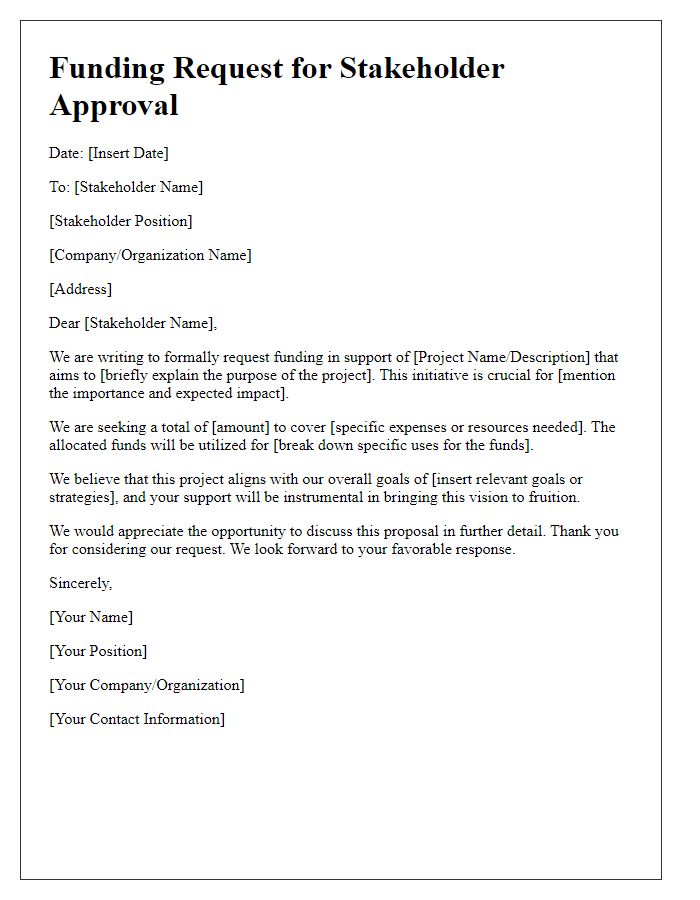

Are you looking to secure funding for your project from stakeholders? Crafting a well-structured letter is crucial for gaining their trust and support. In this article, we'll explore essential tips and a template that will help you convey your message clearly and effectively. So, let's dive in and unlock the secrets to writing a compelling funding approval letter!

Clear Objective of the Funding Request

The funding request aims to secure financial resources to enhance the community park in downtown Springfield, a vibrant area frequented by local families and visitors. The objective includes upgrading playground equipment, improving landscaping with native plants, and installing sustainable solar lighting throughout the park. These enhancements can attract more visitors and provide a safe, environmentally friendly space for community gatherings. The total funding amount requested is $150,000, intended for completion by the summer of 2024, ensuring the park serves as a centerpiece for community engagement and recreational activities year-round.

Detailed Budget Breakdown

Stakeholder funding approval requires a transparent and thorough budget breakdown. The detailed budget includes projected costs for various categories, such as personnel expenses, which may encompass salaries and benefits for research team members across a timeline of 12 months. Operational expenses cover materials needed for project implementation, estimated at $25,000, while travel costs for stakeholder meetings and conferences, projected at $10,000, ensure collaboration. Marketing and outreach efforts may need a budget of $15,000 to disseminate findings effectively to the public and relevant communities. Additionally, contingency funds (around 10% of total budget) prepare for unforeseen expenses. Each line item in the budget directly correlates with project success metrics, justifying the financial investment needed for sustainable outcomes.

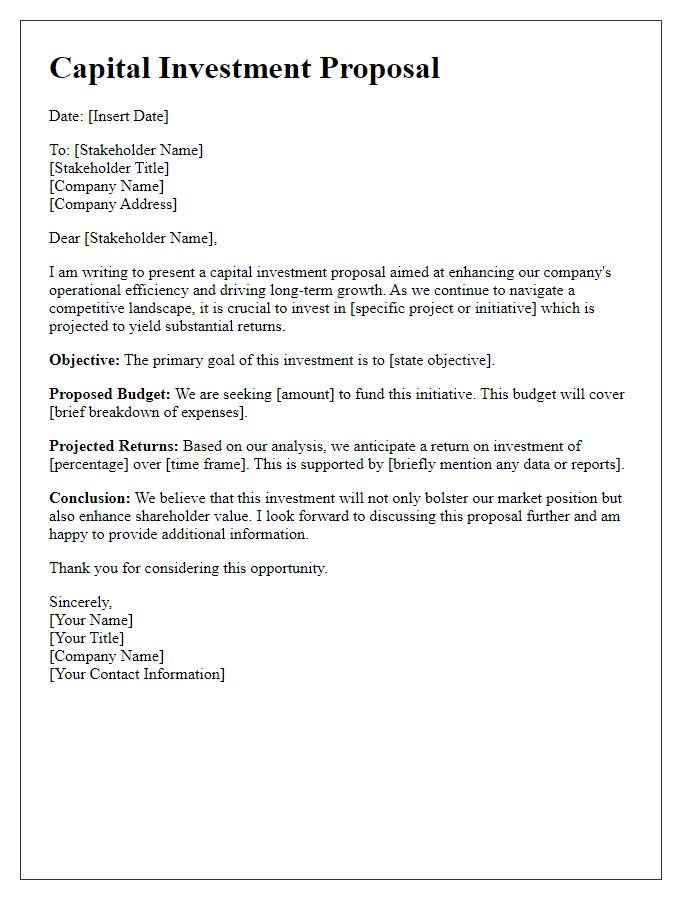

Alignment with Stakeholder Interests

The alignment with stakeholder interests is crucial for the success of any funding initiative within organizations. Stakeholder groups, including investors, community members, and employees, each possess distinct priorities and concerns, which must be addressed for effective collaboration. For instance, local communities often seek economic development opportunities, while investors prioritize return on investment. Understanding these dynamics can ensure the proposed funding strategies resonate with stakeholder values. Transparent communication regarding project benefits, such as job creation and environmental sustainability, can foster trust and engagement. Additionally, regular updates on project progress and adjustments based on stakeholder feedback can enhance alignment, ensuring that funding efforts remain cohesive with broader organizational goals and societal needs.

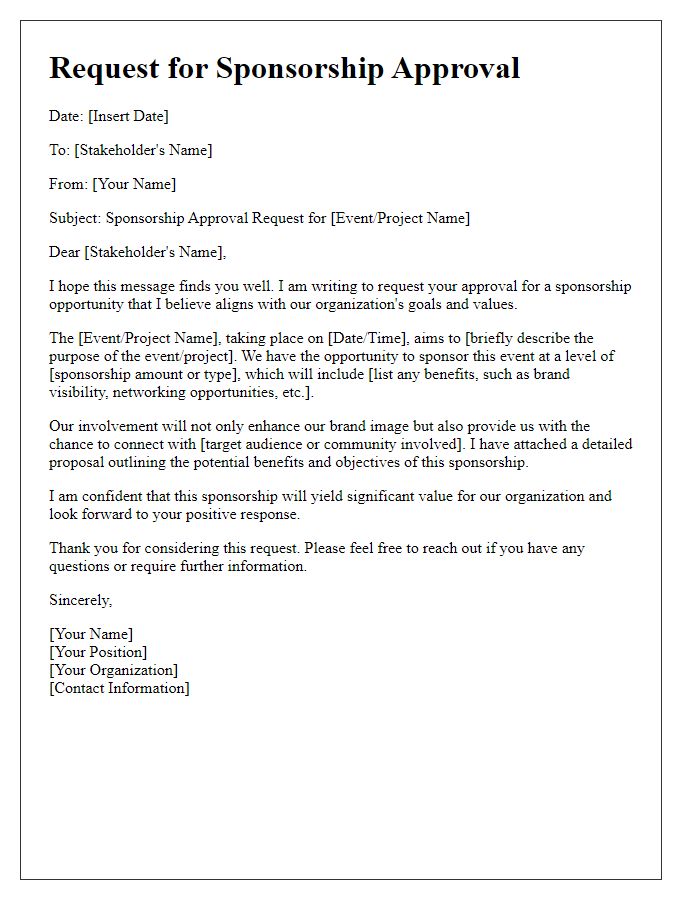

Project Impact and Benefits

The proposed initiative aims to enhance renewable energy adoption through the installation of solar panels in underserved communities. This initiative seeks funding of $500,000 to support the deployment of 2,000 solar panel systems across low-income neighborhoods in Atlanta, Georgia, where energy costs exceed the national average by 30%. Each solar panel system can produce approximately 300 watts of power, contributing to an estimated annual reduction of 2,000 tons of carbon emissions. Additionally, this program is projected to save participating households an average of $150 per month on energy bills, significantly improving their financial stability. Local job creation is anticipated, with around 50 positions opening for installation and maintenance over the project's two-year span. Community outreach workshops will further educate residents on energy efficiency and sustainability practices, fostering a culture of environmental stewardship. The long-term benefits include increased access to clean energy, economic empowerment, and a tangible reduction in the community's carbon footprint.

Comprehensive Risk Assessment and Mitigation Plan

A comprehensive risk assessment and mitigation plan aims to identify potential risks associated with projects and outline strategies to minimize their impact on objectives. This plan includes qualitative and quantitative risk analysis techniques, enabling stakeholders to understand the probability and impact of risks such as regulatory changes, market volatility, and operational challenges. For example, a project with a budget of $1 million may face financial risk if market conditions fluctuate, potentially leading to a 20% increase in costs. Mitigation strategies can involve diversification of funding sources, regular compliance audits, and risk-sharing partnerships. Continuous monitoring and adaptation of the plan are crucial for ensuring the project's success and stakeholder confidence throughout its lifecycle.

Comments