key to establishing a mutually beneficial agreement that helps both parties flourish. By discussing payment timelines, discounts, and penalties, you can create a payment structure that supports your business's cash flow while showing your supplier you're committed to a long-term partnership. Ready to dive deeper into effective negotiation strategies? Let's explore the ins and outs together!

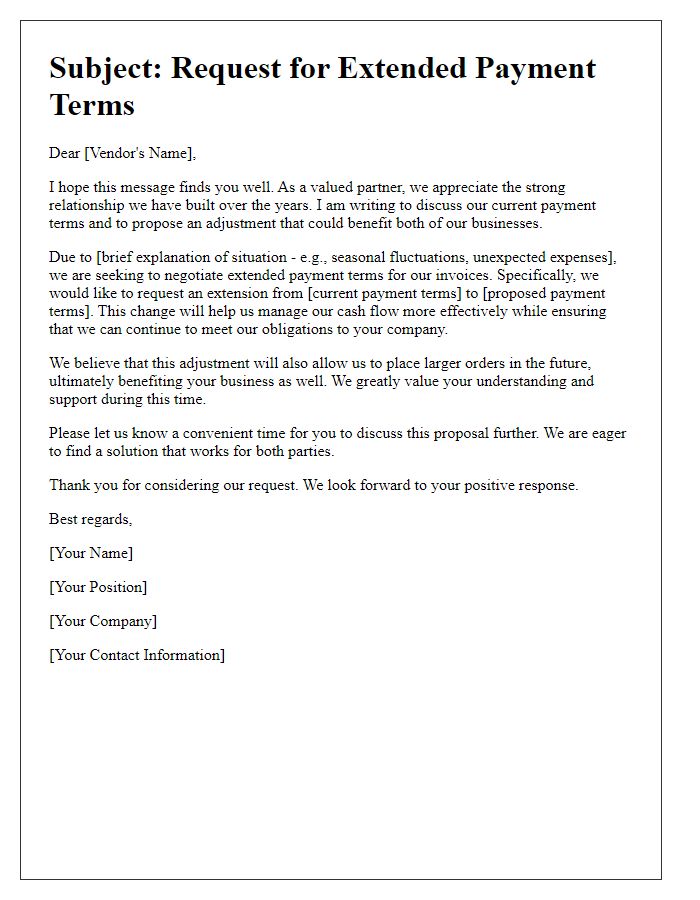

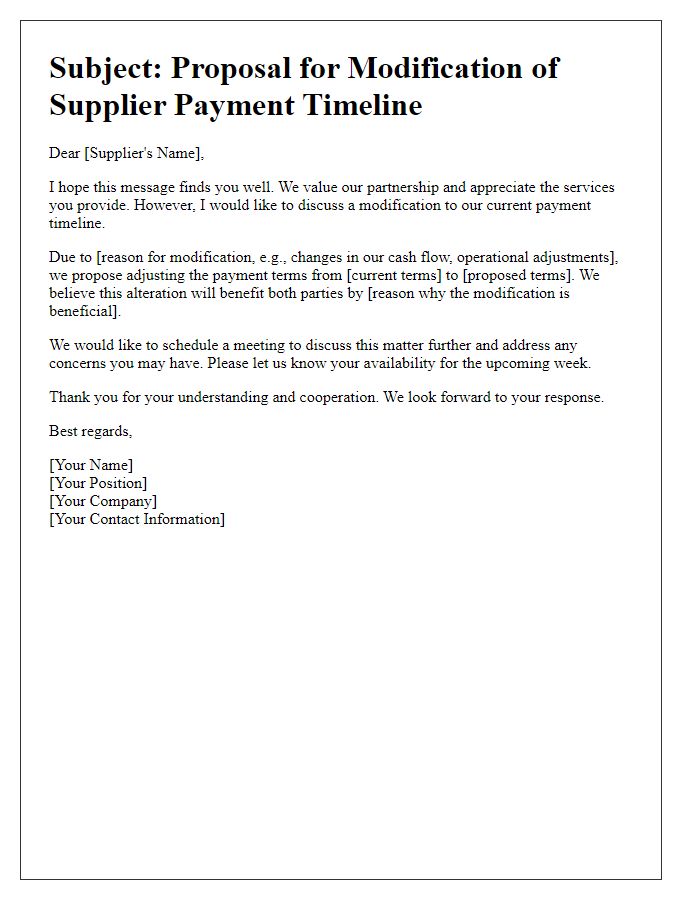

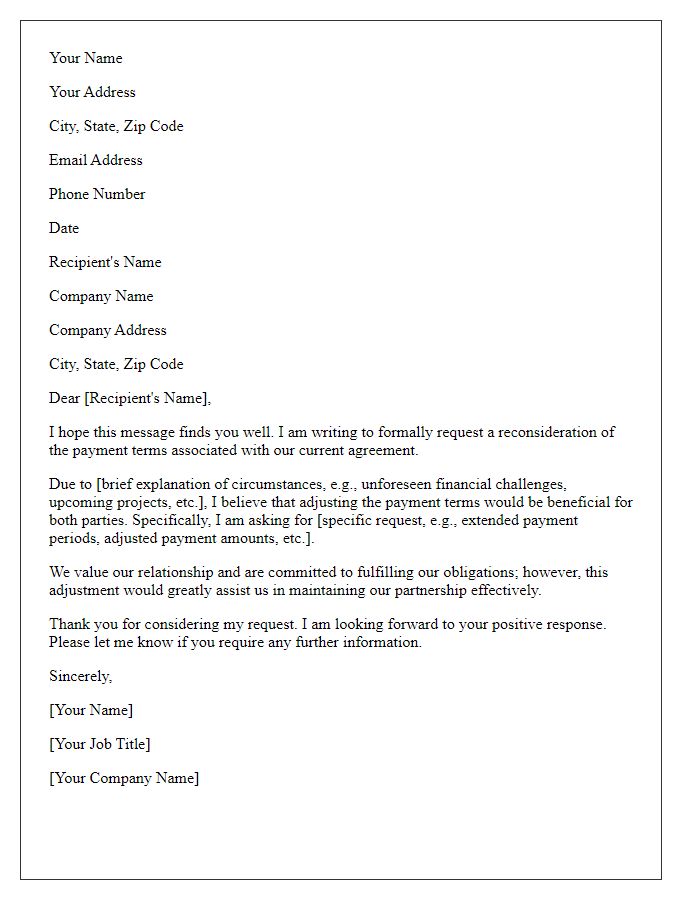

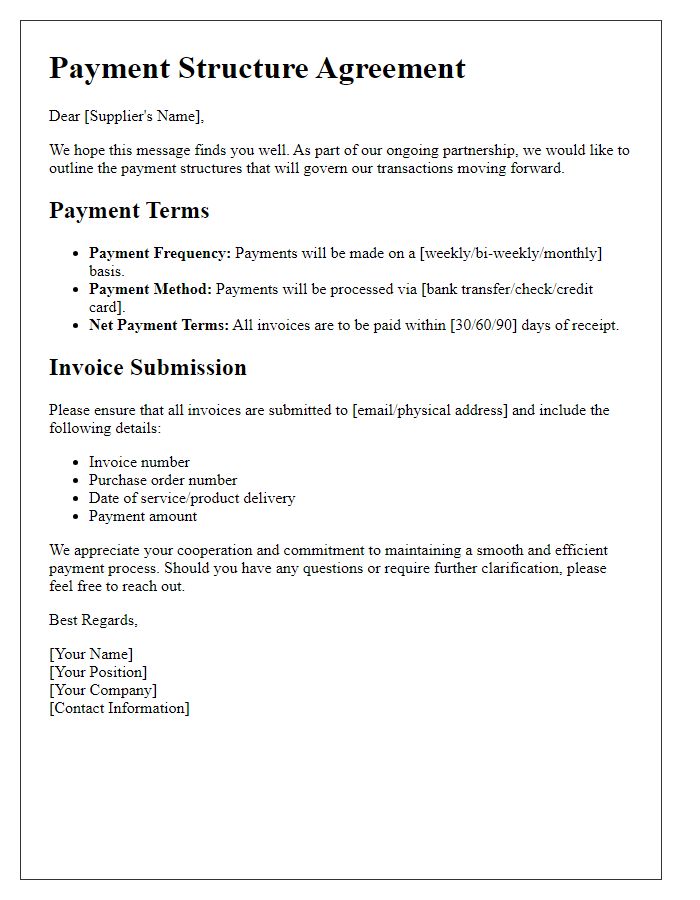

Clear subject line

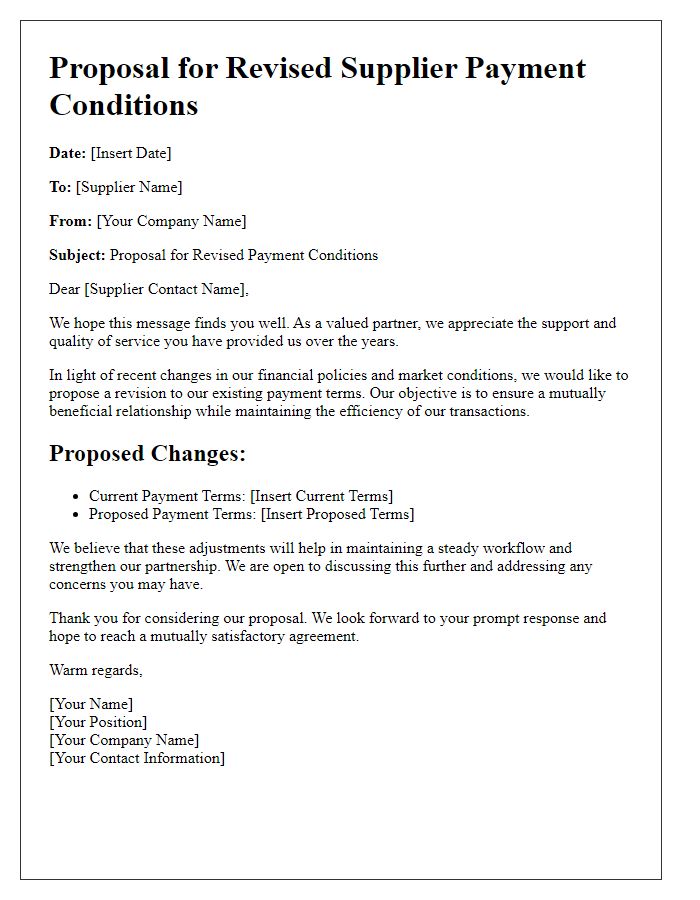

Negotiating payment terms with suppliers can significantly impact cash flow management. Clear communication is essential during this process. Establish a defined subject line such as "Proposal for Revised Payment Terms" to immediately convey the purpose of the correspondence. Include specific details such as proposed payment duration (e.g., net 30, net 60 days) and any early payment discounts (e.g., 2% discount for payments made within 10 days). The objective is to reach mutually beneficial terms that align with the financial practices of the business while maintaining a strong relationship with suppliers. Consistency in payment terms fosters trust and reliability, encouraging timely deliveries and collaboration on future projects.

Introduction and relationship acknowledgment

Establishing a fruitful partnership with suppliers hinges on clear and effective payment terms. Initiating discussions entails recognizing the existing relationship built on mutual trust and collaboration. Acknowledgment of the supplier's contribution to business operations highlights their role in ensuring timely deliveries and quality materials. When negotiating payment terms, it is crucial to articulate a balance that respects the supplier's financial needs while aligning with the company's cash flow requirements. This mutually beneficial approach fosters long-term stability and growth for both parties involved, laying the groundwork for transparent communication and future dealings.

Current payment terms overview

Current payment terms overview for suppliers highlights essential financial agreements that dictate the timing and conditions of payments for goods and services. Standard payment terms often range from net 30 to net 90 days, reflecting the period allowed for invoice settlement after receipt of products. Conditions may include early payment discounts, typically ranging from 1% to 3% if paid within a specified period, or penalties applied for late payments, which could escalate to an additional 1.5% per month. Such arrangements aim to improve cash flow for suppliers while considering the purchasing organization's liquidity requirements, influencing overall procurement strategies and supplier relationships. Understanding these terms helps organizations optimize their supply chain management and maintain financial health.

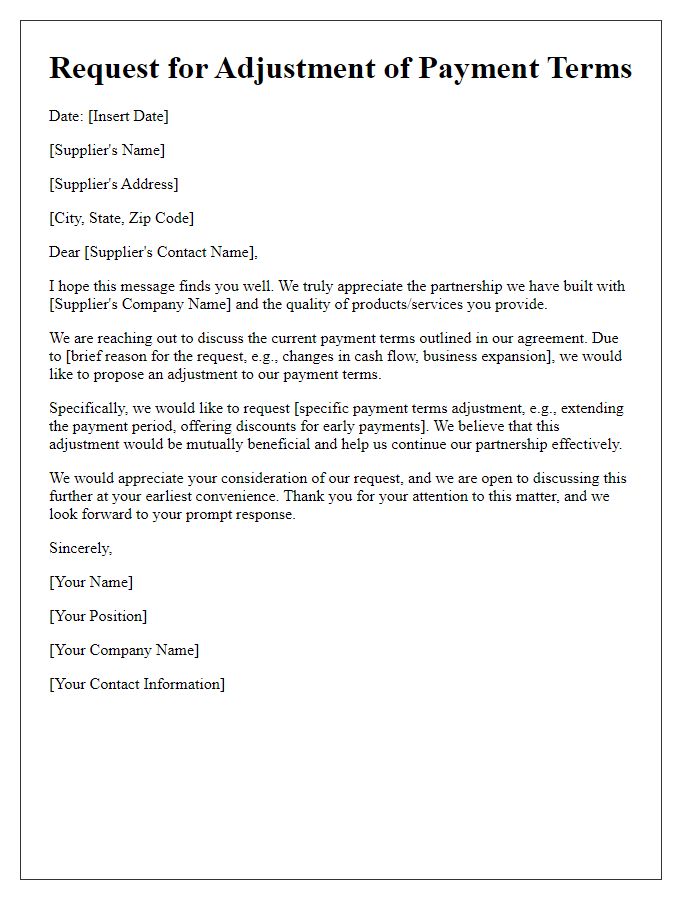

Proposed payment terms and rationale

Negotiating favorable payment terms with suppliers can significantly impact cash flow management for businesses. Consider a payment term proposal of net 60 days instead of the standard net 30 days. This extended timeframe allows businesses to align cash inflows from customer payments with outgoing expenses, easing financial pressure. During peak production periods, such as holiday seasons where inventory turnover is high, flexibility in payment schedules becomes crucial. Suppliers such as ABC Manufacturing in the electronics sector may benefit from this arrangement as it ensures larger order volumes in exchange for extended payment timelines. Providing assurance of continued orders (e.g., forecasting increases of 20% in the next quarter) can strengthen the negotiation position while maintaining fruitful supplier relationships.

Closing with appreciation and next steps

Negotiating supplier payment terms involves a detailed approach to ensure both parties understand the conditions of the agreement. Payment terms such as Net 30, Net 60, or discounts for early payment significantly impact cash flow for businesses. Companies often engage in discussions to approach terms that benefit operational needs while fostering long-term relationships. After reaching a mutual understanding, expressing gratitude for the collaborative effort strengthens partnership ties. Completing the negotiation typically includes outlining the next steps, such as drafting the formal agreement and scheduling a follow-up meeting to finalize details. Appreciate the supplier's flexibility and willingness to collaborate on mutually beneficial terms.

Letter Template For Supplier Payment Terms Negotiation Samples

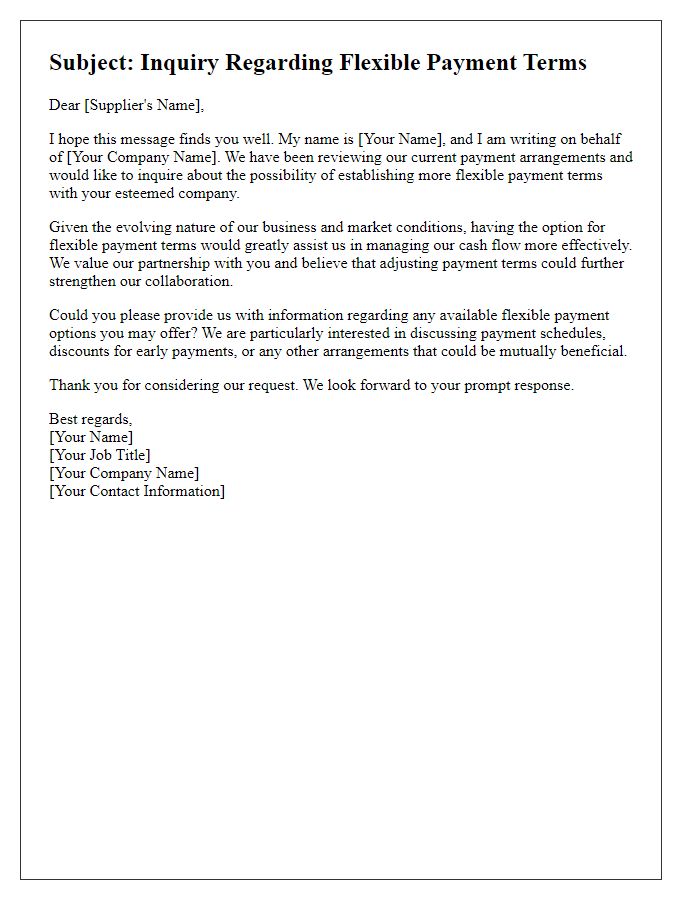

Letter template of inquiry regarding flexible payment terms with suppliers

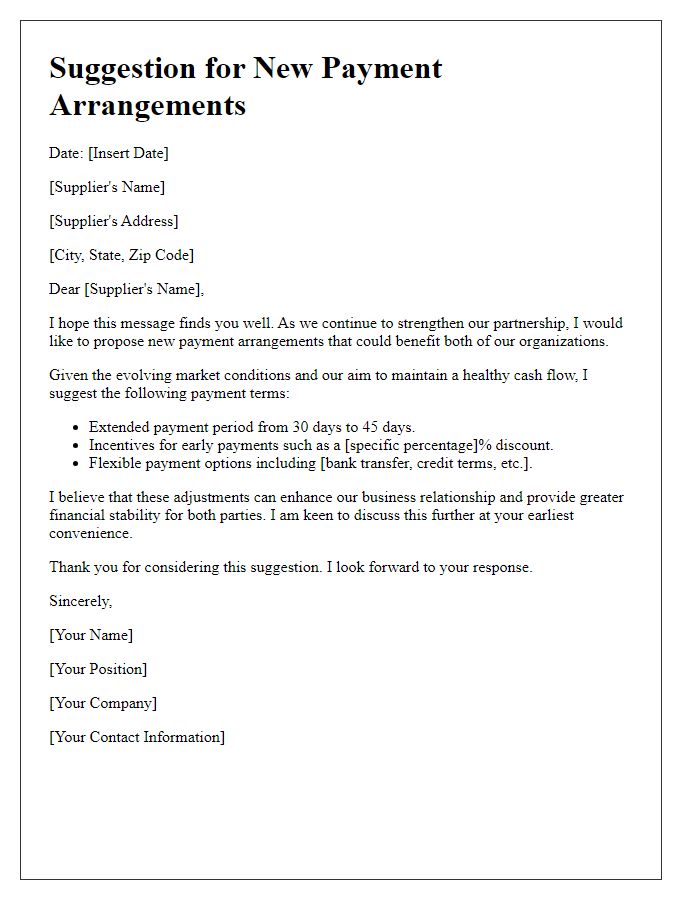

Letter template of suggestion for new payment arrangements with suppliers

Comments