Are you looking to secure a credit reference from your suppliers but unsure how to get started? Crafting the perfect request letter can be a game changer in establishing trust and reliability in your business relationship. It's essential to approach the matter professionally while maintaining a friendly tone to encourage a positive response. Dive into our guide where you'll find a convenient template to help you request that credit reference seamlessly!

Supplier Company Details

A supplier credit reference request typically includes essential company details to facilitate the process. The request should state the supplier's company name (e.g., ABC Supplies Inc.), address including city (e.g., 123 Market St, Springfield), postal code (e.g., 62701), and contact information including phone number (e.g., (555) 123-4567) and email (e.g., contact@abcsupplies.com). It's crucial to specify the nature of the business relationship, such as duration of partnership (e.g., two years), types of products supplied (e.g., office materials), and any previous credit terms agreed upon (e.g., net 30). Additionally, the request should mention any relevant account numbers, if applicable, to streamline the verification process.

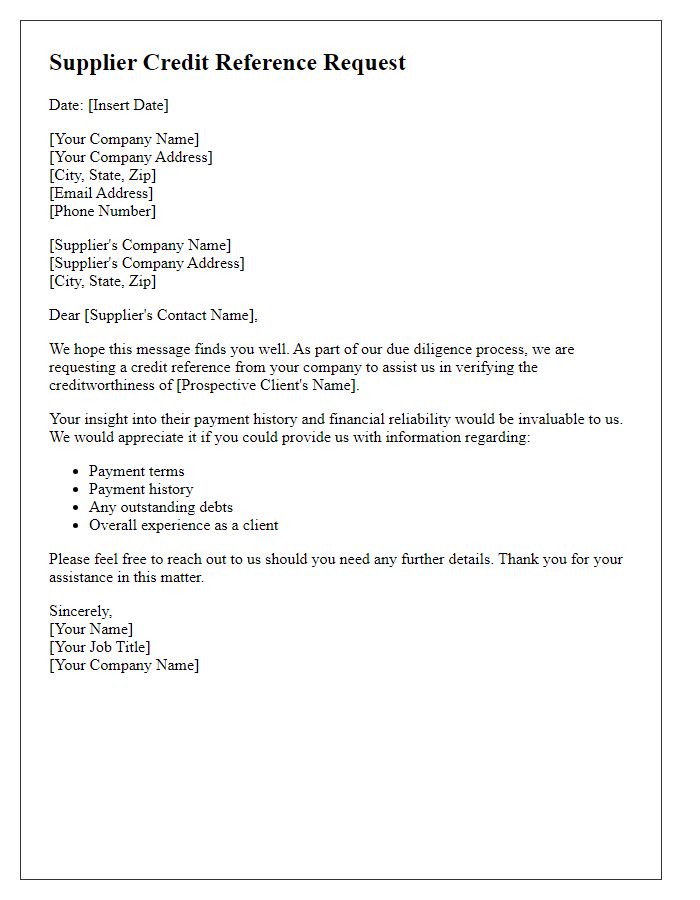

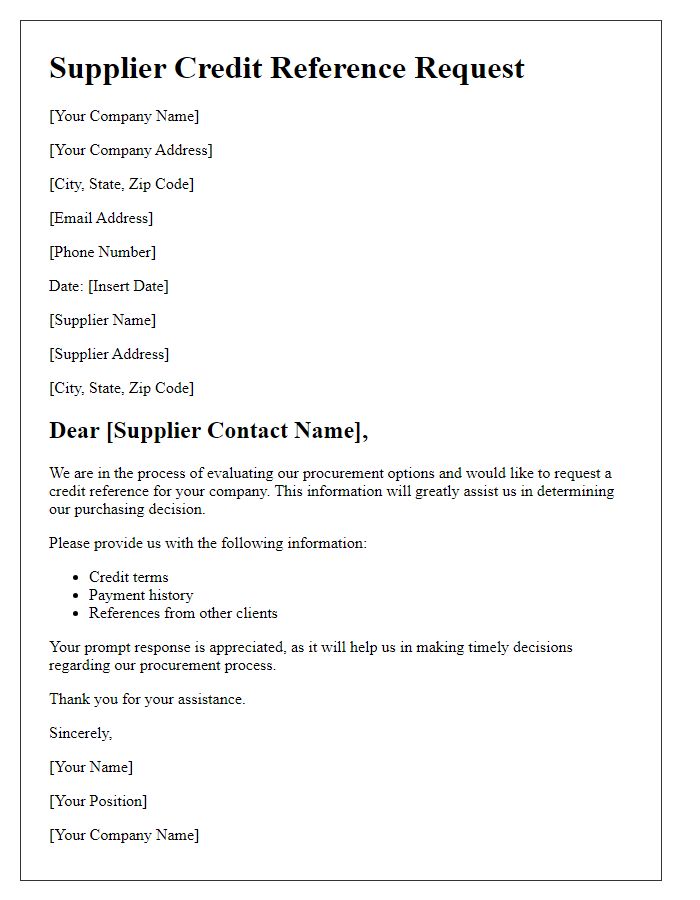

Credit Reference Request Statement

A Credit Reference Request typically involves seeking financial information about a business's creditworthiness from a supplier. Suppliers such as wholesalers or manufacturers often provide these references based on previous transactions and payment histories. Businesses may inquire about factors such as payment timeliness, outstanding invoices, and overall financial reliability. Most requests are formalized through a written statement that includes business details like legal name, contact information, and the nature of the credit requested. The decision to extend credit often relies on the evaluation of these references, which not only helps assess risk but also enhances long-term business relationships.

Potential Account Details

A supplier credit reference request is essential for assessing financial reliability and trustworthiness of potential accounts. Key details include the prospective client's company name, established date (years in business), structure (e.g., LLC, Corporation), and monthly purchase volume (amount transactions). Additionally, financial health indicators such as credit limits (suggested maximum borrowing), payment history (timeliness of payments over specific periods), and trade references (names of other suppliers providing credit) offer valuable insights. An accurate account review shortens the evaluation process, ensuring informed decisions aligned with business objectives.

Contact Information

Supplier credit reference requests are essential in assessing the creditworthiness of potential suppliers and ensuring reliable financial transactions. Key details include the supplier's name, address, and contact numbers to establish clear communication channels. Terms of reference should specify the nature of the request, highlighting factors such as payment history, credit limits, and any outstanding balances associated with similar entities. Additionally, the response time can be critical, as prompt feedback can expedite the decision-making process. Including detailed company information, such as registration number and business type, can also offer context when evaluating the supplier's stability.

Privacy and Data Protection Acknowledgment

A supplier credit reference request often entails a formal acknowledgment of privacy and data protection regulations, especially under frameworks like the General Data Protection Regulation (GDPR). This request typically includes the name of the requesting entity, associated details like tax identification number and company address, and the specific nature of the information sought, which might involve past credit behavior, payment history, or outstanding balances. Suppliers are expected to confirm their agreement to adhere to privacy standards, ensuring that any data shared complies with relevant laws and is protected from unauthorized access. This acknowledgment is crucial in maintaining trust and safeguarding sensitive business information during the reference verification process.

Letter Template For Supplier Credit Reference Request Samples

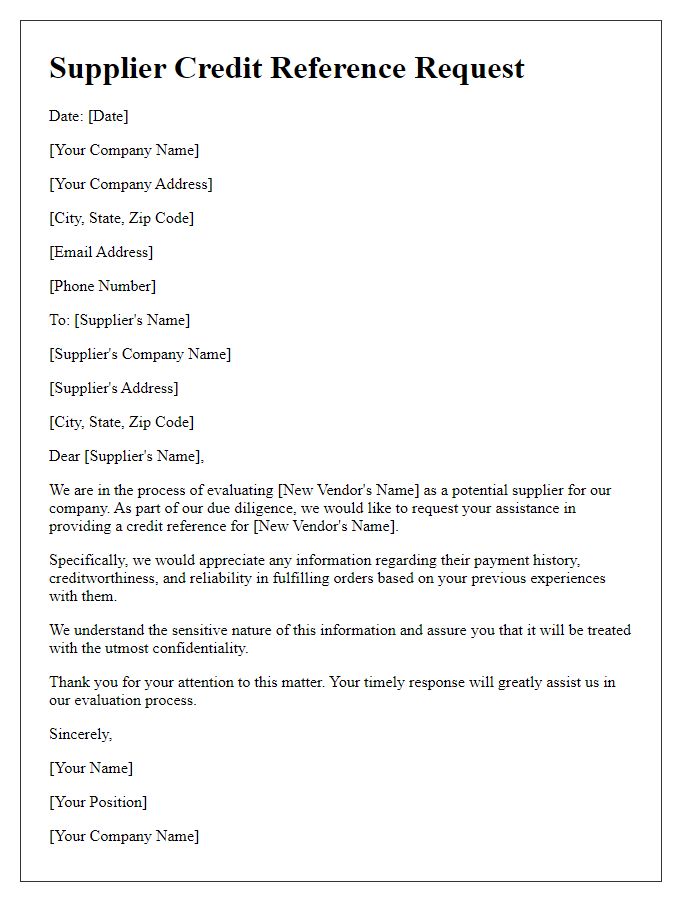

Letter template of Supplier Credit Reference Request for New Vendor Evaluation

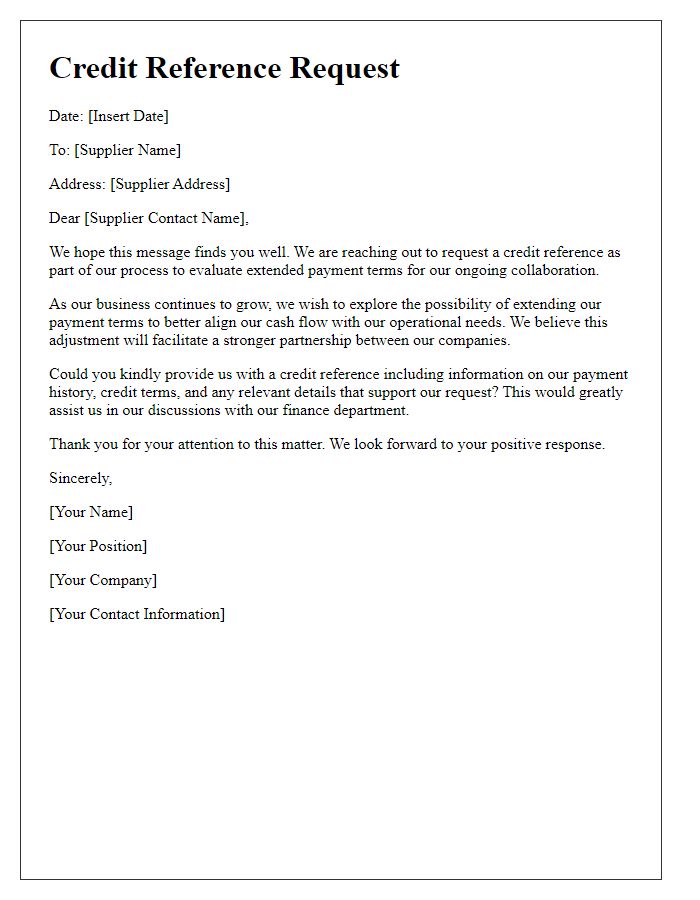

Letter template of Supplier Credit Reference Request for Extended Payment Terms

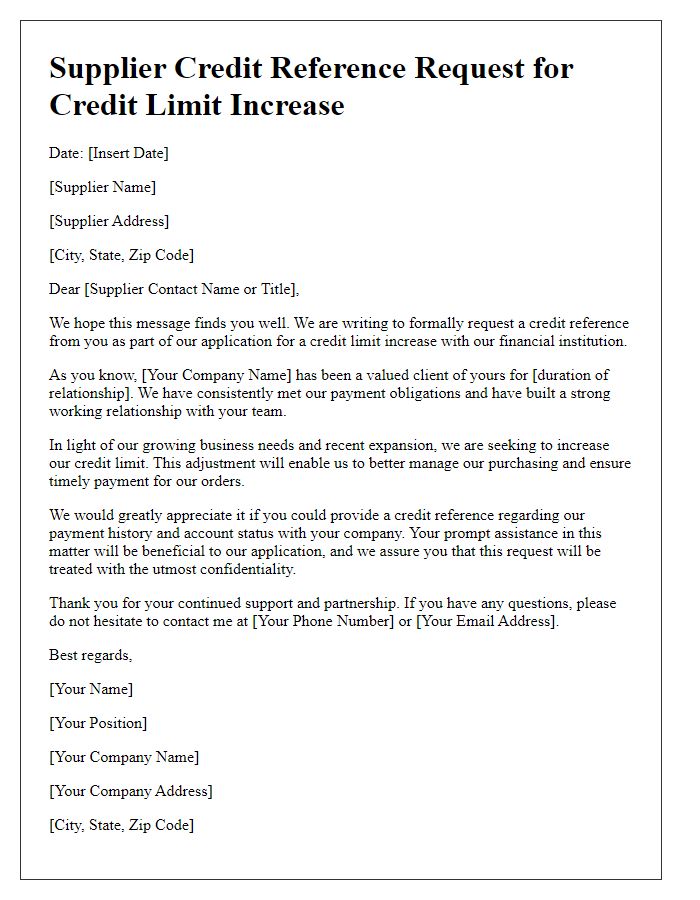

Letter template of Supplier Credit Reference Request for Credit Limit Increase

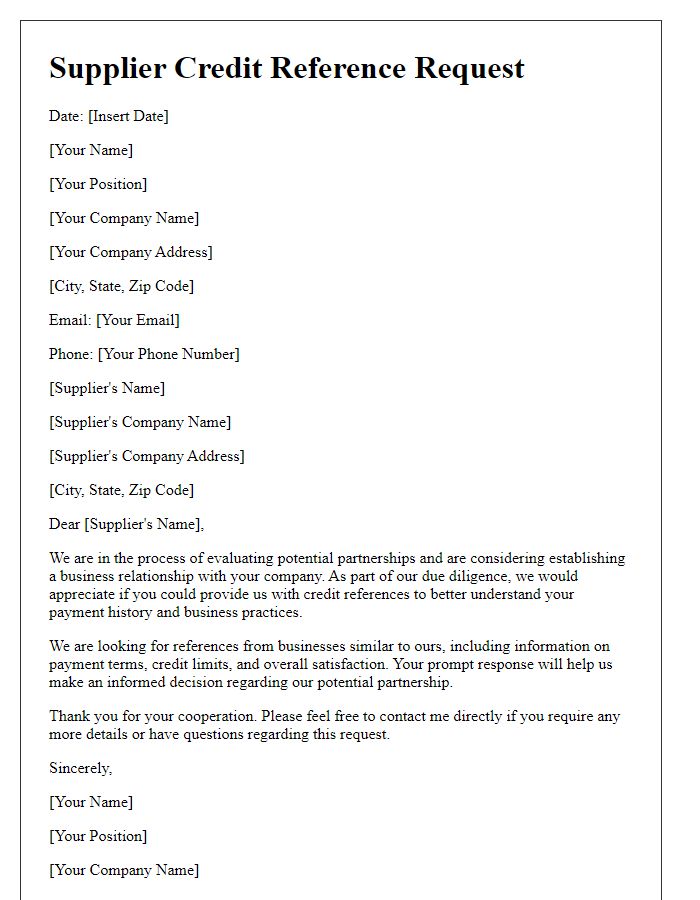

Letter template of Supplier Credit Reference Request for Partnership Consideration

Letter template of Supplier Credit Reference Request for Financial Stability Assessment

Letter template of Supplier Credit Reference Request for Supplier Risk Management

Letter template of Supplier Credit Reference Request for Trade Credit Approval

Letter template of Supplier Credit Reference Request for Business Relationship Development

Letter template of Supplier Credit Reference Request for Creditworthiness Verification

Comments