Are you feeling overwhelmed by the process of filing a retroactive benefit claim? You're not aloneâmany individuals find themselves navigating the complexities of policy details and paperwork. Understanding the ins and outs of this claim process can significantly enhance your chances of a successful outcome. Join us as we break down everything you need to know to make your claim smoother and more effective; we invite you to read more!

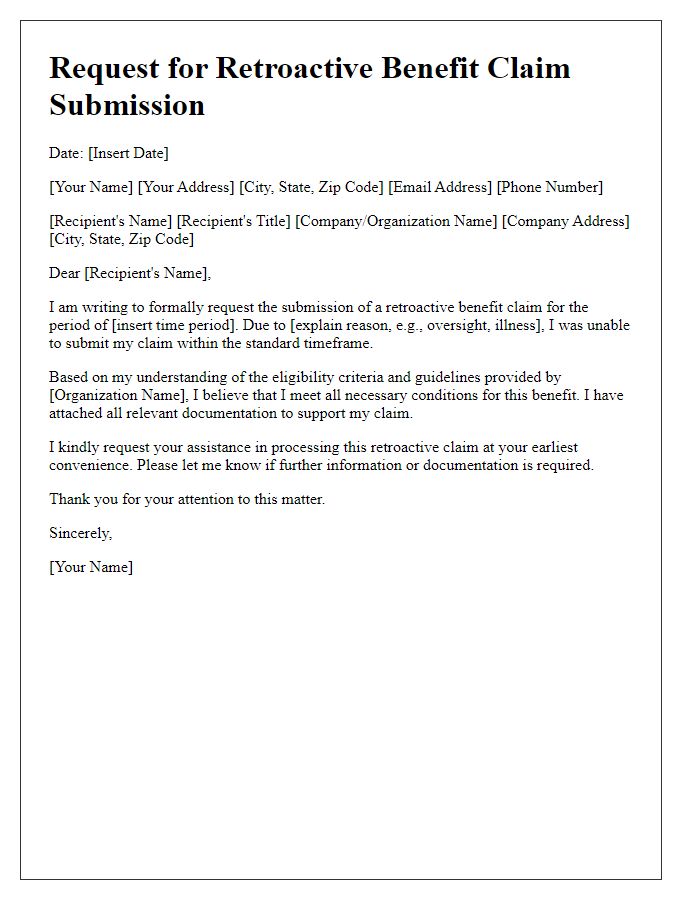

Claimant's personal and policy information

A retroactive benefit claim policy requires detailed information about the claimant's personal and policy specifics to ensure accurate processing and compliance with regulations. Essential details include the claimant's full name, social security number (typically a nine-digit number used in the United States), date of birth (format: MM/DD/YYYY), and contact information (including phone number and email address). Policy information should encompass the policy number (a unique identifier assigned to the insurance policy), the name of the insurer (such as a designated insurance company), and the effective dates (start and end dates of the coverage period). Additionally, pertinent information regarding the nature of the benefits being claimed, such as the dates of service or events leading to the claim, is crucial for the evaluation process.

Detailed explanation of the claim

The retroactive benefit claim policy applies to individuals seeking compensation for benefits not received during a specific time frame. These benefits may include unemployment insurance, social security payments, or disability aid, often stretching back several months or even years. Claimants must provide substantial documentation, such as pay stubs, tax returns, or medical records, to demonstrate eligibility. For instance, a claimant might be eligible if they lost a job in May 2022 and did not receive unemployment benefits until October 2022. The claim will also require the completion of specified forms and adherence to deadlines outlined by the issuing body, like the U.S. Department of Labor, ensuring proper processing. Claimants should be aware of potential hearings or appeals, especially if an initial claim is denied, necessitating a thorough understanding of local regulations and procedures regarding retroactive benefits.

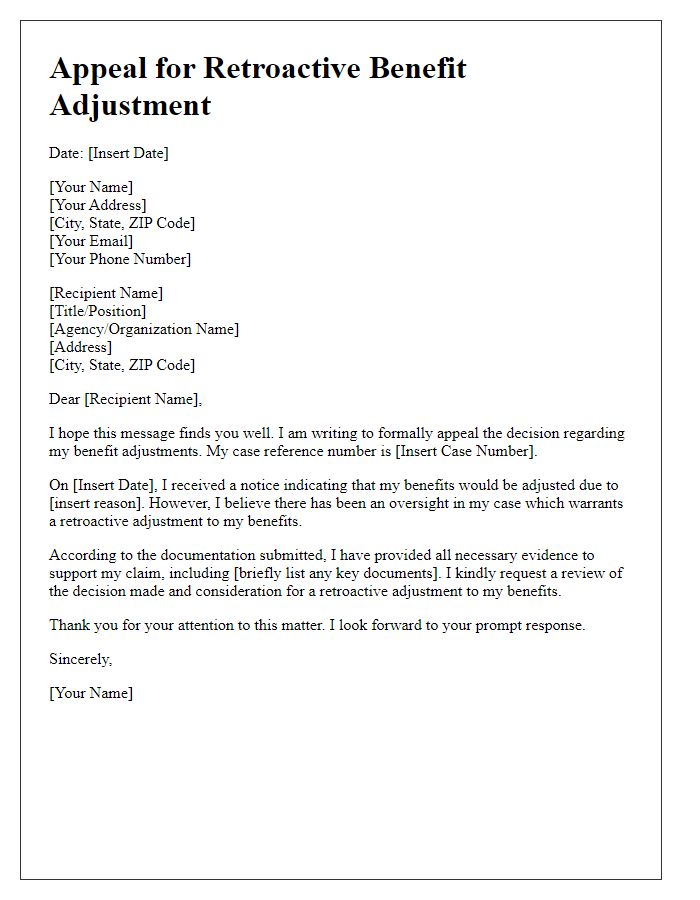

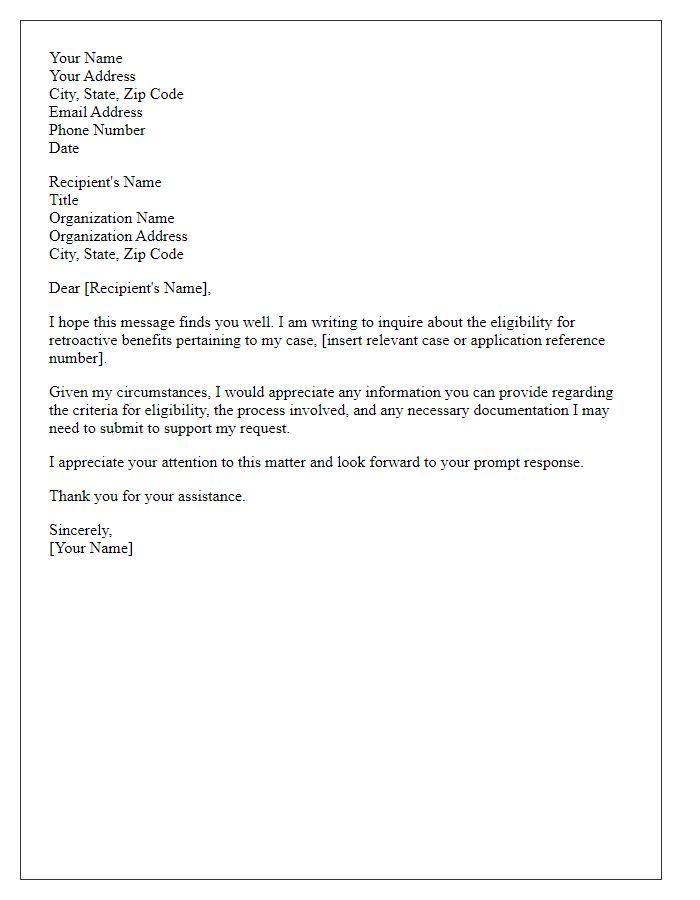

Relevant policy terms and conditions

The process of filing retroactive benefit claims requires adherence to specific policy terms and conditions outlined by the issuing organization. Applicants must provide documentation supporting the claim, including eligibility proof, dates of service, and benefit amounts. The requesting party is mandated to submit claims within designated timeframes, typically outlined in the policy, which commonly ranges from 30 to 180 days after the initial denial or inability to claim. Additionally, any discrepancies in personal information may lead to delays or denials requiring careful review. Appeals for denied claims often necessitate a re-evaluation request, and applicants should be aware of the procedure for submitting additional information or evidence in support of their claims. Careful attention to the fine print of the policy can aid in navigating any complexities during the claims process.

Supporting documents and evidence

When submitting a retroactive benefit claim, it is crucial to include supporting documents and relevant evidence to substantiate your request. Key documents may include tax returns from previous years, medical bills, or proof of income that demonstrate eligibility for benefits, such as the Supplemental Nutrition Assistance Program (SNAP). It is also important to include forms like the Application for Benefits (FNS-252) or any prior correspondence with the administering agency. Evidence should highlight extraordinary circumstances, such as recent loss of employment or medical emergencies, to strengthen the claim's validity. Organizing these documents chronologically can enhance clarity and facilitate quicker processing by the benefits agency.

Clear request and desired outcome

A retroactive benefit claim policy allows individuals to seek compensation for benefits they may have been entitled to in the past but did not receive. This process typically includes specific steps to submit a clear request for restitution. Individuals should provide relevant information, such as identification numbers, claim forms, and documentation detailing the period for which benefits are being claimed. Desired outcomes usually include receiving the backdated payments covering missed benefits. It is crucial that all submissions are thorough, as missing or incorrect information can delay the review process, which typically follows specific timelines depending on the governing agency. Moreover, including a detailed explanation of circumstances leading to the initial claim denial can strengthen the request.

Comments