When managing a retail account, receiving credit confirmation can feel like a significant milestone in your shopping experience. It not only reassures you about your financial standing but also opens doors to exciting new purchasing possibilities. Understanding the nuances of credit confirmations can make a world of difference in your shopping journey, empowering you to make informed decisions. So, let's dive deeper into the importance of credit confirmations and how they can enhance your retail experience.

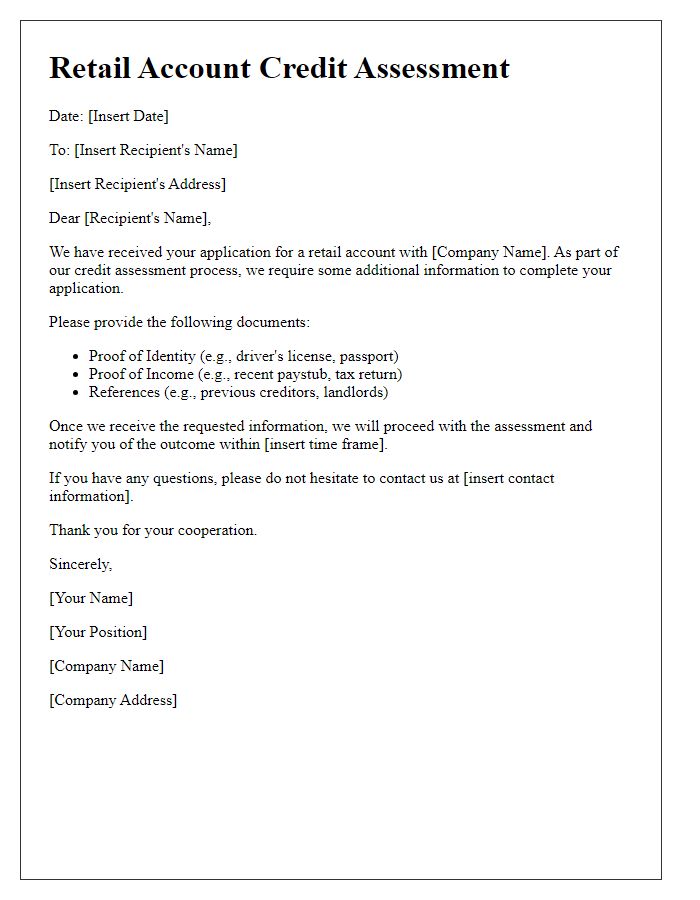

Clear Account Information

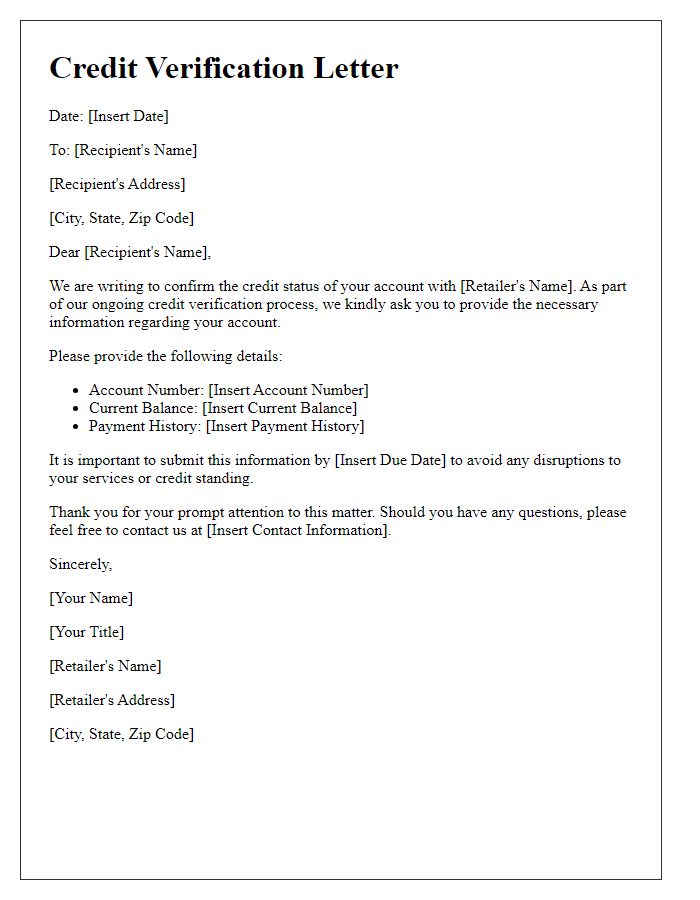

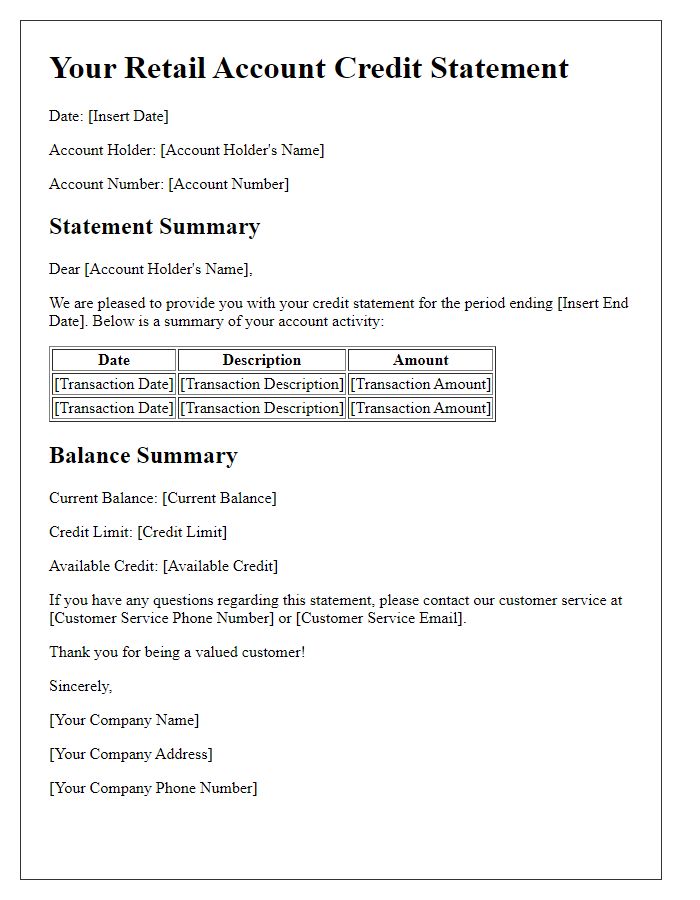

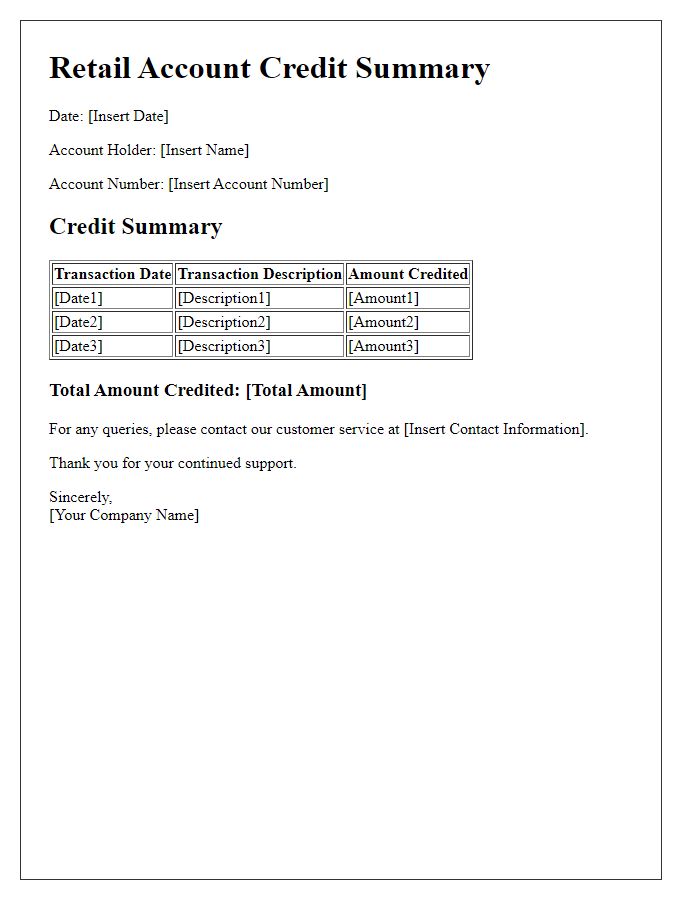

Retail account credit confirmations are essential documents for transactions in retail environments. Confirmation notices often detail account specifics such as account number (unique identifier for customer accounts), credit amount (specific dollar value granted), and transaction date (the day when the credit was processed). A clear statement of terms and conditions (rules governing the credit usage process) may also be included to inform customers about limitations or expiration dates. Retailers, including well-known brands like Walmart or Target, utilize these confirmations to reassure customers about their credit status and maintain transparent communications. Proper formatting and legibility of these documents enhance customer understanding and trust.

Concise Credit Details

Retail account credit confirmation involves specific details regarding transaction adjustments. Retailers such as Walmart and Target may update credit for returns or promotional adjustments. Credit values can range from $5 to several hundred dollars, based on purchase amount or item condition. Confirmation typically includes a unique reference number for tracking, ensuring clarity on the transaction. Communication channels like email or SMS provide immediate updates to customers, enhancing customer satisfaction and trust. Accurate record-keeping allows merchants to manage inventory efficiently, while prompt notifications minimize customer confusion regarding account balances.

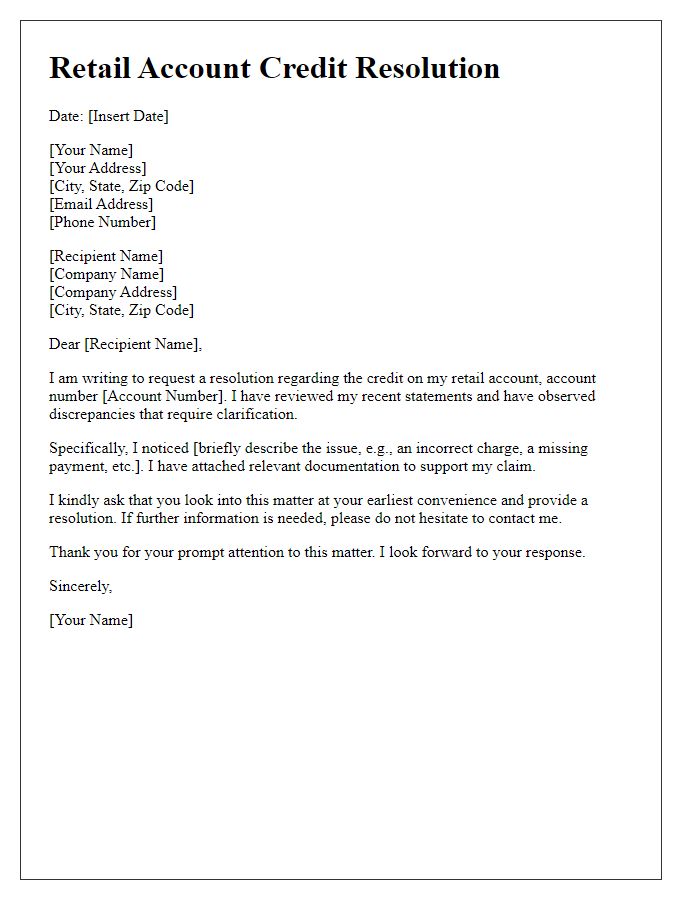

Professional Tone

Retail account credit confirmation provides essential information for ongoing financial management. Confirmation letters typically include details such as customer name, account number, credit amount, and transaction reference. The date of the credit issuance is crucial for record-keeping. Additionally, it encompasses any relevant terms related to the credit, such as expiration dates or conditions for usage. Including contact information for customer service enhances transparency, allowing customers to clarify any queries or concerns. This formal communication fosters trust and clarity between retailers and clients.

Contact Information for Queries

Retail account credit confirmation provides vital information regarding customer credits applied to accounts. Retailers maintain contact information for queries, enabling customers to resolve issues efficiently. This typically includes a customer service phone number, often 1-800-555-0199, and designated email addresses such as support@retailcompany.com. Certain retailers may offer live chat options on their official websites, ensuring prompt responses during business hours from representatives. Online customer service portals can also facilitate queries related to account balances and credit status. Ensuring customers have access to clear contact information enhances the retail experience, fostering trust and facilitating timely assistance.

Legal and Compliance Notes

Retail account credit confirmation is an important process that involves verifying account balances and ensuring compliance with financial regulations. Legal and compliance notes often include references to relevant regulations such as the Fair Credit Reporting Act (FCRA) and the Truth in Lending Act (TILA), which govern credit practices in retail. It is essential to document the credit limits, repayment terms, and interest rates clearly. Additionally, retailers must ensure that consumer protection laws are adhered to, safeguarding customers' rights and privacy during the credit confirmation process. Non-compliance with these regulations can result in legal repercussions, including fines and litigation, emphasizing the need for accurate documentation and transparent communication.

Comments