Are you a shareholder looking to maximize your investment potential? Making the decision to reinvest your dividends can be a powerful way to grow your wealth over time. In this article, we'll guide you through the process of confirming your dividend reinvestment, ensuring you're making the most of your dividends. So, grab a cup of coffee and let's dive into the details!

Shareholder Information

Shareholder information is crucial for effective communication between the company and its investors. Accurate details such as name, address, and shareholder identification number ensure that dividend payments are processed correctly and efficiently. The shareholder confirmation of dividend reinvestment allows individuals to opt for reinvesting dividends instead of receiving cash payouts, potentially enhancing their investment portfolio. This option usually includes details about the dividend rate, which may vary according to board approval and company profitability. Additionally, understanding tax implications related to reinvestment could impact financial decisions for shareholders. Regular updates and clear communication help maintain trust and transparency within the shareholder community.

Dividend Reinvestment Details

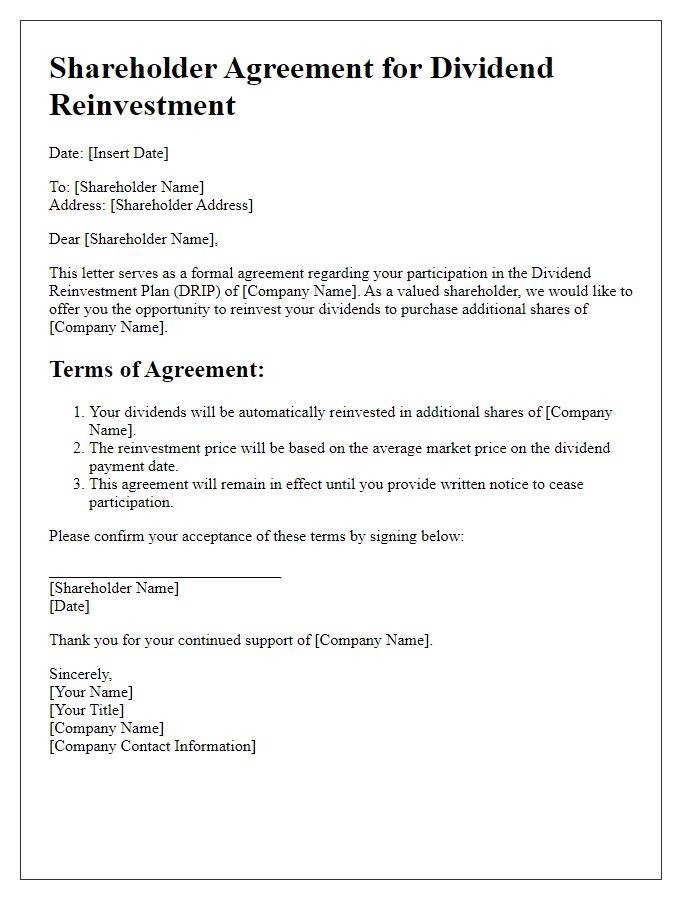

Shareholders increasingly opt for dividend reinvestment plans (DRIPs) to maximize their investment returns. DRIPs allow investors to automatically reinvest their dividends into additional shares of stock, eliminating brokerage fees, thereby benefiting from compounding gains. The primary details regarding dividend reinvestment include the reinvestment percentage, usually 100%, and specific dates when dividends are declared and eventually reinvested, often quarterly for many companies. Additionally, shareholders should be aware of their rights, including the ability to opt-out or modify their participation at any time, enabling greater control over their investment strategies. It's crucial for shareholders to keep track of these details to ensure alignment with their long-term financial goals.

Declaration Statement

Shareholders confirm their intent to participate in dividend reinvestment plans, allowing Automatic reinvestment of dividends into additional shares instead of cash payouts. This mechanism benefits long-term investment strategies, fostering compounding growth over time. Shareholders may find specific programs offered by companies, such as 401(k) plans or direct stock purchase plans, that streamline this process. Additionally, keeping records of reinvested dividends contributes to proper tax reporting and investment tracking, ensuring transparency and compliance with financial regulations.

Contact Information

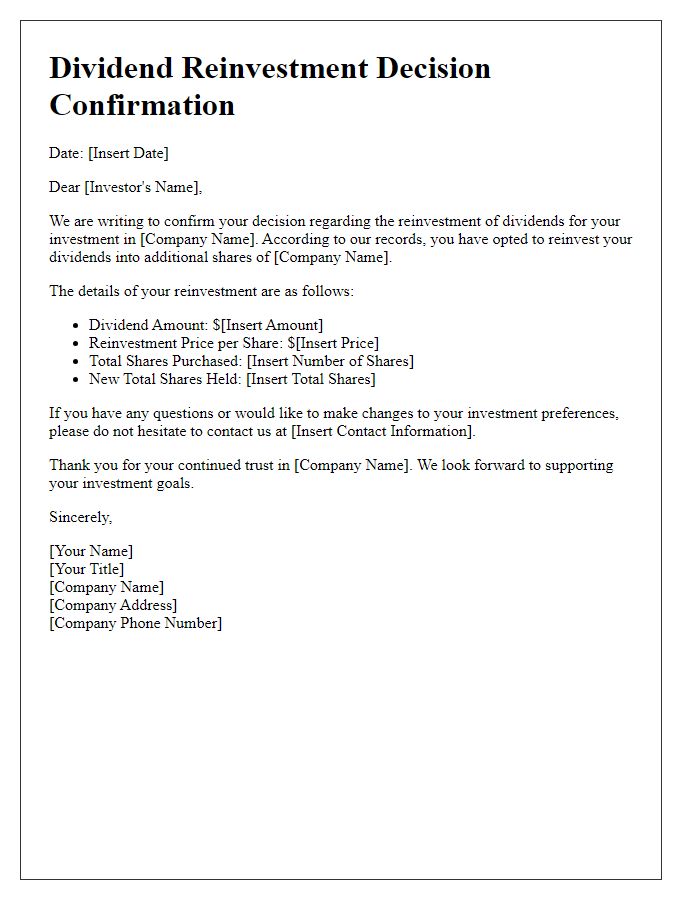

Shareholder confirmation of dividend reinvestment involves the communication between the company and its shareholders regarding the automatic reinvestment of dividends. This process can enhance shareholder value by allowing dividends to purchase additional shares rather than receiving cash. Essential elements include the company's name and registered address, shareholder name and identification number, the amount of dividend declared (for example, $0.50 per share), the reinvestment percentage, and confirmation of compliance with federal regulations. Clear instructions for shareholders on how to opt-in or opt-out of this program are crucial to facilitate understanding and participation. Additionally, providing a contact number for customer support can assist shareholders with any inquiries regarding the reinvestment program.

Signature and Date

Shareholders should receive confirmation regarding their dividend reinvestment options and preferences, particularly for financial years ending on specific dates. Companies may provide a detailed breakdown of dividends, highlighting rates such as 3.5% per share. A clear statement about the reinvestment plan, established in the corporate bylaws, must outline how dividends are allocated for purchasing additional shares at prevailing market rates. Furthermore, shareholders are often required to supply their signatures and the date of consent for proper record-keeping and compliance with financial regulations, ensuring transparency in the management of shareholder investments.

Letter Template For Shareholder Confirmation Of Dividend Reinvestment Samples

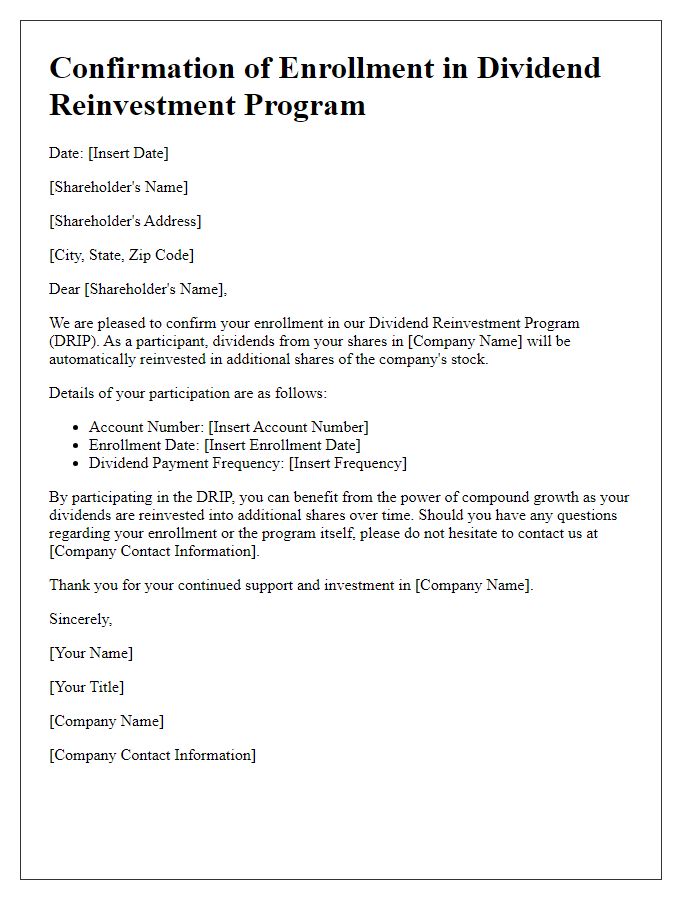

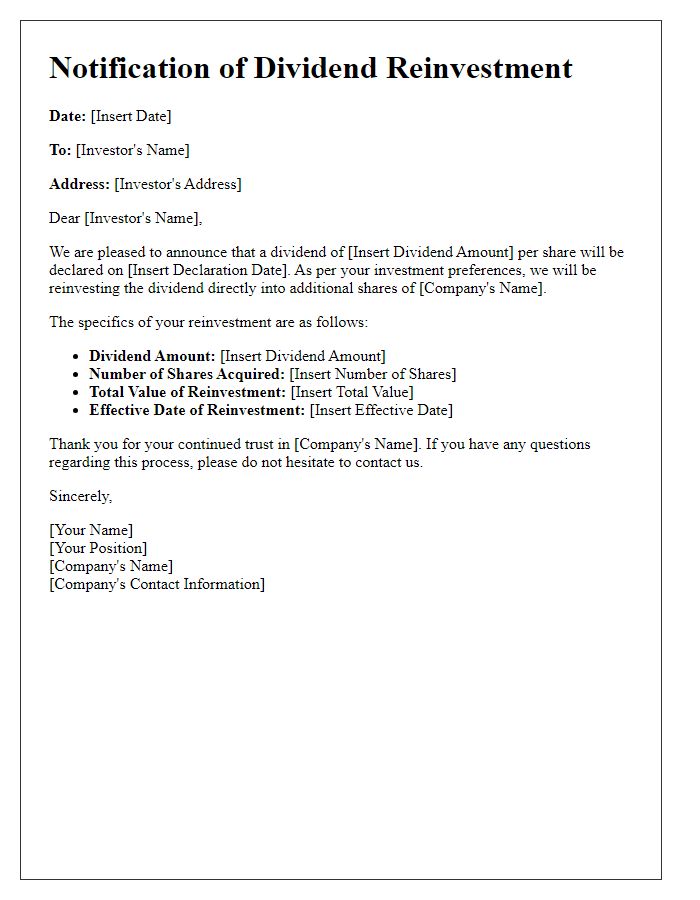

Letter template of Confirmation for Shareholder Dividend Reinvestment Program

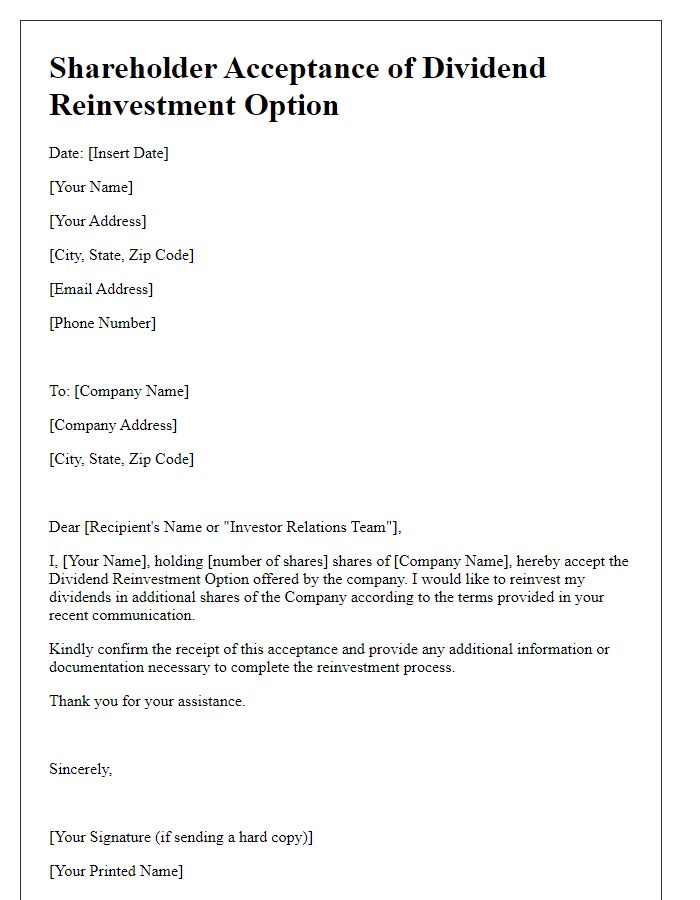

Letter template of Shareholder Acceptance of Dividend Reinvestment Option

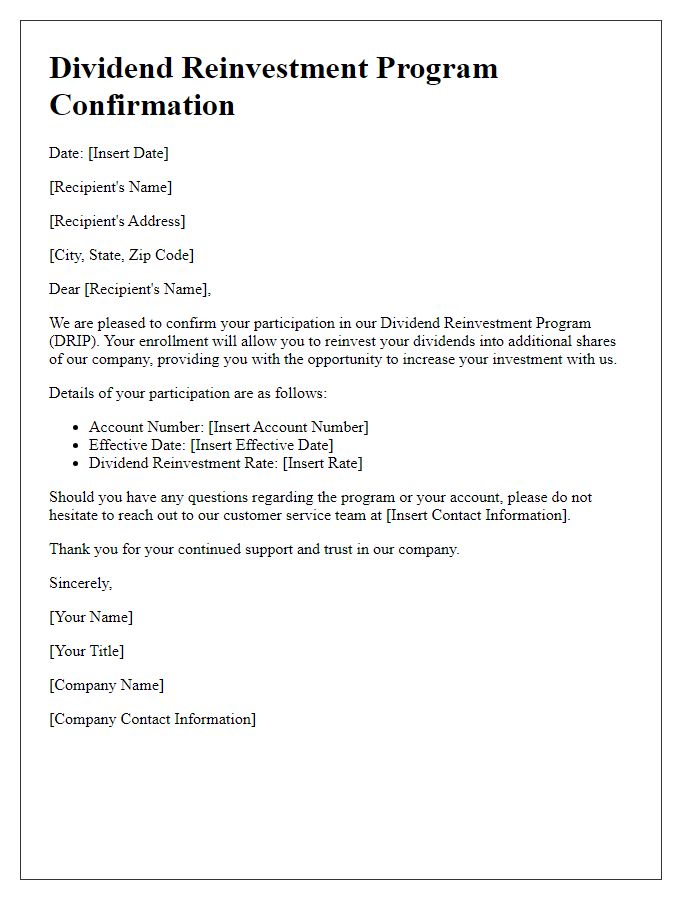

Letter template of Dividend Reinvestment Program Participation Confirmation

Letter template of Acknowledgment of Dividend Reinvestment for Shareholders

Letter template of Confirmation Notice for Dividend Reinvestment Participation

Comments