Navigating the intricate world of strategic partnerships can be daunting, but crafting a well-structured shareholder agreement is essential for ensuring mutual benefits and clarity. This important document lays the foundation for collaboration, setting clear expectations, roles, and responsibilities for all parties involved. By outlining financial contributions, decision-making processes, and exit strategies, a comprehensive agreement fosters trust and accountability among stakeholders. Ready to dive deeper into the nuances of creating an effective shareholder agreement? Let's explore further!

Introduction and Purpose

A shareholder agreement serves as a vital framework for defining the terms of a strategic partnership between entities, such as companies seeking to collaborate on innovative projects or shared investments. This agreement articulates the intentions of stakeholders, clarifying the roles, responsibilities, and expectations of each party involved. The purpose of this document is to establish mutual understanding, ensuring alignment on goals and strategies that drive the partnership forward. Key elements such as profit distribution percentages, voting procedures, and dispute resolution mechanisms will be outlined, providing a comprehensive legal structure to safeguard interests and enhance cooperation between the shareholders. The agreement ultimately aims to foster a robust partnership that leverages combined resources and expertise for achieving shared objectives in the dynamic market environment.

Terms and Conditions

A shareholder agreement outlines the collaborative framework for a strategic partnership between two entities, detailing key terms and conditions. This agreement typically includes the definition of the partnership's purpose, such as joint product development or market expansion, to establish goals and synergies. Financial contributions from each party, including equity stakes and investment amounts, must be specified to ensure clarity on capital allocation. Governance structure, including board composition, voting rights, and decision-making processes, should be defined to facilitate effective management. Confidentiality clauses safeguard sensitive information, while exit strategies outline conditions under which a partner can divest shares. Dispute resolution mechanisms provide a method for addressing conflicts, typically through mediation or arbitration, to maintain operational stability.

Roles and Responsibilities

Strategic partnerships often involve complex roles and responsibilities that are critical to mutual success. Each partner must define specific functions within the collaboration framework. Responsibilities may include financial contributions, resource allocation, and operational oversight. Key roles might encompass a Project Manager tasked with day-to-day coordination, a Financial Officer responsible for budget management, and a Communications Liaison to ensure transparent dialogue. Terms regarding intellectual property rights may need careful delineation, especially regarding shared technologies or proprietary information. Performance metrics should also be established to evaluate the partnership's effectiveness, including quarterly reviews assessing progress towards mutual goals. Additionally, legal provisions should outline dispute resolution mechanisms to address any conflicts that may arise during the partnership.

Governance and Decision-Making

A governance framework in a shareholder agreement for a strategic partnership outlines the structured decision-making process between stakeholders involved. It typically defines roles for board members, including their qualifications and appointment procedures, assuring diverse expertise to navigate complex market dynamics. Regular meetings, often quarterly, maintain consistent engagement, while voting mechanisms, such as a supermajority requirement for key decisions, enhance accountability. Clear protocols for conflict resolution ensure collaborative problem-solving, promoting stability in partnership operations. Established reporting standards mandate transparency in financial performance and strategic initiatives, fostering trust among shareholders. Specific committees, such as audit and compensation, can be formed to oversee critical functions, ensuring adherence to regulatory compliance and ethical practices. This structured approach to governance and decision-making cultivates a robust partnership, driving mutual growth and long-term sustainability.

Confidentiality and Non-Disclosure

Confidentiality and Non-Disclosure Agreements (NDAs) in shareholder agreements play a crucial role in protecting sensitive business information. They establish clear boundaries regarding what constitutes confidential information, which can include trade secrets, operational strategies, financial data, and proprietary technology. Effective NDAs outline the conditions under which confidential information may be shared among partners involved in the strategic partnership, ensuring that all parties understand their responsibilities and the legal ramifications of any disclosure. Typically, the duration of confidentiality obligations spans several years, often extending beyond the termination of the partnership itself. This legal framework is vital for preserving trust, safeguarding competitive advantages, and fostering a collaborative environment among stakeholders, particularly in industries characterized by rapid innovation and competition.

Letter Template For Shareholder Agreement On Strategic Partnership Samples

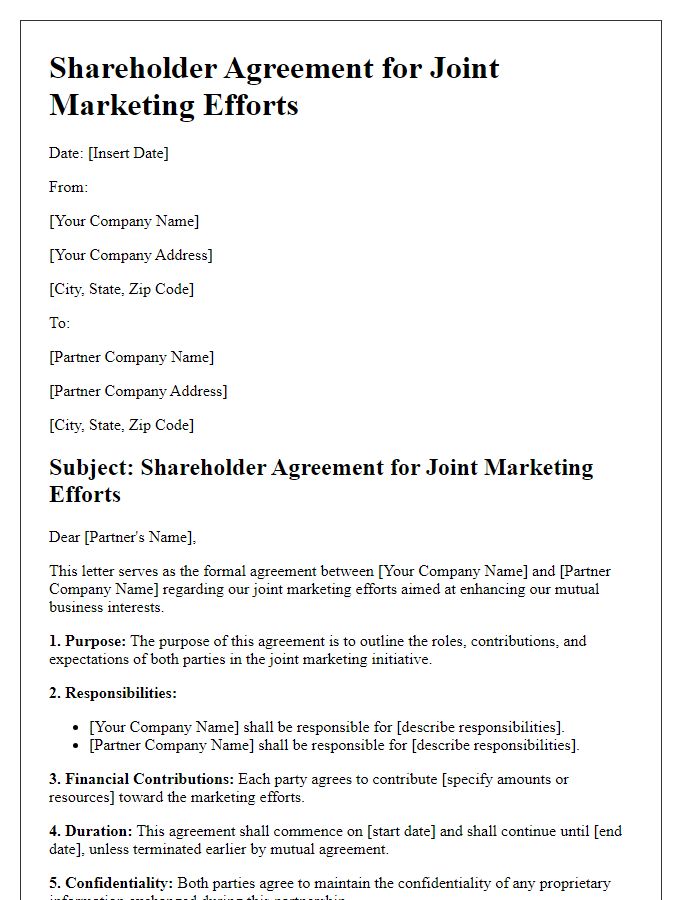

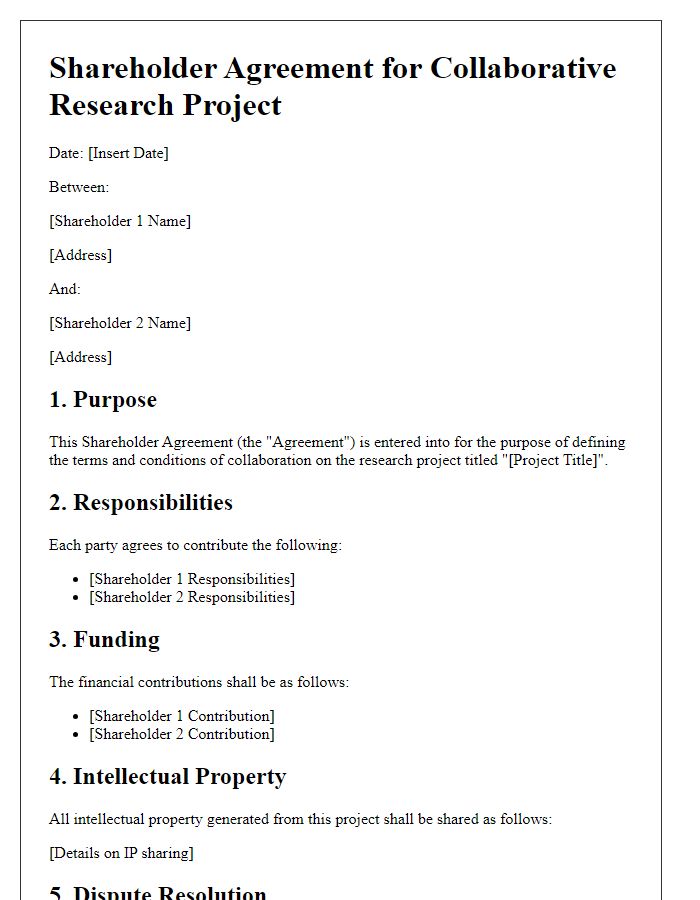

Letter template of shareholder agreement for strategic partnership formation

Letter template of shareholder agreement for joint venture collaboration

Letter template of shareholder agreement for equity investment in a partnership

Letter template of shareholder agreement for sharing resources in strategic alignment

Letter template of shareholder agreement for cross-functional team initiatives

Letter template of shareholder agreement for strategic alliance with defined roles

Letter template of shareholder agreement for mergers and acquisitions discussions

Comments