Are you a small business owner seeking financial support to grow your venture? Crafting the perfect loan request letter can be the key to unlocking the funds you need. In this article, we'll guide you through the essential elements of an effective letter while providing a handy template that you'll find easy to customize. Ready to take the next step in securing your business's future? Let's dive in!

Business Overview

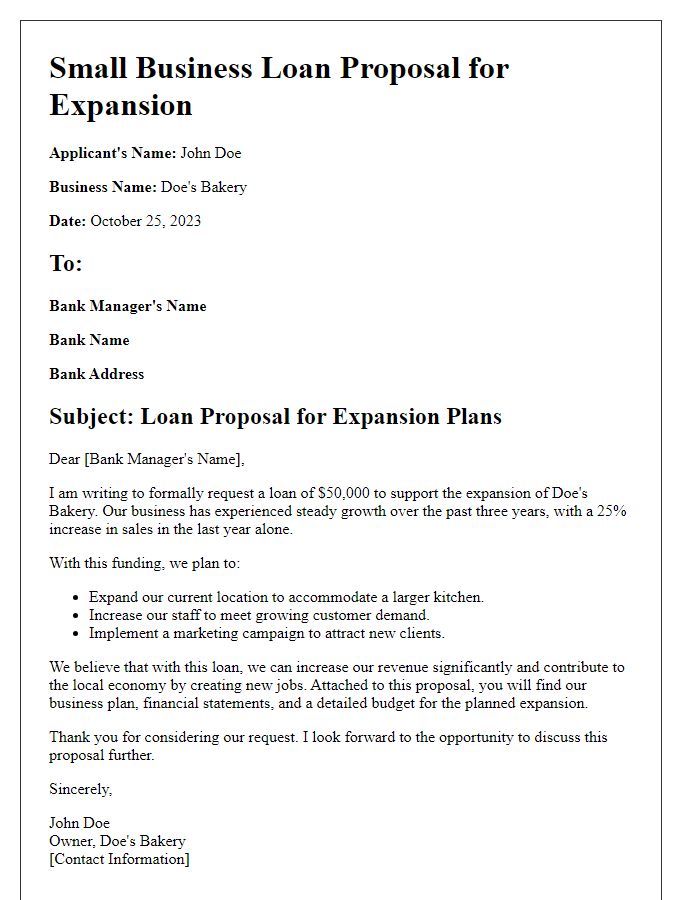

A small business loan request typically includes a detailed business overview that outlines the company's mission, market position, and financial standing. For instance, ABC Bakery, established in 2018 in Springfield, Massachusetts, specializes in organic, artisanal breads and pastries. The bakery has built a loyal customer base, achieving annual revenue of $250,000 and a steady growth rate of 15% per year. The 1,000 square foot retail space, located in a high-foot-traffic area near Springfield University, hosts an average of 150 customers daily. Currently, the business employs five local workers, contributing to the community's economy. The requested loan of $50,000 will facilitate the expansion of production capabilities to meet increasing demand and improve marketing efforts.

Loan Amount and Purpose

A small business loan request typically specifies the desired loan amount and its intended purpose. For instance, a request could state the need for a loan of $50,000 to expand a bakery located in Austin, Texas. This amount would facilitate the purchase of new commercial-grade baking equipment and cover renovations to create a welcoming customer space. The funds will also help hire additional staff for increased production capacity, thus allowing the bakery to meet the growing demand seen in the local community. Furthermore, the expansion is expected to contribute to overall economic growth within the area by creating new job opportunities.

Financial Projections

Financial projections play a crucial role in assessing the viability of a small business loan request. Typically spanning three to five years, these projections include vital components like projected revenue, expenses, cash flow, and net profit. For instance, a local cafe in Austin, Texas, might forecast an annual revenue growth of 10% based on market research indicating a growing coffee culture in the area. Detailed expense forecasts could account for fixed costs such as rent (averaging $3,000 per month) and variable costs, including inventory and utilities. Cash flow statements often highlight critical periods, such as seasonal fluctuations in sales, ensuring lenders understand potential risks. Additionally, presenting a break-even analysis can provide insights into when the business will become profitable, further solidifying the loan request's credibility.

Credit History and Financial Statements

A small business seeking a loan often needs to present a clear picture of its credit history and financial statements to lenders. Credit history, which includes details like payment history, outstanding debts, and overall credit score, provides insight into the business's reliability. Well-organized financial statements, including balance sheets, income statements, and cash flow statements, are essential for demonstrating financial health. A comprehensive balance sheet reveals assets such as inventory and equipment, liabilities like loans and unpaid bills, and equity reflecting owner investments. Income statements highlight revenue streams, operating expenses, and net profit or loss for specific periods, showcasing profitability trends. Cash flow statements demonstrate the business's ability to generate cash, crucial for meeting loan repayment obligations. Presenting these documents clearly and professionally increases the loan request's success rate and shows the lender that the business is serious and responsible.

Repayment Plan

Creating a comprehensive repayment plan for a small business loan involves outlining key financial strategies to ensure timely repayment. The plan may specify a loan amount, for instance, $50,000, with a fixed interest rate of 6% over a five-year term. Monthly payments could be calculated to approximately $966 based on amortization. The business, located in Springfield, may increase revenue through initiatives such as expanding product lines, targeting specific demographics, or enhancing marketing efforts. Inventory management, including a streamlined supply chain, could optimize cash flow. Additionally, identifying seasonal sales peaks, like the holiday season, can help maximize profits. Regular financial reviews and adjustments to the plan might be necessary to respond to market trends or unexpected expenses, ensuring consistent adherence to the payment schedule. Emergency funds or a backup financing option may also be highlighted to mitigate risks of default.

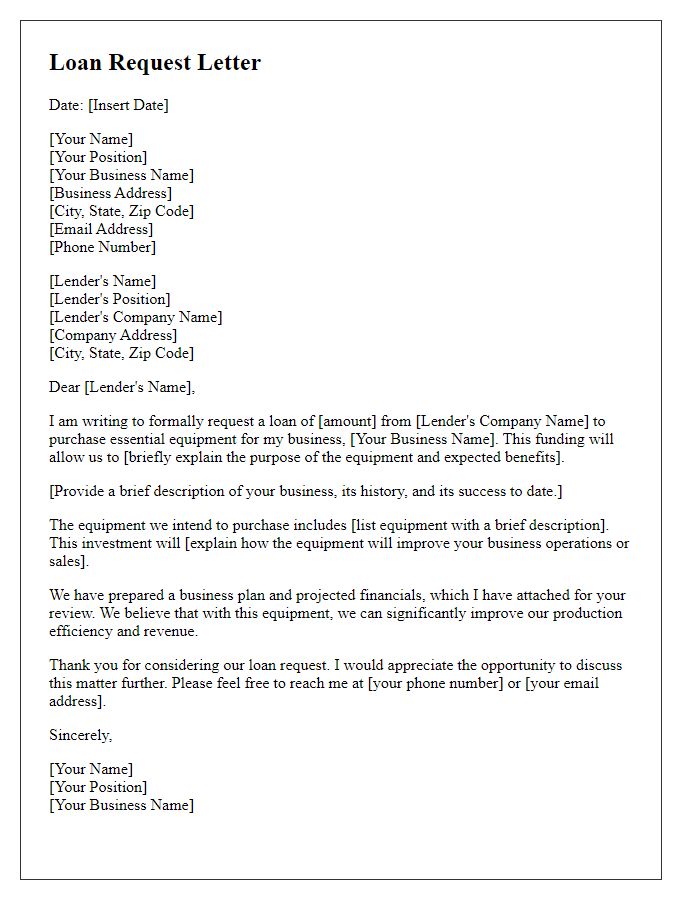

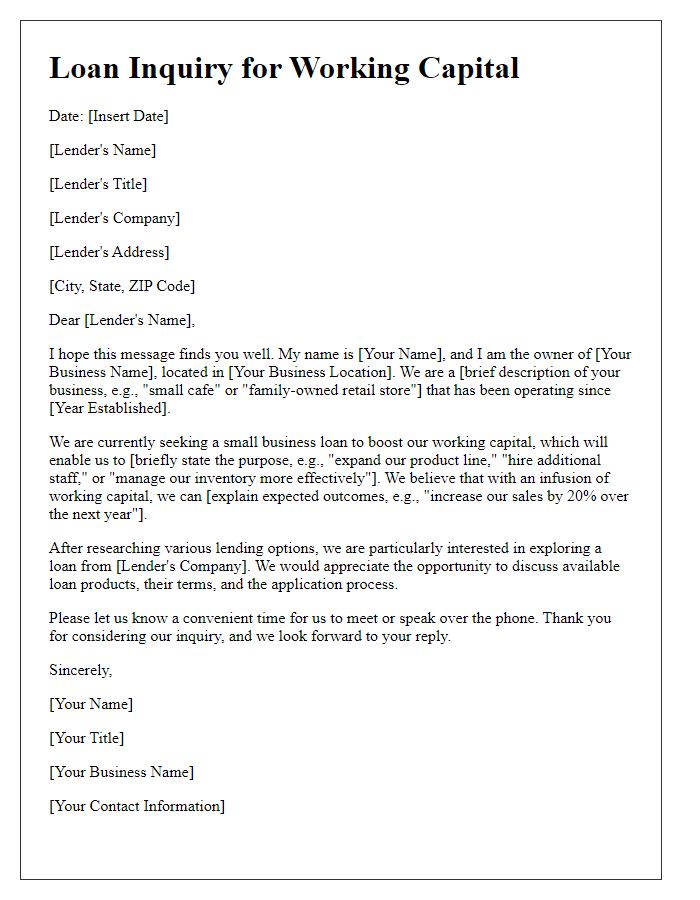

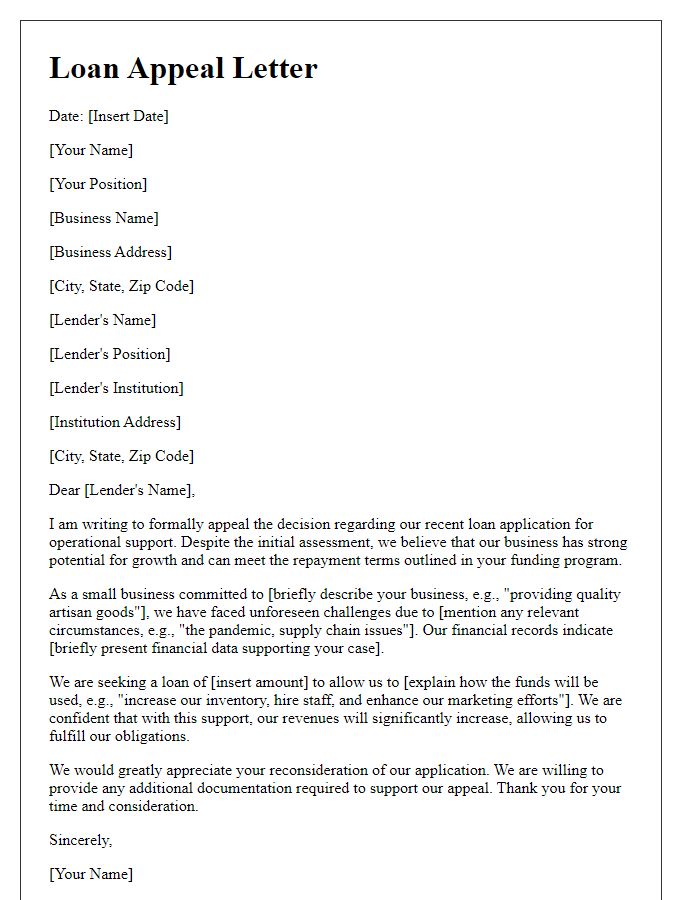

Letter Template For Small Business Loan Request Samples

Letter template of small business loan application for franchise investment

Letter template of small business loan proposal for marketing initiatives

Letter template of small business loan request for real estate acquisition

Comments