Are you a shareholder looking to obtain important documents from your company? Navigating the process can be a bit overwhelming, but we're here to simplify it for you. Understanding your rights and the required steps can empower you to get the information you need efficiently. Join us as we break down the essential framework for crafting a compelling shareholder request letter and explore valuable tips to ensure your request is met promptly!

Clear identification of recipient and requester.

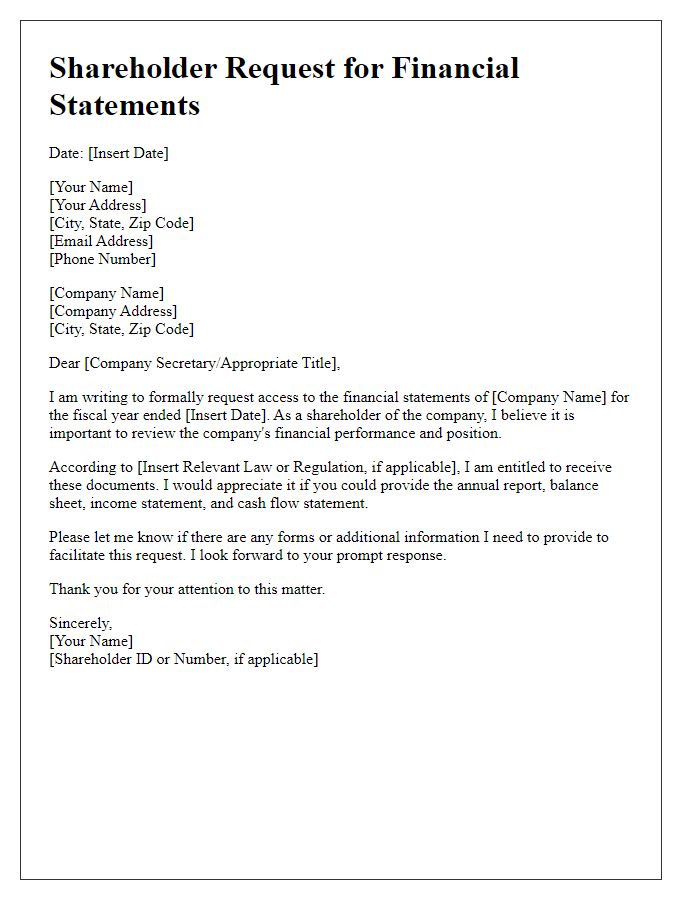

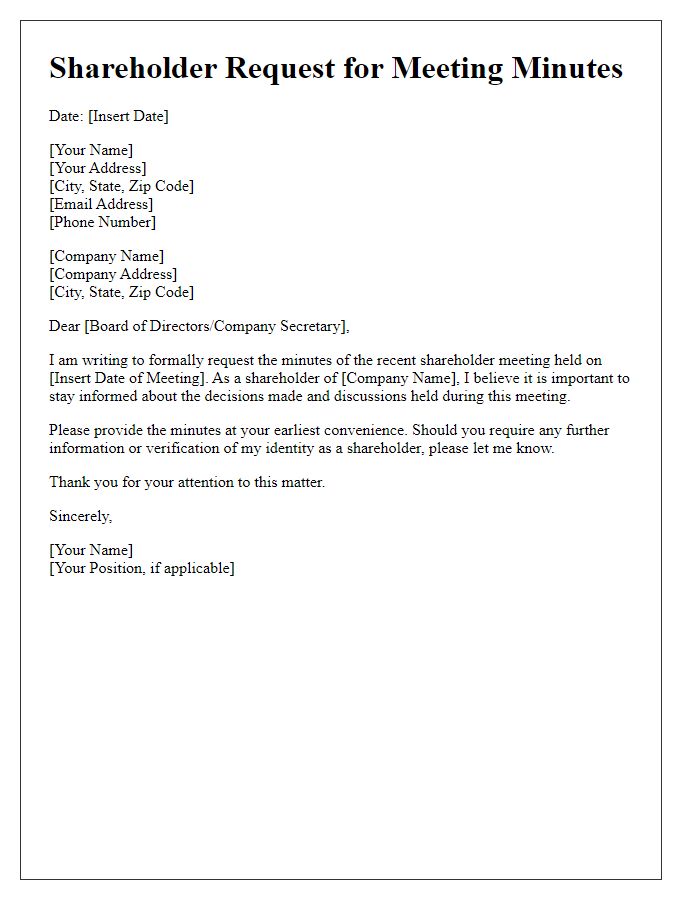

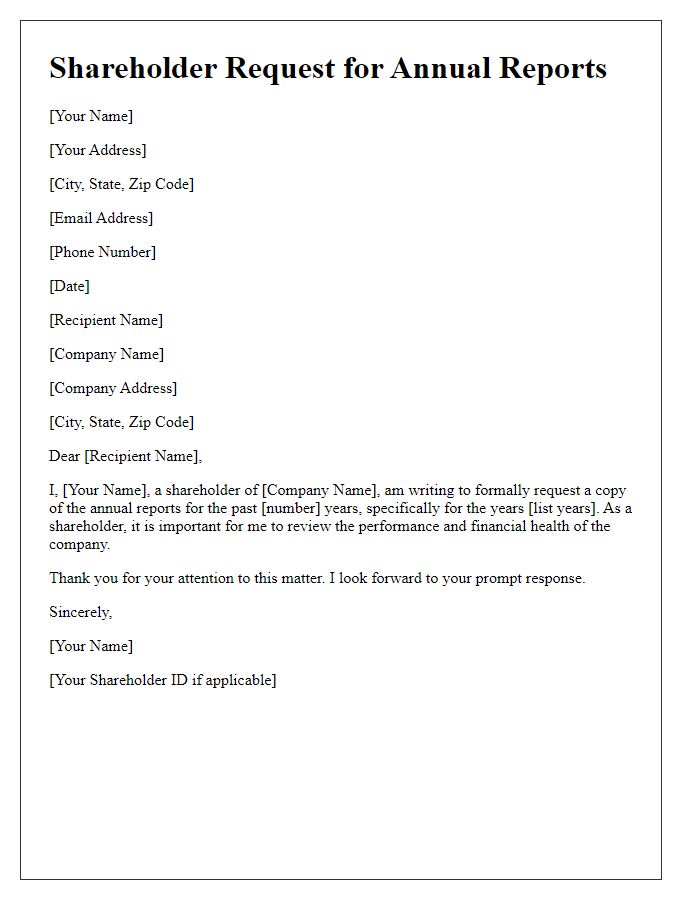

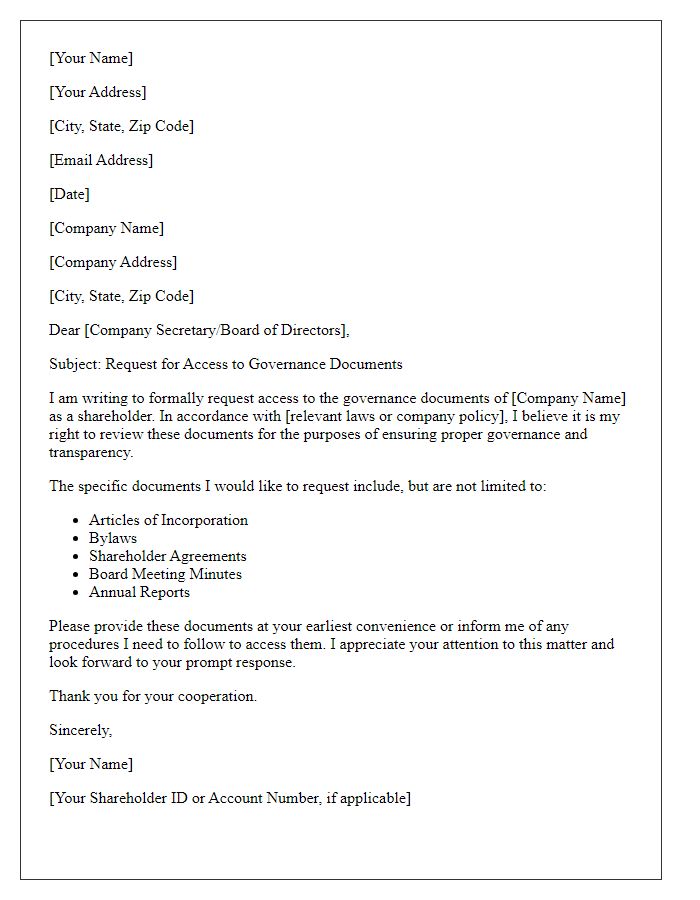

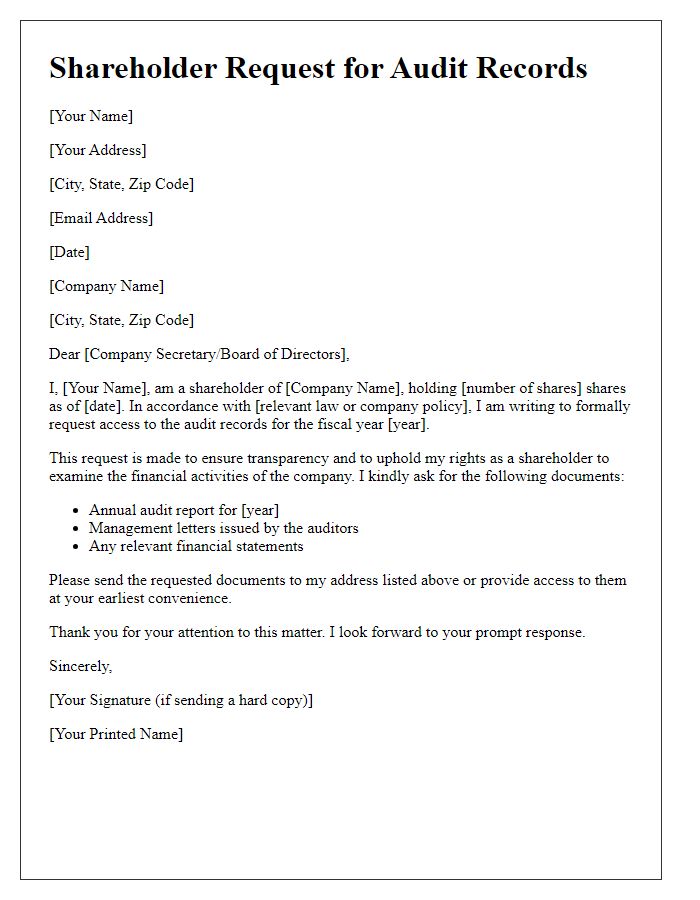

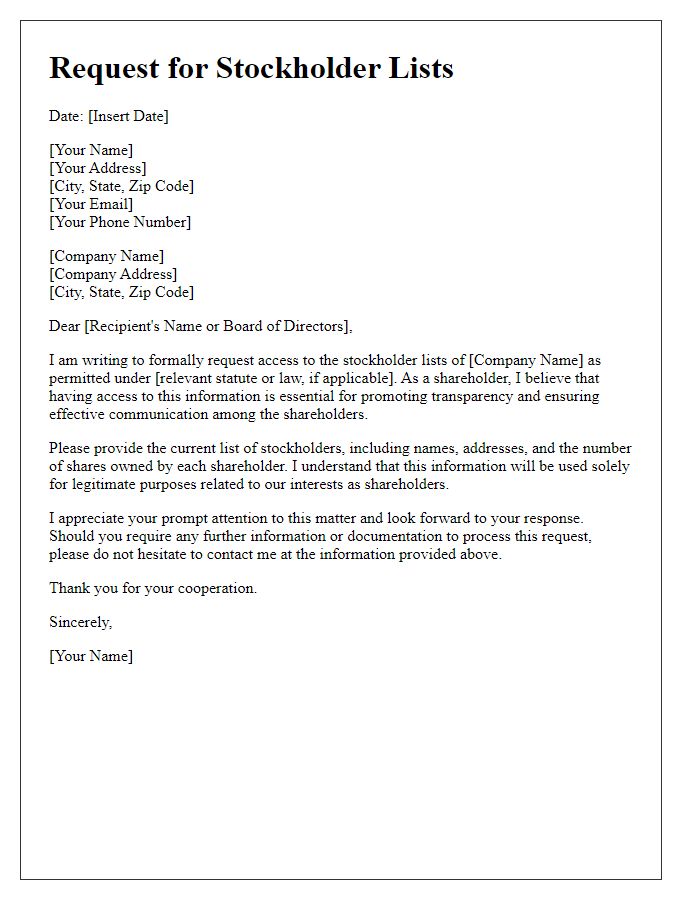

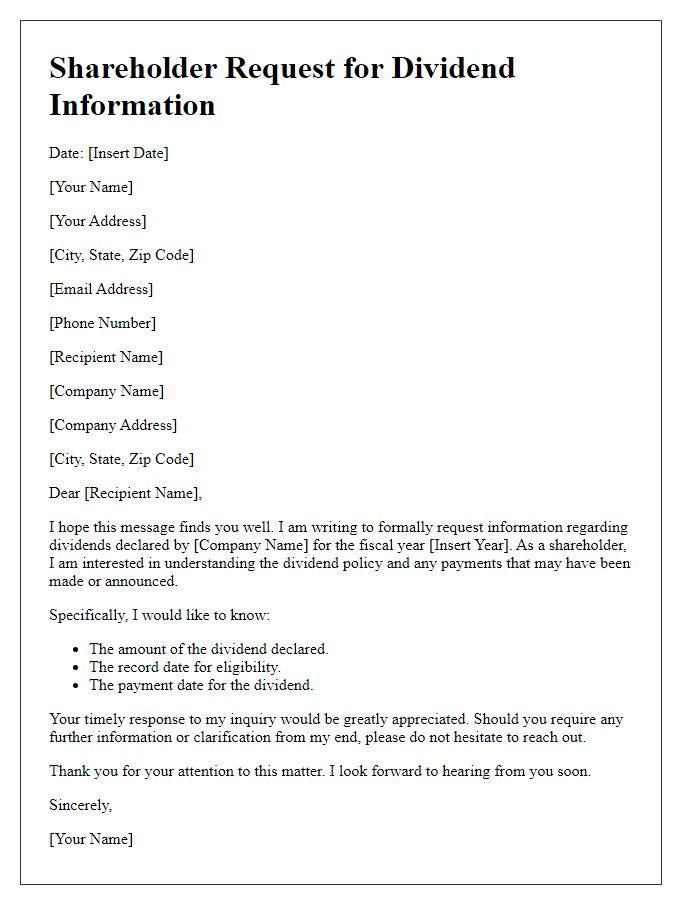

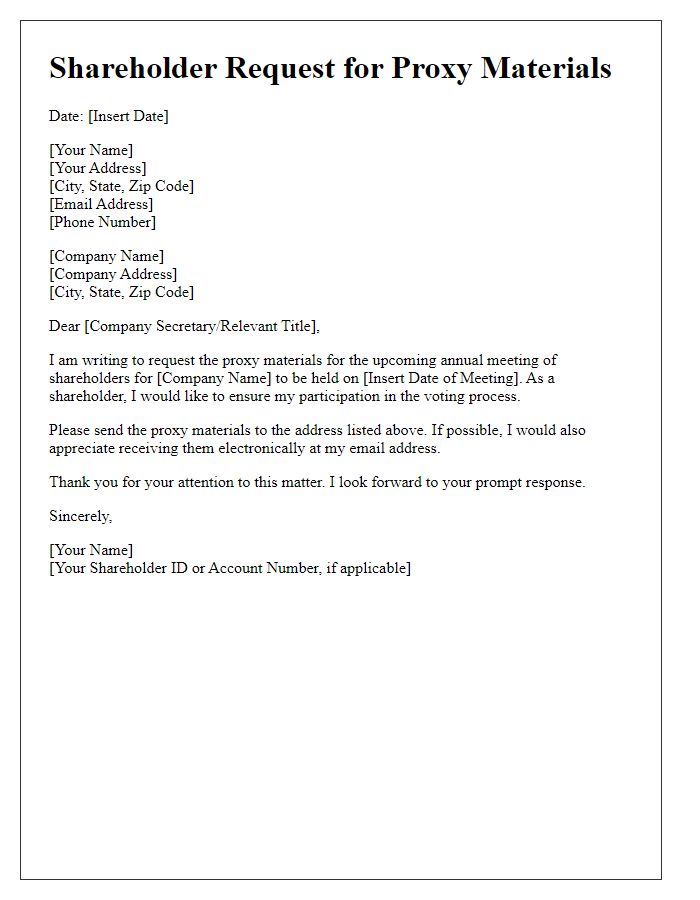

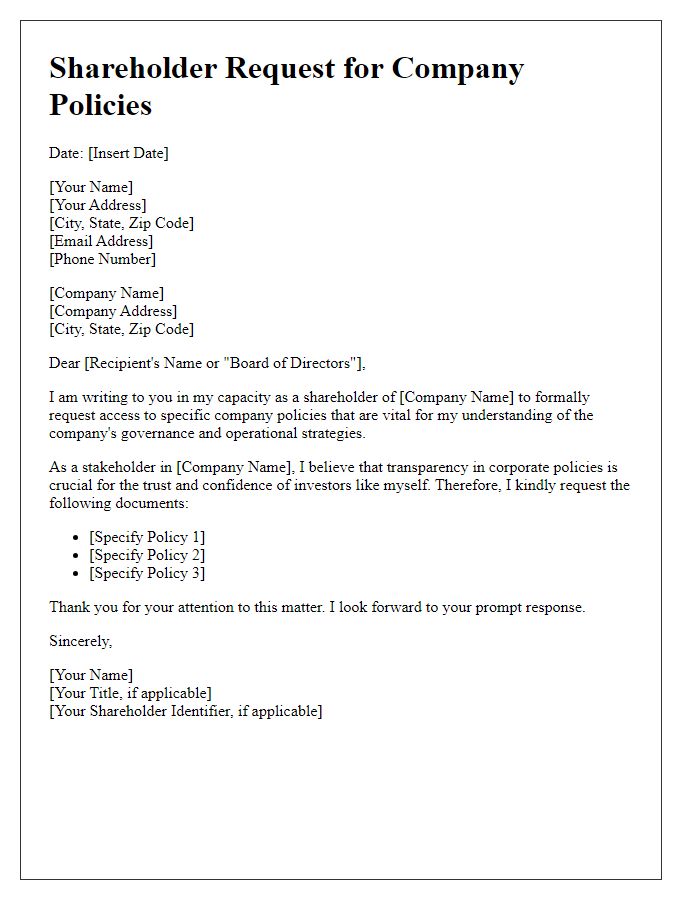

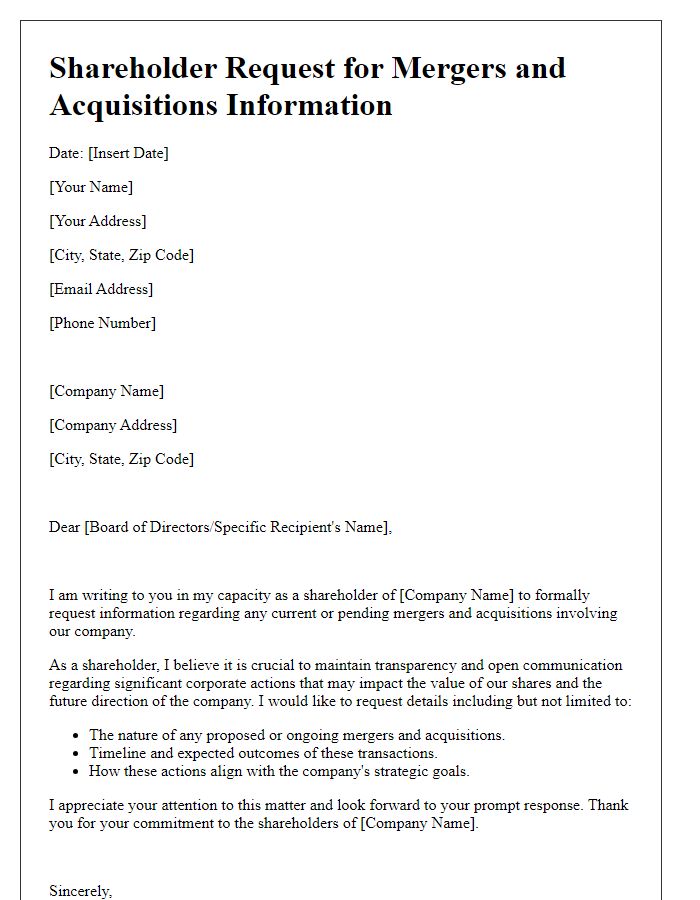

A shareholder's request for documents should include the full name and address of the shareholder, as well as the company's name and address. The request should specify the documents needed, such as financial statements, meeting minutes, or records pertaining to company performance. Identification details about the shareholder, such as shareholder registration number or shareholding percentage, ensure proper verification. Additionally, the date of the request should be noted, along with a clear statement of the purpose for obtaining these documents, such as assessing investment value or staying informed about company operations.

Specific details of documents requested.

Shareholders may request specific documents to gain insight into the operations of a company. Relevant documents could include quarterly financial statements, annual reports, and meeting minutes from board meetings. The request might specify the last three fiscal years of financial data, detailed breakdowns of revenue sources, and any investor presentations. Additionally, shareholders may seek access to governance documents such as bylaws and corporate policies regarding executive compensation. Clarity in the request ensures that all relevant materials, which could include filings with regulatory bodies like the Securities and Exchange Commission (SEC), are efficiently provided for review and analysis.

Legal basis or entitlement for request.

Shareholders possess the right to request documents under specific legal statutes, which may include provisions outlined in national company laws or corporate governance frameworks. For example, companies listed on stock exchanges in jurisdictions such as the United States or the United Kingdom are often governed by regulations that mandate transparency and accountability. Under the Securities Exchange Act of 1934 in the U.S., shareholders can request access to financial statements, proxy materials, and minutes from shareholder meetings. Likewise, the Companies Act 2006 in the U.K. provides shareholders the legal entitlement to inspect certain corporate records. The entitlement typically extends to documents necessary for shareholders to exercise their rights effectively, ensuring that they remain informed about the company's management and financial health. Specific requirements, such as submitting a written request or providing a rationale, may apply according to the governing documents of the company or local regulations.

Deadline for document provision.

Shareholders often require specific documents to assess the performance and governance of a company. In accordance with corporate regulations, companies must comply with reasonable requests for these documents. The deadline for document provision typically aligns with a specific timeframe, often set forth in corporate bylaws or state laws. A common timeframe may span around 30 days from the date of the written request, but this can vary based on jurisdiction and internal policies. Key documents frequently requested include annual financial statements, minutes from board meetings, and shareholder voting records, all of which provide valuable insights into the company's operations and decision-making processes.

Contact information for follow-up.

Shareholders require access to critical documents to ensure transparency and informed decision-making in corporate governance. Important documents may include annual reports, financial statements, investor communication records, and meeting minutes from Board of Directors' meetings. Seeking these documents is supported by regulations under the Securities Exchange Act, which safeguards shareholder rights. Contact information for follow-up inquiries is crucial, typically consisting of an email address, a direct phone number, and a mailing address of the company's investor relations department. Maintaining open lines of communication fosters trust and enhances shareholder engagement in company affairs.

Comments