Are you a shareholder looking to make your voice heard? Submitting a shareholder resolution can be a powerful way to influence corporate governance and drive meaningful change. In this article, we'll walk you through a helpful letter template that ensures your submission is clear, concise, and effective. Stick around to learn how to craft your proposal and engage your fellow shareholders!

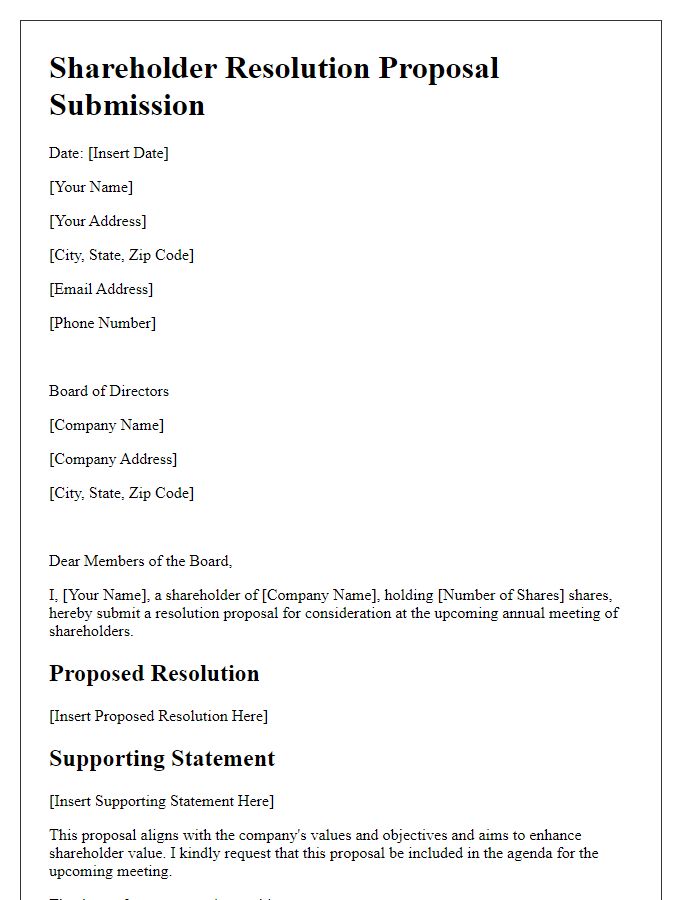

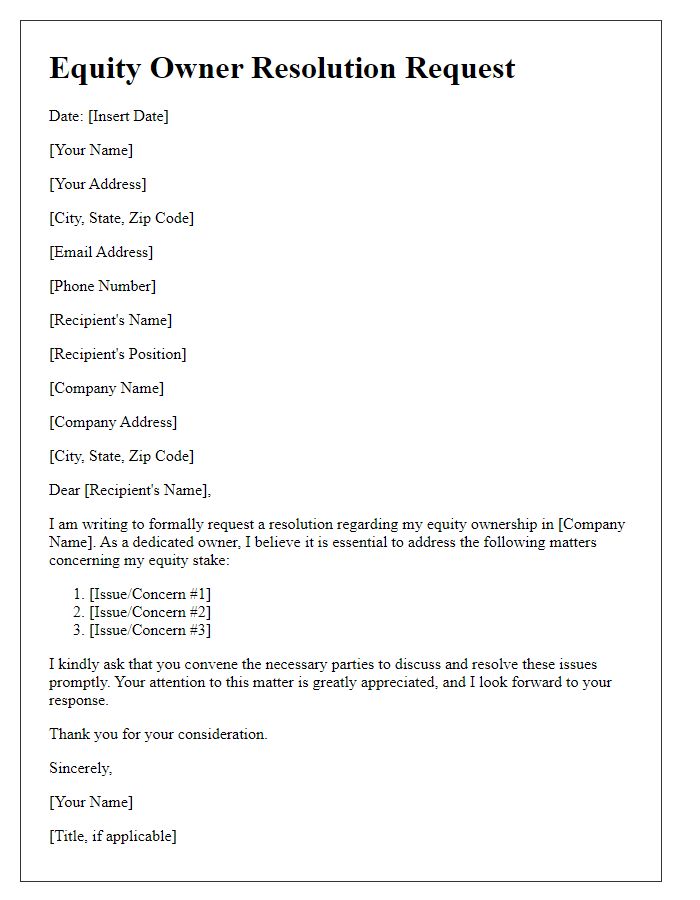

Clear Identification of Shareholder and Securities Owned

Shareholder resolutions play a critical role in corporate governance, allowing investors to voice their opinions on important company policies. Shareholders, such as mutual funds or individual investors, must clearly identify themselves alongside their respective securities. Ownership details, including the number of shares (usually denoted in thousands), must be specified to validate the submission. For instance, if a shareholder owns 1,000 shares of a public company like XYZ Corp, these details must be included in the resolution documentation. Additionally, stating the registration status, such as being a registered or beneficial owner, can enhance the clarity of the submission. Proper identification supports the legitimacy of the resolution, ensuring it is addressed during annual general meetings or special shareholders meetings.

Precise Statement of the Proposed Resolution

The proposed shareholder resolution aims to enhance corporate transparency by mandating annual sustainability reporting aligned with Global Reporting Initiative (GRI) standards. This resolution seeks detailed disclosures regarding environmental impact, including greenhouse gas emissions, water usage, and waste management practices, targeting a specific reduction in carbon emissions of 25% by 2025. The report should also outline company strategies and targets for renewable energy adoption and sustainable sourcing practices to provide stakeholders with a clear understanding of the company's commitment to sustainability. This initiative is aimed at not only improving public perception but also aligning with the increasing investor demand for responsible and ethical business practices.

Background and Justification Supporting the Resolution

Shareholder resolutions often address significant issues affecting a corporation's governance or operational practices. For instance, a resolution addressing climate change might request that a company, such as ExxonMobil, commit to reducing greenhouse gas emissions by a specific percentage (e.g., 50% lower by 2030) compared to 2019 levels. The justification for such a request could focus on the increasing regulatory pressures from governments worldwide, including the European Union's strict emissions trading system and the heightened expectations from investors for sustainable practices. Moreover, studies, such as those conducted by the Intergovernmental Panel on Climate Change (IPCC), emphasize the urgency of mitigating climate-related risks, showing a direct correlation between corporate environmental responsibility and long-term financial stability. Ultimately, the resolution aims to ensure the company's resilience against future market shifts while aligning its operational strategies with global sustainability goals.

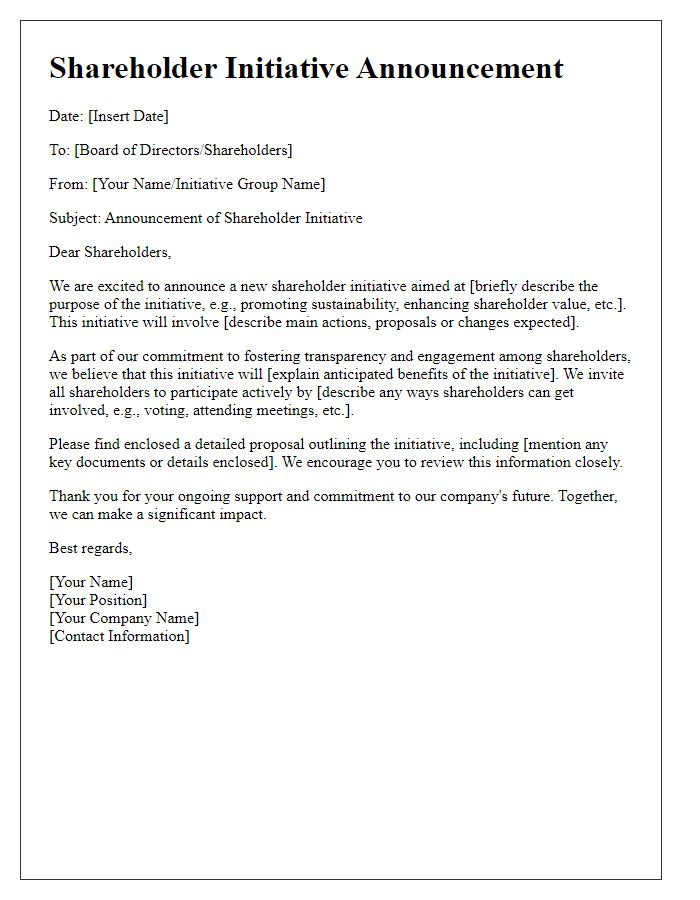

Reference to Compliance with Legal and Regulatory Requirements

Shareholder resolutions are submitted to ensure compliance with legal and regulatory requirements governing corporate governance. The resolution, often presented during annual general meetings (AGMs), outlines specific requests that align with the interests of shareholders and the broader stakeholders. Such resolutions can address issues like corporate transparency, environmental sustainability practices, social responsibility, and executive compensation policies. Regulatory bodies, such as the Securities and Exchange Commission (SEC) in the United States, provide guidelines to ensure that resolutions meet specific criteria, fostering accountability and ethical practices in corporate management. The engagement of shareholders in this process reinforces their rights and acknowledges their role in shaping corporate policy and governance.

Submission Deadline and Contact Information

Shareholder resolutions play a crucial role in corporate governance and can influence key decisions within a company. Typically, companies set specific submission deadlines for shareholder resolutions, often aligned with their annual meeting schedules. For example, the submission deadline could be 120 days before the annual shareholder meeting, allowing adequate time for review and publication in proxy statements. Contact information for submitting these resolutions typically includes the company's corporate secretary or investor relations department. This ensures that all inquiries regarding the resolution process and related documentation are efficiently handled. Shareholders can often find this information detailed on the company's official website or in recent SEC filings, providing transparency and accessibility to all stakeholders involved in the decision-making process.

Comments